Investor Concerns About Stock Market Valuations: BofA's Rebuttal

Table of Contents

BofA's Key Arguments Against Overvaluation Concerns

BofA's analysis challenges the prevailing narrative of an overvalued market. Their assessment rests on three key pillars: robust earnings growth projections, a considered view of the interest rate environment, and a bullish outlook on long-term growth opportunities.

Earnings Growth Projections

BofA predicts strong corporate earnings growth in the coming years, suggesting that current valuations are justified. Their projections consider various macroeconomic factors and industry-specific trends.

- Technology: BofA forecasts double-digit earnings growth for the technology sector, driven by advancements in artificial intelligence and cloud computing.

- Healthcare: The healthcare sector is projected to experience moderate but consistent growth, fueled by an aging population and ongoing pharmaceutical innovation.

- Financials: BofA anticipates steady growth in the financial sector, underpinned by rising interest rates and increased lending activity.

Their methodology incorporates detailed financial modeling, incorporating factors like revenue growth, profit margin expansion, and cost efficiencies. This granular approach supports their conclusion that current valuation multiples, while seemingly high, are sustainable given the projected earnings growth and corporate profits. Analyzing metrics like price-to-earnings ratio (P/E) in conjunction with future earnings projections is critical in assessing the true value of stocks.

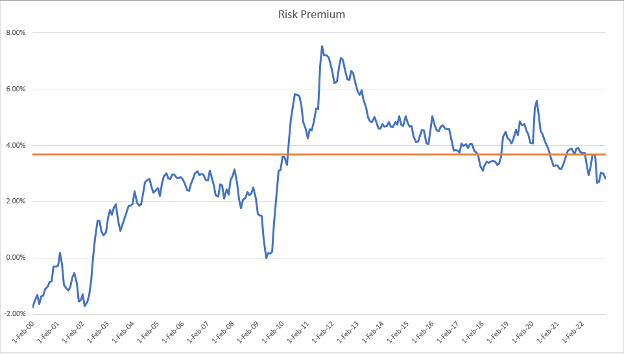

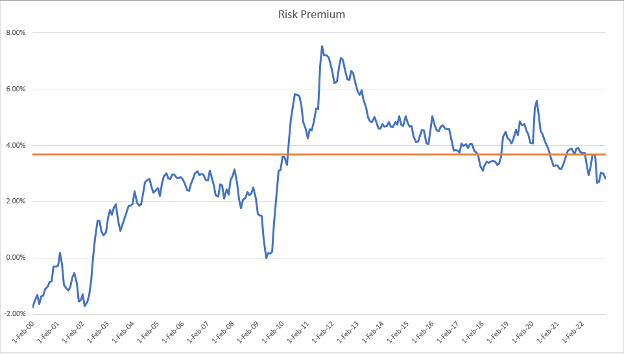

Interest Rate Environment

BofA acknowledges the impact of rising interest rates on stock valuations. However, they argue that the current interest rate hikes are already largely factored into current market prices. Their analysis suggests that the market has already priced in several further rate increases.

- BofA's reports on interest rate predictions frequently highlight the balance between controlling inflation and avoiding a recession.

- They analyze bond yields to gauge the market’s expectation of future interest rates and find them largely consistent with their projections.

- The discount rate, a key element in valuation models, is assessed by BofA to reflect the current interest rate environment, leading them to believe that valuations aren't excessively inflated.

Long-Term Growth Opportunities

BofA highlights significant long-term growth opportunities across various sectors, further supporting their view that current stock market valuations are not excessive.

- Technological Innovation: They point to continued advancements in artificial intelligence, renewable energy, and biotechnology as catalysts for long-term economic growth.

- Emerging Markets: BofA identifies opportunities in emerging markets, anticipating significant economic expansion in several regions over the next decade.

- Secular Trends: The firm underscores the long-term impact of secular trends like urbanization, digitalization, and the increasing demand for sustainable solutions. These factors are expected to drive consistent growth across multiple sectors, justifying higher valuation multiples for some companies based on their long-term investment prospects.

Addressing Specific Investor Concerns

BofA directly addresses several key concerns voiced by investors regarding stock valuations.

High Price-to-Earnings Ratios (P/E)

The elevated P/E ratios of many stocks are a major source of investor anxiety. BofA argues that these ratios are justified by the expected strong earnings growth detailed above. Historical P/E ratios, while useful for comparison, do not fully account for the unique macroeconomic environment and technological advancements driving today's market. Therefore, a comparison with historical valuations should be done cautiously and with the understanding of the current market context and future projections. Analyzing price-to-earnings ratios alone without considering future growth is an incomplete way of evaluating stock valuations.

Market Volatility and Uncertainty

Market volatility and uncertainty are undeniably present. BofA acknowledges these concerns but emphasizes the importance of a long-term investment strategy. They advise investors to focus on fundamental analysis, diversification, and risk management techniques. These strategies help mitigate the impact of short-term market fluctuations on overall portfolio performance. Understanding how to effectively manage risk is crucial in navigating market uncertainty and making informed investment decisions.

Conclusion

BofA's rebuttal to investor concerns regarding stock market valuations rests on a combination of projected earnings growth, a considered assessment of the interest rate environment, and the identification of substantial long-term growth opportunities. They directly address concerns about high P/E ratios and market volatility, providing a balanced perspective that emphasizes long-term investment strategies. Understanding stock market valuations is crucial for informed investment decisions. Explore BofA's insights today! For a nuanced perspective on stock market valuation, consult BofA's latest reports.

Featured Posts

-

Pakistan Stock Exchange Portal Down Volatility And Growing Tensions

May 10, 2025

Pakistan Stock Exchange Portal Down Volatility And Growing Tensions

May 10, 2025 -

Elizabeth Hurley Rocks Bikinis In The Maldives A Look At Her Vacation Style

May 10, 2025

Elizabeth Hurley Rocks Bikinis In The Maldives A Look At Her Vacation Style

May 10, 2025 -

Dakota Johnson Ir Krauju Isteptos Plintos Visa Istorija

May 10, 2025

Dakota Johnson Ir Krauju Isteptos Plintos Visa Istorija

May 10, 2025 -

Update Pam Bondi To Publicly Release Documents Related To Epstein Diddy Jfk And Mlk

May 10, 2025

Update Pam Bondi To Publicly Release Documents Related To Epstein Diddy Jfk And Mlk

May 10, 2025 -

The Jeffrey Epstein Files A Public Vote On Ag Pam Bondis Decision

May 10, 2025

The Jeffrey Epstein Files A Public Vote On Ag Pam Bondis Decision

May 10, 2025