Investors Are Piling Into This Hot New SPAC Stock: Should You Follow Suit?

Table of Contents

Keywords: SPAC stock, SPAC investment, hot SPAC, new SPAC, SPAC investing, should I invest in a SPAC, SPAC risk, SPAC reward, special purpose acquisition company

The SPAC market is buzzing. Fueled by a surge in investor interest and high-profile deals, many are wondering if this is the right time to jump into the world of SPAC investing. But before you chase the latest "hot" SPAC stock, it's crucial to understand the risks and rewards involved. This article will delve into the current SPAC frenzy, analyze a specific example, and guide you through the essential due diligence needed before making any investment decisions.

Understanding the Current SPAC Market Frenzy

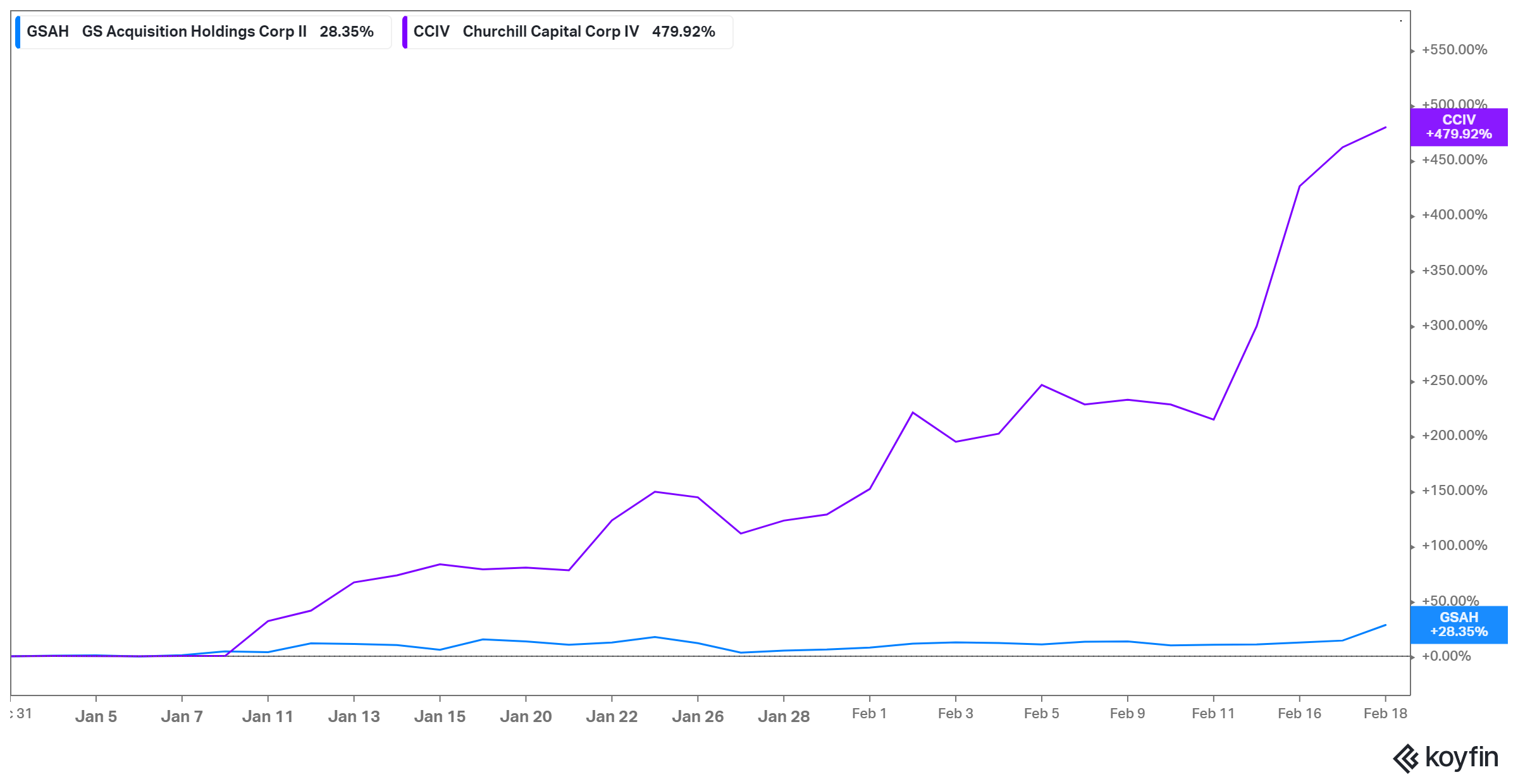

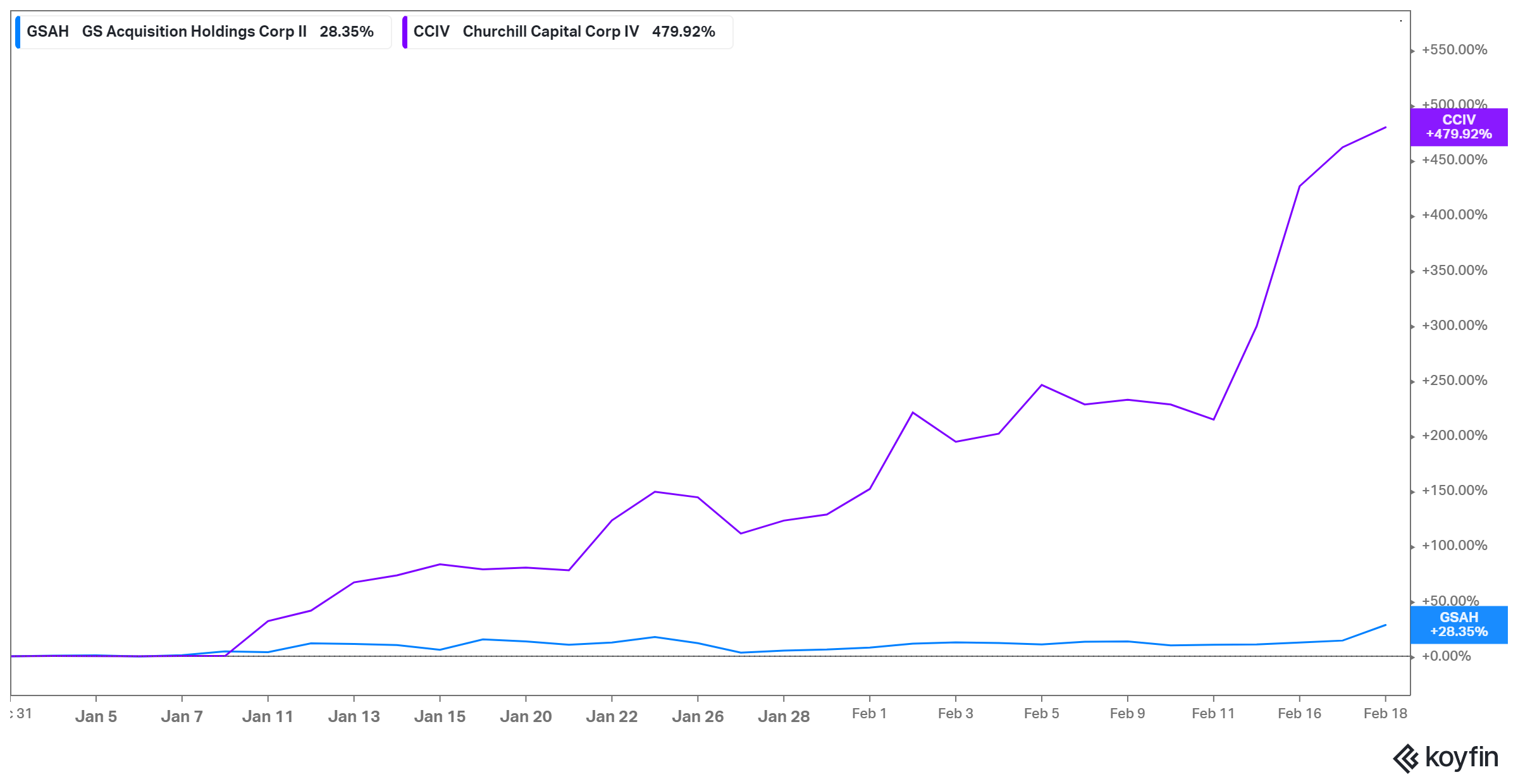

The SPAC market has experienced explosive growth in recent years. This SPAC boom, characterized by a significant increase in SPAC deals and high valuations, has captured considerable media attention and attracted a vast pool of investors. Several factors contributed to this frenzy, including low interest rates, abundant liquidity, and the perceived ease of accessing high-growth companies through the SPAC route.

- Successful SPAC Mergers: Recent successful mergers, like [Insert example of a successful recent SPAC merger], have fueled investor enthusiasm and further amplified the perception of quick riches.

- Increased Media Attention: The increased coverage in financial media and popular press has heightened public awareness and interest in SPACs, contributing to the market’s rapid expansion.

- Potential Risks of the Hype: However, this rapid growth also carries significant risks. The potential for a SPAC bubble cannot be ignored. The current market hype might be overinflated, leading to unsustainable valuations and potential losses for investors who jump in without proper due diligence.

Analyzing the Specific "Hot" SPAC Stock: [Specific SPAC Ticker] - [Specific SPAC Name]

Let's analyze a specific example: [Specific SPAC ticker], a SPAC that has recently garnered significant attention. [Specific SPAC Name]'s business plan focuses on acquiring a target company in the [Target Acquisition Sector] sector. The SPAC's management team boasts significant experience in [Mention relevant experience], suggesting a degree of expertise.

- Business Plan & Target Acquisition: The management team has publicly stated its intention to target companies with a strong track record of [mention key characteristics], aiming for a synergy that will drive significant value creation.

- Management Team: The team includes [mention key individuals and their experience]. Their previous successes and industry connections lend credibility to their strategy.

- SPAC Valuation & Comparison: Currently valued at [current valuation], the SPAC presents an interesting proposition compared to established players in the [Target Acquisition Sector]. However, this SPAC valuation needs to be carefully assessed against its projected growth and market conditions. A thorough comparison with similar companies is vital.

- Potential Risks & Rewards: Investing in [Specific SPAC ticker] presents both significant opportunities and considerable risks. The potential for substantial returns exists if the target acquisition is successful and the merged entity performs well. However, the risk of the target company underperforming or failing to meet expectations is very real, resulting in significant losses.

The Risks of Investing in SPACs: A Cautious Approach

While the potential rewards of SPAC investing are alluring, it's crucial to acknowledge the inherent risks. The SPAC market is known for its volatility, and investments can fluctuate significantly.

- Volatility: SPAC investments are highly volatile, especially before a target company is identified and a merger is completed. Prices can swing wildly based on news, rumors, and market sentiment.

- Share Dilution: After a merger, existing shareholders might experience dilution, as new shares are often issued to facilitate the acquisition. This can reduce the value of existing shares.

- Target Company Underperformance: The target company might fail to meet expectations, significantly impacting the SPAC's post-merger performance. Thorough due diligence on the target is critical.

- Redemption Risk: Investors can often redeem their shares before a merger is completed. High redemption rates can negatively impact the SPAC's ability to fund its acquisition.

Due Diligence: Essential Steps Before Investing in a SPAC

Before investing in any SPAC, particularly a "hot" one, thorough SPAC research and SPAC due diligence are paramount. Don't be swayed by hype alone.

- Thorough Research: Carefully review the SPAC's offering documents, including the prospectus and financial statements. Analyze the management team's experience and track record.

- Analyzing Financial Statements: Assess the SPAC's financial health and its ability to fund potential acquisitions. Look for any red flags or inconsistencies.

- Management Team Reputation: Investigate the background and reputation of the management team and their previous ventures. A strong management team increases the chances of a successful acquisition.

- Understanding the Terms: Carefully understand the terms of the SPAC offering, including the potential for dilution and the redemption process.

Conclusion

Investing in a "hot" SPAC stock like [Specific SPAC ticker] can be enticing, but it's crucial to approach such opportunities with caution. The potential for high returns exists, but the inherent risks associated with SPAC investing, including volatility, dilution, and the possibility of target company underperformance, must be carefully considered. Remember, conducting thorough due diligence, including examining the SPAC's financial statements and the management team's experience, is crucial before committing your capital. While the allure of a hot SPAC is tempting, remember to conduct your own thorough research before investing. Only invest in a SPAC stock after careful consideration of the risks and rewards, and after performing your own due diligence. Don’t jump on the bandwagon blindly; approach SPAC investment thoughtfully.

Featured Posts

-

Analisis Del Partido Liga De Quito Iguala Con Flamengo En La Copa Libertadores

May 08, 2025

Analisis Del Partido Liga De Quito Iguala Con Flamengo En La Copa Libertadores

May 08, 2025 -

Las Vegas Concert Counting Crows Announce Strip Performance

May 08, 2025

Las Vegas Concert Counting Crows Announce Strip Performance

May 08, 2025 -

Arsenals Semi Final Hurdle Psg Posed A Greater Threat Than Real Madrid

May 08, 2025

Arsenals Semi Final Hurdle Psg Posed A Greater Threat Than Real Madrid

May 08, 2025 -

Zielinskis Calf Injury Inter Milan Midfielder Faces Weeks Out

May 08, 2025

Zielinskis Calf Injury Inter Milan Midfielder Faces Weeks Out

May 08, 2025 -

Nba Watch Thunder Vs Trail Blazers Live On March 7th Game Time And Streaming Details

May 08, 2025

Nba Watch Thunder Vs Trail Blazers Live On March 7th Game Time And Streaming Details

May 08, 2025