IRS Data To Be Used For Immigration Enforcement: Judge's Ruling

Table of Contents

The Judge's Ruling and its Rationale

The controversial ruling stems from [insert name of court case here], where a judge [insert name of judge] decided [summarize the judge's decision concisely]. The legal basis for the ruling appears to rest on [mention specific laws or statutes cited, e.g., Section X of the Immigration and Nationality Act, or relevant case precedents]. The judge's reasoning emphasized [explain the judge's key arguments, e.g., national security concerns, the government's need for information to enforce immigration laws].

- Data Sharing Agreement: The ruling likely involved a data-sharing agreement between the IRS and either Immigration and Customs Enforcement (ICE) or Customs and Border Protection (CBP), outlining the specific types of data to be shared and under what conditions. The exact details of this agreement remain [clarify if details are public or not].

- Justification for Overriding Privacy Concerns: The judge likely addressed potential privacy violations by arguing that [summarize the judge's counter-arguments to privacy concerns]. This argument may have weighed the importance of immigration enforcement against individual privacy rights.

- Dissenting Opinions and Appeals: [Mention if there were dissenting opinions or any appeals filed against the ruling. Detail the status of any appeals].

Privacy Concerns and Potential for Abuse

The ruling raises significant privacy concerns. The IRS possesses vast amounts of sensitive personal information, including Social Security numbers, addresses, income details, and tax filing history. This data, if misused, could be weaponized against individuals, leading to potential violations of the Fourth Amendment's protection against unreasonable searches and seizures.

- Sensitive Personal Information: IRS data includes highly personal financial information that, in the wrong hands, could expose individuals to identity theft, financial exploitation, and discriminatory targeting.

- Discriminatory Targeting: The potential exists for discriminatory targeting of specific immigrant groups based on their tax information. This could disproportionately affect vulnerable populations.

- Data Security Breaches: The sharing of such sensitive data increases the risk of data security breaches and unauthorized access, potentially exposing millions of taxpayers to significant harm. The potential for misuse within the enforcement agencies themselves should also be considered. The ruling has sparked discussion on the security measures in place to prevent this.

Political and Public Reaction

The ruling has triggered a strong backlash from various political factions and advocacy groups. The political response has largely fallen along partisan lines, with [mention specific positions of the major political parties].

- Statements from Key Political Figures: [Include quotes or summaries of statements from prominent politicians, such as Senators, Representatives, or the President, expressing their opinions on the ruling].

- Reactions from Advocacy Groups: Immigrant rights organizations and privacy advocates have vehemently condemned the ruling, citing potential for widespread abuse and chilling effects on tax compliance within immigrant communities. [Cite specific organizations and their statements].

- Public Opinion: Public opinion polls [cite sources if available] indicate [summarize public sentiment regarding the ruling; e.g., strong opposition, divided opinions, etc.]. This highlights a significant public debate around the balance between immigration enforcement and individual rights.

The Impact on Immigrant Communities

This ruling will disproportionately affect immigrant communities. The fear of having their tax information used against them in immigration proceedings could deter many from filing taxes, even those who are legally entitled to do so.

- Tax Compliance: The ruling may lead to decreased tax compliance among immigrant populations due to fear of deportation. This could have significant consequences for the IRS and the overall tax system.

- Increased Fear and Self-Deportation: The increased fear of deportation may drive self-deportation, potentially separating families and negatively impacting communities. Fear of government surveillance could discourage immigrants from seeking necessary services.

- Access to Government Services: The fear of using government services might also impact access to essential resources, such as healthcare, education, and social welfare programs.

Future Legal Challenges and Potential Legislative Action

The ruling is likely to face significant legal challenges, with appeals potentially going all the way to the Supreme Court. Congressional action could also play a major role.

- Legal Avenues: Various legal avenues are available to challenge the ruling, including appeals based on violations of taxpayer privacy rights and potential due process violations. Lawsuits might focus on arguing that the ruling violates constitutional rights.

- Legislative Action: Congress could intervene through legislation either to codify this type of data sharing or to explicitly prohibit it. The political climate will significantly influence the likelihood of such legislation.

- Likelihood of Success: The success of both legal challenges and legislative efforts will depend on a complex interplay of legal arguments, political will, and public pressure.

Conclusion

The judge's ruling allowing the use of IRS data for immigration enforcement raises profound concerns about taxpayer privacy, the potential for abuse, and the impact on immigrant communities. The ensuing political and public reaction underscores the significance of this issue. The potential for future legal challenges and legislative action highlights the ongoing battle over balancing national security priorities with the protection of fundamental rights. This ruling on IRS data immigration enforcement necessitates vigilance and engagement. Stay informed about further developments in this critical legal battle, and consider contacting your elected officials to voice your concerns about IRS data immigration enforcement and advocate for policies that protect both taxpayer privacy and the rights of immigrants.

Featured Posts

-

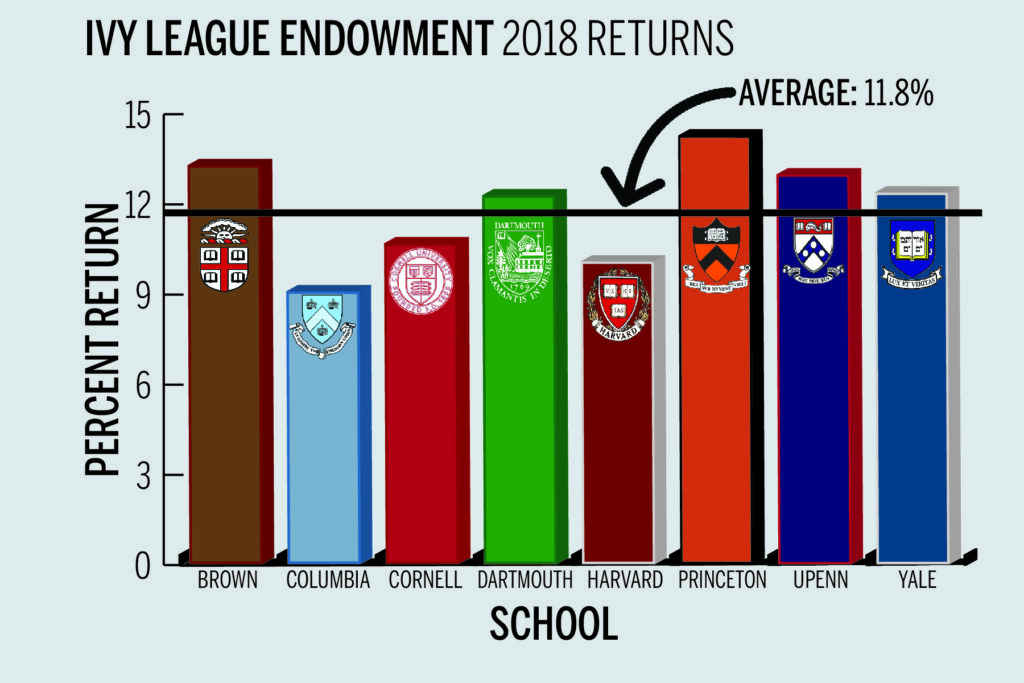

Increased Taxes On Ivy League Endowments The Harvard And Yale Case

May 13, 2025

Increased Taxes On Ivy League Endowments The Harvard And Yale Case

May 13, 2025 -

Leonardo Di Caprios Relationship Twist A Deeper Look

May 13, 2025

Leonardo Di Caprios Relationship Twist A Deeper Look

May 13, 2025 -

Amokalarm In Braunschweig Die Neue Oberschule Im Fokus

May 13, 2025

Amokalarm In Braunschweig Die Neue Oberschule Im Fokus

May 13, 2025 -

The Da Vinci Code A Comprehensive Guide

May 13, 2025

The Da Vinci Code A Comprehensive Guide

May 13, 2025 -

Myanmar Perangi Judi Online Dan Penipuan Telekomunikasi Langkah Langkah Penindakan

May 13, 2025

Myanmar Perangi Judi Online Dan Penipuan Telekomunikasi Langkah Langkah Penindakan

May 13, 2025

Latest Posts

-

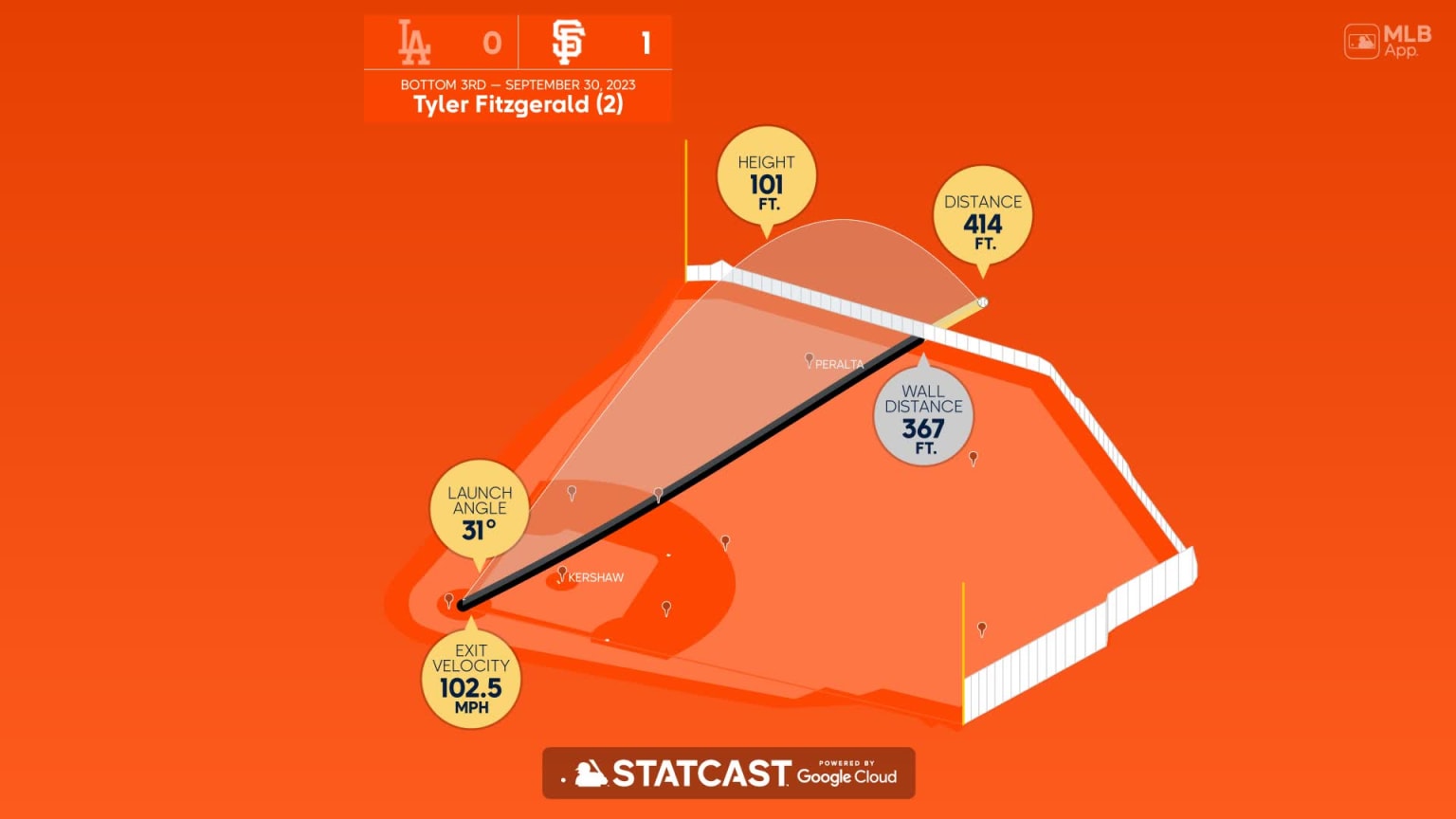

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025 -

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025 -

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025 -

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025 -

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025