Is $1,500 The Next Ethereum Price Target? Crucial Support Under Scrutiny.

Table of Contents

Ethereum's Recent Price Action and Market Sentiment

Recent price action for Ethereum has been characterized by significant volatility. After a period of relative stability, ETH experienced a sharp surge, briefly exceeding $1,600, before encountering significant selling pressure, pushing the price back towards the crucial $1,500 support level. This price movement highlights the ongoing battle between buyers and sellers, and the importance of this key psychological level.

Analyzing technical indicators provides further insight. The Relative Strength Index (RSI) showed signs of overbought conditions before the recent sell-off, while the Moving Average Convergence Divergence (MACD) is currently giving mixed signals, suggesting ongoing uncertainty. The $1,500 Ethereum price level has seen increased trading volume, indicating strong resistance or support, depending on the direction of the break.

- Significant sell-off observed after the last price surge, highlighting profit-taking activity.

- Increased trading volume around the $1,500 support level indicates a significant battleground for bulls and bears.

- Negative sentiment in the crypto community, fueled by concerns over regulatory uncertainty and macroeconomic headwinds, has contributed to price pressure.

Analyzing the $1,500 Support Level

The $1,500 price point holds significant importance for Ethereum. It represents a key psychological barrier for investors, and historically, it has acted as both support and resistance in the past. A sustained break below this level could trigger a cascade of further selling, potentially leading to a more significant price correction. Conversely, a strong defense of this level, with increased buying pressure, could signal a potential reversal and resumption of the upward trend.

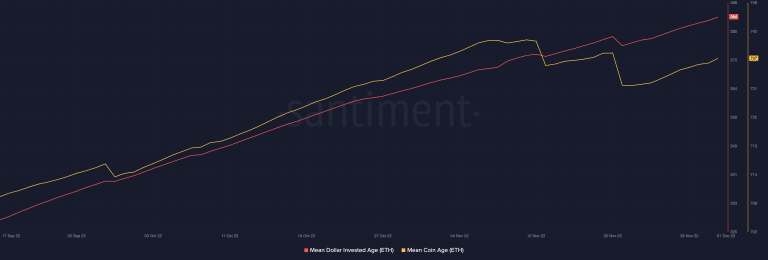

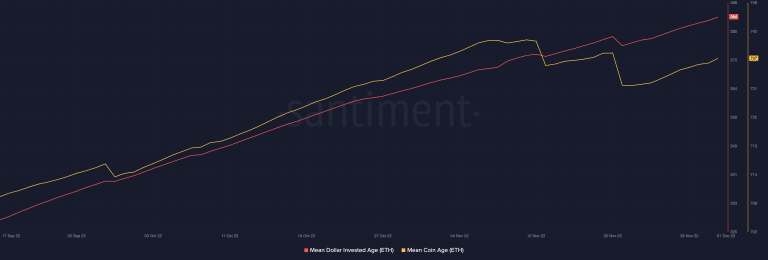

Analyzing on-chain data provides a more nuanced perspective. Examining metrics like active addresses, transaction volume, and exchange balances can help assess the underlying strength of the market. Decreasing transaction volume coupled with a high percentage of ETH held on exchanges could be bearish indicators, suggesting weak hands are likely to sell.

- A breach below $1,500 could trigger further downward pressure and potentially lead to lower price targets.

- Strong buying pressure around $1,500 could signal a potential reversal and a renewed bullish trend for the $1500 Ethereum price.

- Analysis of whale activity near the $1,500 level is crucial to understanding large-scale market manipulation or accumulation.

Factors Influencing Ethereum's Future Price

Several macroeconomic and industry-specific factors will significantly influence Ethereum's future price trajectory. The current inflationary environment, coupled with rising interest rates and recessionary fears, casts a shadow over the entire cryptocurrency market. Increased regulatory scrutiny and potential legal challenges also pose a risk to Ethereum's price.

However, Ethereum's ongoing development and upgrades, including improvements in scalability and efficiency, offer positive counterweights. Increased institutional adoption and the potential for decentralized finance (DeFi) applications to flourish could also bolster the price. Competition from other smart contract platforms should also be considered.

- The potential impact of upcoming Ethereum hard forks and their effect on the $1500 Ethereum price target.

- Increased institutional adoption could drive higher prices, providing a strong base for the Ethereum support level.

- Negative news concerning regulatory crackdowns in various jurisdictions could cause a significant price drop.

Conclusion

The $1,500 support level for Ethereum is a critical juncture. While various factors point to both potential bullish and bearish scenarios, its significance as a psychological and historical price point cannot be understated. Our analysis suggests a potential for further price decline if the support breaks, while a strong defense could signal a price rebound. The interplay between macroeconomic conditions, regulatory pressures, and Ethereum's ongoing development will ultimately shape its future price trajectory. The potential for the $1500 Ethereum price to act as either support or resistance is significant, and understanding this dynamic is crucial for traders. Therefore, stay informed about the latest developments affecting the Ethereum price target and conduct your own thorough research before making any investment decisions. Consider diversifying your portfolio and understanding the risks inherent in investing in cryptocurrencies like Ethereum. This $1500 Ethereum price level deserves continued monitoring for accurate Ethereum price prediction and investment strategy.

Featured Posts

-

The Most Gripping War Movies Available Now On Amazon Prime Video

May 08, 2025

The Most Gripping War Movies Available Now On Amazon Prime Video

May 08, 2025 -

The Great Decoupling A Geopolitical Perspective

May 08, 2025

The Great Decoupling A Geopolitical Perspective

May 08, 2025 -

Investigation Into Antisemitic Acts At Boeings Seattle Facility

May 08, 2025

Investigation Into Antisemitic Acts At Boeings Seattle Facility

May 08, 2025 -

Uber Kenya Cashback For Customers More Orders For Drivers And Couriers

May 08, 2025

Uber Kenya Cashback For Customers More Orders For Drivers And Couriers

May 08, 2025 -

Gha Opposes Jhl Privatization Plan Key Concerns And Arguments

May 08, 2025

Gha Opposes Jhl Privatization Plan Key Concerns And Arguments

May 08, 2025