Is A Bond Market Crash Imminent? Assessing The Risks

Table of Contents

Rising Interest Rates: The Biggest Threat to Bond Prices

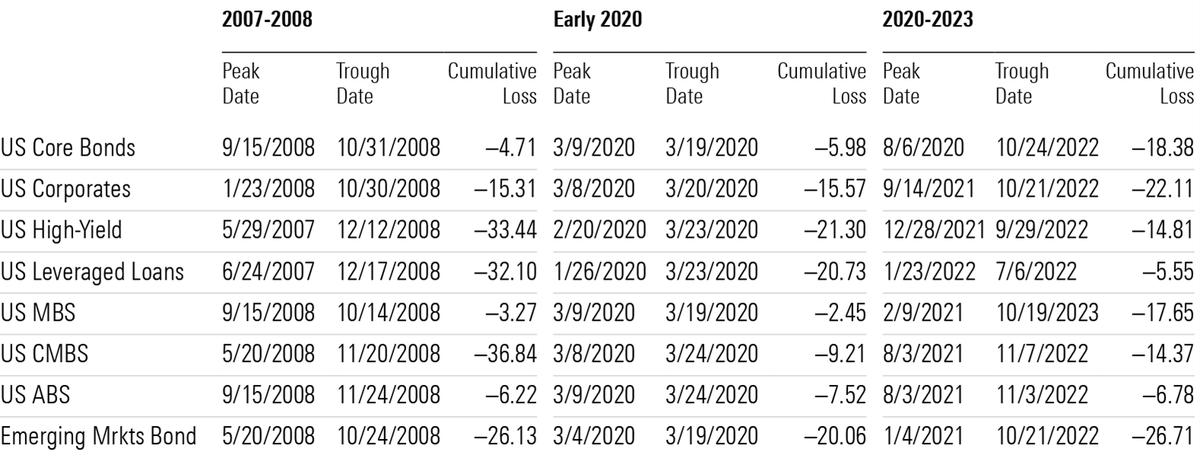

The relationship between interest rates and bond prices is inversely proportional. This means that as interest rates rise, bond prices fall, and vice-versa. This inverse relationship is fundamental to understanding the current risks facing the bond market. The Federal Reserve's monetary policy, aimed at controlling inflation, plays a significant role in shaping interest rate movements. By increasing the federal funds rate, the Fed makes borrowing more expensive, impacting the entire yield curve.

- Higher interest rates make existing bonds less attractive. New bonds issued at higher rates offer better returns, making older, lower-yielding bonds less appealing to investors.

- Investors sell existing bonds to buy new ones with higher yields. This increased selling pressure drives down the prices of existing bonds.

- This increased selling pressure drives bond prices down. The more investors sell, the lower the price will go until a new equilibrium is reached.

- Impact on different types of bonds (e.g., government bonds, corporate bonds). While government bonds are generally considered safer, they are not immune to the effects of rising interest rates. Corporate bonds, with their higher yields, are often more susceptible to price fluctuations.

[Insert chart here illustrating the correlation between interest rates and bond prices. The chart should clearly show the inverse relationship.]

Inflation's Erosive Power on Bond Returns

Inflation significantly diminishes the real return on bonds. While a bond might promise a fixed interest payment, if inflation outpaces that payment, the real value of your investment erodes. Persistent high inflation erodes investor confidence, leading to demands for higher yields to compensate for the inflation risk.

- Inflation erodes the purchasing power of future bond payments. If inflation is 5% and your bond yields 3%, you're actually losing 2% of purchasing power each year.

- Investors demand higher yields to compensate for inflation risk. This further pushes up interest rates, creating a vicious cycle that can depress bond prices.

- High inflation can lead to higher interest rates, further impacting bond prices. Central banks often raise interest rates to combat inflation, exacerbating the downward pressure on bond prices.

- Real vs. nominal yields – explanation and importance. The nominal yield is the stated interest rate, while the real yield accounts for inflation. Understanding the difference is crucial for evaluating the true return on your bond investment.

Investing in inflation-protected securities (TIPS) can help mitigate the risk of inflation eroding your bond returns. TIPS adjust their principal value based on the inflation rate, protecting your investment's purchasing power.

Geopolitical Risks and Their Influence on the Bond Market

Global events such as war, political instability, and economic sanctions significantly influence bond market sentiment. These events create uncertainty, which can trigger dramatic shifts in investor behavior. The "flight to safety" phenomenon often sees investors flocking to government bonds perceived as safe havens during times of turmoil. However, prolonged uncertainty can also trigger selling pressure as investors seek liquidity.

- Uncertainty leads to increased demand for safe-haven assets like government bonds. This can temporarily boost bond prices.

- However, prolonged uncertainty can also trigger selling pressure. If the uncertainty persists, investors may seek to divest from all assets, including bonds.

- Specific examples of geopolitical events and their impact on the bond market. Recent geopolitical events, such as the war in Ukraine, have demonstrably impacted bond markets worldwide.

- Diversification strategies to mitigate geopolitical risk. Diversifying your bond portfolio across different countries and currencies can help mitigate the impact of geopolitical risks.

Assessing Your Personal Risk Tolerance and Investment Strategy

Before investing in bonds, understanding your risk tolerance is paramount. Your investment timeline and financial goals should dictate your bond investment strategy. Consider strategies such as laddering (spreading investments across different maturities) and diversification across various bond types and issuers.

- Consider your investment timeline and financial goals. Longer-term investors may be more tolerant of short-term price fluctuations.

- Diversify across different bond types and maturities. Don't put all your eggs in one basket.

- Regularly review and adjust your portfolio based on market conditions. Market conditions change constantly; your investment strategy should adapt accordingly.

- Seek professional advice from a financial advisor. A financial advisor can help you create a personalized bond investment strategy aligned with your risk tolerance and financial objectives.

Conclusion

While a bond market crash isn't guaranteed, several significant risks suggest a potential for substantial downturn. Rising interest rates, persistent inflation, and ongoing geopolitical uncertainty are key factors to monitor closely. Understanding these risks is crucial for navigating the current bond market environment. By proactively assessing your investment strategy and considering diversification tactics, you can better prepare for potential volatility and mitigate the impact of a possible bond market crash. Stay informed about bond market trends and consider seeking professional advice to effectively manage your bond investments.

Featured Posts

-

Limited Time Nike Dunks Reduced 52 At Revolve

May 29, 2025

Limited Time Nike Dunks Reduced 52 At Revolve

May 29, 2025 -

Vaccinazione Covid Riduzione Del 27 Del Rischio Di Long Covid Negli Adulti Ecdc

May 29, 2025

Vaccinazione Covid Riduzione Del 27 Del Rischio Di Long Covid Negli Adulti Ecdc

May 29, 2025 -

Help Solve A Homicide Seattle Police Seek Tips On First Hill Case

May 29, 2025

Help Solve A Homicide Seattle Police Seek Tips On First Hill Case

May 29, 2025 -

Localizacion De Radares En Zaragoza 2025 Fijos Moviles Y De Tramo

May 29, 2025

Localizacion De Radares En Zaragoza 2025 Fijos Moviles Y De Tramo

May 29, 2025 -

Oranjegekte In Liverpool Titelstrijd Lokt Massaal Nederlandse Supporters

May 29, 2025

Oranjegekte In Liverpool Titelstrijd Lokt Massaal Nederlandse Supporters

May 29, 2025

Latest Posts

-

Cycle News Magazine 2025 Issue 17 Features Reviews And News From The Cycling Industry

May 31, 2025

Cycle News Magazine 2025 Issue 17 Features Reviews And News From The Cycling Industry

May 31, 2025 -

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025 -

Jokics Incredible One Handed Flick Leads Nuggets To Victory Against Jazz

May 31, 2025

Jokics Incredible One Handed Flick Leads Nuggets To Victory Against Jazz

May 31, 2025 -

Cycle News Magazine 2025 Issue 12 Key Stories And Highlights

May 31, 2025

Cycle News Magazine 2025 Issue 12 Key Stories And Highlights

May 31, 2025 -

2025 Fox Raceway National Complete Motocross Results For Round 1

May 31, 2025

2025 Fox Raceway National Complete Motocross Results For Round 1

May 31, 2025