Is A Trillion-Dollar Palantir Possible By 2030? An In-Depth Analysis

Table of Contents

Palantir's Current Market Position and Financial Performance

Understanding Palantir's current market capitalization and financial performance is crucial to evaluating its potential to reach a trillion-dollar valuation. While its current market cap is significantly below a trillion dollars, its recent financial performance offers insights into its growth trajectory. Analyzing Palantir revenue streams, derived from both government contracts and commercial partnerships, provides a clear picture of its current financial health.

- Revenue Streams: Palantir's revenue is generated through two main channels: its government contracts, which have historically been a significant source of income, and its expanding commercial partnerships with businesses across various sectors. The balance between these two revenue streams is a key factor influencing future growth.

- Financial Performance: Examination of Palantir's financials, including revenue growth rates, profitability margins, and cash flow, is critical. Consistent growth and profitability are essential indicators of a company's ability to sustain rapid expansion. Analyzing trends in these key metrics helps to project future financial performance.

- Key Clients and Market Segments: A detailed analysis of Palantir's client base, including the size and influence of both its government and commercial clients, provides valuable insights into the stability and potential for future growth. Understanding its market share within each segment is critical for valuation.

Growth Drivers and Opportunities for Palantir

Palantir's potential to reach a trillion-dollar valuation hinges on several key growth drivers and opportunities. Expansion into new markets and continued technological advancements are crucial factors.

Expansion into New Markets

Palantir has significant potential to expand into new market sectors and geographic regions. Its existing platform is adaptable and can be tailored to meet the specific needs of various industries.

- New Market Penetration Strategies: Palantir could leverage strategic partnerships, acquisitions, and targeted marketing campaigns to penetrate new sectors such as healthcare, finance, and energy. These markets present vast opportunities for data-driven solutions.

- Market Size and Growth Potential: Analysis of the market size and projected growth in these new sectors will reveal the potential revenue streams and market share that Palantir could capture. The potential for substantial market penetration is a critical factor in its valuation.

Technological Advancements and Innovation

Palantir's continued investment in R&D, particularly in the areas of artificial intelligence (AI) and machine learning, is a vital driver for growth. Its ability to develop cutting-edge data analytics solutions will be crucial for maintaining its competitive advantage.

- Innovative Products and Services: The introduction of new products and services built upon its core platform will broaden its appeal and attract new clients across various sectors. The development of innovative AI and data analytics capabilities can unlock significant growth opportunities.

- Competitive Advantages in AI and Data Analytics: Palantir's ability to leverage its advanced technology to solve complex problems will be a significant factor in its success. Maintaining a competitive edge in the rapidly evolving AI and data analytics space is crucial.

Challenges and Risks Facing Palantir

While Palantir's prospects are promising, several challenges and risks could hinder its journey to a trillion-dollar valuation.

Competition in the Data Analytics Market

The data analytics market is highly competitive, with established players and emerging startups vying for market share.

- Competitive Strengths and Weaknesses: A thorough assessment of Palantir’s competitive strengths and weaknesses, compared to rivals like AWS, Google Cloud, and Microsoft Azure, is necessary. Understanding its unique value proposition is crucial for maintaining market share.

- Potential Threats from Established Players and Startups: The continuous emergence of new technologies and competitors necessitates ongoing innovation and adaptation. Palantir needs to constantly evolve to maintain a competitive edge.

Regulatory and Geopolitical Risks

Government regulations, international relations, and cybersecurity threats pose significant risks to Palantir's operations.

- Regulatory Challenges and Geopolitical Uncertainties: Compliance with data privacy regulations and navigating geopolitical complexities can impact its operations and growth prospects. Understanding and mitigating these risks is crucial.

- Palantir's Risk Mitigation Strategies: The company's ability to proactively address these challenges and implement effective risk mitigation strategies will directly impact its overall success.

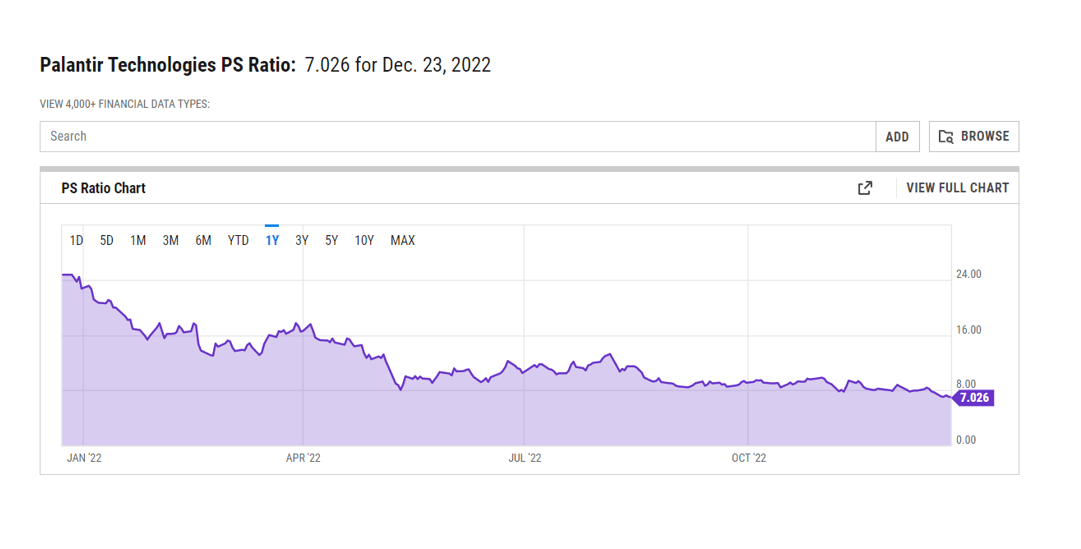

Valuation and Probability of Reaching a Trillion-Dollar Market Cap

Determining the probability of Palantir reaching a trillion-dollar market cap requires a robust valuation analysis.

- Valuation Models: Various valuation models, including discounted cash flow (DCF) analysis and comparable company analysis, should be employed. Each model will offer a different perspective, and a comprehensive approach is needed.

- Assumptions Underlying Valuation Scenarios: The assumptions used in these models, such as revenue growth rates, profit margins, and discount rates, significantly impact the valuation. Sensitivity analysis helps understand the impact of various assumptions.

- Probability Assessment: By considering both optimistic and pessimistic scenarios, we can assess the likelihood of Palantir reaching a trillion-dollar valuation by 2030. This requires a careful weighing of the growth drivers, challenges, and risks discussed above.

Conclusion: The Trillion-Dollar Palantir Question – A Verdict

Achieving a trillion-dollar valuation by 2030 presents a significant challenge for Palantir. While its innovative platform, strong client base, and potential for expansion in new markets are compelling, the competitive landscape and inherent risks cannot be ignored. The company’s success hinges on its ability to navigate the complexities of the data analytics market, maintain technological leadership, and effectively manage regulatory and geopolitical risks. While the probability remains uncertain, Palantir’s potential for growth in the data analytics market remains considerable. Further research and careful consideration of the factors discussed above are crucial for investors and analysts alike to accurately assess the likelihood of a trillion-dollar Palantir. Thorough due diligence is essential before making any investment decisions related to Palantir stock or its future prospects.

Featured Posts

-

High Potential Series Finale Features Unexpected Reunion

May 10, 2025

High Potential Series Finale Features Unexpected Reunion

May 10, 2025 -

Hills 27 Saves Power Golden Knights Past Blue Jackets

May 10, 2025

Hills 27 Saves Power Golden Knights Past Blue Jackets

May 10, 2025 -

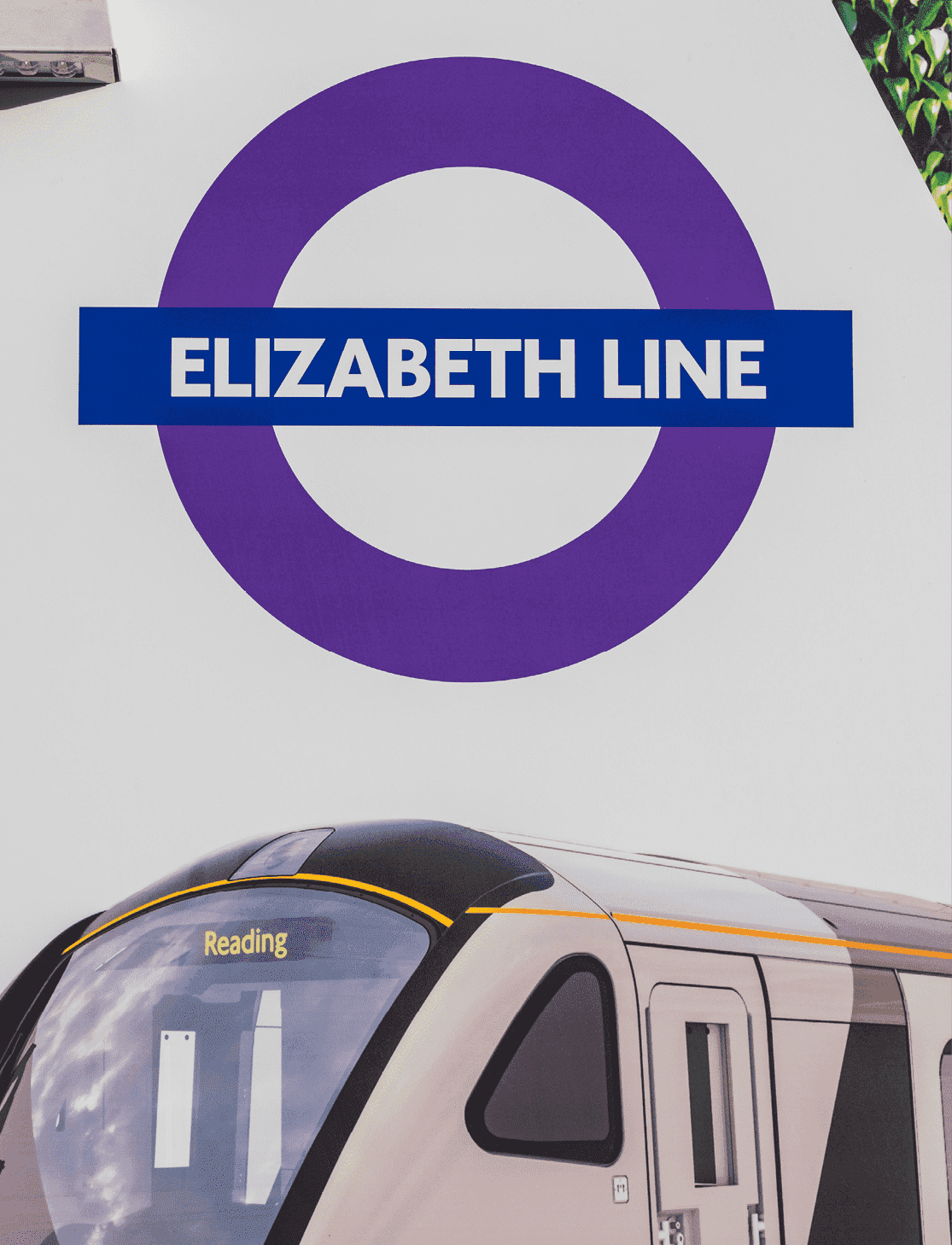

Wheelchair Accessibility Concerns On The Elizabeth Line

May 10, 2025

Wheelchair Accessibility Concerns On The Elizabeth Line

May 10, 2025 -

Renaissance Et Modem Vers Une Fusion Gouvernementale

May 10, 2025

Renaissance Et Modem Vers Une Fusion Gouvernementale

May 10, 2025 -

Analyzing The Geopolitical Shift Trumps Legacy On Greenland Denmark Relations

May 10, 2025

Analyzing The Geopolitical Shift Trumps Legacy On Greenland Denmark Relations

May 10, 2025