Is BigBear.ai Stock A Buy Right Now? A Motley Fool Analysis

Table of Contents

BigBear.ai's Recent Performance and Financial Health

Understanding BigBear.ai's financial health is crucial before considering an investment. Analyzing BigBear.ai stock performance requires examining key financial metrics. Recent stock price movements have (insert description of recent price trends – e.g., shown significant volatility, experienced a period of growth, etc.). To assess BigBear.ai's financial health, we need to look beyond the stock price fluctuations.

-

Revenue Growth: BigBear.ai's revenue growth in the last quarter was (insert specific data, e.g., X%, representing a Y% increase/decrease compared to the same period last year). This indicates (insert interpretation of the data – e.g., strong growth, stagnation, or decline).

-

Profitability: The company's profitability (or lack thereof) is another critical factor. Current profit margins stand at (insert data and context – e.g., -X%, indicating the company is currently operating at a loss, but focusing on growth).

-

Debt Levels: BigBear.ai's debt-to-equity ratio is currently (insert data and context – e.g., X:1, suggesting a manageable/high level of debt). A high debt level could signify increased financial risk.

-

Cash Flow: Analyzing free cash flow is crucial for assessing BigBear.ai's ability to fund operations and future growth. The company's free cash flow is currently (insert data and context – e.g., positive/negative, indicating its ability/inability to generate cash from operations).

Comparing BigBear.ai's financials to its competitors is also vital. (Insert comparison to 1-2 key competitors, mentioning their performance and how BigBear.ai stacks up in terms of revenue, profitability, etc.). This comparative analysis helps assess BigBear.ai's position within the broader market landscape concerning BigBear.ai stock performance and BigBear.ai financials.

Competitive Landscape and Market Opportunities

BigBear.ai operates in a competitive landscape, primarily within the AI and government contracting sectors. Key competitors include (list 2-3 key competitors and briefly describe their business models and market share). The company's primary markets include national security and commercial applications of AI.

-

Market Size: The market for AI-driven solutions in national security is projected to reach (insert market size projections and source). The commercial applications market is similarly vast and growing rapidly.

-

Competitive Advantages: BigBear.ai's competitive advantage stems from its (describe 2-3 key competitive advantages – e.g., proprietary AI algorithms, strong relationships with government agencies, experienced team). These factors are vital in assessing the BigBear.ai market opportunity and the long-term viability of BigBear.ai stock.

Analyzing BigBear.ai's unique selling propositions (USPs) is crucial. (Explain how its specific offerings differentiate it from competitors – e.g., specialized expertise in a niche market, superior technology, better customer service). This is a key aspect of BigBear.ai's competitive advantage.

Risks and Potential Downsides of Investing in BigBear.ai Stock

Investing in BigBear.ai stock, like any investment, carries inherent risks. These risks should be carefully considered before committing capital.

-

Dependence on Government Contracts: A significant portion of BigBear.ai's revenue comes from government contracts. Changes in government policy or budget cuts could significantly impact the company's financial performance.

-

Competition: The AI sector is highly competitive. Emerging technologies and new competitors could erode BigBear.ai's market share and profitability.

-

Technological Disruption: Rapid technological advancements could render BigBear.ai's existing technology obsolete, requiring significant investments in research and development.

-

Economic Downturn: During economic downturns, government spending on national security and commercial investment in AI might decrease, potentially impacting BigBear.ai's revenue and profits. Considering this economic factor is crucial when assessing BigBear.ai stock risk.

The volatility of BigBear.ai stock also presents a risk. Investors should have a high risk tolerance before considering this stock as part of their portfolio. BigBear.ai investment risks are significant, and a proper understanding of these risks is essential.

Motley Fool's Assessment and Recommendation

Based on the analysis of BigBear.ai's financial health, competitive landscape, and inherent risks, (insert your recommendation – Buy, Sell, or Hold).

-

Positive Factors: (List the key positive factors influencing the recommendation – e.g., strong growth potential, unique technology, potential for increased government contracts).

-

Negative Factors: (List the key negative factors – e.g., high debt levels, dependence on government contracts, competitive market).

-

Recommendation Summary: (Provide a concise summary of the recommendation and its justification).

-

Disclaimer: Investing in stocks always carries inherent risks. This analysis is for informational purposes only and is not financial advice. Consult with a financial advisor before making any investment decisions.

Conclusion: Is BigBear.ai Stock Right for Your Portfolio?

BigBear.ai presents a compelling investment opportunity within the burgeoning AI sector. However, careful consideration of its financial performance, competitive landscape, and inherent risks is essential. While the company shows promise, its dependence on government contracts and the volatile nature of its stock price should be weighed against its growth potential. Ultimately, the decision of whether to buy BigBear.ai stock rests with you. Thoroughly research BigBear.ai stock and consult with a financial advisor before investing. Remember to assess your own risk tolerance and diversify your investment portfolio accordingly. Don't hesitate to seek professional advice before making any decisions concerning BigBear.ai stock or any other investment opportunity.

Featured Posts

-

Nyt Mini Crossword Solutions And Clues For May 13 2025

May 20, 2025

Nyt Mini Crossword Solutions And Clues For May 13 2025

May 20, 2025 -

Jose Mourinho Nun Tadic Ve Dzeko Elestirisi

May 20, 2025

Jose Mourinho Nun Tadic Ve Dzeko Elestirisi

May 20, 2025 -

High Ranking Navy Official Faces Bribery Charges A Detailed Look At The Scandal

May 20, 2025

High Ranking Navy Official Faces Bribery Charges A Detailed Look At The Scandal

May 20, 2025 -

Premiere Edition Du Marche Africain Des Solutions Spatiales Mass Une Occasion Unique Pour L Innovation Spatiale En Afrique

May 20, 2025

Premiere Edition Du Marche Africain Des Solutions Spatiales Mass Une Occasion Unique Pour L Innovation Spatiale En Afrique

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Detalji O Rodenju

May 20, 2025

Jennifer Lawrence I Drugo Dijete Detalji O Rodenju

May 20, 2025

Latest Posts

-

Wasikowska And Waititi Team Up For Family Film

May 20, 2025

Wasikowska And Waititi Team Up For Family Film

May 20, 2025 -

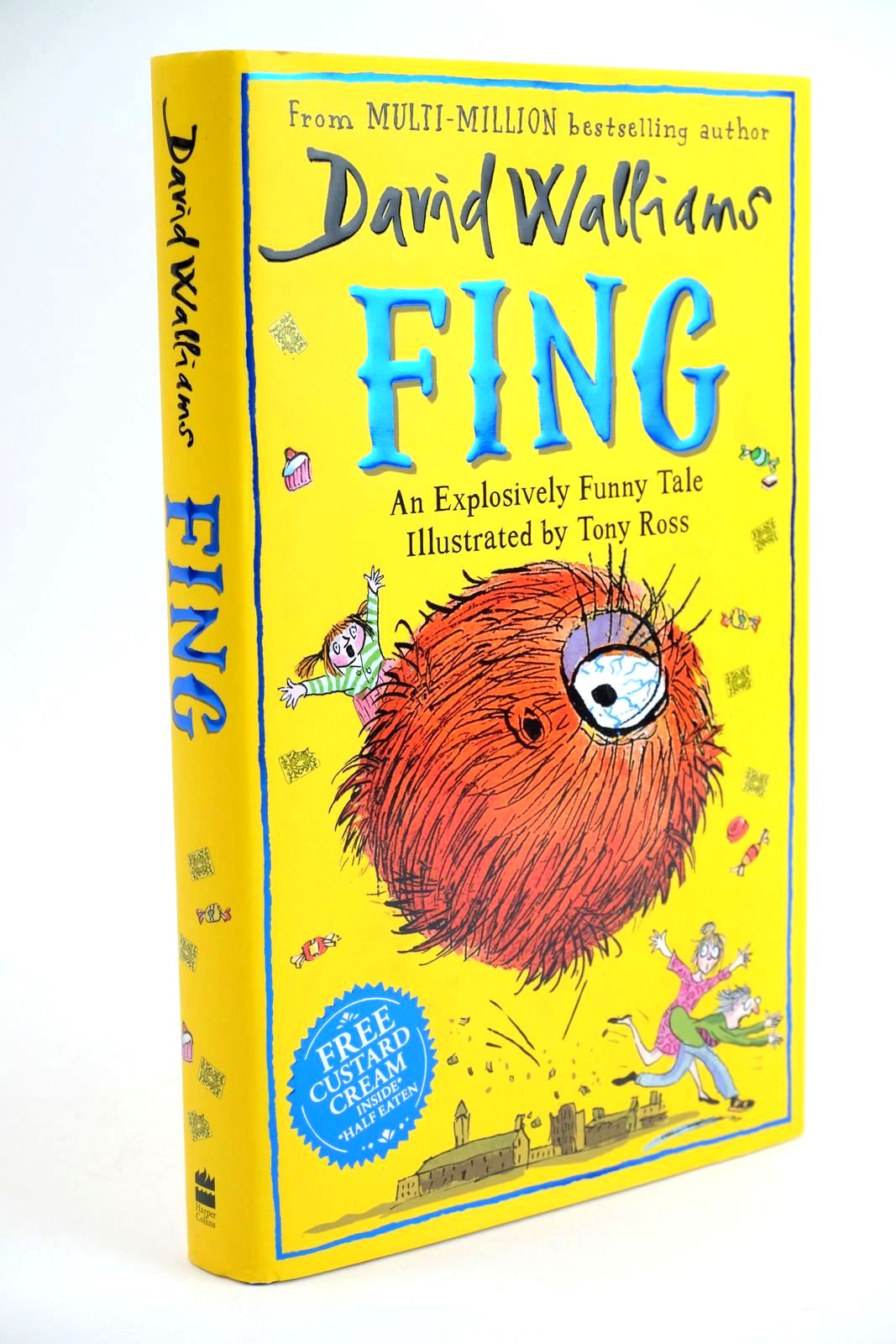

David Walliams And Stan Partner On New Fantasy Film Fing

May 20, 2025

David Walliams And Stan Partner On New Fantasy Film Fing

May 20, 2025 -

New Family Movie Featuring Mia Wasikowska And Taika Waititi

May 20, 2025

New Family Movie Featuring Mia Wasikowska And Taika Waititi

May 20, 2025 -

Fing David Walliams Fantasy Film Gets The Go Ahead From Stan

May 20, 2025

Fing David Walliams Fantasy Film Gets The Go Ahead From Stan

May 20, 2025 -

Stan Approves David Walliams Fing Fantasy Film In Development

May 20, 2025

Stan Approves David Walliams Fing Fantasy Film In Development

May 20, 2025