Is BigBear.ai Stock A Good Investment In 2024?

Table of Contents

BigBear.ai Company Overview and Business Model

BigBear.ai offers a range of advanced AI-powered solutions, primarily focusing on data analytics and cybersecurity. Their clientele spans diverse sectors, including government agencies, defense contractors, and commercial enterprises. They leverage cutting-edge technologies to tackle complex challenges, providing strategic insights and enhanced security measures. Their competitive advantage lies in their blend of advanced algorithms, experienced data scientists, and a strong understanding of the unique needs of their target markets.

- Key services offered: AI-powered analytics, cybersecurity solutions, data visualization, predictive modeling, and advanced threat detection.

- Target markets: Government (defense, intelligence), commercial (finance, healthcare), and critical infrastructure sectors.

- Recent contracts and partnerships: BigBear.ai actively seeks and secures contracts with major government agencies and private sector clients. Tracking these announcements is crucial for assessing the health and trajectory of the company. (Note: Specific contract details would need to be researched and inserted here from reliable financial news sources.)

- Financial performance summary: A review of BigBear.ai's recent financial statements (10-K reports, quarterly earnings) is necessary to evaluate revenue growth, profitability, and overall financial health. This information is publicly available and should be consulted for a complete picture.

Financial Performance and Valuation of BigBear.ai Stock

Analyzing BigBear.ai's financial performance requires a thorough examination of several key metrics. Reviewing revenue growth trends, profitability (or lack thereof), debt levels, and comparing these figures to industry competitors will offer a more complete view of the company's financial health. Further, evaluating valuation metrics such as the Price-to-Earnings (P/E) ratio and market capitalization against similar companies provides a benchmark for assessing whether BigBear.ai stock is undervalued or overvalued.

- Revenue growth trends: Examining year-over-year and quarter-over-quarter revenue growth reveals the company's ability to generate sales and expand its market presence.

- Profitability analysis: Assessing profitability, including gross margins, operating income, and net income, is crucial in understanding the company's ability to generate profit from its operations.

- Debt levels and financial risk: High levels of debt can significantly impact a company's financial stability and increase the risk for investors. Analyzing debt-to-equity ratios and other debt metrics is essential.

- Key valuation ratios compared to competitors: Comparing key valuation ratios (P/E ratio, Price-to-Sales ratio) with those of competitors helps determine whether BigBear.ai stock is appropriately priced relative to its peers.

Risks and Challenges Facing BigBear.ai

Investing in BigBear.ai stock, like any investment, carries inherent risks. Understanding these risks is crucial for making informed investment decisions. The company faces competition from established players in the AI and cybersecurity fields, and its reliance on government contracts creates vulnerability to changes in government spending and procurement policies. Technological advancements could also render some of their solutions obsolete.

- Competition from established players: BigBear.ai operates in a competitive market with larger, more established companies with greater resources and market share.

- Dependence on government contracts: A significant portion of BigBear.ai's revenue may come from government contracts, making them susceptible to changes in government priorities and funding.

- Technological obsolescence risk: The rapid pace of technological advancement in AI and cybersecurity requires continuous innovation to stay competitive. Failure to adapt could negatively impact the business.

- Regulatory risks: Changes in regulations, particularly regarding data privacy and cybersecurity, could impact BigBear.ai's operations and profitability.

- Market sentiment and investor confidence: The overall sentiment towards the tech sector and investor confidence in BigBear.ai can significantly influence the stock price.

Future Growth Prospects and Potential for BigBear.ai Stock

The market for AI and intelligence solutions is experiencing rapid growth, presenting significant opportunities for companies like BigBear.ai. Analyzing the company's strategic initiatives, research and development efforts, and expansion plans provides insight into its potential for future growth. Assessing the long-term sustainability of its business model, considering technological advancements and market trends, is equally important.

- Growth potential in target markets: The continued growth in government spending on defense and intelligence, coupled with increasing demand for cybersecurity solutions in the private sector, offers potential for BigBear.ai's expansion.

- Technological innovation and R&D efforts: BigBear.ai's investment in research and development is vital for maintaining its competitive edge. Evaluating their innovation pipeline is key.

- Expansion plans and new market entries: Any strategic initiatives aimed at expanding into new markets or offering new services can influence future growth prospects.

- Long-term sustainability of the business model: Assessing the resilience and adaptability of BigBear.ai's business model to changing market conditions and technological disruptions is vital for evaluating its long-term potential.

Conclusion

Investing in BigBear.ai stock presents a complex scenario with both potential rewards and considerable risks. While the company operates in a high-growth market and possesses advanced technological capabilities, its dependence on government contracts and intense competition pose significant challenges. A thorough review of its financial performance, valuation, and future growth prospects is essential before making any investment decisions. Remember, this analysis is not financial advice.

Investment Recommendation: A cautious approach is recommended. Thoroughly research BigBear.ai's financial reports, industry trends, and competitive landscape before considering a BigBear.ai investment.

Call to Action: Do your own due diligence on BigBear.ai stock. Consider BigBear.ai investment options carefully and learn more about BigBear.ai shares before investing. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

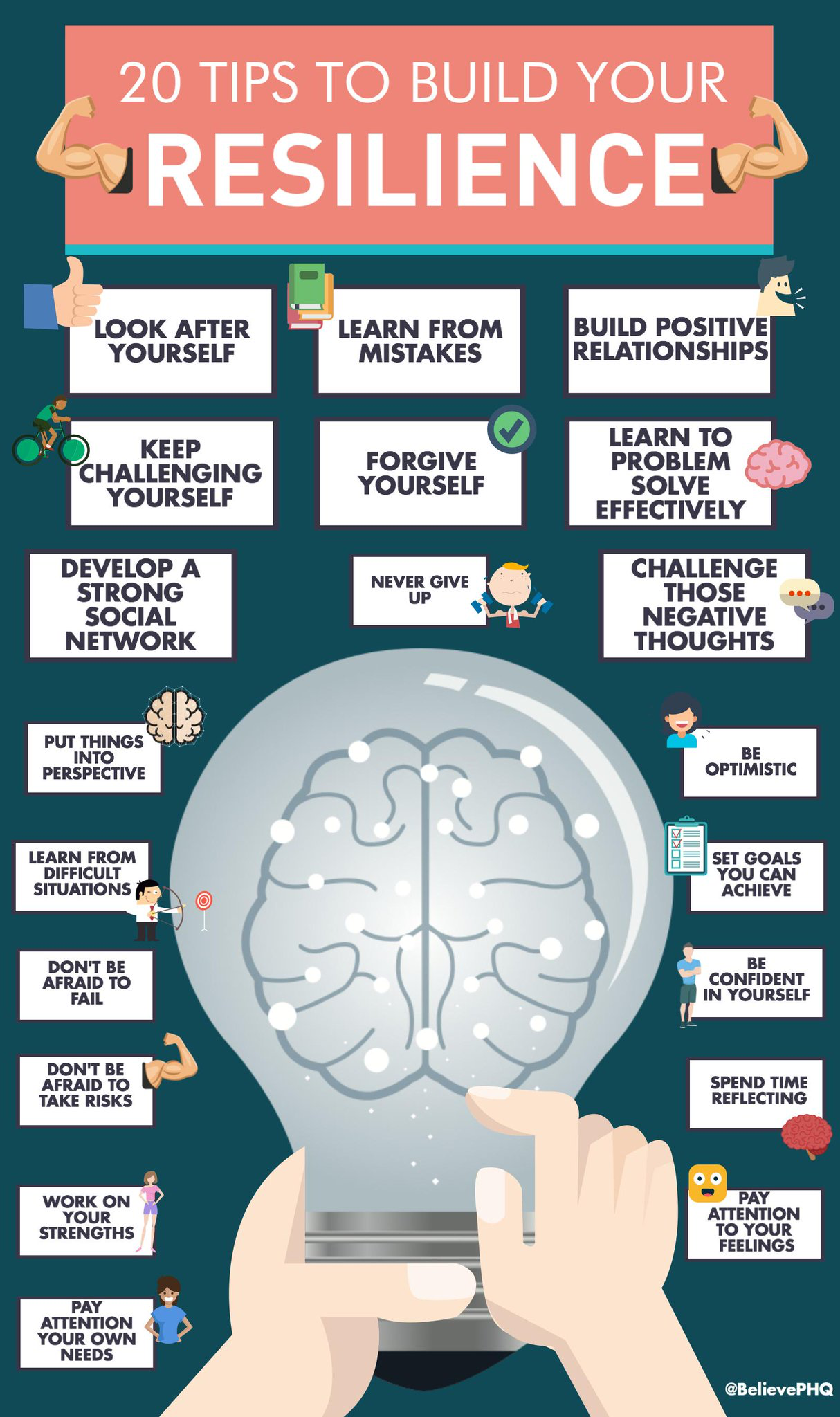

Boosting Resilience Strategies For Improved Mental Health

May 20, 2025

Boosting Resilience Strategies For Improved Mental Health

May 20, 2025 -

T Hanatos Apo Bullying I Istoria Toy Baggeli Giakoymaki

May 20, 2025

T Hanatos Apo Bullying I Istoria Toy Baggeli Giakoymaki

May 20, 2025 -

Analyzing The Impact Of Qbts Earnings On Stock Price

May 20, 2025

Analyzing The Impact Of Qbts Earnings On Stock Price

May 20, 2025 -

Is A John Cena Vs Randy Orton Match Happening Bayleys Injury Status

May 20, 2025

Is A John Cena Vs Randy Orton Match Happening Bayleys Injury Status

May 20, 2025 -

62 5m Transfer Battle Man Utd Joins Arsenal And Chelsea In Pursuit

May 20, 2025

62 5m Transfer Battle Man Utd Joins Arsenal And Chelsea In Pursuit

May 20, 2025

Latest Posts

-

New Cliff Richard Musical A Collaboration A Challenge

May 20, 2025

New Cliff Richard Musical A Collaboration A Challenge

May 20, 2025 -

Sandylands U Tv Schedule Where And When To Watch

May 20, 2025

Sandylands U Tv Schedule Where And When To Watch

May 20, 2025 -

Watch Sandylands U Episode Guide And Air Dates

May 20, 2025

Watch Sandylands U Episode Guide And Air Dates

May 20, 2025 -

Find Sandylands U On Tv A Comprehensive Guide

May 20, 2025

Find Sandylands U On Tv A Comprehensive Guide

May 20, 2025 -

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025