Is Bitcoin At A Critical Juncture? Analyzing Key Price Points

Table of Contents

Historical Bitcoin Price Trends and Support Levels

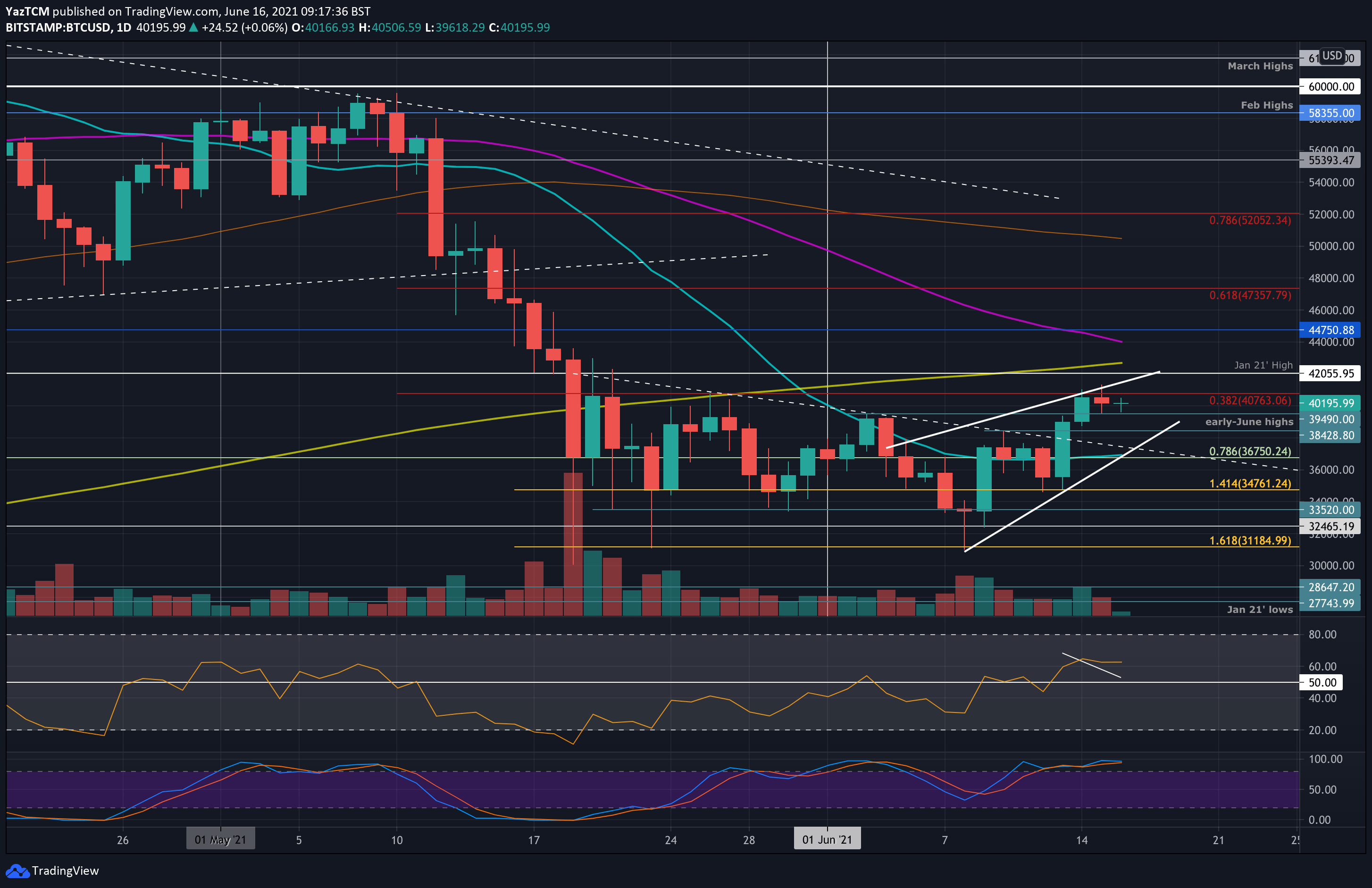

Understanding support and resistance levels is crucial for analyzing Bitcoin price. Support levels represent price points where buying pressure is strong enough to prevent further price declines. Conversely, resistance levels mark areas where selling pressure overwhelms buying pressure, halting upward momentum. Bitcoin's history is punctuated by several key price points that have acted as significant support or resistance.

- $20,000: This level acted as strong support in 2020 and 2021, marking a significant psychological barrier. Breaks below this level often signaled bearish market sentiment.

- $30,000: This level has served as both support and resistance, representing a crucial threshold in Bitcoin's price trajectory. Sustained trading above $30,000 often indicates a bullish trend.

- $60,000: This all-time high (ATH) in late 2021 acted as significant resistance before the market correction. Reclaiming this level would be a strong bullish signal.

Bullet Points:

- Market Sentiment: Breaks below key support levels historically coincided with negative market sentiment, fear, uncertainty, and doubt (FUD), leading to further price drops. Conversely, sustained trading above resistance levels fueled bullish sentiment and price rallies.

- Major Events: The Bitcoin halving events, which reduce the rate of new Bitcoin creation, have historically led to significant price increases in the long term due to decreased supply. Regulatory changes, both positive and negative, also profoundly impact the Bitcoin price.

- Illustrative Charts: (Insert relevant charts and graphs showcasing historical Bitcoin price action and key support/resistance levels. Clearly label the chart with key price points and dates.)

Current Market Indicators and Technical Analysis

Technical analysis provides valuable insights into potential price movements. Key indicators such as moving averages (MA), Relative Strength Index (RSI), and Bollinger Bands offer clues about the strength and direction of the Bitcoin price trend.

Bullet Points:

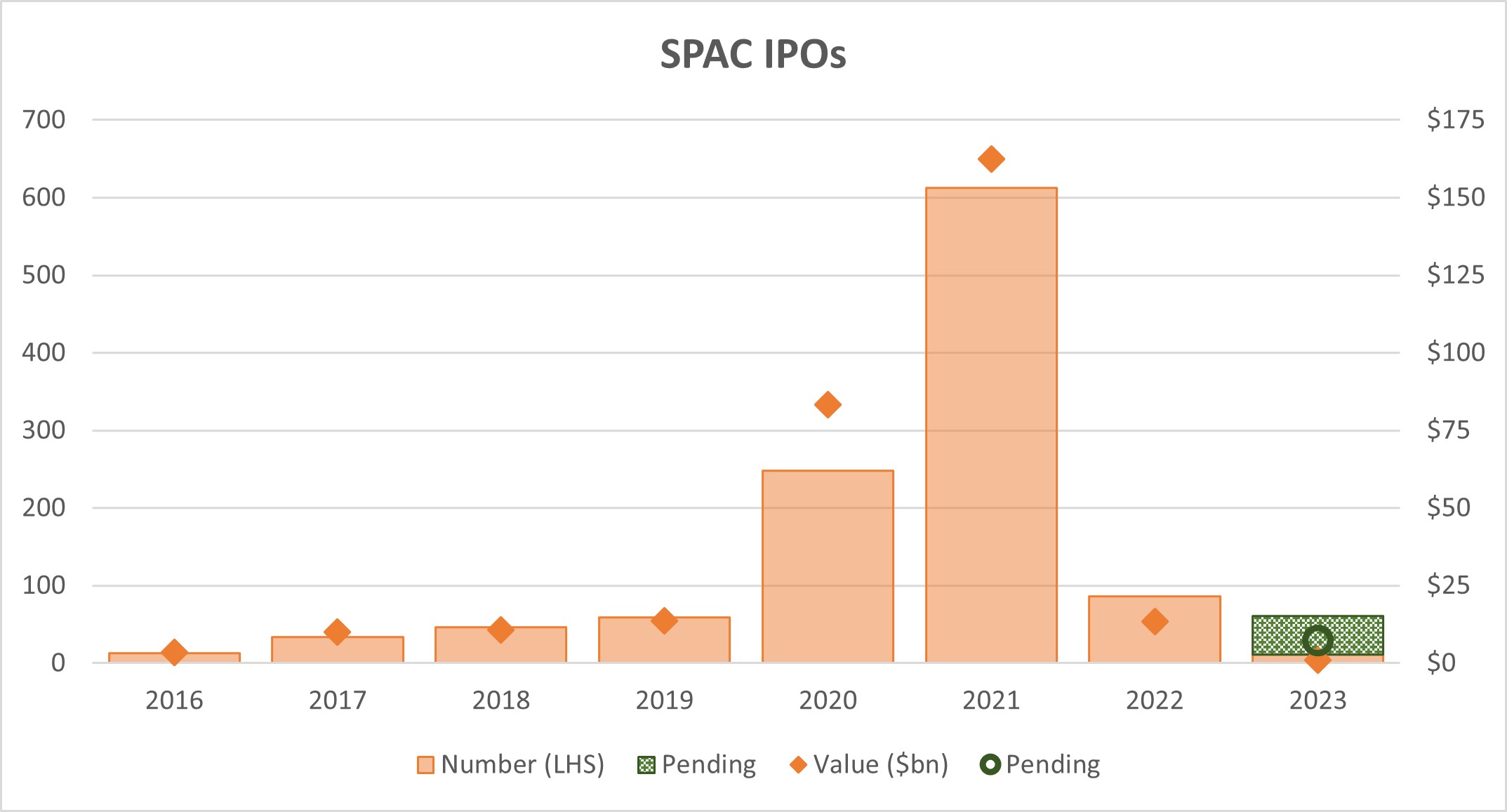

- Moving Averages: The relationship between Bitcoin's price and its 50-day and 200-day moving averages can signal bullish or bearish trends. A price above the moving averages suggests upward momentum, while a price below suggests downward pressure.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 often signals an overbought market, potentially indicating a price correction, while an RSI below 30 suggests an oversold market, potentially hinting at a price rebound.

- Bollinger Bands: These bands measure price volatility. Wider bands indicate higher volatility, while narrower bands suggest lower volatility. Price bounces off the upper and lower bands can signal potential reversal points.

Macroeconomic Factors Influencing Bitcoin Price

Bitcoin's price is not immune to macroeconomic forces. While often touted as a hedge against inflation, its correlation with traditional markets is complex and not always consistent.

Bullet Points:

- Inflation and Interest Rates: High inflation often drives investors towards alternative assets, potentially boosting Bitcoin's price. However, rising interest rates can decrease the attractiveness of riskier assets like Bitcoin.

- Global Economic Uncertainty: During periods of economic instability, Bitcoin can experience increased volatility as investors seek safe havens or speculate on its potential as digital gold.

- Regulatory Changes: Favorable regulatory frameworks can attract institutional investors, increasing demand and driving up the Bitcoin price. Conversely, restrictive regulations can hinder adoption and negatively affect the price.

- Institutional Adoption: Increased institutional investment, such as by large corporations and hedge funds, often leads to greater price stability and potential for sustained growth.

The Impact of Bitcoin Halving on Future Price

The Bitcoin halving, which occurs roughly every four years, reduces the rate of newly mined Bitcoin by half. This reduction in supply often leads to a scarcity effect, historically driving up the Bitcoin price.

Bullet Points:

- Historical Halvings: Past halvings have been followed by significant price increases in the long term. Analyzing these historical trends provides valuable insights into potential future price movements.

- Supply and Demand: The halving directly impacts supply, creating a potential imbalance in favor of increased price due to a limited supply.

- Miner Capitulation: During periods of low Bitcoin prices, miners might be forced to sell their holdings, causing further downward pressure on price. However, this capitulation often marks a bottom, setting the stage for a price recovery.

Assessing the Risk and Potential of Bitcoin at this Juncture

Investing in Bitcoin carries inherent risks. While it holds significant growth potential, its volatility is a major consideration.

Bullet Points:

- Volatility: The Bitcoin price can experience dramatic swings in short periods, resulting in substantial gains or losses.

- Risk Management: Diversification, dollar-cost averaging (DCA), and setting stop-loss orders are essential risk management strategies for Bitcoin investors.

- Potential for Gains and Losses: Bitcoin's price could experience significant appreciation, but substantial losses are also possible.

Conclusion:

Determining whether Bitcoin is at a critical juncture requires analyzing various factors. Historical price trends, current technical indicators, macroeconomic influences, and the upcoming halving all play significant roles in shaping the future Bitcoin price. While current Bitcoin price levels might suggest a potential turning point, the inherent volatility demands cautious optimism. Thoroughly researching and understanding the potential risks and rewards before investing is crucial. Continue monitoring the Bitcoin price and these key indicators to make informed decisions about your Bitcoin investment strategy. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions related to Bitcoin price fluctuations. Understanding the nuances of Bitcoin price is crucial for navigating this dynamic market.

Featured Posts

-

Analysis Of Kyle Kuzmas Comment On Jayson Tatums Viral Instagram

May 08, 2025

Analysis Of Kyle Kuzmas Comment On Jayson Tatums Viral Instagram

May 08, 2025 -

Recent India Pakistan Confrontation Understanding The Deep Strikes

May 08, 2025

Recent India Pakistan Confrontation Understanding The Deep Strikes

May 08, 2025 -

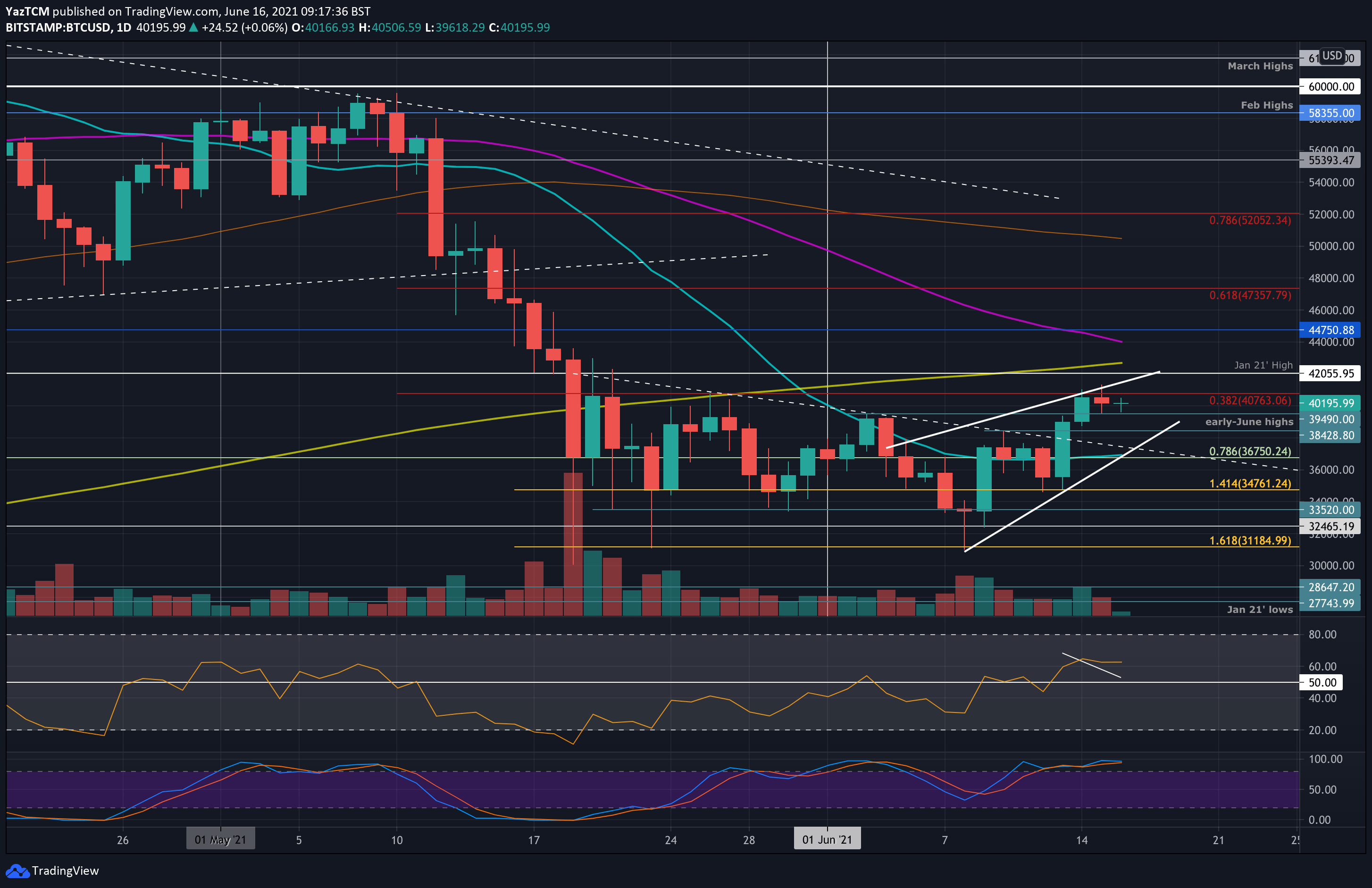

Is This New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025

Is This New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025 -

Lahwr Py Ays Ayl Ke Dwran Askwlwn Ke Awqat Kar Myn Tbdyly Ka Nwtyfkyshn

May 08, 2025

Lahwr Py Ays Ayl Ke Dwran Askwlwn Ke Awqat Kar Myn Tbdyly Ka Nwtyfkyshn

May 08, 2025 -

Understanding Bitcoins Golden Cross A Cyclical Indicator Explained

May 08, 2025

Understanding Bitcoins Golden Cross A Cyclical Indicator Explained

May 08, 2025