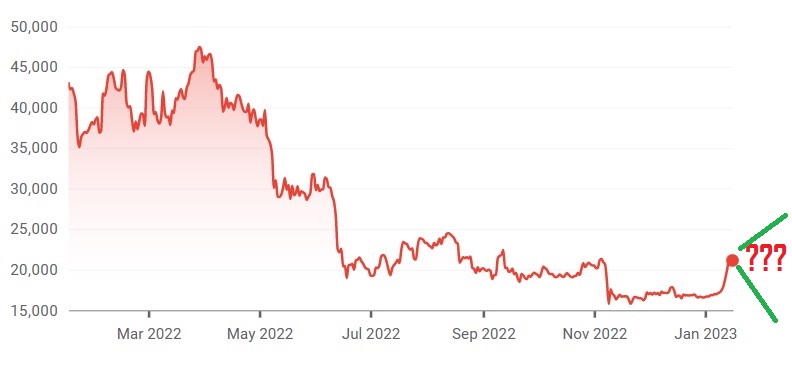

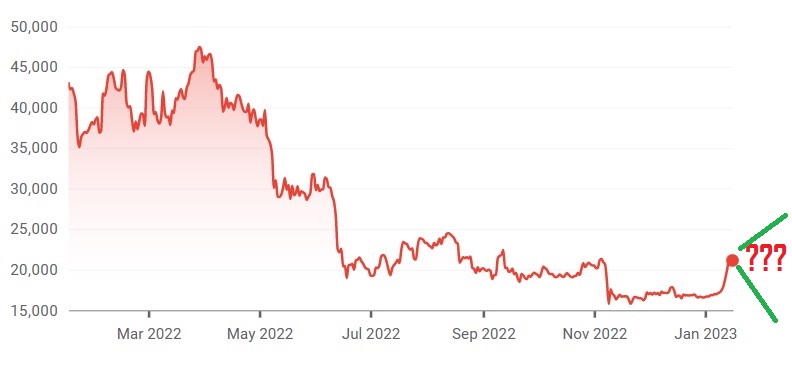

Is Bitcoin's Rebound Just The Beginning? A Comprehensive Analysis

Table of Contents

Analyzing the Drivers Behind Bitcoin's Rebound

Several key factors have contributed to the recent resurgence in Bitcoin's price. Understanding these drivers is crucial for evaluating the sustainability of Bitcoin's rebound.

Institutional Investment and Adoption

Institutional investors are increasingly embracing Bitcoin, a trend significantly impacting its price. This growing adoption reflects a shift in perception, with Bitcoin no longer viewed solely as a speculative asset but as a potential portfolio diversifier.

- MicroStrategy's significant Bitcoin holdings demonstrate a commitment to long-term investment, influencing market sentiment.

- Tesla's initial foray into Bitcoin, though later partially reversed, highlighted the potential for mainstream corporate adoption.

- The increasing prospect of Bitcoin ETFs in major markets could significantly boost institutional participation and liquidity, driving further price increases.

- Gradual increases in regulatory clarity in certain jurisdictions are making institutional investment more palatable and reducing associated risks.

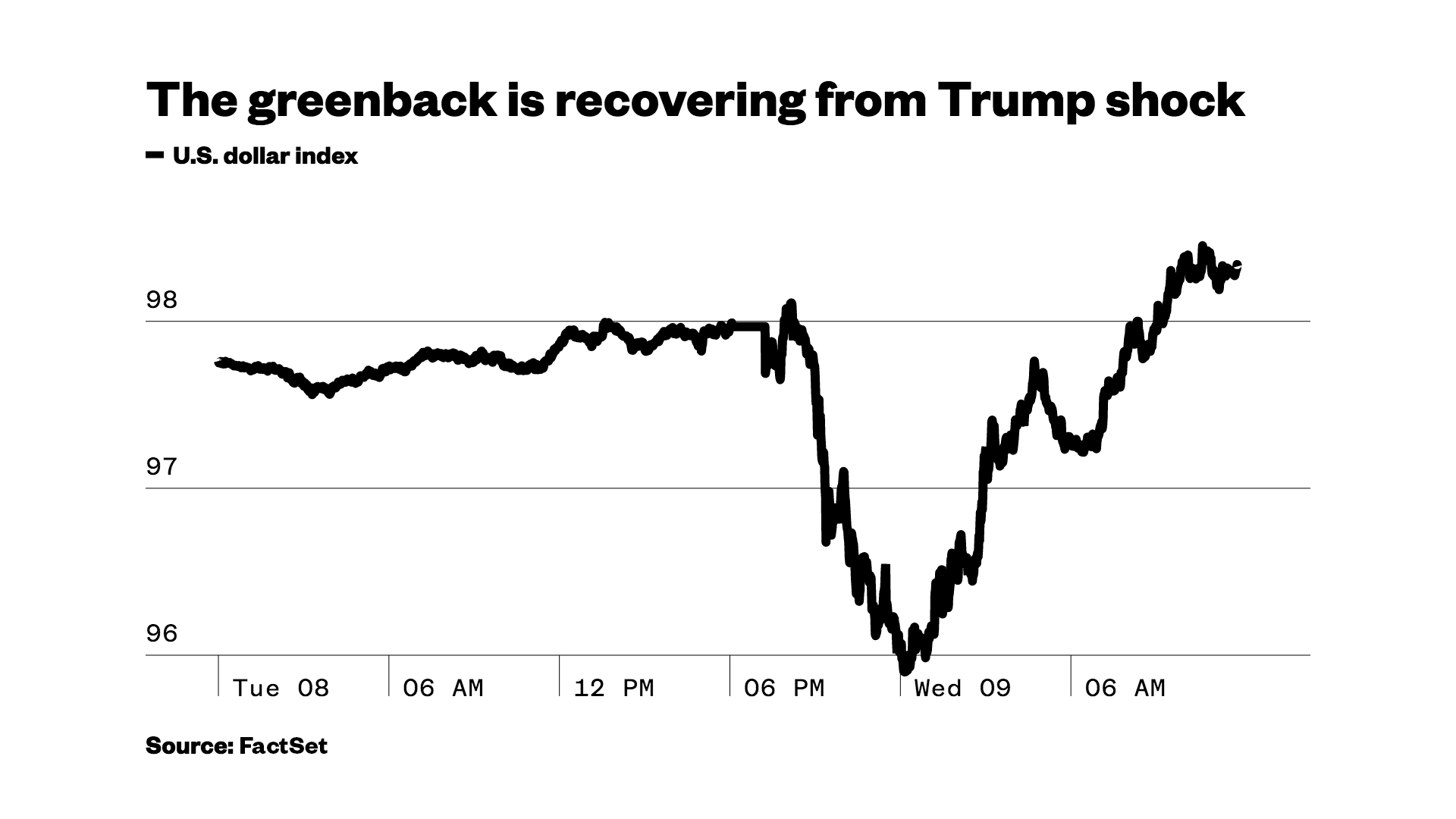

Macroeconomic Factors and Inflation Hedge

Macroeconomic instability and persistent inflation are fueling demand for Bitcoin as a potential inflation hedge. Investors are seeking alternative assets to preserve their purchasing power, and Bitcoin's limited supply makes it an attractive option.

- Soaring inflation rates globally are eroding the value of fiat currencies, making Bitcoin a more appealing store of value.

- High levels of government debt and ongoing quantitative easing policies in many countries further contribute to the appeal of Bitcoin as a decentralized, non-inflationary asset.

- Bitcoin's inherent scarcity, with a fixed supply of 21 million coins, is a key factor differentiating it from traditional fiat currencies.

Technological Advancements and Network Growth

Technological improvements and increased network activity enhance Bitcoin's functionality and appeal, boosting its long-term prospects.

- The Lightning Network, a second-layer scaling solution, significantly improves transaction speeds and reduces fees, making Bitcoin more practical for everyday use.

- A growing number of Bitcoin nodes strengthens the network's decentralization and resilience.

- Increased on-chain activity indicates growing adoption and usage, a positive sign for the long-term health of the Bitcoin ecosystem.

Assessing the Sustainability of Bitcoin's Rebound

While the drivers behind Bitcoin's rebound are compelling, several factors could influence its sustainability. A comprehensive analysis needs to consider these potential challenges.

Regulatory Landscape and Government Policies

The regulatory landscape surrounding Bitcoin varies considerably across jurisdictions. This uncertainty poses a significant risk to its future price.

- Differing regulatory approaches around the world create uncertainty and potential for market instability.

- Increased regulatory scrutiny in certain regions could stifle growth and dampen investor enthusiasm.

- The impact of upcoming legislation on Bitcoin remains a key uncertainty that could significantly impact its price.

Market Sentiment and Speculative Activity

Market sentiment, fueled by factors like FOMO (fear of missing out) and speculative trading, significantly influences Bitcoin's price volatility.

- The impact of social media narratives and news cycles can cause dramatic price swings, irrespective of underlying fundamentals.

- Periods of intense speculative activity often lead to unsustainable price bubbles, followed by sharp corrections.

- Understanding the role of market psychology is vital for assessing the sustainability of any price rebound.

Long-Term Adoption and Use Cases

The long-term potential of Bitcoin extends beyond speculation. Its adoption in various sectors will determine its ultimate value.

- Bitcoin's potential for use in cross-border payments could significantly reduce transaction costs and processing times.

- Its use in supply chain management could enhance transparency and traceability.

- The growing DeFi (decentralized finance) ecosystem is exploring innovative applications for Bitcoin.

- Increased merchant adoption is essential for Bitcoin's mainstream acceptance and daily use.

Predicting the Future of Bitcoin's Price

Predicting Bitcoin's future price with certainty is impossible. However, analyzing various scenarios can help us understand potential price movements.

Potential Price Targets and Scenarios

Several forecasting models exist, each with its own assumptions and limitations.

- Technical analysis studies price charts and patterns to predict future price movements.

- Fundamental analysis considers underlying economic factors and technological advancements.

- Different models generate varying price targets, ranging from bullish to bearish scenarios. It is crucial to approach all predictions with caution and acknowledge the inherent uncertainty.

Risk Factors and Potential Challenges

Several risks and challenges could hinder Bitcoin's growth trajectory.

- Environmental concerns surrounding Bitcoin mining's energy consumption require attention and innovative solutions.

- Security vulnerabilities remain a constant threat, requiring continuous improvements to security protocols.

- Competition from other cryptocurrencies could affect Bitcoin's market dominance.

Conclusion

Bitcoin's recent rebound is a complex phenomenon driven by a confluence of factors, including institutional adoption, macroeconomic instability, and technological advancements. While these factors suggest a positive outlook, the sustainability of this rebound depends on several key variables, including the regulatory landscape, market sentiment, and the pace of long-term adoption. The future of Bitcoin's price remains inherently uncertain. However, understanding the drivers behind Bitcoin's rebound is crucial for navigating this dynamic market. Stay informed and continue your research into Bitcoin's potential and the intricacies of its price movements. Monitoring Bitcoin's price rebound and its contributing factors will be key to making informed investment decisions.

Featured Posts

-

Check The Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025

Check The Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025 -

Understanding Xrps Price Movement The Role Of President Trump And Market Sentiment

May 08, 2025

Understanding Xrps Price Movement The Role Of President Trump And Market Sentiment

May 08, 2025 -

16th April 2025 Lotto Results Winning Numbers Announced

May 08, 2025

16th April 2025 Lotto Results Winning Numbers Announced

May 08, 2025 -

Jayson Tatums Bone Bruise Game 2 Status Update And Report

May 08, 2025

Jayson Tatums Bone Bruise Game 2 Status Update And Report

May 08, 2025