Is D-Wave Quantum Inc. (QBTS) The Best Quantum Computing Stock?

Table of Contents

D-Wave Quantum's Technology and Market Position

D-Wave Quantum's approach to quantum computing centers around quantum annealing, a method distinct from the gate-based model pursued by competitors like IBM and Google. Understanding this distinction is crucial for assessing QBTS's potential.

-

Quantum Annealing Explained: D-Wave's quantum annealers are designed to solve specific optimization problems by finding the lowest energy state of a quantum system. This approach is particularly well-suited for tackling complex combinatorial problems found in areas like logistics, finance, and materials science. Unlike gate-based quantum computers, which aim for universal computation, D-Wave's technology is specialized.

-

Market Share and Competition: While D-Wave was the first company to commercially sell quantum computers, its market share is a subject of ongoing debate. Companies like IBM, Google, IonQ, and Rigetti are also significant players, each with their own unique technologies and strategies. D-Wave's focus on specific applications, rather than general-purpose computation, positions it differently within this competitive landscape.

-

Advantages and Disadvantages of Quantum Annealing: The advantage of quantum annealing lies in its potential for solving specific optimization problems faster than classical computers. However, its specialized nature limits its applicability compared to the more versatile gate-based approach. This specialization also means D-Wave's quantum computers aren't directly comparable to other quantum computing platforms.

-

Key Clients and Applications: D-Wave boasts a range of clients across various industries, utilizing its technology for tasks such as drug discovery, financial modeling, and materials science research. These real-world applications showcase the practical potential of its technology, although the scale of these implementations remains relatively limited compared to the long-term vision.

Financial Performance and Investment Analysis of QBTS Stock

Analyzing QBTS stock requires a careful examination of D-Wave's financial performance and future prospects. The company's financial data provides crucial insights into its current stability and growth potential.

-

Recent Financial Performance: D-Wave's recent financials reveal a company still in its growth phase, with revenue increasing but profitability remaining a key challenge. Examining key metrics such as revenue growth, operating expenses, and cash flow is essential for understanding the company's financial health. (Charts and graphs illustrating financial data would be included here).

-

Growth Potential and Future Projections: The long-term growth potential of D-Wave hinges on the adoption of quantum annealing technology and its ability to expand into new markets and applications. Analysts' projections and the company's own forecasts should be considered, but remember these are inherently uncertain given the nascent stage of the quantum computing industry.

-

Investment Risks: Investing in QBTS stock carries inherent risks, including significant volatility due to the early stage of the quantum computing industry and intense competition. Market fluctuations, technological setbacks, and the failure to achieve anticipated milestones can all significantly impact the stock price.

-

Stock Valuation: Comparing D-Wave's valuation to its peers and the broader market provides context for assessing the stock's potential. Standard valuation metrics such as price-to-sales ratio (P/S) can help gauge whether the stock is overvalued or undervalued relative to its expected future growth.

Comparison with Other Quantum Computing Stocks

To accurately assess the investment potential of QBTS, comparing it to competitors is essential. This analysis illuminates D-Wave's strengths and weaknesses within the broader quantum computing ecosystem.

-

Competitor Analysis: Leading competitors in the quantum computing space include IBM (with its gate-based quantum computers), Google Quantum AI (also gate-based), IonQ (trapped ion technology), and Rigetti Computing (superconducting qubits). Each company possesses unique technological advantages and disadvantages, impacting their market positioning and investment profiles.

-

Technology and Business Model Comparison: A table summarizing the key differences between D-Wave and these competitors, including their technology types, target markets, and business models, would provide a clear comparative analysis. (Table would be included here).

-

Relative Investment Risks and Returns: The potential returns and associated risks vary significantly across these companies. Factors such as technological maturity, market penetration, and funding levels significantly influence investment risk and reward.

Considering the Long-Term Potential of QBTS

The long-term outlook for D-Wave and the broader quantum computing industry is crucial for assessing the wisdom of a QBTS investment. This analysis considers the future potential impact of quantum computing and D-Wave's place within it.

-

Long-Term Potential of Quantum Computing: Quantum computing holds immense potential to revolutionize numerous industries, from drug discovery and materials science to finance and artificial intelligence. The long-term market opportunity is massive, but the timeline for widespread adoption remains uncertain.

-

D-Wave's Technological and Business Goals: D-Wave's success hinges on its ability to improve its quantum annealing technology, expand its client base, and develop new applications for its systems. Assessing the plausibility of achieving these goals is critical.

-

Future Breakthroughs and Innovations: The rapid pace of innovation in quantum computing means that future breakthroughs could dramatically alter the landscape. D-Wave's ability to adapt and innovate will be crucial for its long-term survival and success. Continued R&D investment and partnerships are key factors to consider.

Conclusion

This article explored the question of whether D-Wave Quantum Inc. (QBTS) represents the best quantum computing stock. While D-Wave holds a unique position in the market with its quantum annealing technology, investors should carefully weigh its financial performance, technological advancements, and competitive landscape against other players in the quantum computing arena. Investing in any quantum computing stock involves inherent risks due to the early stage of the technology.

Call to Action: Thorough research is crucial before investing in any quantum computing stock, including D-Wave Quantum (QBTS). Do your due diligence and consider your risk tolerance before making any investment decisions related to D-Wave or other quantum computing stocks. Understanding the nuances of quantum annealing versus gate-based technologies is key to making an informed decision about whether D-Wave Quantum is the right quantum computing investment for you.

Featured Posts

-

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalinteko Kyvyt

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalinteko Kyvyt

May 20, 2025 -

Analyzing Suki Waterhouses Full Circle Met Gala Style

May 20, 2025

Analyzing Suki Waterhouses Full Circle Met Gala Style

May 20, 2025 -

Maiara E Maraisa No Festival Da Cunha Confirmacao De Isabelle Nogueira

May 20, 2025

Maiara E Maraisa No Festival Da Cunha Confirmacao De Isabelle Nogueira

May 20, 2025 -

Formula 1 2024 Sezonu Oencesi Geri Sayim Ve Analiz

May 20, 2025

Formula 1 2024 Sezonu Oencesi Geri Sayim Ve Analiz

May 20, 2025 -

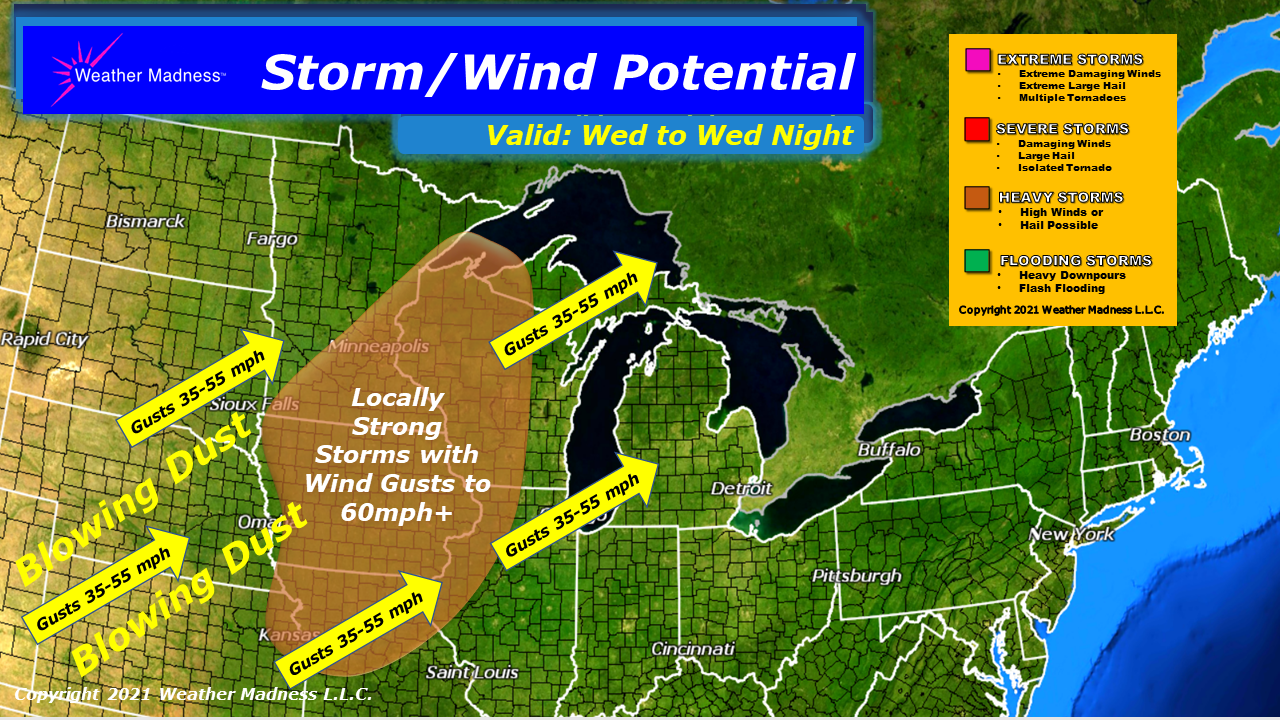

Understanding Damaging Winds In Fast Moving Storms

May 20, 2025

Understanding Damaging Winds In Fast Moving Storms

May 20, 2025

Latest Posts

-

I Patriarxiki Akadimia Kritis Filoksenei Esperida Gia Ti Megali Tessarakosti

May 20, 2025

I Patriarxiki Akadimia Kritis Filoksenei Esperida Gia Ti Megali Tessarakosti

May 20, 2025 -

Kancelaria Vs Home Office Vyhody A Nevyhody Pre Manazerov A Firmy

May 20, 2025

Kancelaria Vs Home Office Vyhody A Nevyhody Pre Manazerov A Firmy

May 20, 2025 -

Syzitisi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025

Syzitisi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Home Office Ci Kancelaria Analyza Preferencii Manazerov A Ich Zamestnancov

May 20, 2025

Home Office Ci Kancelaria Analyza Preferencii Manazerov A Ich Zamestnancov

May 20, 2025 -

Blog Home Office Alebo Kancelaria 79 Manazerov Uprednostnuje Osobne Stretnutia

May 20, 2025

Blog Home Office Alebo Kancelaria 79 Manazerov Uprednostnuje Osobne Stretnutia

May 20, 2025