Is Foot Locker (FL) A Genuine Winner According To Jim Cramer?

Table of Contents

Jim Cramer's Past Statements on Foot Locker (FL)

Jim Cramer, known for his outspoken views on Mad Money and other financial news programs, has offered various perspectives on Foot Locker stock over the years. Understanding his past recommendations is crucial for evaluating his current stance, if he's even commented recently.

-

Bullet Point 1: A History of Buy, Hold, and Sell Recommendations: Tracking Cramer's recommendations requires extensive research. Unfortunately, compiling a complete timeline of every comment on FL across all his platforms would be a monumental task. However, by searching transcripts and video archives from shows like Mad Money and Squawk on the Street, we can identify instances where he's discussed FL. For instance, searching for "Foot Locker Cramer" on reputable financial news sites might yield relevant articles and videos. Remember that opinions change as the market changes.

-

Bullet Point 2: The Rationale Behind Cramer's Opinions: When analyzing Cramer's past statements, we need to look beyond simple buy/sell signals. What were the underlying reasons behind his opinions? Did he cite strong earnings reports indicating robust revenue growth and increased profitability? Did he highlight concerns about competition from online retailers or shifting consumer preferences toward specific brands like Nike or Adidas? Understanding the context, such as prevailing market trends, is critical. Was the overall stock market bullish or bearish? Did macro-economic factors play a role?

-

Bullet Point 3: Verifying Information with Reliable Sources: It's essential to verify any information about Cramer's statements with credible sources. Relying only on second-hand accounts can be misleading. Always refer back to official transcripts, video recordings, or reputable financial news articles that directly quote Cramer. Direct links to these sources should be included for transparency and to confirm the accuracy of the information presented.

Foot Locker's (FL) Financial Performance and Market Position

To assess whether Foot Locker is a solid investment, it's vital to move beyond Cramer's opinions and conduct independent fundamental analysis.

-

Bullet Point 1: Analyzing Revenue, Earnings, and Growth: Examine Foot Locker's recent financial reports. Look for trends in revenue, net income, and earnings per share (EPS). Are these figures growing year-over-year? How do they compare to industry averages and the performance of competitors like Hibbett Sports or Dick's Sporting Goods? Analyzing these key performance indicators (KPIs) provides a clear picture of the company's financial health.

-

Bullet Point 2: E-commerce and Adaptability: Foot Locker's success depends on its ability to navigate the evolving retail landscape. How strong is its online presence? Does it have a robust e-commerce platform? How effectively is it integrating its online and offline channels (omnichannel strategy)? A company's ability to adapt to changing consumer behavior and embrace technological advancements is a key determinant of long-term success.

-

Bullet Point 3: Competitive Landscape and Market Share: Assess Foot Locker's position within the athletic footwear and apparel market. What is its market share? How does it compete against giants like Nike and Adidas, both in terms of product offerings and brand perception? Does Foot Locker have a clear competitive advantage, such as exclusive partnerships or a strong brand identity?

Reconciling Cramer's View with Foot Locker's Fundamentals

This section synthesizes Cramer's perspectives with our objective analysis of Foot Locker's financial health and market position.

-

Bullet Point 1: Comparing and Contrasting: Do Cramer's past recommendations align with Foot Locker's actual financial performance and market standing? Are there any significant discrepancies? Identifying these areas of agreement and disagreement helps determine whether his opinions are grounded in reality.

-

Bullet Point 2: Potential Biases: It's important to consider potential biases that might influence Cramer's opinions. Does he have any financial interests in Foot Locker or related companies? Could advertising revenue or market sentiment affect his outlook? Acknowledging these potential biases allows for a more critical assessment of his statements.

-

Bullet Point 3: Independent Investment Assessment: Ultimately, we should ask: Does Cramer's view on Foot Locker align with a sound investment strategy based on fundamental analysis? Considering all available information, is Foot Locker a worthwhile investment for you, irrespective of Cramer’s past commentary?

Conclusion: Is Foot Locker (FL) a Genuine Winner for You?

This article explored Jim Cramer's past statements on Foot Locker (FL), comparing them to a thorough analysis of the company's financial health and market position. While Cramer's opinions can offer valuable insight, they should be viewed as one piece of the puzzle, not the complete picture. Whether Foot Locker (FL) is a "genuine winner" depends entirely on your individual investment goals, risk tolerance, and thorough due diligence. Remember to conduct your own research and, if necessary, consult a financial advisor before making any investment decisions regarding Foot Locker (FL) stock or any other security.

Featured Posts

-

Concerns Raised Over Proposed Everest Climb Using Anesthetic Gas

May 15, 2025

Concerns Raised Over Proposed Everest Climb Using Anesthetic Gas

May 15, 2025 -

Fatih Erbakandan Kibris Aciklamasi Sehitlerimizin Kaniyla Cizilmis Kirmizi Cizgi

May 15, 2025

Fatih Erbakandan Kibris Aciklamasi Sehitlerimizin Kaniyla Cizilmis Kirmizi Cizgi

May 15, 2025 -

Mlb Betting Padres Vs Pirates Predictions And Best Odds Today

May 15, 2025

Mlb Betting Padres Vs Pirates Predictions And Best Odds Today

May 15, 2025 -

Joe Bidens Denials A Washington Examiner Analysis

May 15, 2025

Joe Bidens Denials A Washington Examiner Analysis

May 15, 2025 -

Snelle Actie Beloofd Na Gesprek Over Frederieke Leeflang En De Npo

May 15, 2025

Snelle Actie Beloofd Na Gesprek Over Frederieke Leeflang En De Npo

May 15, 2025

Latest Posts

-

12 7

May 16, 2025

12 7

May 16, 2025 -

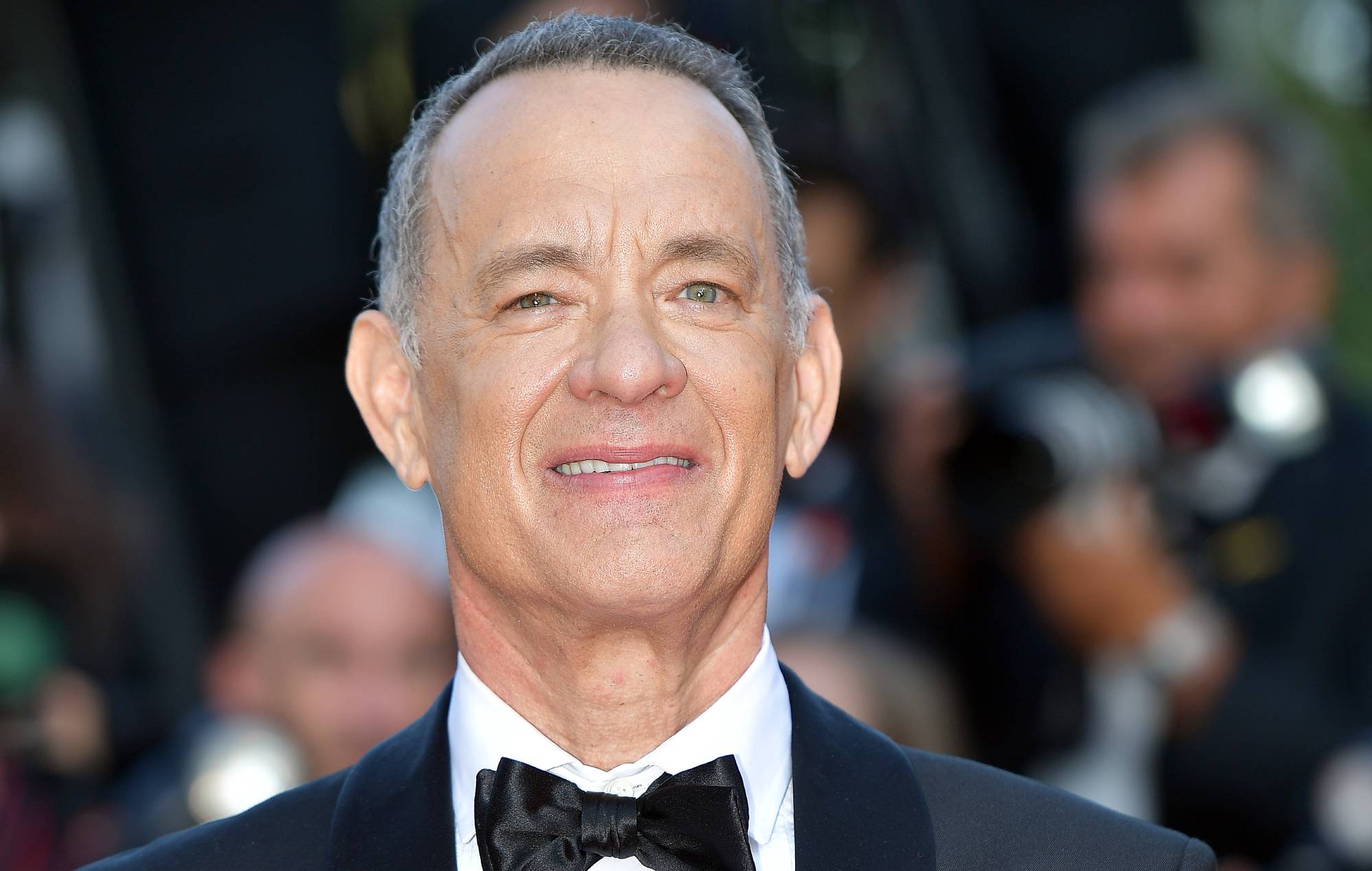

The 1 Debt Tom Cruises Unpaid Role To Tom Hanks

May 16, 2025

The 1 Debt Tom Cruises Unpaid Role To Tom Hanks

May 16, 2025 -

7 12

May 16, 2025

7 12

May 16, 2025 -

Tom Hanks And Tom Cruise A 1 Debt That Still Remains Unsettled

May 16, 2025

Tom Hanks And Tom Cruise A 1 Debt That Still Remains Unsettled

May 16, 2025 -

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 16, 2025

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 16, 2025