Is It Realistic To Buy A House While In Student Loan Repayment?

Table of Contents

Assessing Your Financial Situation

Before even considering a mortgage application, a thorough assessment of your financial health is crucial. This involves understanding your student loan debt and calculating how much of a mortgage you can realistically afford.

Analyzing Your Student Loan Debt

Understanding your student loan debt is the first step. This includes:

- Types of Loans: Differentiate between federal and private student loans, as they often have different repayment options and interest rates.

- Interest Rates: Knowing your interest rates is critical for projecting total repayment costs and choosing the most effective repayment strategy.

- Repayment Plans: Explore options like standard repayment, income-driven repayment (IDR), and graduated repayment plans. Understanding your options is vital in managing your monthly cash flow. Income-driven repayment plans, for example, may lower monthly payments, freeing up more cash for a mortgage.

- Loan Forgiveness Programs: Research potential loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), which may impact your long-term repayment burden.

Using a loan amortization calculator can help you visualize your total repayment cost and project future payments, giving you a clearer picture of your monthly financial commitment. This knowledge is essential when assessing your ability to simultaneously manage student loan repayments and a mortgage.

Calculating Your Affordable Mortgage Payment

Determining mortgage affordability involves more than just your monthly income. Lenders consider several factors:

- Debt-to-Income Ratio (DTI): This ratio compares your total monthly debt payments (including student loans) to your gross monthly income. A lower DTI improves your chances of mortgage approval.

- Credit Score Impact: Your credit score significantly influences your interest rate and, consequently, your monthly mortgage payment. A higher credit score usually translates to better terms.

- Down Payment Requirements: A larger down payment often leads to lower interest rates and monthly payments.

- Closing Costs: These upfront expenses, including appraisal fees, title insurance, and other charges, must be factored into your budget.

Pre-approval for a mortgage is highly recommended. This process gives you a realistic estimate of how much you can borrow, allowing you to shop for a house within your means, considering your existing student loan payments. Understanding the interplay between your student loan payments and potential mortgage payments is key to avoiding financial overextension.

Building an Emergency Fund

Unexpected expenses are inevitable. A robust emergency fund is essential for both maintaining financial stability and protecting your new home. Consider:

- Unexpected Home Repair Costs: From a leaky roof to a malfunctioning appliance, homeownership brings unexpected repair costs.

- Job Loss Scenarios: An emergency fund can provide a safety net if you lose your job, ensuring you can still meet your mortgage and student loan payments.

Aim for at least three to six months' worth of living expenses in your emergency fund before purchasing a home. This cushion offers peace of mind and helps avoid the high-interest debt that can quickly derail your financial plans.

Exploring Different Mortgage Options

Several mortgage options cater to different financial situations. Understanding these options is crucial for finding the best fit for your circumstances.

Government-Backed Loans (FHA, VA)

These loans offer several advantages for borrowers with existing debt:

- Lower Down Payment Requirements: FHA and VA loans often require lower down payments than conventional mortgages, making homeownership more accessible.

- Eligibility Criteria: While eligibility criteria exist, these loans are generally more lenient than conventional mortgages, making them suitable for individuals with student loan debt.

- Potential Benefits: These loans might offer more favorable terms for borrowers who might otherwise struggle to secure a conventional mortgage due to their student loan repayments.

Conventional Mortgages

Conventional mortgages are offered by private lenders and generally come with:

- Higher Down Payment Requirements: They typically demand larger down payments than government-backed loans.

- Stricter Eligibility: Lenders scrutinize credit scores and debt-to-income ratios more rigorously.

- Potential for Better Interest Rates: With a strong credit score and a substantial down payment, you might secure a lower interest rate compared to government-backed options.

Carefully compare and contrast the benefits and drawbacks of each mortgage type to determine which best aligns with your financial situation and student loan repayment plan.

Strategies for Managing Debt and Homeownership

Successfully managing both student loan repayments and homeownership requires strategic financial planning.

Prioritizing Debt Repayment

Several methods can accelerate your loan repayment without jeopardizing homeownership:

- Debt Snowball Method: Focus on paying off your smallest debt first for a quick win and motivational boost.

- Debt Avalanche Method: Prioritize paying off debts with the highest interest rates first, minimizing overall interest payments.

- Refinancing Options: Consider refinancing your student loans to secure a lower interest rate, reducing your monthly payments and freeing up cash flow.

Choose the debt repayment strategy best suited to your personality and financial situation. Consistency and discipline are vital to success.

Budgeting and Financial Planning

Meticulous budgeting is paramount:

- Creating a Realistic Budget: Allocate funds for your mortgage payment, student loan repayment, utilities, groceries, and other essential expenses.

- Tracking Expenses: Monitor your spending to ensure you stay within your budget.

- Saving for Home Maintenance and Repairs: Establish a separate savings account specifically for home maintenance and unexpected repairs.

Long-term financial planning is crucial. Regularly review your budget and adjust it as needed to adapt to changing circumstances and ensure that you are consistently working towards your financial goals.

Conclusion: Making the Dream of Homeownership a Reality While Managing Student Loan Repayment

Buying a house while repaying student loans presents unique challenges, but it's entirely achievable with careful financial planning and a realistic approach. By thoroughly assessing your financial situation, exploring various mortgage options, and implementing effective debt management strategies, you can make the dream of homeownership a reality. Start planning your path to homeownership today, even with student loan debt. Learn more about managing your finances and achieving your homeownership goals.

Featured Posts

-

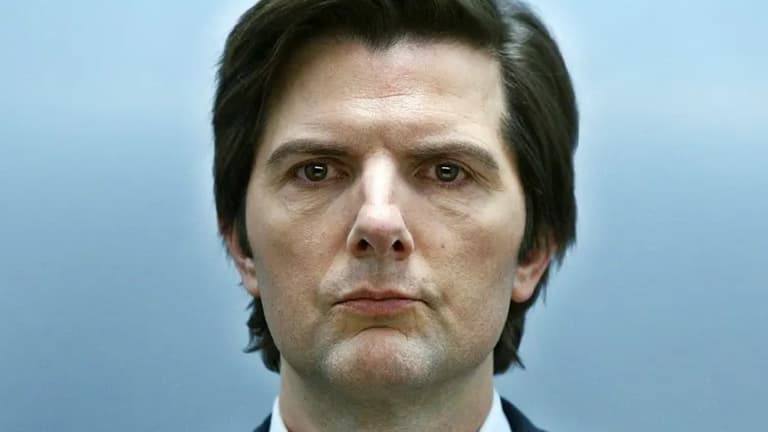

Is Severance Renewed For Season 3 A Look At The Possibilities

May 17, 2025

Is Severance Renewed For Season 3 A Look At The Possibilities

May 17, 2025 -

Is Josh Hart The Knicks Version Of Draymond Green Analyzing His Contributions

May 17, 2025

Is Josh Hart The Knicks Version Of Draymond Green Analyzing His Contributions

May 17, 2025 -

Knicks Playoff Hopes Rise As Jalen Brunson Nears Return

May 17, 2025

Knicks Playoff Hopes Rise As Jalen Brunson Nears Return

May 17, 2025 -

Reddit Down Thousands Of Users Worldwide Affected

May 17, 2025

Reddit Down Thousands Of Users Worldwide Affected

May 17, 2025 -

Andor Season 2 Exploring The Possibility Of Rebels Crossovers

May 17, 2025

Andor Season 2 Exploring The Possibility Of Rebels Crossovers

May 17, 2025