Is Jim Cramer Right About CoreWeave (CRWV)? Analyzing Its Position In AI Infrastructure

Table of Contents

CoreWeave's Business Model and Competitive Advantages

CoreWeave's success hinges on a strategic and innovative business model. Its key advantage lies in its specialized approach to providing cloud-based access to high-performance computing resources.

Leveraging NVIDIA GPUs for AI Workloads

CoreWeave's specialization in providing cloud-based access to high-performance NVIDIA GPUs is a key differentiator in the AI infrastructure market. This model offers several significant benefits:

- Scalability: Businesses can easily scale their computing resources up or down based on their needs, avoiding the high upfront costs of purchasing and maintaining their own hardware. This is particularly beneficial for AI projects that can experience fluctuating computational demands.

- Cost-Effectiveness: By utilizing a pay-as-you-go model, CoreWeave allows businesses to only pay for the computing power they actually use, minimizing wasted resources and operational expenses. This contrasts with the significant capital expenditure required for owning and operating a large-scale data center.

- Accessibility for Smaller Businesses: CoreWeave's cloud-based infrastructure makes access to powerful NVIDIA GPUs – such as the H100 and A100 – readily available to smaller companies and startups that might not otherwise have the resources to invest in such advanced technology. This democratization of access to AI capabilities is a major driver of growth.

While precise market share figures are difficult to obtain for this rapidly evolving market, CoreWeave's rapid growth suggests a significant and increasing presence amongst competitors. Industry analysts predict substantial growth within the GPU cloud services sector, indicating CoreWeave is well-positioned for continued expansion.

Focus on Sustainability and Efficiency

CoreWeave is differentiating itself through its commitment to environmental sustainability, a growing concern within the data center industry.

- Renewable Energy Sources: CoreWeave actively utilizes renewable energy sources to power its data centers, reducing its carbon footprint and aligning with the growing demand for environmentally responsible computing.

- Advanced Cooling Technologies: The company employs innovative cooling technologies to minimize energy consumption and improve efficiency, further contributing to its sustainability goals.

- Waste Reduction Initiatives: CoreWeave implements waste reduction initiatives throughout its operations, minimizing its environmental impact.

These sustainability efforts not only enhance CoreWeave's brand image but also contribute to long-term cost savings through reduced energy consumption. This commitment to sustainability is a powerful selling point in an increasingly environmentally conscious market.

Market Analysis: CoreWeave's Position in the AI Infrastructure Landscape

CoreWeave operates in a highly competitive market dominated by major players like AWS, Google Cloud, and Microsoft Azure. However, its focused approach and strategic advantages allow it to carve out a unique niche.

Competition and Market Share

The competition is fierce, with established cloud giants possessing extensive infrastructure and broad service offerings.

- AWS, Google Cloud, and Microsoft Azure: These players offer comprehensive cloud services, including GPU-based computing, but may not specialize in the same way as CoreWeave, potentially offering less focused and potentially more expensive solutions for specific AI workloads.

- Strengths and Weaknesses: CoreWeave’s strength lies in its deep specialization in AI workloads and its cost-effective, scalable GPU-as-a-service model. Its relatively smaller size compared to hyperscalers might be perceived as a weakness in terms of overall infrastructure scale, but also allows for greater agility and potentially faster innovation.

Market research reports suggest a substantial and rapidly expanding market for AI infrastructure services, offering significant growth potential for specialized players like CoreWeave. Disruptions, such as the increasing demand for more powerful GPUs and the need for sustainable data center solutions, favor CoreWeave's current position.

Growth Potential and Future Prospects

CoreWeave's future prospects are promising, with several avenues for expansion and growth.

- Strategic Acquisitions: Acquiring smaller companies with complementary technologies or expertise could accelerate CoreWeave's expansion into new markets or service areas.

- Strategic Partnerships: Collaborations with software providers, AI developers, or hardware manufacturers could broaden CoreWeave's reach and enhance its service offerings.

- Technological Advancements: Investing in and deploying cutting-edge GPU technologies and optimizing its infrastructure for maximum efficiency will be vital for maintaining a competitive edge.

The overall market growth in AI infrastructure is projected to be substantial, and CoreWeave's specialized focus positions it to benefit significantly from this growth.

Financial Performance and Investor Sentiment

Assessing CoreWeave's financial health and investor sentiment is crucial for understanding its overall prospects.

Analyzing CoreWeave's Financials

While CoreWeave is a relatively young company, examining its available financial data provides insights into its performance. Key metrics to consider include revenue growth, profitability, and debt levels. (Note: Specific financial data would need to be incorporated here from publicly available sources). Analyzing these metrics in the context of the company's growth trajectory is essential for evaluating its long-term financial sustainability.

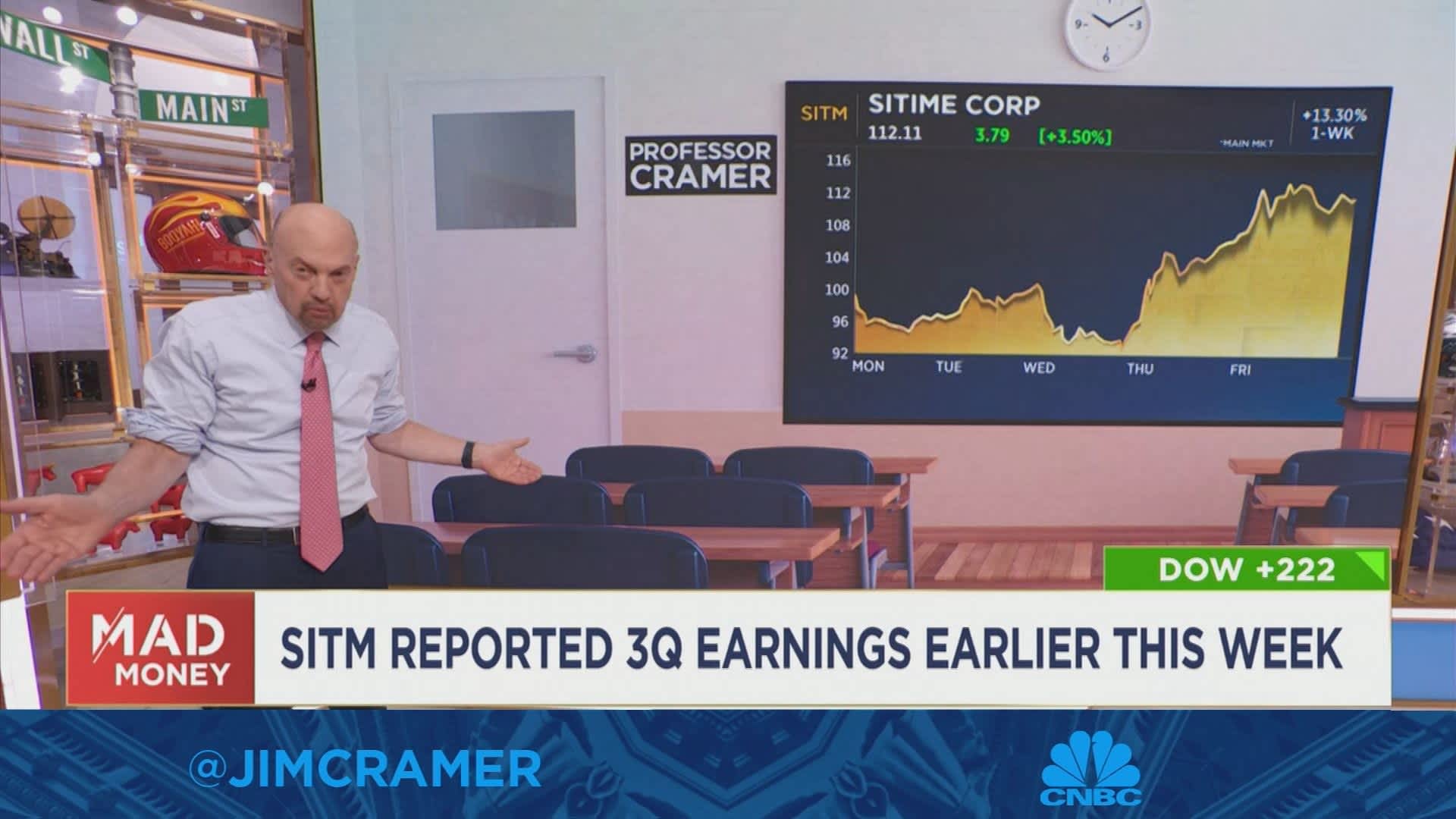

Investor Confidence and Stock Performance

Investor sentiment towards CoreWeave (CRWV) stock is a key factor influencing its valuation. Recent stock price movements, analyst ratings, and news events significantly affect investor confidence. Jim Cramer's comments, while not always a perfect predictor of future performance, should be considered within the broader context of market analysis and the company's underlying fundamentals.

Conclusion

This analysis has explored CoreWeave's (CRWV) position in the AI infrastructure market, considering its business model, competitive advantages, financial performance, and market outlook. We've evaluated the factors that contribute to its success and weighed them against various assessments. While determining whether any specific commentator's assessment is completely accurate requires ongoing monitoring and analysis, CoreWeave's strong specialization, commitment to sustainability, and the booming AI infrastructure market suggest a promising future for the company.

Call to Action: Whether you agree with Jim Cramer or not, stay informed about the developments in CoreWeave (CRWV) and the broader AI infrastructure sector. Continue researching CoreWeave (CRWV) and its competitors to make informed investment decisions based on your own due diligence. Understanding the intricacies of the CRWV business model and its competitive positioning within the AI infrastructure landscape is crucial for assessing its long-term potential.

Featured Posts

-

Strange Red Lights Observed Across France A Recent Event Investigated

May 22, 2025

Strange Red Lights Observed Across France A Recent Event Investigated

May 22, 2025 -

China Us Trade Soars Exporters Rush To Beat Trade Truce Deadline

May 22, 2025

China Us Trade Soars Exporters Rush To Beat Trade Truce Deadline

May 22, 2025 -

Loto Du Patrimoine 2025 Visite Virtuelle De L Interieur Du Theatre Tivoli A Clisson

May 22, 2025

Loto Du Patrimoine 2025 Visite Virtuelle De L Interieur Du Theatre Tivoli A Clisson

May 22, 2025 -

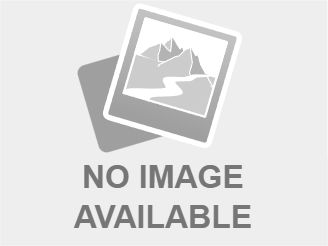

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

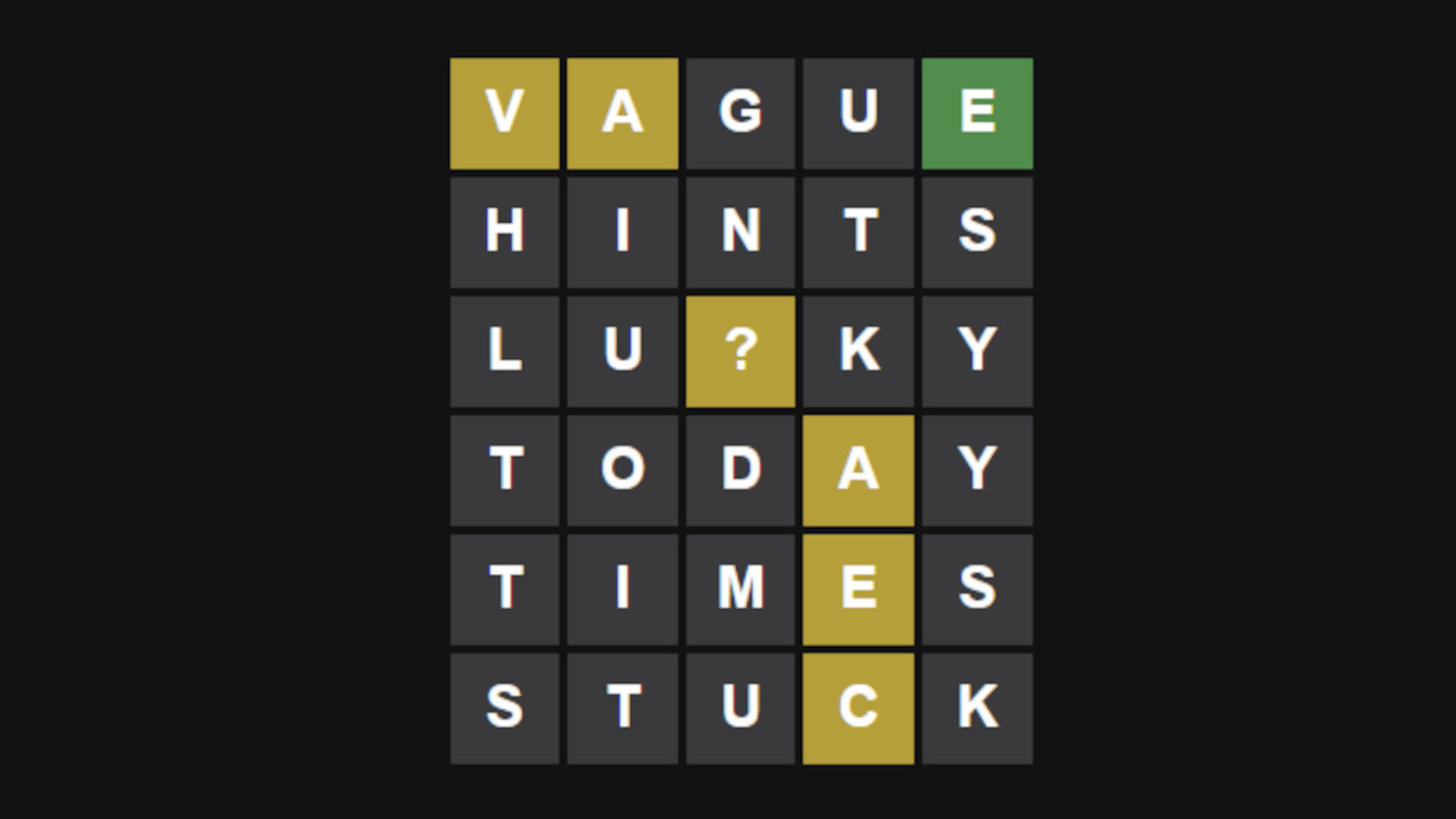

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025

Latest Posts

-

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025 -

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025 -

Todays Wordle Answer March 16th Solving Wordle 1366

May 22, 2025

Todays Wordle Answer March 16th Solving Wordle 1366

May 22, 2025 -

Challenging Wordle Puzzle Nyt Answer For March 26

May 22, 2025

Challenging Wordle Puzzle Nyt Answer For March 26

May 22, 2025