Is Live Now, Pay Later Right For You? A Practical Assessment

Table of Contents

Understanding Buy Now, Pay Later (BNPL) Schemes

How BNPL Works

Buy Now, Pay Later services allow you to purchase goods or services and pay for them in installments over a fixed period, usually interest-free for a limited time. However, this seemingly straightforward system has several nuances. Let's break down the mechanics:

- Payment Schedules: Most BNPL providers offer a four-payment plan, split over several weeks or months. The first payment is often due at the time of purchase.

- Eligibility Criteria: Generally, you need to be of legal age, have a valid bank account, and provide personal information for verification. Specific eligibility requirements vary among providers.

- Merchant Partnerships: BNPL services typically partner with various online and offline retailers, expanding their reach and making them available in a wide range of purchasing scenarios.

- Popular BNPL Providers: Klarna, Afterpay, Affirm, and PayPal's Pay in 4 are some of the major players in the BNPL market, each with slight variations in their terms and conditions.

Pros and Cons of BNPL

While the allure of instant gratification is undeniable, it's crucial to weigh the advantages and disadvantages carefully:

Pros:

- Convenience: BNPL simplifies the checkout process, making it easier to purchase items online or in-store.

- Improved Cash Flow (Short-Term): Spreading payments over time can alleviate immediate financial strain, especially for smaller purchases.

- Accessibility: BNPL can be accessible to individuals with limited credit history who might struggle to obtain traditional financing.

Cons:

- Potential for Debt Accumulation: Using BNPL for multiple purchases simultaneously can quickly lead to overwhelming debt.

- High Interest Charges: Missed payments often incur significant interest charges and late fees, potentially escalating the cost of the initial purchase substantially. Late fees can range from $10 to $30 per missed payment, and interest rates can reach 25% APR or more.

- Negative Impact on Credit Score: Late or missed payments on BNPL accounts can negatively affect your credit score, making it harder to secure loans or credit cards in the future.

Assessing Your Financial Situation

Before considering BNPL, a thorough self-assessment of your financial health is crucial.

Budgeting and Debt Management

Effective budgeting is paramount. Before using any BNPL service, honestly assess your income and expenses.

- Track Expenses: Monitor your spending habits for at least a month to understand where your money goes.

- Create a Budget: Develop a realistic budget that allocates funds for necessities, savings, and debt repayments.

- Understand Current Debt Levels: Be aware of existing debts and their associated interest rates. Using BNPL to cover existing debt is a dangerous cycle that can quickly spiral out of control.

Credit Score and Financial Health

Your credit score is a critical factor. Missed BNPL payments can significantly damage it.

- Maintain a Good Credit Score: A good credit score opens doors to better financial opportunities, including lower interest rates on loans and credit cards.

- Consequences of Poor Credit: Poor credit can lead to higher interest rates, limited access to credit, and difficulty renting an apartment or securing a job.

- Check Your Credit Score: Regularly check your credit score using free online tools or credit report services.

Alternatives to Buy Now, Pay Later

Instead of relying on BNPL, consider these alternatives:

Traditional Financing Options

- Credit Cards: If used responsibly, credit cards offer flexibility and can build credit history. However, high interest rates can accumulate debt if not managed carefully.

- Personal Loans: Personal loans provide a fixed repayment schedule and a potentially lower interest rate than BNPL, but typically require a credit check.

- Store Credit Cards: Some retailers offer store-specific credit cards with special promotions, but be mindful of high interest rates and strict terms.

Saving Up

The most responsible approach is to save for larger purchases.

- Budgeting and Saving: Develop a savings plan to gradually accumulate the funds needed for your desired purchase.

- Setting Financial Goals: Establish short-term and long-term savings goals to stay motivated and track your progress.

Conclusion

Buy Now, Pay Later services offer convenience but come with potential risks. While they can be beneficial for short-term cash flow management of smaller purchases, irresponsible use can lead to debt accumulation and damage your credit score. Before committing to a "live now, pay later" agreement, thoroughly assess your financial situation, create a budget, and explore alternative financing options. Responsible financial planning is key to avoiding debt and building a secure financial future. Is live now, pay later truly right for you? Only you can decide.

Featured Posts

-

Treyler Filma Frankenshteyn Ot Gilermo Del Toro Premera V Subbotu

May 30, 2025

Treyler Filma Frankenshteyn Ot Gilermo Del Toro Premera V Subbotu

May 30, 2025 -

Deutsche Bank Contractors Girlfriend In Data Center Security Breach

May 30, 2025

Deutsche Bank Contractors Girlfriend In Data Center Security Breach

May 30, 2025 -

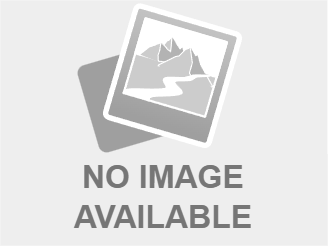

March Rainfall Insufficient To Relieve Water Deficit

May 30, 2025

March Rainfall Insufficient To Relieve Water Deficit

May 30, 2025 -

Odigos Tiletheasis Savvato 12 Aprilioy

May 30, 2025

Odigos Tiletheasis Savvato 12 Aprilioy

May 30, 2025 -

Unlocking Insights Ais Role In Analyzing And Transforming Scatological Documents Into Podcasts

May 30, 2025

Unlocking Insights Ais Role In Analyzing And Transforming Scatological Documents Into Podcasts

May 30, 2025