Is MicroStrategy Stock Or Bitcoin The Smarter Investment In 2025?

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's foray into Bitcoin has made it a unique entity in the business world. Understanding its strategy is crucial to evaluating its stock as an investment.

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's core business revolves around providing business intelligence, mobile software, and cloud-based services. However, its massive Bitcoin holdings have become a defining characteristic. As of [insert most recent date and update data], MicroStrategy holds approximately [insert number] Bitcoin, representing a significant portion of its total assets. The company's rationale for this massive Bitcoin investment centers on the belief in Bitcoin's long-term potential as a store of value and a hedge against inflation.

- Market Capitalization: [Insert current market cap] (Note: This will need to be updated frequently)

- Number of Bitcoins Held: [Insert current number of Bitcoins] (Note: This will need to be updated frequently)

- Impact of Bitcoin Price Fluctuations on MicroStrategy's Balance Sheet: Directly tied to Bitcoin's price, MicroStrategy's balance sheet experiences significant volatility. A surge in Bitcoin's price boosts the company's asset value, while a downturn has the opposite effect. This highlights the significant risk associated with MicroStrategy Bitcoin holdings.

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents a unique risk-reward profile. Its success is inextricably linked to Bitcoin's performance.

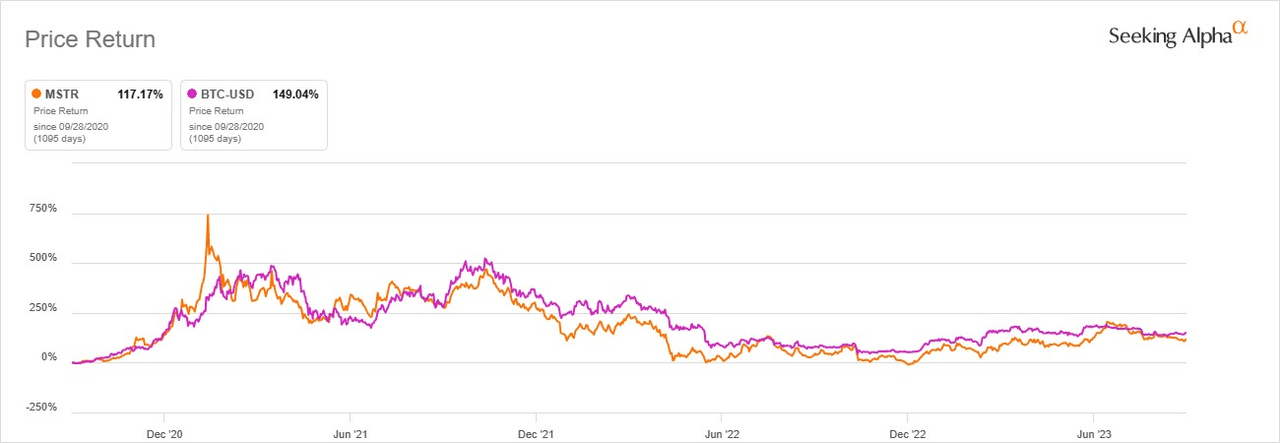

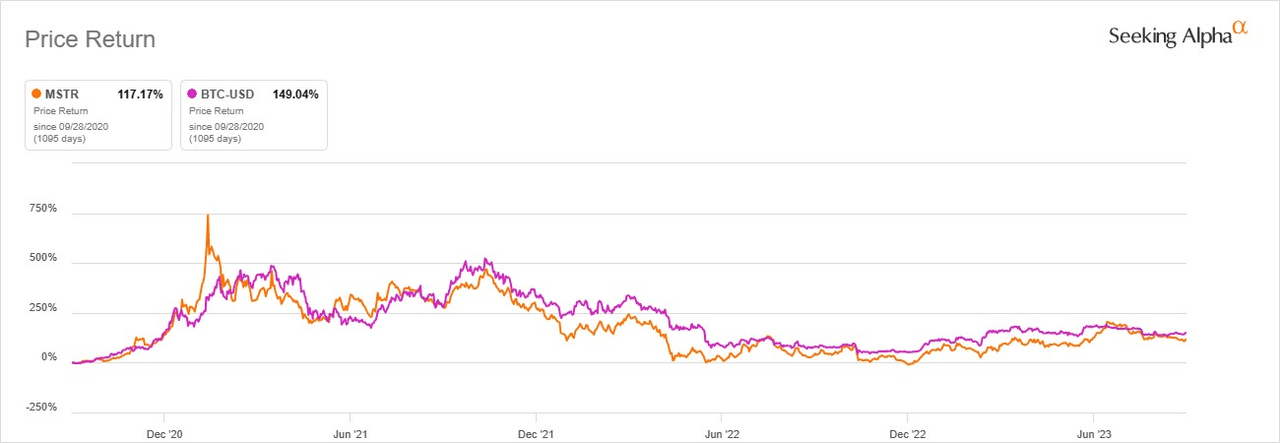

- Correlation between MicroStrategy stock price and Bitcoin price: A strong positive correlation exists; when Bitcoin's price rises, MicroStrategy's stock price generally follows suit, and vice-versa. This lack of diversification is a key risk factor.

- Potential for Growth: If Bitcoin continues its upward trajectory, MicroStrategy stands to benefit significantly, offering substantial growth potential for investors.

- Risks associated with a single-asset-heavy strategy: MicroStrategy's heavy reliance on Bitcoin exposes it to significant volatility and risk. A sharp downturn in the Bitcoin market could severely impact the company's financial health and stock price. This risk is amplified by the inherent volatility of Bitcoin price.

Analyzing Bitcoin as an Independent Investment

Bitcoin's status as a decentralized digital currency has made it a compelling investment option for many.

Bitcoin's Long-Term Potential and Adoption

Bitcoin's long-term potential rests on several factors:

- Institutional Adoption: Increasing numbers of institutional investors are adding Bitcoin to their portfolios, signaling growing acceptance and legitimacy.

- Regulatory Changes: While regulatory uncertainty remains a challenge, evolving frameworks in various jurisdictions could lead to greater clarity and wider adoption.

- Technological Advancements: Developments like the Lightning Network aim to improve Bitcoin's scalability and transaction speed, potentially boosting its usability.

- Competition from other cryptocurrencies: The emergence of alternative cryptocurrencies presents competition but also highlights the overall growth of the cryptocurrency market. The Bitcoin future is therefore intertwined with the broader cryptocurrency market trends.

Risks Associated with Bitcoin Investment

Investing directly in Bitcoin carries inherent risks:

- Price Fluctuations: Bitcoin's price is notoriously volatile, experiencing significant swings in short periods.

- Regulatory Risks: Governments worldwide are still developing regulatory frameworks for cryptocurrencies, creating uncertainty and potential for restrictions.

- Security Risks: The decentralized nature of Bitcoin makes it vulnerable to hacking and scams, though significant advancements have been made in security protocols.

- Environmental Concerns: The energy consumption associated with Bitcoin mining is a growing environmental concern.

MicroStrategy Stock vs. Bitcoin: A Direct Comparison

To determine the smarter investment, a direct comparison is necessary.

Comparing Risk Profiles

- Risk Tolerance Assessment: Investors with a high-risk tolerance may find Bitcoin more appealing, while those with lower risk tolerance might prefer the potentially more stable (though still volatile) MicroStrategy stock.

- Diversification Benefits: Investing directly in Bitcoin lacks diversification, while MicroStrategy stock, although heavily tied to Bitcoin, offers some diversification through its core business operations.

- Correlation Analysis: The strong positive correlation between MicroStrategy stock and Bitcoin limits diversification benefits, making direct Bitcoin investment a potentially more efficient way to gain Bitcoin exposure.

- Comparison of Potential Returns: Both offer high potential returns, but Bitcoin’s potential for higher gains is balanced by correspondingly higher risks.

Evaluating Long-Term Growth Potential

- Long-term projections for both Bitcoin and MicroStrategy stock: Predicting long-term growth for either is challenging, dependent on many external factors.

- Factors influencing future growth: Technological advancements, regulatory changes, market adoption, and macroeconomic conditions all play a significant role.

- Comparison of potential returns: While both offer substantial potential returns, the risk-reward ratio differs significantly. Bitcoin provides potentially higher returns but with significantly higher volatility. MicroStrategy stock offers a less volatile but possibly less lucrative alternative.

Conclusion

Choosing between MicroStrategy stock and Bitcoin as an investment for 2025 depends heavily on your individual risk tolerance and investment goals. While MicroStrategy offers some diversification through its core business, its fortunes remain deeply tied to Bitcoin's price. Bitcoin, on the other hand, presents a more direct, but riskier, exposure to the cryptocurrency market. Both assets offer significant potential rewards but also carry substantial risks.

Ultimately, the "smarter" investment depends on your individual circumstances and risk appetite. Thoroughly research both options, consult with a financial advisor, and make an informed decision about your investment strategy in MicroStrategy stock and/or Bitcoin for 2025 and beyond. Remember to diversify your portfolio effectively to mitigate risk. Consider your investment strategy for 2025 carefully, and remember that no investment is without risk.

Featured Posts

-

Experience Uber One Kenya Free Deliveries And Exclusive Member Benefits

May 08, 2025

Experience Uber One Kenya Free Deliveries And Exclusive Member Benefits

May 08, 2025 -

Gambits Heartbreaking New Weapon Revealed

May 08, 2025

Gambits Heartbreaking New Weapon Revealed

May 08, 2025 -

Lotto And Lotto Plus Results Wednesday April 2 2025

May 08, 2025

Lotto And Lotto Plus Results Wednesday April 2 2025

May 08, 2025 -

Bitcoin Buying Volume Surges On Binance First Time In Six Months

May 08, 2025

Bitcoin Buying Volume Surges On Binance First Time In Six Months

May 08, 2025 -

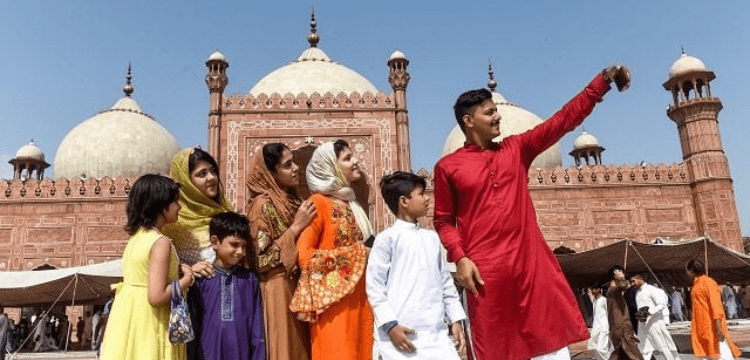

Weather In Lahore Punjab For Eid Ul Fitr A Two Day Prediction

May 08, 2025

Weather In Lahore Punjab For Eid Ul Fitr A Two Day Prediction

May 08, 2025