Is News Corp's Current Valuation Justified? Exploring Potential Undervaluation

Table of Contents

News Corp is a global media and information services company with diverse holdings, including newspapers (like the Wall Street Journal and the New York Post), book publishing houses, and digital real estate businesses. While recent performance has been mixed, a closer examination reveals compelling arguments suggesting the market may be overlooking the true value of this media giant. This article aims to analyze News Corp's valuation and present the case for potential undervaluation.

News Corp's Asset Base and Intrinsic Value

News Corp possesses a substantial asset base, both tangible and intangible, that contributes significantly to its intrinsic value. Many analysts believe the current market price fails to fully reflect this inherent worth.

Tangible Assets

News Corp's tangible assets represent a significant portion of its overall value, often underestimated by market sentiment.

- Real Estate Holdings: News Corp owns valuable real estate properties in key locations worldwide. The potential appreciation of these assets alone could significantly impact the company's overall valuation. For instance, prime real estate in New York City, where many of their operations are based, is consistently appreciating.

- Publishing Brands: The brand recognition and established reputation of publications like the Wall Street Journal and HarperCollins represent immense value. These brands command significant advertising revenue and reader loyalty, contributing to long-term profitability. The intangible value of these brands far exceeds their book value.

- Other Tangible Assets: News Corp possesses a diverse portfolio of other physical assets including printing facilities, office buildings, and technology infrastructure. These assets, while not as immediately lucrative as their media properties, contribute significantly to their operational capacity and overall worth.

The market's short-term focus often overlooks the long-term value of these tangible assets, potentially contributing to News Corp's undervaluation.

Intangible Assets

Beyond tangible assets, News Corp boasts a powerful portfolio of intangible assets:

- Intellectual Property: The vast library of copyrighted content, including news articles, books, and other intellectual properties, forms a significant asset base. This IP generates recurring revenue and provides a competitive advantage.

- Brand Recognition: Decades of building brand trust and reputation have created highly valuable intangible assets. Names like the Wall Street Journal and HarperCollins carry immense weight in their respective markets.

- Subscriber Base: A loyal and substantial subscriber base ensures consistent revenue streams, providing a crucial foundation for long-term growth. The digital transformation has presented challenges, but News Corp has demonstrated adaptability in maintaining and growing its subscriber numbers across various platforms.

These intangible assets, difficult to quantify precisely, contribute significantly to News Corp’s overall value and future earning potential, yet are often underrepresented in market valuations.

Financial Performance and Future Growth Prospects

Analyzing News Corp's financial performance and growth prospects provides further insight into its current valuation.

Revenue Streams and Diversification

News Corp's revenue streams are diversified across several segments, offering resilience against fluctuations within any single sector.

- Newspaper Circulation: While print circulation faces challenges, News Corp's flagship newspapers maintain strong digital subscriptions and advertising revenues.

- Book Publishing: HarperCollins continues to be a significant revenue generator, adapting to evolving consumer preferences by expanding digital offerings.

- Digital Real Estate: This rapidly growing segment provides significant opportunities for future growth, leveraging digital platforms and innovative business models.

Recent strategic acquisitions and investments demonstrate News Corp's commitment to diversification and adaptation to the changing media landscape.

Profitability and Cash Flow

News Corp consistently generates strong cash flow, providing the financial flexibility for future investments and shareholder returns.

- Profitability: Despite challenges in certain sectors, News Corp demonstrates consistent profitability, indicating efficient operations and a strong business model.

- Debt Levels: News Corp maintains manageable debt levels, allowing it to navigate market fluctuations and pursue strategic growth opportunities.

- Free Cash Flow: Strong free cash flow enables the company to invest in new initiatives, return capital to shareholders through dividends or buybacks, and weather economic downturns effectively.

A comparison of News Corp's financial health with its competitors reveals a comparable, and in certain aspects superior, financial position.

Market Growth and Opportunities

News Corp is well-positioned to capitalize on emerging market opportunities and the continued expansion of digital media.

- Emerging Markets: Expansion into international markets offers significant growth potential for News Corp's diversified portfolio.

- Digital Platforms: News Corp continues to invest in and adapt to the changing digital media landscape, exploring innovative content formats and platforms to reach wider audiences.

- Strategic Initiatives: News Corp's ongoing strategic initiatives, including investments in technology and digital content, reflect its commitment to long-term growth and adaptation to the ever-evolving media environment.

These opportunities present significant potential for future revenue growth and enhanced profitability.

Market Sentiment and Valuation Multiples

Market sentiment often plays a crucial role in shaping a company's valuation, and News Corp is no exception.

Current Market Valuation

News Corp's current market capitalization may not accurately reflect its underlying asset value and future earning potential.

- Market Sentiment: Short-term market fluctuations and sector-wide pessimism could be contributing to undervaluation. Investors might be overlooking the long-term value proposition of News Corp's diverse assets and strong cash flow.

- Peer Comparison: Comparing News Corp's valuation to its peers reveals potential undervaluation, particularly considering its diverse asset base and strong financial performance.

The market's short-sightedness in assessing long-term value might be a major factor impacting News Corp's current valuation.

Valuation Metrics

Using key valuation metrics, we can further assess News Corp’s potential undervaluation:

- Price-to-Earnings (P/E) Ratio: A low P/E ratio, compared to industry peers, could suggest undervaluation.

- Price-to-Book (P/B) Ratio: A low P/B ratio can indicate that the market undervalues the company's net asset value.

- Enterprise Value/EBITDA (EV/EBITDA): Analyzing this metric in comparison to competitors sheds further light on potential undervaluation.

A comprehensive analysis of these metrics, combined with qualitative factors, supports the argument of potential undervaluation.

Conclusion

In summary, News Corp's diverse asset base, robust financial performance, and significant growth prospects suggest that its current market valuation may not fully reflect its intrinsic value. The market's short-term focus and sector-wide pessimism may be overlooking the long-term value of its tangible and intangible assets and strong cash flow generation. Is News Corp's current valuation justified? Based on this analysis, the answer leans towards a resounding "no." Investigate whether News Corp's current valuation is truly justified for yourself. Conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Indonesia Classic Art Week 2025 Pameran Porsche

May 25, 2025

Indonesia Classic Art Week 2025 Pameran Porsche

May 25, 2025 -

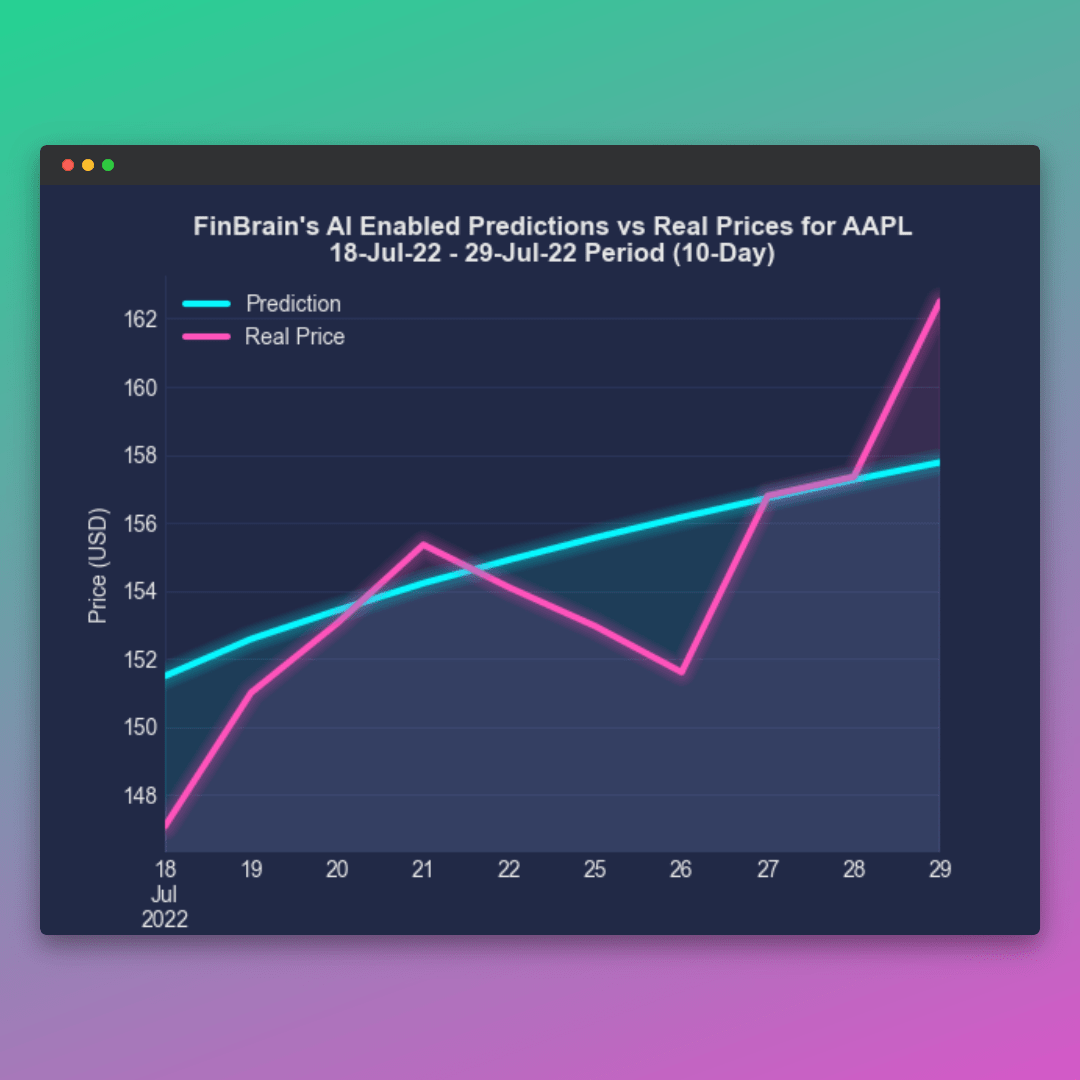

Aapl Stock Analysis Of Upcoming Price Levels And Support Resistance

May 25, 2025

Aapl Stock Analysis Of Upcoming Price Levels And Support Resistance

May 25, 2025 -

Paris Facing Economic Headwinds Luxury Sector Slowdown

May 25, 2025

Paris Facing Economic Headwinds Luxury Sector Slowdown

May 25, 2025 -

Philips 2024 Annual General Meeting What To Expect

May 25, 2025

Philips 2024 Annual General Meeting What To Expect

May 25, 2025 -

Crystal Palace Target Free Transfer For Kyle Walker Peters

May 25, 2025

Crystal Palace Target Free Transfer For Kyle Walker Peters

May 25, 2025

Latest Posts

-

Analyzing Thames Waters Executive Bonus Scheme

May 25, 2025

Analyzing Thames Waters Executive Bonus Scheme

May 25, 2025 -

The Problem With Thames Waters Executive Bonuses

May 25, 2025

The Problem With Thames Waters Executive Bonuses

May 25, 2025 -

Thames Waters Executive Pay Performance Vs Reward

May 25, 2025

Thames Waters Executive Pay Performance Vs Reward

May 25, 2025 -

Thames Water Executive Compensation A Public Outcry

May 25, 2025

Thames Water Executive Compensation A Public Outcry

May 25, 2025 -

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025