Is Palantir A Buy After A 30% Drop?

Table of Contents

Analyzing Palantir's Recent Performance and the Reasons for the Drop

Market Sentiment and Sector-Wide Downturn

The recent slump in Palantir stock isn't solely attributable to company-specific factors. The broader market environment has played a significant role. Rising interest rates, persistent inflation, and a general increase in investor risk aversion have negatively impacted the technology sector, of which Palantir is a part. This sector-wide downturn has created a challenging climate for even high-growth companies like Palantir.

- Rising interest rates: Increased borrowing costs reduce the attractiveness of high-growth stocks like PLTR, which are often valued based on future earnings potential.

- Inflation concerns: Inflation erodes the purchasing power of future earnings, impacting the valuation of growth stocks.

- Investor risk aversion: In uncertain economic times, investors often shift towards safer investments, leading to a sell-off in riskier assets, including Palantir stock.

Palantir's Financial Performance and Growth Prospects

While Palantir has demonstrated substantial revenue growth, profitability remains a key area of focus. Examining Palantir's recent financial reports reveals a mixed picture. Revenue growth has been impressive, but profitability lags behind expectations. Analyzing key financial metrics is crucial to understanding the company's current state and its prospects for future growth.

- Revenue Growth: Palantir has consistently shown significant year-over-year revenue growth, fueled by its expanding customer base across government and commercial sectors.

- Profitability: While revenue is increasing, profitability remains a challenge. Investors are scrutinizing Palantir's ability to translate revenue growth into consistent and sustainable profits.

- Debt Levels: Monitoring Palantir's debt levels is important for assessing its financial health and risk profile. High debt can restrict future growth and increase financial vulnerability.

Specific Events Impacting Palantir Stock

Beyond macroeconomic factors, specific events have influenced Palantir's stock price. For example, contract wins or losses, particularly in the government sector, can significantly impact investor sentiment. Any regulatory changes affecting the big data analytics industry also play a role.

- Contract wins/losses: Large government contracts are crucial to Palantir's revenue stream. The success or failure in securing new contracts directly influences investor confidence and stock price.

- Regulatory changes: Changes in data privacy regulations or government procurement policies can significantly impact Palantir's operations and revenue potential.

Evaluating Palantir's Long-Term Potential and Investment Risks

Growth Potential in Big Data and AI

Palantir operates in the rapidly growing big data and artificial intelligence markets, positioning it for significant long-term growth. Its advanced data analytics platforms are increasingly sought after by government agencies and commercial organizations looking to leverage data for strategic decision-making.

- Technological Advantages: Palantir possesses unique technological capabilities and expertise in big data analytics, giving it a competitive edge.

- Strategic Partnerships: Partnerships and collaborations with key players in the tech industry can accelerate Palantir's growth and market penetration.

Government Contracts vs. Commercial Partnerships

Palantir's revenue is derived from both government contracts and commercial partnerships. The balance between these two revenue streams presents both opportunities and risks. Government contracts often offer stability and predictable revenue, but their growth potential may be limited. Commercial partnerships, on the other hand, present higher growth potential but can be more volatile.

- Government Contracts: These contracts provide a reliable revenue stream but may be subject to bureaucratic processes and funding cycles.

- Commercial Partnerships: These partnerships offer higher growth potential but involve greater competition and market uncertainties.

Competitive Landscape and Market Share

Palantir faces competition from other big data analytics companies. Analyzing the competitive landscape is essential for assessing Palantir's market share and its ability to maintain a competitive advantage.

- Key Competitors: Identify and analyze Palantir's main competitors in the big data and AI space.

- Competitive Strengths and Weaknesses: Evaluate Palantir's strengths and weaknesses relative to its competitors.

Valuation and Future Price Targets

Assessing Palantir's current valuation and projecting future price targets requires employing various financial models. Different valuation methods can lead to varying conclusions about the stock's intrinsic value.

- Discounted Cash Flow (DCF) Analysis: A DCF model estimates the present value of Palantir's future cash flows to determine its intrinsic value.

- Comparable Company Analysis: This method compares Palantir's valuation multiples (e.g., price-to-sales ratio) to those of similar companies.

Conclusion: Is Now the Time to Buy Palantir Stock?

Palantir's recent 30% stock price drop presents a complex investment scenario. While the broader market downturn and certain company-specific factors contributed to the decline, Palantir operates in a high-growth sector with significant long-term potential. The balance between its reliance on government contracts and its pursuit of commercial partnerships presents both risks and opportunities. Ultimately, whether Palantir stock is a buy depends on individual risk tolerance and investment horizons. A thorough due diligence process, considering both the potential upside and downside, is essential.

Considering Palantir's potential and the recent price drop, now might be a good time to research Palantir stock further and decide if it aligns with your investment strategy. Conduct your own due diligence before making any investment decisions regarding PLTR. Remember that this article is for informational purposes only and is not financial advice.

Featured Posts

-

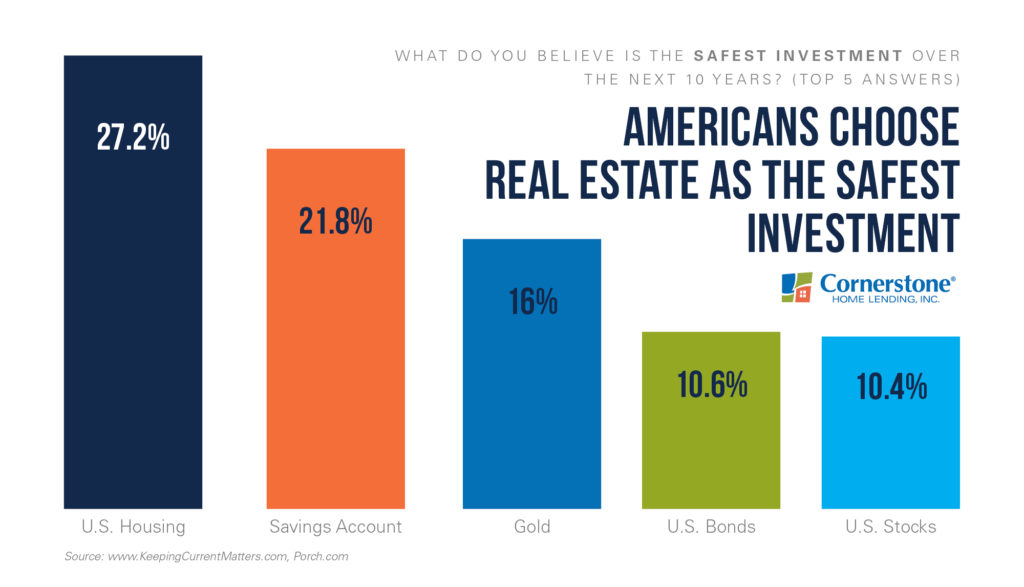

Is This Investment Really A Safe Bet A Practical Guide

May 10, 2025

Is This Investment Really A Safe Bet A Practical Guide

May 10, 2025 -

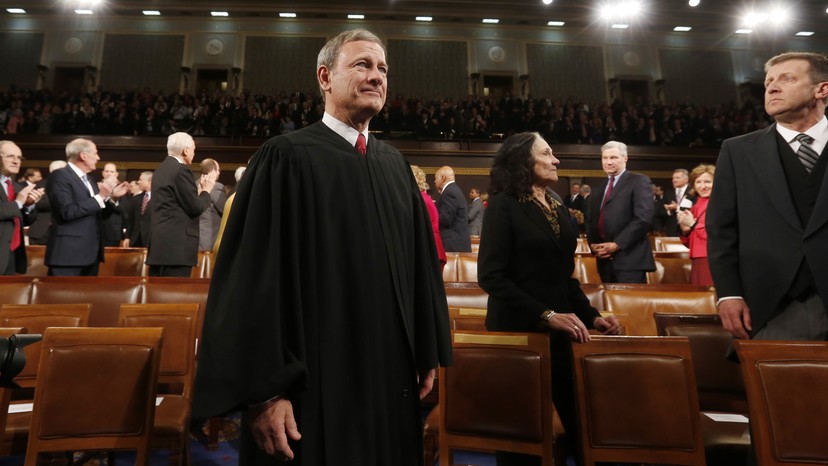

Chief Justice Roberts Shares How He Handled Being Mistaken For Former Gop House Leader

May 10, 2025

Chief Justice Roberts Shares How He Handled Being Mistaken For Former Gop House Leader

May 10, 2025 -

Pentagons Greenland Realignment Assessing The Strategic Implications And Public Concerns

May 10, 2025

Pentagons Greenland Realignment Assessing The Strategic Implications And Public Concerns

May 10, 2025 -

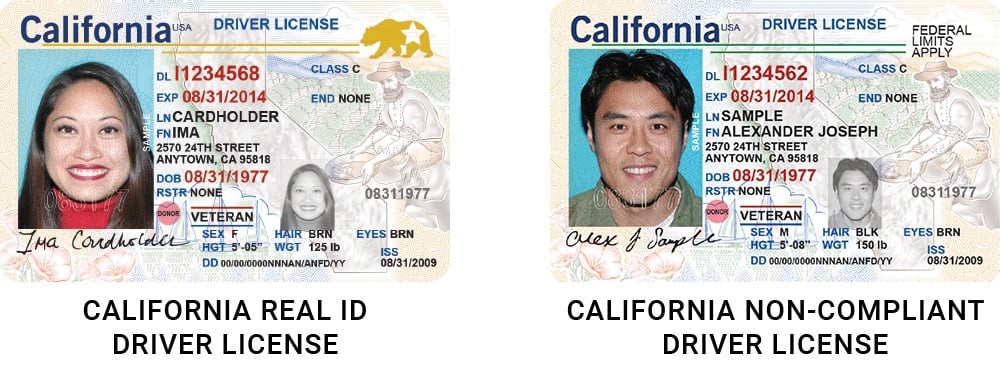

Preparing For Real Id Compliance A Guide For Summer Travelers

May 10, 2025

Preparing For Real Id Compliance A Guide For Summer Travelers

May 10, 2025 -

R5

May 10, 2025

R5

May 10, 2025