Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir is a data analytics company renowned for its powerful platforms, Gotham and Foundry, serving both government and commercial clients. It leverages advanced artificial intelligence and machine learning to help organizations analyze massive datasets, uncovering valuable insights and improving operational efficiency. This analysis aims to provide a clear picture of Palantir’s current standing and potential, enabling you to determine if it's a suitable addition to your investment portfolio.

Palantir's Business Model and Revenue Streams

Palantir's revenue streams are primarily derived from two key sectors: government contracts and commercial partnerships. The balance between these two significantly impacts its overall financial health and future growth potential.

Government Contracts

Government contracts form a significant portion of Palantir's revenue, providing a degree of stability and predictable income. These contracts often involve long-term partnerships, offering sustained revenue streams. However, reliance on government funding also presents inherent risks.

- Key Government Clients: The US intelligence community, various branches of the US military, and several international government agencies.

- Contract Values: While specific contract values are often undisclosed for security reasons, public filings indicate multi-year agreements worth hundreds of millions of dollars.

- Future Contract Expectations: Palantir actively pursues new government contracts and continues to expand its existing relationships, suggesting consistent future revenue from this sector.

Commercial Partnerships

Palantir's commercial sector is experiencing rapid expansion, broadening its client base beyond government entities. This diversification is crucial for long-term stability and growth, reducing reliance on a single revenue stream.

- Significant Commercial Partnerships: Palantir works with leading companies across various sectors, including finance, healthcare, and energy. Specific partnerships are often announced through press releases.

- Contribution to Revenue Growth: The commercial sector's revenue contribution is increasing year-on-year, demonstrating strong market acceptance and potential for future growth.

- Future Projections: Analysts predict continued growth in the commercial sector, fueled by increased demand for Palantir's data analytics capabilities across diverse industries.

Platform Growth and Innovation

Palantir's ongoing investment in research and development fuels continuous improvement of its platforms, Gotham and Foundry. These upgrades ensure competitiveness and attract new clients.

- Key Features and Updates: Regular software updates introduce new functionalities, improved user interfaces, and enhanced analytical capabilities.

- Competitive Advantages: Palantir's platforms are known for their ability to handle extremely large and complex datasets, providing a significant competitive advantage.

- Potential for Future Innovation: Palantir's commitment to innovation positions it well to capitalize on emerging trends in artificial intelligence and big data analytics.

Financial Performance and Valuation

Analyzing Palantir's financial performance is crucial to assess its investment potential. Key metrics provide insights into its financial health and future outlook.

Revenue Growth and Profitability

Palantir has demonstrated consistent revenue growth, although profitability remains a focus area. Analyzing year-over-year growth rates and comparing them to industry benchmarks is essential.

- Key Financial Metrics: Revenue, net income, earnings per share (EPS), and operating margins are all crucial indicators of Palantir's financial performance.

- Year-Over-Year Growth Rates: Examining the consistent increase in revenue and other key metrics provides a clear picture of Palantir’s growth trajectory.

- Profitability Trends: While Palantir is not yet consistently profitable, monitoring the trends in its profitability margins reveals progress and future potential.

Stock Valuation and Price Targets

Assessing Palantir's current stock valuation involves evaluating various metrics and comparing them to analyst price targets and industry peers.

- Current Stock Price: The current market price of PLTR stock is readily available through financial websites.

- P/E Ratio: The Price-to-Earnings ratio provides insights into the market's valuation of Palantir's earnings.

- Price Targets from Analysts: Various financial analysts provide price targets for PLTR stock, offering different perspectives on its potential future value.

- Implications for Investors: Comparing the current price to analyst targets, considering the P/E ratio, and factoring in growth prospects helps determine whether the stock is currently undervalued or overvalued.

Risks and Challenges Facing Palantir

While Palantir presents significant growth potential, several risks and challenges must be considered.

Competition and Market Saturation

The data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share.

- Key Competitors: Companies like AWS, Microsoft, and Google offer competing data analytics solutions.

- Market Share: Assessing the market share held by Palantir and its competitors provides a perspective on its competitive positioning.

- Potential Impact on Palantir's Growth: The increased competition could potentially slow Palantir’s growth rate if it fails to innovate and maintain its competitive edge.

Dependence on Government Contracts

Palantir's reliance on government contracts exposes it to risks associated with potential budget cuts or policy changes.

- Potential Risks: Changes in government priorities, reduced defense spending, or shifts in geopolitical situations could negatively impact revenue from government contracts.

- Mitigation Strategies: Diversifying its revenue streams into the commercial sector is a key mitigation strategy employed by Palantir.

Economic Uncertainty

Broader economic conditions, such as inflation or recession, can impact Palantir’s business and stock price.

- Macroeconomic Factors: Factors like interest rate hikes, inflation rates, and overall economic growth can influence investor sentiment and demand for Palantir's services.

Conclusion

Analyzing whether Palantir stock is a buy right now requires careful consideration of its strong growth in the commercial sector, its innovative technology, and its established government partnerships. However, the risks associated with competition, reliance on government contracts, and broader economic uncertainty must also be weighed. While Palantir's long-term potential is promising, its current valuation and profitability need further assessment.

Based on this analysis, a balanced approach might be recommended. Thorough due diligence is critical before making any investment decision.

Ultimately, the decision of whether or not to buy Palantir stock is yours. Weigh the factors discussed in this analysis and determine if Palantir stock aligns with your investment goals and risk tolerance. Remember to conduct your own research and consult with a financial advisor before investing in any stock.

Featured Posts

-

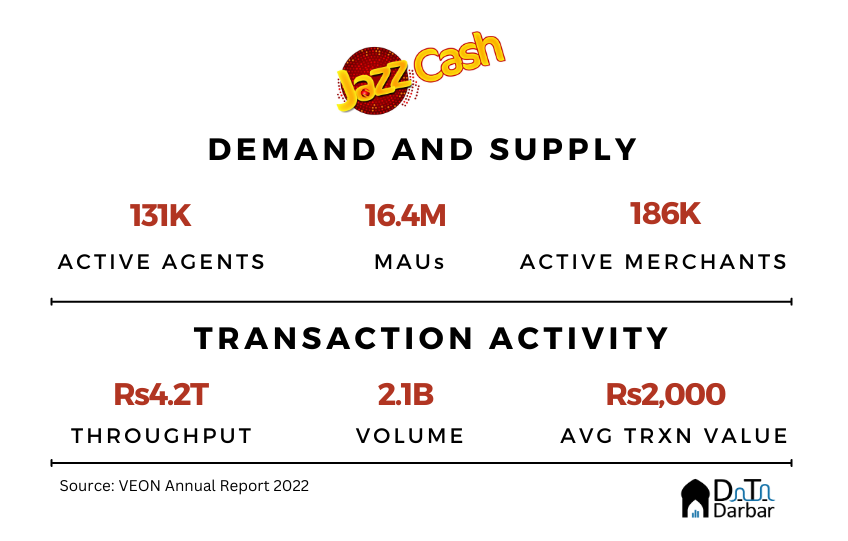

How Jazz Cash And K Trade Are Making Stock Trading More Accessible

May 09, 2025

How Jazz Cash And K Trade Are Making Stock Trading More Accessible

May 09, 2025 -

High Potential Season 2 Renewal Status And Episode Information

May 09, 2025

High Potential Season 2 Renewal Status And Episode Information

May 09, 2025 -

Programme Ecologiste Pour Les Municipales A Dijon En 2026

May 09, 2025

Programme Ecologiste Pour Les Municipales A Dijon En 2026

May 09, 2025 -

Vozvraschenie Stivena Kinga V X Oskorbleniya V Adres Ilona Maska

May 09, 2025

Vozvraschenie Stivena Kinga V X Oskorbleniya V Adres Ilona Maska

May 09, 2025 -

Khudshie Filmy Goda Dakota Dzhonson I Zolotaya Malina

May 09, 2025

Khudshie Filmy Goda Dakota Dzhonson I Zolotaya Malina

May 09, 2025