Is Palantir Stock A Good Buy Before Its May 5th Earnings Release?

Table of Contents

Palantir's Recent Performance and Growth Trajectory

Understanding Palantir's recent performance is crucial for evaluating its current value. The company operates in two primary business segments: government and commercial. Analyzing revenue growth, profitability, and market share across these segments paints a clearer picture of its trajectory.

-

Government Contracts: Palantir's government business remains a significant revenue driver. Recent wins and contract extensions highlight the company's strong position within the government sector. The long-term nature of these contracts offers predictability, but also presents a degree of dependence.

-

Commercial Expansion: Palantir's commercial growth is a key area to watch. Expansion into new markets and adoption by various industries indicate strong potential, though profitability in this segment might lag behind the government sector.

-

Key Metrics:

- Revenue growth in Q4 2022 exceeded expectations, showcasing a positive trend.

- Significant contract wins in the government sector demonstrate continued strength in this key area.

- Expansion into new commercial markets shows promise, though profitability remains a key focus.

Analyzing these factors alongside Palantir revenue and PLTR growth trends offers valuable insights into the company's overall financial health and future prospects.

Analyzing Analyst Expectations and Price Targets

Financial analysts offer a range of opinions and predictions on Palantir's upcoming earnings report. Understanding the consensus among these analysts and their price targets is critical.

-

Earnings Expectations: Analysts' expectations for Palantir earnings vary. Some predict a beat, while others anticipate a miss. This divergence highlights the uncertainty surrounding the announcement and its impact on the stock.

-

Price Targets: The range of price targets set by analysts can be quite broad. This reflects the different perspectives on Palantir's valuation and future potential.

-

Potential Scenarios:

- Earnings Beat: If Palantir exceeds expectations, the stock price could surge due to positive investor sentiment.

- Earnings Miss: Conversely, if earnings miss expectations, the stock price could experience a significant drop.

- Meeting Expectations: Meeting expectations might result in a muted reaction, with the stock price remaining relatively stable.

Understanding these scenarios helps to prepare for potential market reactions, informing investment strategies. The current analyst sentiment regarding Palantir price target and overall analyst ratings should also be considered.

Risks and Potential Downsides of Investing in Palantir

Investing in any stock carries risk, and Palantir is no exception. Several factors contribute to the inherent volatility of PLTR stock.

-

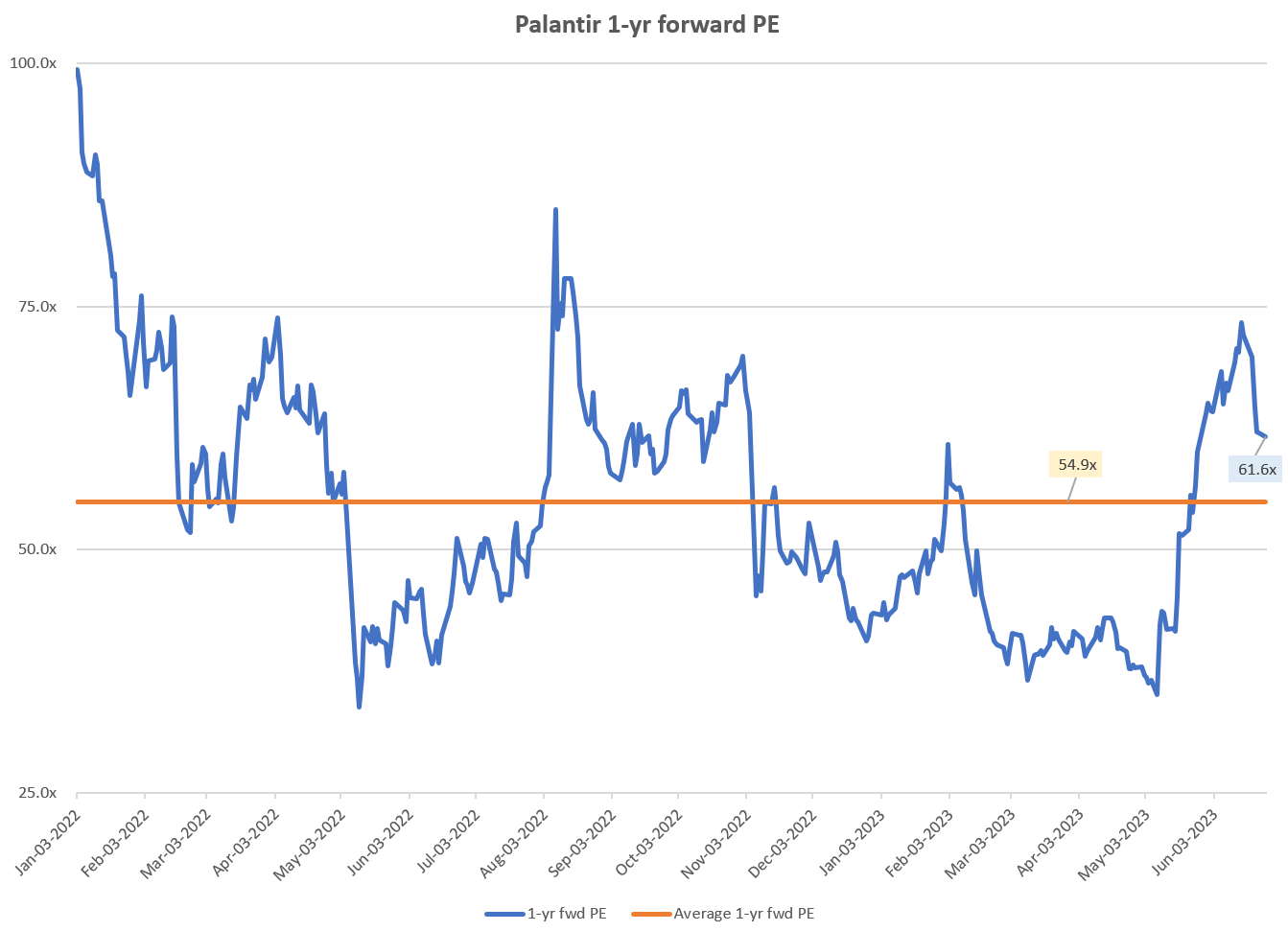

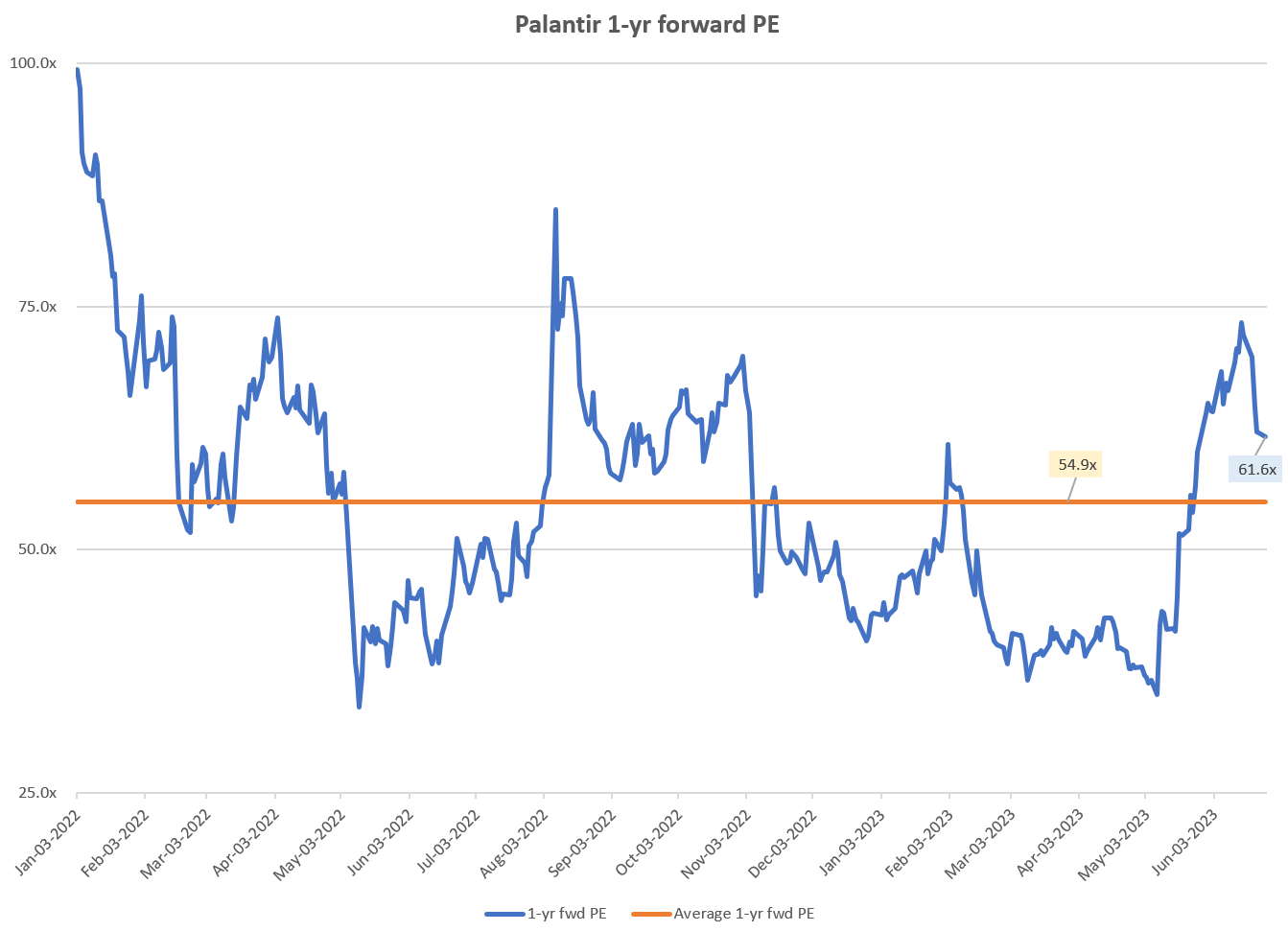

High Valuation: Palantir's stock valuation has historically been high relative to its profitability. This makes it susceptible to market corrections and changes in investor sentiment.

-

Competition: The data analytics market is highly competitive, with established players and emerging startups vying for market share. This poses a significant risk to Palantir's growth.

-

Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could negatively impact the company's performance.

-

Key Risks:

- Competition from established players in the data analytics market.

- Dependence on large government contracts for a significant portion of revenue.

- High stock valuation compared to profitability, making it vulnerable to market corrections.

These risks contribute to the overall investment risk associated with Palantir stock. Understanding and weighing these factors is crucial before making an investment decision.

Considering Alternative Investment Options

Before committing to Palantir stock, it's important to consider alternative investment options within the technology sector or related fields. Diversification is a key element of risk management.

-

Tech Stock Alternatives: The tech sector offers a variety of companies with different risk-reward profiles. Some may offer more established revenue streams and lower volatility, while others may present higher growth potential but also higher risk.

-

Risk-Reward Comparison: Comparing key metrics such as revenue growth, profitability, and valuation multiples across different companies helps determine which aligns best with your risk tolerance and investment goals.

Considering alternative options allows for a more balanced investment portfolio, minimizing the impact of potential losses from a single stock.

Conclusion: Should You Buy Palantir Stock Before Earnings?

The decision of whether to buy Palantir stock before its May 5th earnings release requires careful consideration. While Palantir demonstrates strong potential in both the government and commercial sectors, significant risks remain. The high valuation and dependence on government contracts contribute to its volatility. The upcoming earnings report will be crucial in shaping investor sentiment.

While a positive earnings surprise could lead to a price surge, a disappointing report might cause a significant drop. Therefore, it is essential to conduct thorough due diligence, understand your own risk tolerance, and potentially explore alternative investment options before making any investment decisions regarding Palantir stock. Before buying or selling PLTR, carefully analyze the Palantir investment decision based on your personal financial situation and risk tolerance. Further research on Palantir stock outlook and earnings analysis is highly recommended.

Featured Posts

-

Metas 168 Million Payment In Whats App Spyware Case Analysis And Outlook

May 10, 2025

Metas 168 Million Payment In Whats App Spyware Case Analysis And Outlook

May 10, 2025 -

Identifying Emerging Business Hubs Across The Country

May 10, 2025

Identifying Emerging Business Hubs Across The Country

May 10, 2025 -

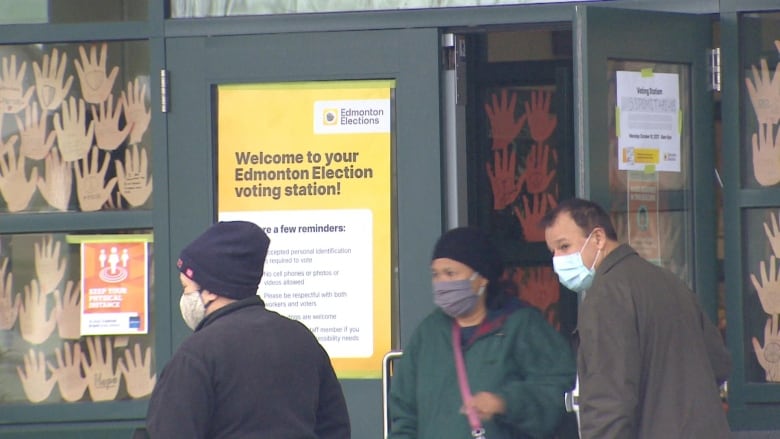

How Federal Riding Redistributions Could Impact Edmonton Voters

May 10, 2025

How Federal Riding Redistributions Could Impact Edmonton Voters

May 10, 2025 -

Elizabeth City Seeks Publics Help In Solving Recent Vehicle Break Ins

May 10, 2025

Elizabeth City Seeks Publics Help In Solving Recent Vehicle Break Ins

May 10, 2025 -

Nyt Spelling Bee Strands April 12 2025 Complete Guide

May 10, 2025

Nyt Spelling Bee Strands April 12 2025 Complete Guide

May 10, 2025