Is Palantir Stock A Good Investment Before May 5th Earnings Report?

Table of Contents

Palantir's Recent Performance and Market Sentiment

Understanding Palantir's recent performance is crucial before deciding on an investment strategy. Recent stock price fluctuations have been influenced by various factors, including overall market sentiment towards the tech sector, specific news related to Palantir, and broader geopolitical events. Analyzing these factors gives a clearer picture of the current landscape for PLTR.

-

Stock Price Fluctuations and Trading Volume: Tracking recent price movements and trading volume helps assess investor interest and market confidence in Palantir. High volume combined with significant price increases suggests strong bullish sentiment, while the opposite might indicate bearishness.

-

Market Sentiment and the Tech Sector: The overall health of the tech sector significantly impacts Palantir's stock performance. Positive sentiment in the broader market often translates to higher valuations for tech companies like Palantir. Conversely, negative sentiment can lead to price drops.

-

News Impacting PLTR: Recent news, such as new contract wins (especially large government contracts), successful partnerships, or regulatory changes, can significantly influence Palantir's stock price. Keep abreast of press releases and financial news related to PLTR.

-

Analyst Ratings and Price Targets: Monitoring analyst ratings and price targets provides valuable insights into the perspectives of financial experts. A consensus of positive ratings and high price targets might suggest a positive outlook for Palantir stock.

-

Geopolitical Events: Geopolitical instability and international tensions can impact Palantir's business, particularly its government contracts. Increased global uncertainty often leads to increased demand for data analytics and security solutions, which could positively impact Palantir.

-

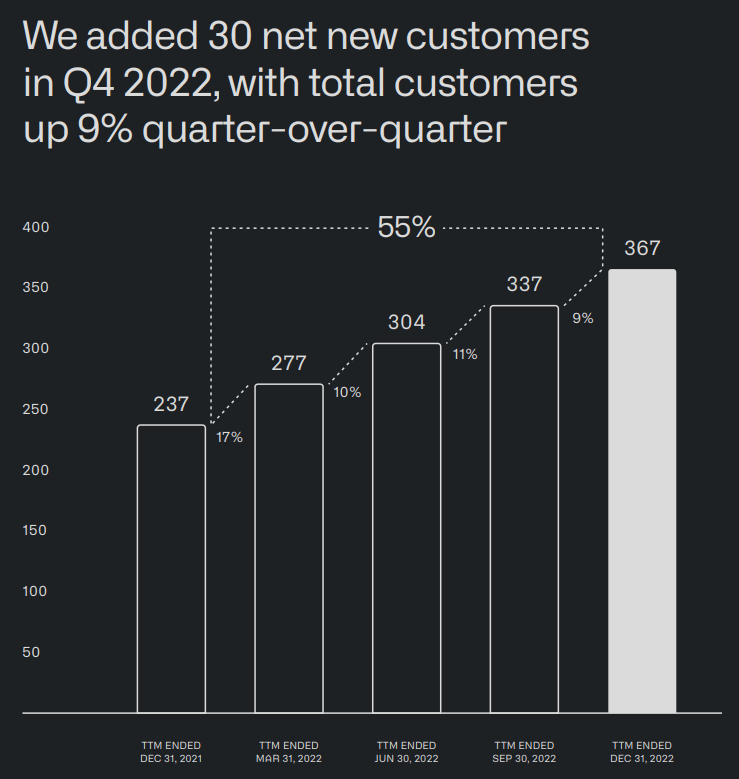

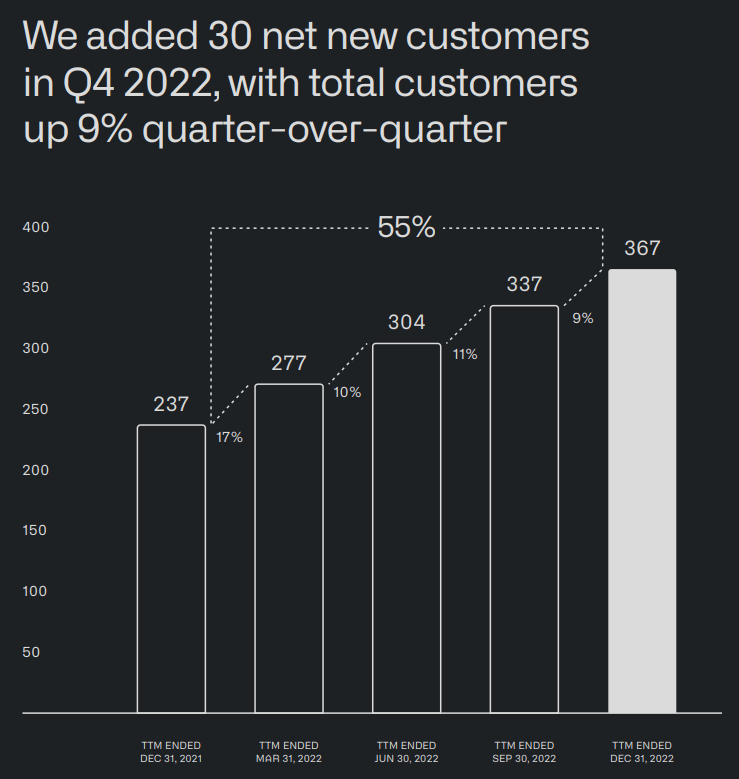

Growth Trajectory and Revenue Streams: Palantir’s growth trajectory and diversification of revenue streams (government vs. commercial) are key indicators of its long-term health. Consistent revenue growth and expansion into new markets signal positive future prospects.

Key Factors to Consider Before May 5th Earnings

The May 5th earnings report will be a pivotal moment for Palantir investors. Several key factors should be considered before the announcement:

Expected Earnings and Revenue

Analysts' predictions for Q1 2024 earnings and revenue growth offer a benchmark for evaluating Palantir’s performance.

-

Impact of Exceeding/Missing Expectations: Beating or missing earnings expectations can significantly impact Palantir's stock price. Exceeding expectations typically results in a positive market reaction, while missing them often leads to a price drop.

-

Comparison to Competitors: Analyzing Palantir's performance relative to its competitors (e.g., Databricks, Snowflake) in the big data analytics market provides a valuable context for evaluating its success.

Guidance for the Future

Palantir's guidance for the remainder of 2024 will be closely scrutinized by investors.

-

Long-Term Growth Potential: The company's projected long-term growth potential and the sustainability of its business model are crucial factors to consider.

-

New Product Launches/Strategic Initiatives: Any announcements regarding new product launches or strategic initiatives can substantially influence investor sentiment and future growth projections.

Risks and Challenges

Investing in Palantir carries inherent risks that must be carefully considered.

-

Increasing Competition: The data analytics market is becoming increasingly competitive. New entrants and established players constantly vie for market share, putting pressure on Palantir's profitability.

-

Reliance on Government Contracts: Palantir's significant reliance on government contracts introduces considerable risk. Changes in government policy or budget cuts could negatively impact its revenue.

-

Cash Flow and Debt Levels: Analyzing Palantir's cash flow and debt levels provides crucial insights into its financial health and stability. High debt levels and inconsistent cash flow can be warning signs.

Alternative Investment Strategies for Palantir

Several investment strategies exist for navigating the uncertainty surrounding the May 5th earnings report.

-

Buying Before Earnings: Buying before the report presents the potential for high returns if the results are positive, but also carries a higher risk of losses if the results disappoint.

-

Waiting for a Post-Earnings Dip: Waiting for a potential post-earnings dip offers a chance to buy at a lower price, but risks missing out on potential gains if the stock price rises.

-

Options Trading Strategies: Options trading can offer leveraged exposure to Palantir's stock, but it's a complex strategy with high risk.

-

Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, reducing the risk associated with market timing. This approach is suitable for investors with a long-term perspective.

Conclusion

Determining whether Palantir stock is a good investment before the May 5th earnings report requires careful consideration of its recent performance, expected earnings, future guidance, and associated risks. By thoroughly analyzing Palantir's financial health, market position, and future prospects, and understanding your own risk tolerance, you can make a more informed investment decision. While this article provides valuable insights, independent research and consultation with a financial advisor are crucial before investing in Palantir or any other stock. Ultimately, whether Palantir stock is right for your portfolio is a decision based on your individual circumstances. So, carefully weigh the information presented here and make an informed decision about your Palantir stock investment before the May 5th earnings report.

Featured Posts

-

Punjab Launches Technical Training Programme For Transgender Individuals

May 09, 2025

Punjab Launches Technical Training Programme For Transgender Individuals

May 09, 2025 -

Spring Fashion Elizabeth Stewart X Lilysilk Collaboration Unveiled

May 09, 2025

Spring Fashion Elizabeth Stewart X Lilysilk Collaboration Unveiled

May 09, 2025 -

Black Rock Etf A Billionaires Play For A Potential 110 Return In 2025

May 09, 2025

Black Rock Etf A Billionaires Play For A Potential 110 Return In 2025

May 09, 2025 -

Dakota Johnson Kraujas Nuotrauku Paaiskinimas Ir Ivykiu Eiga

May 09, 2025

Dakota Johnson Kraujas Nuotrauku Paaiskinimas Ir Ivykiu Eiga

May 09, 2025 -

Le Modem Et Renaissance Vers Une Fusion Pour Clarifier La Ligne Gouvernementale

May 09, 2025

Le Modem Et Renaissance Vers Une Fusion Pour Clarifier La Ligne Gouvernementale

May 09, 2025