Is Palantir Stock A Good Investment In 2024? Risks And Rewards

Table of Contents

Palantir's Business Model and Growth Potential

Palantir's business model centers around providing powerful data analytics platforms to both government and commercial clients. Understanding its revenue streams and growth prospects is crucial for evaluating Palantir stock.

Government Contracts and Revenue Streams

Palantir's early success was significantly driven by lucrative government contracts, particularly within the defense and intelligence sectors. These contracts provide a substantial portion of Palantir's revenue.

- Growth Potential: The ongoing demand for advanced data analytics within defense and intelligence agencies presents significant growth potential for Palantir. Continued investment in national security globally fuels this demand.

- Risks: Government budget fluctuations and potential changes in procurement processes pose risks. A reduction in defense spending could directly impact Palantir's revenue stream.

- Opportunities: Palantir has the opportunity to expand its reach into new government agencies and departments, both domestically and internationally. Securing new contracts in areas like cybersecurity and homeland security could drive substantial future growth.

Commercial Market Expansion

While government contracts form a significant portion of Palantir's revenue, its expansion into the commercial market is vital for long-term growth and reducing reliance on a single sector.

- Success Stories: Palantir has successfully secured contracts with major corporations in diverse sectors like healthcare and finance, showcasing the applicability of its platforms beyond government use.

- Challenges: Competition in the commercial data analytics market is fierce, with established players like Databricks and Snowflake vying for market share. Palantir needs to continuously innovate and adapt to remain competitive.

- Growth Potential: The commercial market offers significant expansion opportunities. As more businesses realize the value of advanced data analytics, the demand for Palantir's platforms is likely to increase, driving revenue growth in the coming years.

Technological Innovation and Competitive Advantage

Palantir's continued technological innovation is crucial for maintaining its competitive edge. Its proprietary platforms offer unique capabilities compared to other players in the market.

- Key Technologies: Palantir Foundry and Gotham are key platforms driving innovation, offering advanced data integration, visualization, and analysis capabilities.

- Competitive Advantage: Palantir's focus on complex data integration and its strong relationships with government agencies provide a significant competitive advantage. However, the emergence of new technologies and open-source alternatives presents a constant challenge.

- Potential Disruptions: The rapid evolution of AI and machine learning could disrupt the market. Palantir's ability to adapt and integrate these emerging technologies into its platforms will be crucial for long-term success.

Assessing the Risks of Investing in Palantir Stock

While Palantir offers compelling growth potential, investing in its stock involves inherent risks. A thorough understanding of these risks is essential before making any investment decisions.

Valuation and Stock Price Volatility

Palantir's valuation has historically been subject to significant volatility. This is partly due to its high growth potential but also reflects market sentiment and investor expectations.

- Current P/E Ratio: Analyzing Palantir's current price-to-earnings ratio in relation to its industry peers provides a benchmark for its valuation. A high P/E ratio can indicate a higher risk.

- Factors Affecting Volatility: Market fluctuations, news about contract wins or losses, and changes in analyst ratings significantly influence Palantir's stock price.

- High Valuation Risk: Investing in a high-growth company with a high valuation inherently carries a higher risk of potential losses if the company fails to meet expectations.

Dependence on a Few Key Clients

Palantir's revenue is concentrated among a relatively small number of large clients. This creates dependency and vulnerability.

- Impact of Losing a Major Contract: Losing a major government or commercial client could severely impact Palantir's revenue and stock price.

- Diversification Strategies: Palantir is actively working to diversify its client base and reduce reliance on individual contracts. The success of these strategies will be crucial for mitigating this risk.

- Client Churn: The risk of client churn, where existing clients decide not to renew their contracts, also needs to be considered.

Competition and Market Saturation

The data analytics market is competitive, with numerous established players and new entrants emerging constantly.

- Major Competitors: Companies like Databricks, Snowflake, and Amazon Web Services pose significant competition.

- Palantir's Competitive Advantages: Palantir's focus on complex data integration and its strong government relationships provide a competitive edge. However, maintaining this advantage requires continuous innovation.

- Market Saturation Risks: As the market matures, there is a risk of market saturation, leading to slower growth rates and increased competition for contracts.

Financial Performance and Future Projections

Analyzing Palantir's financial performance and future projections offers further insight into the potential rewards and risks of investing in its stock.

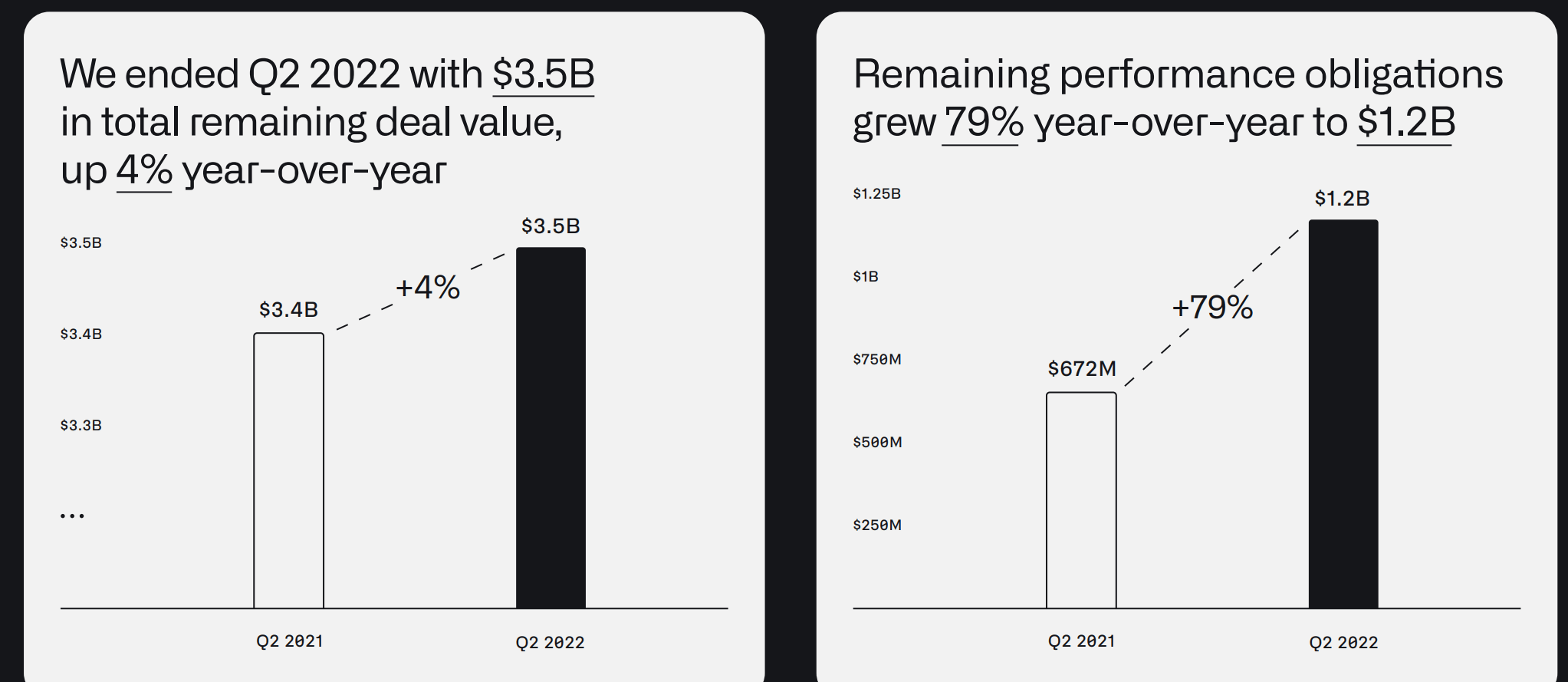

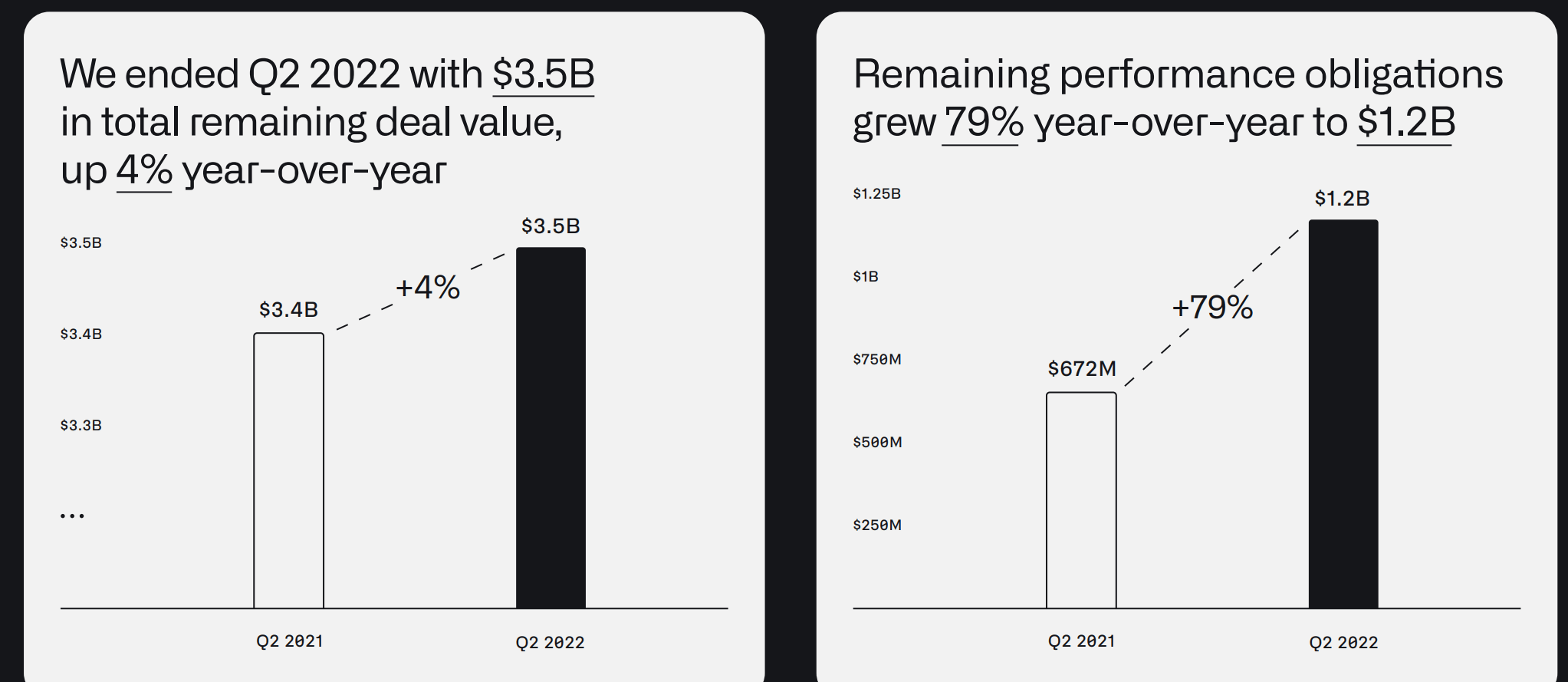

Revenue Growth and Profitability

Evaluating Palantir's revenue growth, profitability, and cash flow provides a crucial assessment of its financial health.

- Key Financial Metrics: Careful examination of revenue growth rates, net income, operating margins, and free cash flow provides valuable insights.

- Analysis of Recent Financial Reports: Thorough analysis of Palantir's recent financial reports, including quarterly and annual earnings, provides the most up-to-date picture of its financial performance.

- Projected Future Financial Performance: Analyst projections and Palantir's own guidance on future performance should be considered with caution, understanding the inherent uncertainties in any forecast.

Analyst Ratings and Price Targets

Understanding the consensus view of financial analysts provides additional perspective on the investment potential of Palantir stock.

- Summary of Analyst Ratings: Reviewing the range of analyst ratings (buy, hold, or sell) provides a snapshot of market sentiment.

- Range of Price Targets: Analyst price targets represent their expectations for the future stock price. The range of these targets reflects varying perspectives on Palantir's growth prospects.

- Reasons Behind Varying Opinions: Understanding the rationale behind differing analyst opinions is crucial for making an informed decision.

Conclusion

Investing in Palantir stock presents a complex picture. While the company boasts cutting-edge technology and potential for growth in both the government and commercial sectors, it also faces risks associated with valuation, client concentration, and intense market competition. The decision of whether Palantir stock represents a good investment in 2024 depends on your risk tolerance and investment horizon. A thorough analysis of its financial performance, competitive landscape, and future projections is paramount. Therefore, further research on Palantir stock is recommended before making any investment decisions. Consider the risks and rewards of Palantir investment carefully, and weigh the pros and cons of Palantir Technologies stock before investing.

Featured Posts

-

Changes To Uk Immigration Fluent English A Must For Maintaining Residency

May 10, 2025

Changes To Uk Immigration Fluent English A Must For Maintaining Residency

May 10, 2025 -

Late To The Palantir Game Evaluating The 40 2025 Growth Prediction

May 10, 2025

Late To The Palantir Game Evaluating The 40 2025 Growth Prediction

May 10, 2025 -

Exclusive Elliott Eyes Russian Gas Pipeline Investment

May 10, 2025

Exclusive Elliott Eyes Russian Gas Pipeline Investment

May 10, 2025 -

Dijon Enquete Apres La Chute Mortelle D Un Ouvrier

May 10, 2025

Dijon Enquete Apres La Chute Mortelle D Un Ouvrier

May 10, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Analysis

May 10, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Analysis

May 10, 2025