Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir Technologies is a unique data analytics company specializing in providing big data solutions to government and commercial clients. Its proprietary platforms, Gotham and Foundry, offer powerful tools for data integration, analysis, and visualization, enabling clients to make better, data-driven decisions. However, its high valuation and reliance on specific clients create both opportunities and significant risks. This article will delve into those factors to help you determine if PLTR is right for your portfolio.

Palantir's Business Model and Growth Potential

Palantir's success hinges on its ability to secure and maintain contracts in both the government and commercial sectors. Let's examine each:

Government Contracts and Revenue

Palantir has a strong presence in the government sector, particularly within defense and intelligence agencies. This segment provides substantial revenue and stability.

- Key Government Clients: The company works with numerous agencies, including the CIA, Department of Defense, and various international governments.

- Contract Wins: Recent years have seen significant contract wins, demonstrating the continued demand for Palantir's services in this area. Continued defense spending globally presents further opportunities for growth.

- International Expansion: Palantir is actively pursuing international government contracts, presenting a significant avenue for future revenue growth. Success in this arena could substantially boost the company's overall revenue. Keywords: Government contracts, Palantir revenue, defense spending, government analytics.

Commercial Market Penetration

While government contracts form a crucial part of Palantir's revenue, the commercial market holds immense growth potential. Palantir Foundry, its commercial platform, targets diverse sectors.

- Success Stories: Palantir has demonstrated success in sectors such as healthcare, finance, and aerospace, securing high-profile clients and delivering tangible results.

- Challenges: Competition in the commercial data analytics market is fierce. Palantir faces challenges in educating potential clients about the value proposition of its platform and navigating the complexities of large-scale enterprise software implementation.

- Future Expansion Plans: Palantir is focused on expanding its commercial footprint, targeting specific industries and developing new capabilities to meet evolving market demands. Keywords: Commercial clients, Palantir Foundry, data analytics platform, commercial market growth.

Financial Performance and Valuation

A thorough analysis of Palantir's financials is essential for any investment decision.

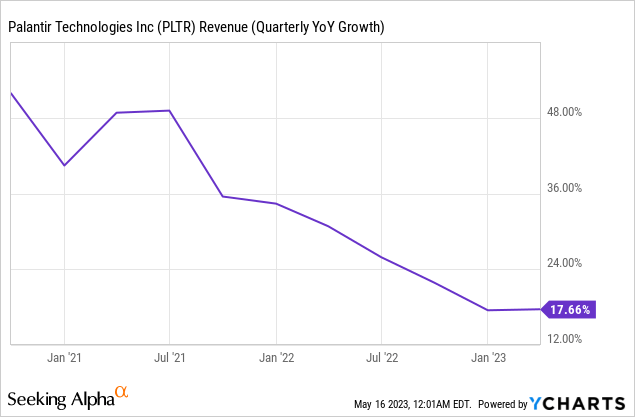

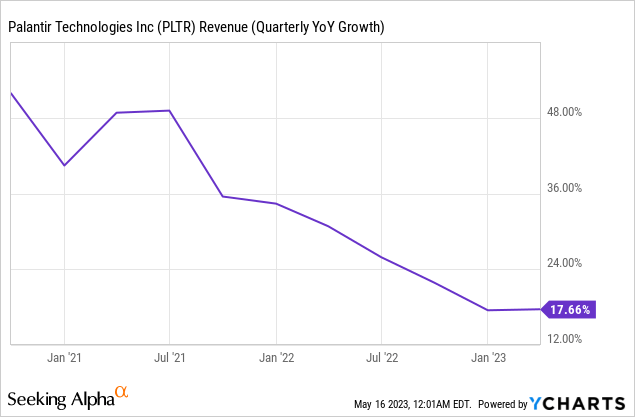

Revenue Growth and Profitability

Palantir has demonstrated significant revenue growth in recent years. However, profitability remains a key area of focus for investors.

- Revenue Growth: While revenue is growing, consistent and substantial profitability is yet to be fully achieved. Analyzing year-over-year revenue growth is crucial for assessing the trajectory.

- Operating Margins: Scrutinizing operating margins provides insights into the efficiency of the company's operations and its ability to translate revenue into profit.

- Net Income: Examining net income trends gives a clear picture of the company's overall profitability. Keywords: Palantir financials, revenue growth, profitability, stock valuation, financial performance.

Stock Valuation and Comparables

Comparing Palantir's valuation to its competitors provides context for its current stock price.

- Price-to-Sales Ratio (P/S): This metric helps assess the stock's valuation relative to its revenue. A high P/S ratio might suggest the stock is overvalued.

- Price-to-Earnings Ratio (P/E): While Palantir may not currently have consistently positive earnings, analyzing the P/E ratio when profits are achieved provides crucial information on its valuation compared to other players in the market. Future earnings projections should also be considered.

- Competitor Analysis: Comparing Palantir's valuation multiples to those of competitors like Databricks, Snowflake, and similar data analytics firms provides valuable context. Keywords: Palantir stock price, valuation multiples, competitor analysis, stock valuation metrics.

Risks and Challenges

Despite its potential, Palantir faces several key risks.

Competition and Market Saturation

The data analytics market is highly competitive.

- Key Competitors: Companies like Databricks, Snowflake, and AWS offer competing data analytics solutions. Each possesses different strengths and weaknesses.

- Market Saturation: The risk of market saturation exists, with many large companies investing heavily in their own data analytics capabilities. This could limit Palantir’s growth potential. Keywords: Data analytics competition, market saturation, competitive landscape, Palantir competitors.

Dependence on Key Clients

Palantir's reliance on a few large clients, both government and commercial, presents a risk.

- Client Concentration Risk: Loss of a key contract could significantly impact Palantir's revenue and profitability.

- Contract Renewal Risk: The success of Palantir depends on consistently securing and renewing contracts. Keywords: Client concentration risk, key client dependency, contract renewal risk.

Conclusion

Is Palantir Technologies Stock a Buy Now? The answer is nuanced. While Palantir possesses significant growth potential fueled by its unique technology and strong presence in the government and commercial sectors, the company faces challenges related to profitability, competition, and its reliance on key clients. The high valuation also warrants caution. Based on the analysis, a hold or cautiously buy approach might be suitable for investors with a high-risk tolerance and a long-term investment horizon. However, the financial situation and market conditions need to be continuously monitored. Conduct your own due diligence before investing in Palantir Technologies stock. Learn more about Palantir Technologies and its investment potential by conducting thorough research and consulting a financial advisor.

Featured Posts

-

France Poland Friendship Treaty Macron Announces Signing Next Month

May 09, 2025

France Poland Friendship Treaty Macron Announces Signing Next Month

May 09, 2025 -

Arrest Made In Elizabeth City Weekend Shooting Suspect In Custody

May 09, 2025

Arrest Made In Elizabeth City Weekend Shooting Suspect In Custody

May 09, 2025 -

How To Watch Celebrity Antiques Road Trip Streaming Episodes And More

May 09, 2025

How To Watch Celebrity Antiques Road Trip Streaming Episodes And More

May 09, 2025 -

Trade Wars And Cryptocurrencies Identifying Potential Winners

May 09, 2025

Trade Wars And Cryptocurrencies Identifying Potential Winners

May 09, 2025 -

Trumps Dc Prosecutor Selection The Jeanine Pirro Nomination

May 09, 2025

Trumps Dc Prosecutor Selection The Jeanine Pirro Nomination

May 09, 2025