Is The XRP Derivatives Market Hindering Price Recovery?

Table of Contents

The Expanding XRP Derivatives Market

The XRP derivatives market, encompassing futures, options, and swaps, has experienced explosive growth. Trading volume in these derivatives significantly surpasses that of the spot market, indicating a considerable level of speculative activity. Major cryptocurrency exchanges like Binance, Coinbase, and Kraken are key players, offering a range of XRP derivative products and contributing to the market's liquidity. While precise figures vary depending on the data source and time period, reports suggest a substantial and accelerating growth trajectory.

- Increased liquidity in the derivatives market: The high trading volumes create a deeper pool of liquidity, facilitating larger transactions.

- Higher trading volumes in derivatives than spot: This disparity suggests a significant portion of market activity is driven by speculation rather than pure asset ownership.

- Presence of major players like Binance, Coinbase, etc.: The involvement of established exchanges legitimizes the market and increases its accessibility.

- Growth of options and futures contracts: The increasing sophistication of derivative products reflects the market's maturity and the diverse needs of its participants.

How Derivatives Can Impact XRP Price

Derivatives trading significantly influences the spot price of XRP through several mechanisms. Short selling, where traders borrow and sell XRP hoping to buy it back at a lower price, can exert considerable downward pressure. Hedging activities by institutional investors, aimed at mitigating risk, can also lead to price volatility. Arbitrage opportunities between spot and derivatives markets allow traders to exploit price discrepancies, further impacting price equilibrium. The use of leverage magnifies both gains and losses, leading to potential margin calls that can trigger further price swings.

- Short selling pressure: A large number of short positions can create a bearish sentiment and drive the price down.

- Hedging activities by institutional investors: While aimed at risk mitigation, these activities can inadvertently contribute to price fluctuations.

- Arbitrage opportunities between spot and derivatives markets: These opportunities ensure a degree of price alignment but can also contribute to volatility.

- Impact of leverage and margin calls: High leverage increases risk and the potential for cascading liquidations that affect the price.

Alternative Perspectives – Benefits of the XRP Derivatives Market

While the potential for downward pressure exists, it's crucial to acknowledge the benefits of a robust XRP derivatives market. Increased liquidity facilitates more efficient price discovery, allowing the market to reflect true value more accurately. Derivatives provide crucial risk management tools for investors, allowing them to hedge against potential losses. Furthermore, hedging activities, while potentially contributing to volatility in the short term, can contribute to price stabilization over the longer term.

- Improved price discovery: High liquidity allows for a more accurate reflection of the asset's intrinsic value.

- Enhanced liquidity: This makes it easier for investors to buy and sell XRP, reducing price slippage.

- Risk management tools for investors: Derivatives offer ways to mitigate risk and protect against potential losses.

- Potential for price stabilization: Hedging activities can help to smooth out price fluctuations over time.

The Regulatory Landscape and its Influence

Regulatory uncertainty surrounding XRP, particularly the ongoing SEC lawsuit, significantly impacts the derivatives market. This uncertainty affects investor sentiment and trading activity, potentially limiting market growth and contributing to price volatility. International regulatory frameworks also play a crucial role, creating a complex and evolving landscape. Different regulatory outcomes could dramatically alter the market’s trajectory, impacting both liquidity and investor participation.

- SEC lawsuit and its ongoing impact: The legal uncertainty creates hesitancy among some investors and institutions.

- Regulatory uncertainty influencing investor confidence: Clarity is needed to attract larger institutional investment.

- Impact of international regulatory frameworks: Global regulatory differences complicate cross-border trading.

- Potential for future regulatory changes: Changes in regulation could lead to significant shifts in the market.

Conclusion: The XRP Derivatives Market and its Impact on Price Recovery

The XRP derivatives market is substantial and growing, exerting a significant influence on XRP's price. While short selling and hedging activities can contribute to downward pressure and volatility, the market also offers benefits such as increased liquidity and improved price discovery. The ongoing regulatory uncertainty surrounding XRP remains a key factor affecting investor sentiment and overall market stability. Therefore, whether the XRP derivatives market ultimately hinders or helps price recovery remains a complex question with no easy answer, demanding continuous monitoring and analysis. Future developments in the regulatory landscape and the evolution of derivative products will significantly shape XRP's price trajectory.

Stay informed on the evolving XRP derivatives market and its impact on XRP's price recovery. Share your thoughts and analysis in the comments below!

Featured Posts

-

Fetterman Responds To Ny Magazines Fitness Concerns

May 08, 2025

Fetterman Responds To Ny Magazines Fitness Concerns

May 08, 2025 -

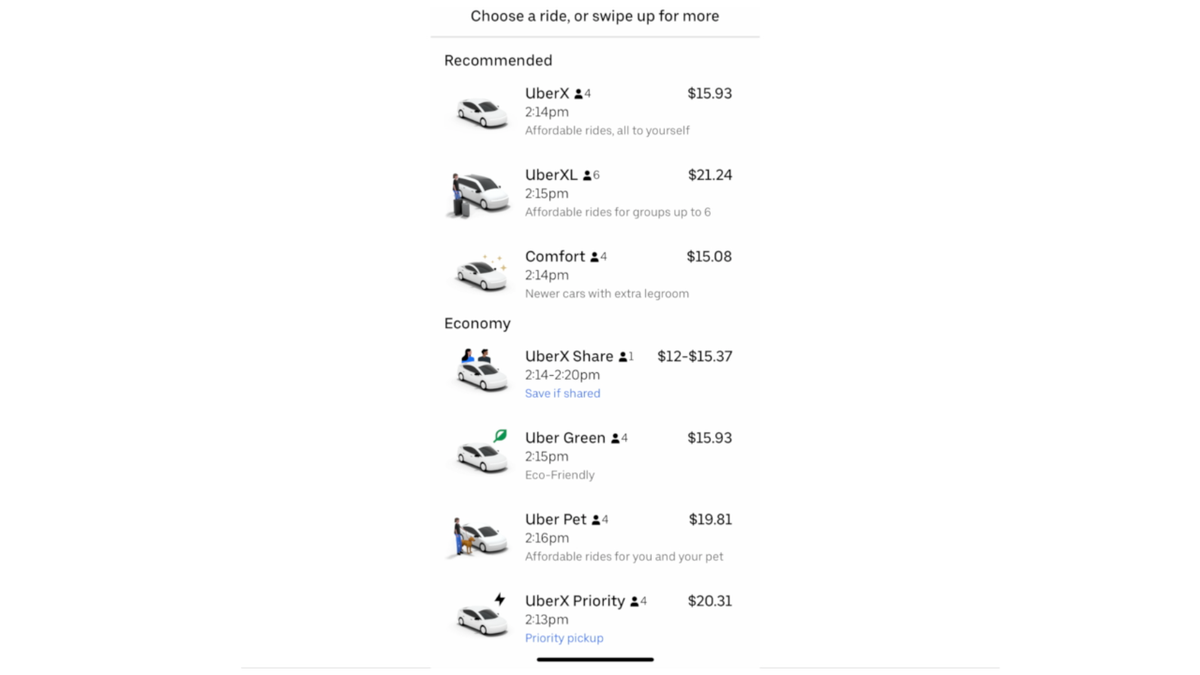

Understanding Ubers New Cash Only Auto Service Option

May 08, 2025

Understanding Ubers New Cash Only Auto Service Option

May 08, 2025 -

Andor First Look Delivers On 31 Years Of Star Wars Teases

May 08, 2025

Andor First Look Delivers On 31 Years Of Star Wars Teases

May 08, 2025 -

Jayson Tatum Takes A Hilarious Hit From Tnt Announcers In Abc Promo

May 08, 2025

Jayson Tatum Takes A Hilarious Hit From Tnt Announcers In Abc Promo

May 08, 2025 -

The 10 Greatest Characters From Saving Private Ryan

May 08, 2025

The 10 Greatest Characters From Saving Private Ryan

May 08, 2025