Is This AI Quantum Computing Stock A Buy On The Dip? One Key Factor

Table of Contents

Understanding the Current Market Dip in AI Quantum Computing Stocks

The current market shows a downturn in AI quantum computing stocks, a trend mirroring broader economic anxieties and sector-specific challenges. Several factors contribute to this dip:

-

Economic Slowdown: The global economic climate plays a significant role. Investors are becoming more risk-averse, leading to a sell-off in growth stocks, including those in the nascent AI quantum computing sector. This is particularly true for companies that are still pre-revenue or operating at a loss.

-

Investor Sentiment: Negative news, even if not directly related to a specific company's performance, can trigger a broader sell-off. Investor confidence is fragile in this emerging technology space, making it susceptible to shifts in overall market sentiment.

-

Technological Setbacks: The development of quantum computing technology is challenging, and unexpected hurdles can impact investor confidence. Public announcements of delays in achieving key milestones or unexpected technical difficulties can lead to immediate stock price drops.

Here's some data to illustrate the situation:

-

Market Capitalization Changes: Many AI quantum computing companies have seen significant drops in market capitalization over the past quarter, ranging from [Insert Percentage Range]% to [Insert Percentage Range]%.

-

Stock Price Fluctuations: Daily price volatility is high, reflecting the speculative nature of the market. Price swings of [Insert Percentage Range]% are not uncommon.

-

Analyst Predictions and Ratings: While some analysts maintain a positive outlook, others have downgraded their ratings, citing concerns about profitability and the timeline for commercial applications.

-

News and Events Impacting the Sector: Negative news regarding government funding cuts or regulatory challenges can significantly influence the entire sector.

The Key Factor: Technological Advancement and Company Roadmap

The critical factor determining whether an AI quantum computing stock is a buy on the dip is the company's technological advancement and its strategic roadmap. A company's long-term potential hinges on its ability to innovate and deliver on its promises.

This involves examining:

-

Recent Research Publications: Has the company published groundbreaking research in peer-reviewed journals? This demonstrates scientific progress and validates their technology.

-

Patent Filings and Approvals: A strong patent portfolio signifies intellectual property protection and a competitive advantage in the market.

-

Partnerships and Collaborations: Strategic alliances with leading technology companies, research institutions, or potential customers can accelerate development and market adoption.

-

Timeline for Key Milestones: A clearly defined roadmap with realistic timelines for achieving crucial milestones (e.g., achieving quantum supremacy, developing specific applications) inspires investor confidence.

-

Competitive Landscape Analysis: How does this company compare to its competitors in terms of technological capabilities, market share, and funding?

Assessing Risk and Reward: Is the Dip a Buying Opportunity?

Investing in AI quantum computing stocks during a dip presents both risks and rewards.

Risks:

-

High Volatility: The sector's inherent volatility means significant price fluctuations are to be expected.

-

Long-Term Investment Horizon: Profitability and significant returns may be years away.

-

Technological Uncertainty: The technology is still developing, and there is no guarantee of success.

Rewards:

-

High Growth Potential: Successful AI quantum computing companies could generate enormous returns.

-

First-Mover Advantage: Early investment in leading companies could yield substantial profits.

Let's examine the risk-reward profile:

-

Risk Assessment using relevant financial metrics: (Include metrics like debt-to-equity ratio, cash burn rate etc. for a specific company example).

-

Potential Return on Investment (ROI) calculations: (Include hypothetical ROI calculations based on different scenarios).

-

Comparison with other tech stocks: How does the risk-reward profile compare to other high-growth tech stocks?

-

Diversification strategies: Investing in AI quantum computing should be part of a diversified portfolio to mitigate risk.

Conclusion: Should You Buy This AI Quantum Computing Stock?

This analysis highlights that the key to evaluating an AI quantum computing stock during a dip lies in understanding its technological advancements and its strategic roadmap. While a market dip presents opportunities, it's crucial to analyze the specific company's progress against competitors. While this analysis suggests that [Stock Name] might be a buy on the dip, considering its advancements in [Specific Technology], remember to always conduct thorough research and consult with a financial advisor before investing in any AI quantum computing stock. Learn more about investing in AI quantum computing stocks and explore other opportunities in the quantum computing market. Due diligence is paramount in this exciting but volatile sector.

Featured Posts

-

Fratii Tate Baie De Multime Si Bolid De Lux In Bucuresti

May 21, 2025

Fratii Tate Baie De Multime Si Bolid De Lux In Bucuresti

May 21, 2025 -

Councillors Wife Fails To Overturn Sentence Following Anti Migrant Post

May 21, 2025

Councillors Wife Fails To Overturn Sentence Following Anti Migrant Post

May 21, 2025 -

Activision Blizzard Acquisition Ftc Files Appeal Against Court Decision

May 21, 2025

Activision Blizzard Acquisition Ftc Files Appeal Against Court Decision

May 21, 2025 -

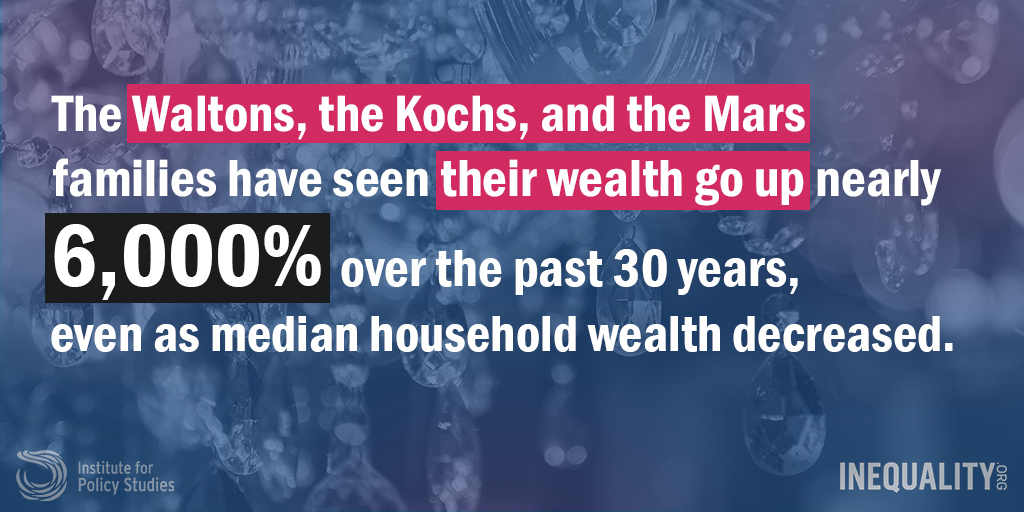

Understanding The Billionaire Boy Exploring The Dynamics Of Inherited Wealth

May 21, 2025

Understanding The Billionaire Boy Exploring The Dynamics Of Inherited Wealth

May 21, 2025 -

Alwlayat Almthdt Bwtshytynw Yetmd Ela 3 Wjwh Jdydt

May 21, 2025

Alwlayat Almthdt Bwtshytynw Yetmd Ela 3 Wjwh Jdydt

May 21, 2025

Latest Posts

-

Me Bwtshytynw Thlatht Wjwh Jdydt Fy Mntkhb Amryka

May 22, 2025

Me Bwtshytynw Thlatht Wjwh Jdydt Fy Mntkhb Amryka

May 22, 2025 -

Njwm Saedt Thlatht Laebyn Yndmwn Lmntkhb Amryka Lawl Mrt

May 22, 2025

Njwm Saedt Thlatht Laebyn Yndmwn Lmntkhb Amryka Lawl Mrt

May 22, 2025 -

Mfajat Bwtshytynw Thlathy Jdyd Fy Tshkylt Mntkhb Amryka

May 22, 2025

Mfajat Bwtshytynw Thlathy Jdyd Fy Tshkylt Mntkhb Amryka

May 22, 2025 -

1 3

May 22, 2025

1 3

May 22, 2025 -

Qaymt Mntkhb Amryka Ttjdd Bdm Thlatht Laebyn Tht Qyadt Bwtshytynw

May 22, 2025

Qaymt Mntkhb Amryka Ttjdd Bdm Thlatht Laebyn Tht Qyadt Bwtshytynw

May 22, 2025