Is Uber Recession-Proof? Analyst Perspectives On Stock Performance

Table of Contents

Uber's Revenue Streams and Recession Resilience

Uber's revenue streams are multifaceted, offering a degree of diversification that could contribute to its resilience during economic uncertainty. However, the extent to which it can withstand a recession remains a subject of debate.

Ride-Sharing Segment: The Core Business Under Scrutiny

Uber's core ride-sharing business has historically shown a sensitivity to economic cycles. During past recessions, demand for ride-hailing services has fluctuated.

- Price Elasticity of Demand: Ride-sharing services are, to a degree, a discretionary expense. As disposable income shrinks during an economic downturn, people may reduce their reliance on ride-hailing, opting for cheaper alternatives like public transport or carpooling.

- Fuel Prices: Fluctuations in fuel prices directly impact Uber's operating costs and potentially its pricing strategies. High fuel prices could squeeze profitability and lead to fare increases, further reducing demand.

- Competition from Public Transport: The availability and affordability of public transport systems can significantly impact the demand for ride-sharing services, especially during economic hardship when people seek budget-friendly options. This competition is a key factor in determining the price sensitivity of ride-hailing services.

Uber Eats and Delivery Services: A Potential Safe Haven?

Uber Eats, the company's food delivery service, has shown greater resilience during economic downturns compared to its ride-sharing counterpart. Even in tough times, people still need to eat.

- Competition and Market Share: Uber Eats competes with other food delivery giants like DoorDash and Grubhub. Their relative performance during economic downturns is a key indicator of the sector's overall robustness.

- Consumer Behavior: While restaurant dining might be curtailed during a recession, the convenience of food delivery often remains appealing, even to budget-conscious consumers.

- Inflation's Impact: Inflation significantly impacts food prices and, consequently, the pricing strategies of food delivery platforms. How Uber Eats manages this pricing dynamic will influence its performance. The sector’s vulnerability to inflation impact is a concern.

Freight and Logistics: Diversification and Stability

Uber Freight, Uber's foray into the logistics sector, represents a potential source of stability during economic downturns. The demand for freight services, while cyclical, is often less sensitive to consumer spending habits than ride-hailing or food delivery.

- Recessionary Demand: While overall freight volume might decrease during a recession, essential goods still need to be transported. This creates a baseline level of demand, making the sector relatively less volatile.

- Pricing Strategies: Uber Freight's pricing strategies during economic uncertainty will be crucial. Maintaining profitability while remaining competitive requires careful management.

- Diversification and Partnerships: Strategic partnerships and diversification within the logistics sector can help mitigate risks and ensure resilience during economic volatility. Economic diversification is a key strategy for Uber Freight.

Analyst Opinions and Stock Performance Predictions

Analyst sentiment regarding Uber's recession-proof nature is mixed, reflecting the complexities inherent in forecasting the performance of a company navigating multiple sectors in an uncertain economic climate.

Bullish vs. Bearish Sentiment: A Divided Opinion

Financial analysts hold a wide range of views on Uber's future stock price prediction. Some exhibit bullish sentiment, emphasizing the company's diversification and potential for growth, while others maintain a bearish outlook, highlighting the vulnerabilities of its core ride-sharing business.

- Analyst Ratings: Reports from various firms like Goldman Sachs, Morgan Stanley, and others provide diverse ratings (buy, hold, sell) with varying target price ranges.

- Market Outlook: The broader market outlook significantly influences analysts' predictions, as general economic conditions heavily impact the performance of even seemingly resilient companies.

- Investment Strategy: Analyst recommendations reflect different investment strategies, from long-term growth to short-term gains.

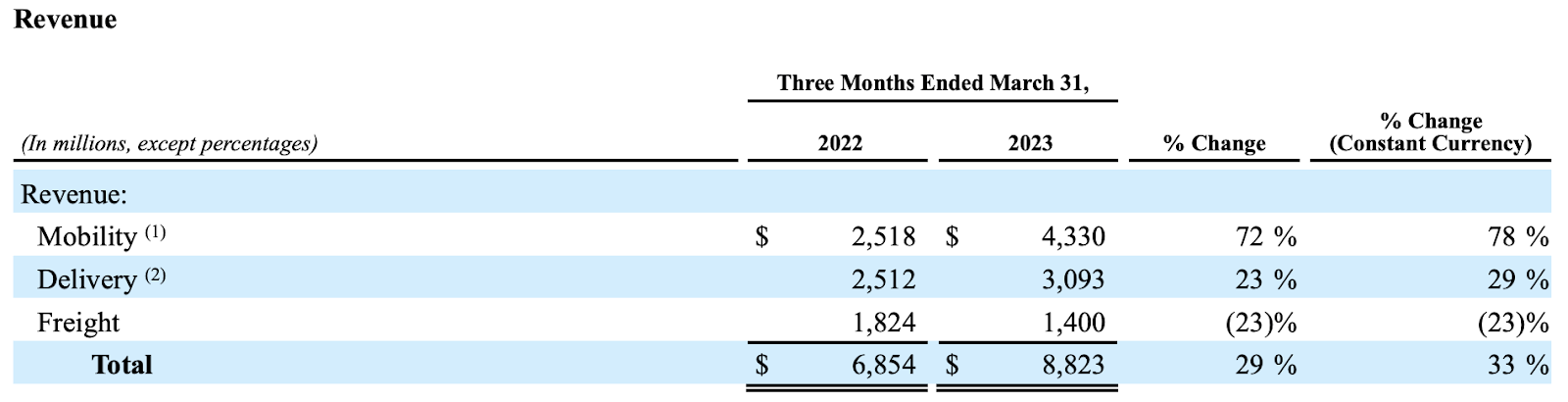

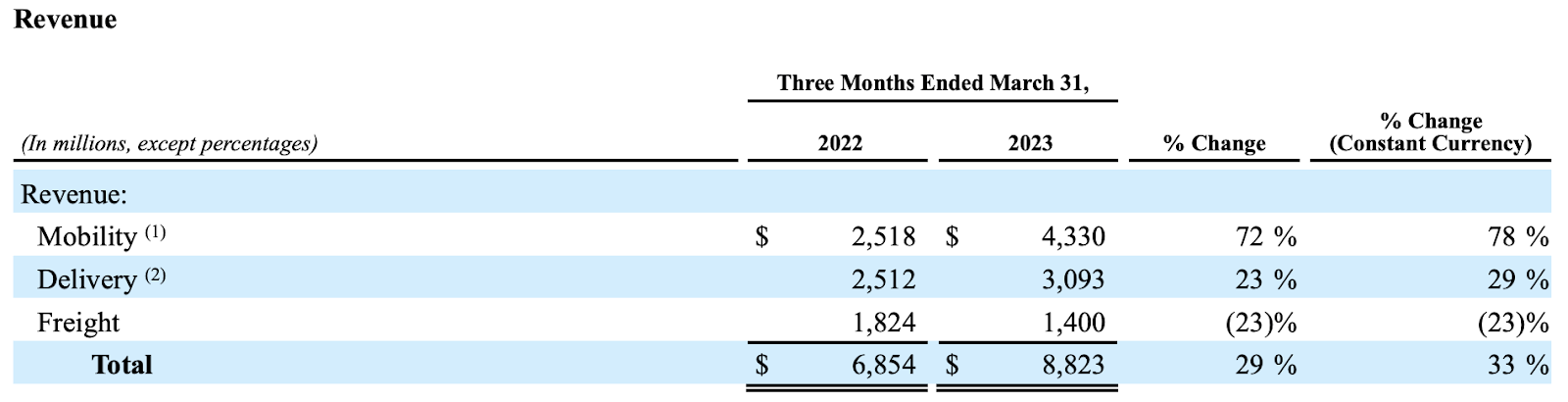

Key Metrics and Financial Indicators: A Closer Look at Uber's Health

Analyzing Uber's financial performance – including revenue growth, profitability, and debt levels – offers valuable insight into its capacity to withstand economic shocks.

- Revenue Growth Trends: Charts illustrating revenue growth across different revenue streams provide clear evidence of performance patterns over time.

- Profitability Metrics: Examining EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and free cash flow offers a more nuanced understanding of profitability beyond reported net income.

- Debt-to-Equity Ratio: A healthy debt-to-equity ratio indicates a sound financial structure capable of weathering economic storms.

Factors Affecting Uber's Long-Term Prospects

Uber's long-term prospects are shaped by various factors beyond immediate economic conditions, significantly impacting its potential to become truly recession-proof.

Technological Advancements: The Promise of Automation

Technological advancements, particularly in autonomous vehicles, present both opportunities and challenges for Uber.

- Automation's Impact: The potential for driverless cars could revolutionize Uber's operating model, reducing labor costs and increasing efficiency, potentially enhancing resilience.

- Technological Disruption: However, the transition to autonomous technology is fraught with challenges, requiring significant investment and navigating regulatory hurdles.

- Cost Reduction Potential: Successful automation could lead to significant cost reduction, boosting profitability and strengthening the company's ability to withstand economic downturns.

Regulatory Landscape: Navigating the Legal Maze

The regulatory landscape significantly shapes Uber's operations and its ability to thrive.

- Labor Laws: Labor laws concerning worker classification and employee benefits represent a significant cost factor for Uber.

- Licensing and Competition: Regulations concerning licensing, competition, and data privacy directly influence Uber's operating costs and overall profitability.

- Government Regulation's Impact: Navigating ever-evolving government regulations necessitates agility and adaptability, critical components for long-term success, especially during economic uncertainty.

Conclusion: Is Uber Recession-Proof? A Final Assessment

Whether Uber is truly recession-proof remains a complex question. While its diversification into food delivery and freight offers some resilience, the inherent sensitivity of its core ride-sharing business to economic cycles cannot be ignored. Analyst perspectives are varied, reflecting the uncertainty inherent in economic forecasting. The company's long-term success hinges on its ability to navigate technological advancements and a constantly evolving regulatory landscape.

To form your own informed opinion on Uber’s recession-proof nature and its stock performance, we encourage you to conduct further research, follow relevant financial news, and analyze the latest analyst reports and financial data. Stay updated on the latest developments in the ride-sharing and delivery sectors to gain a complete picture.

Featured Posts

-

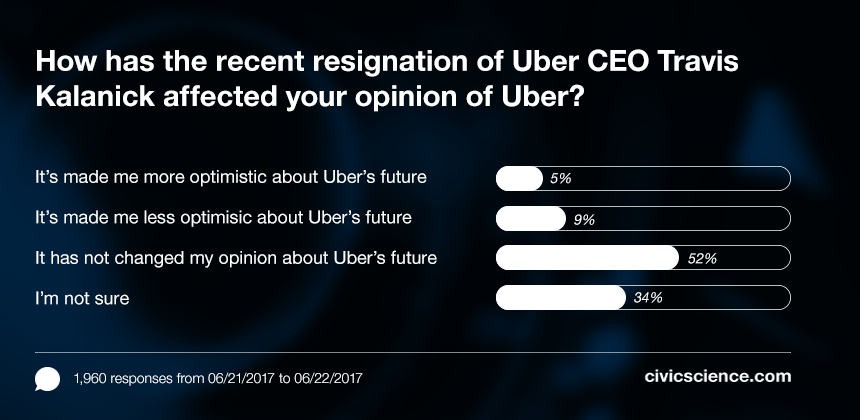

Former Uber Ceo Kalanick Reveals Regret Over Specific Project Strategy Decision

May 17, 2025

Former Uber Ceo Kalanick Reveals Regret Over Specific Project Strategy Decision

May 17, 2025 -

Cassidy Hutchinsons Memoir Insights Into The January 6th Hearings

May 17, 2025

Cassidy Hutchinsons Memoir Insights Into The January 6th Hearings

May 17, 2025 -

Is Josh Hart The Knicks Version Of Draymond Green Analyzing His Contributions

May 17, 2025

Is Josh Hart The Knicks Version Of Draymond Green Analyzing His Contributions

May 17, 2025 -

Network18 Media And Investments Stock Price Technical Analysis And Forecasts 21 Apr 2025

May 17, 2025

Network18 Media And Investments Stock Price Technical Analysis And Forecasts 21 Apr 2025

May 17, 2025 -

The Impact Of Global Economic Slowdown On Atlantic Canadas Lobster Industry

May 17, 2025

The Impact Of Global Economic Slowdown On Atlantic Canadas Lobster Industry

May 17, 2025