Is Uber Stock Recession-Proof? Analyst Insights & Predictions

Table of Contents

Uber's Business Model and Recession Resilience

Analyzing Uber's diverse revenue streams is crucial to understanding its potential resilience during a recession. Uber isn't just a ride-sharing company; it's a multifaceted transportation and logistics network encompassing Uber Rides, Uber Eats, Uber Freight, and other emerging services.

Analyzing Uber's Diverse Revenue Streams:

- Uber Rides: Historically, ride-sharing services have seen reduced demand during economic downturns as people cut back on discretionary spending. However, Uber Rides might see some resilience from essential travel needs.

- Uber Eats: Food delivery services often see increased demand during recessions, as people opt for more affordable home-cooked meals or seek convenient alternatives to dining out. This segment could be a key factor in Uber's recession resistance.

- Uber Freight: This segment, focused on logistics and trucking, could prove more stable than ride-sharing, as essential goods transportation remains a constant demand regardless of the economic climate. However, fluctuations in fuel prices and overall shipping volumes can affect profitability.

- Other Services: Uber's diversification into other areas like micromobility (scooters, bikes) and delivery services beyond food could help to cushion the blow of a recession affecting any one specific sector.

During previous economic slowdowns, the performance of these segments varied. While ride-sharing likely experienced a dip, the food delivery sector often saw growth. The ability of Uber to leverage the strengths of its diversified portfolio will greatly influence its performance during a recession. The question remains: Will the growth in some areas offset the potential decline in others?

Analyst Predictions and Stock Performance

Examining recent analyst ratings and price targets for Uber stock provides valuable insights into market sentiment. While opinions vary, a balanced overview is essential.

Examining Recent Analyst Ratings and Price Targets:

- Mixed Signals: Many analysts offer a "hold" rating, reflecting the uncertainty surrounding Uber's future performance in a potentially challenging economic environment. Some analysts remain bullish, pointing to the long-term growth potential. Conversely, others express more cautious views, citing potential headwinds.

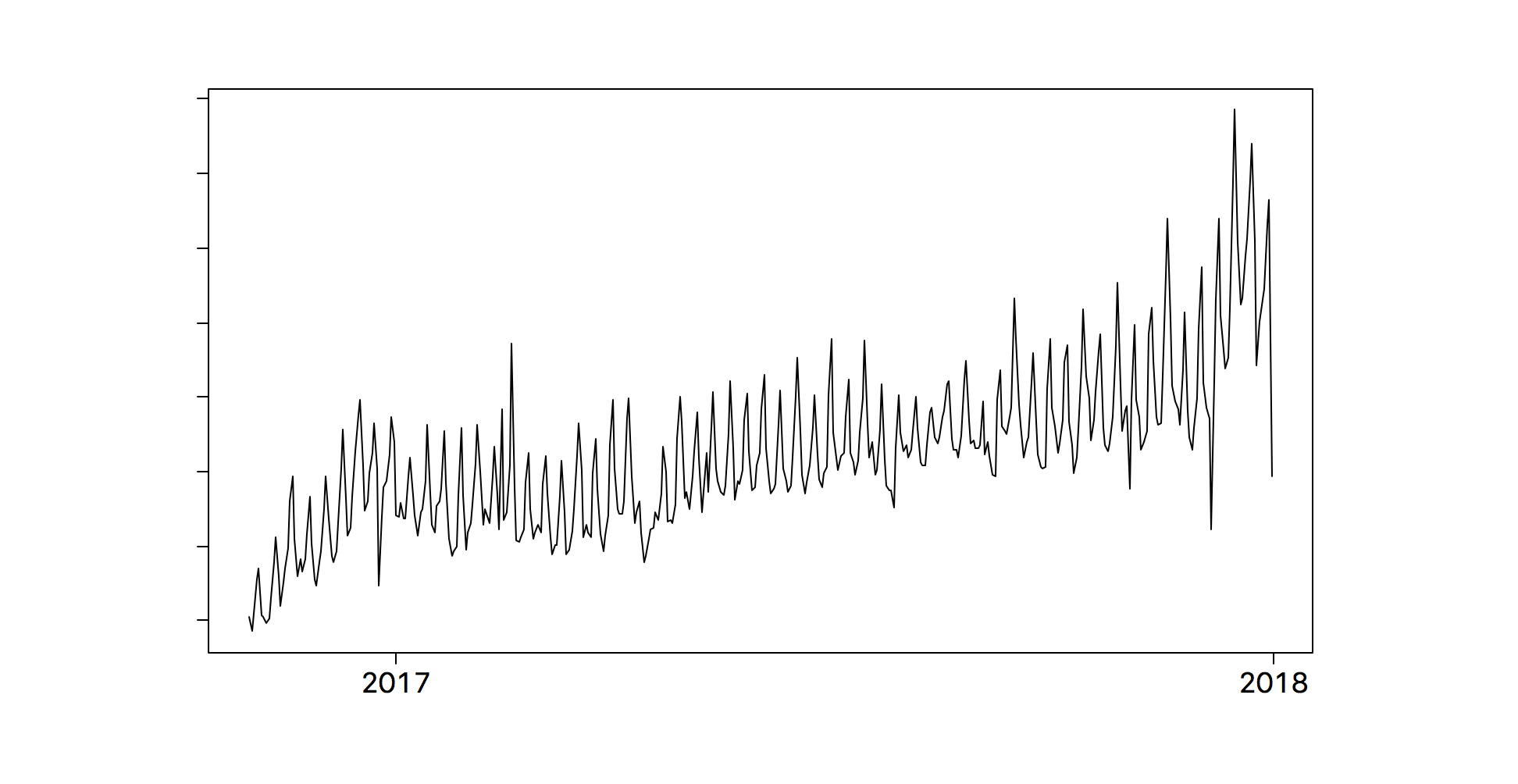

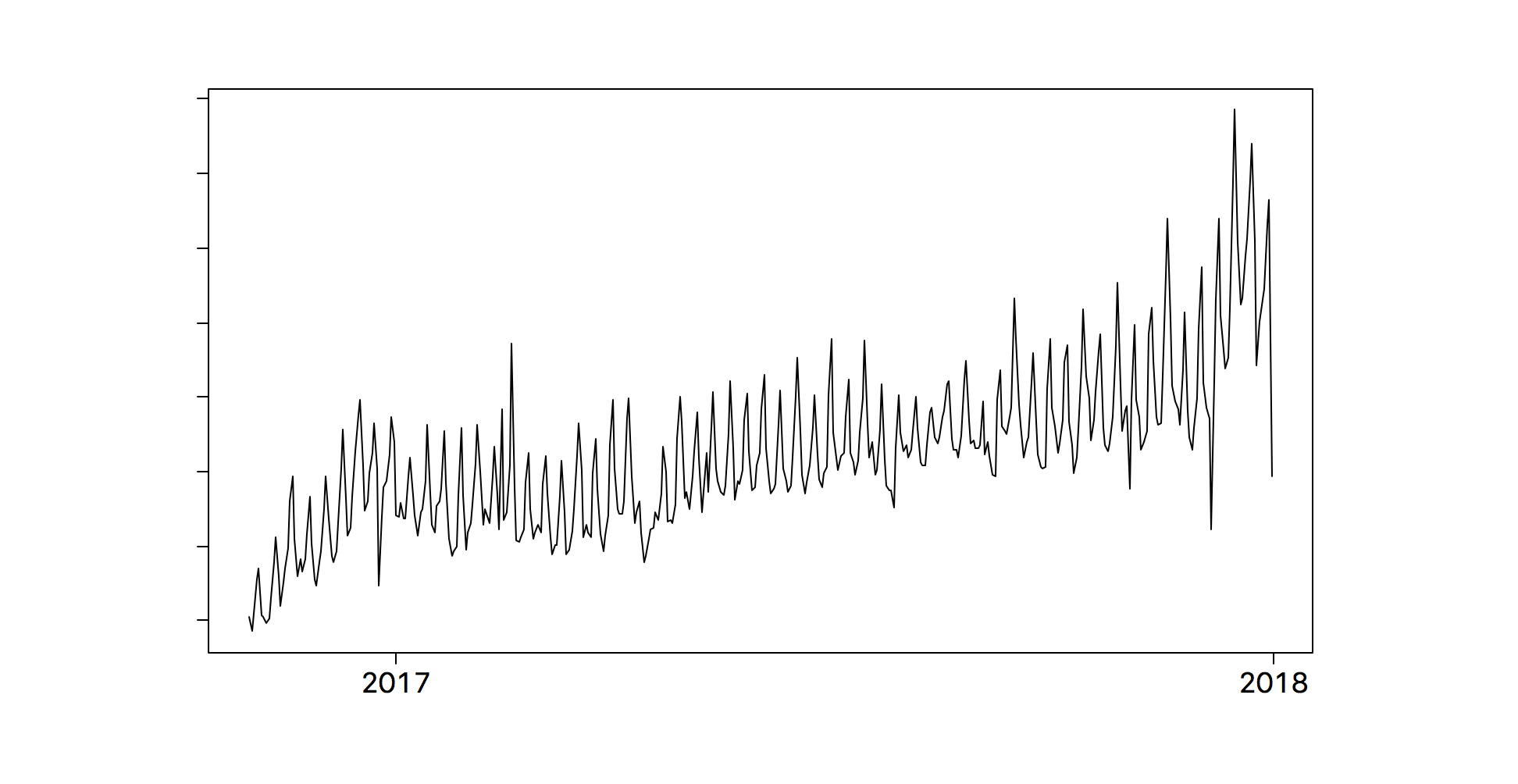

- Price Fluctuations: Uber's stock price has historically shown sensitivity to macroeconomic factors. Tracking its recent performance against broader market trends is key to understanding its volatility.

- Analyst Reasoning: Understanding the reasoning behind different analyst ratings is crucial. Factors considered often include competitive pressures, operational efficiency, and the overall economic outlook.

It's important to remember that analyst predictions are not guarantees. They offer informed opinions based on available data and market analysis, but the actual performance of Uber stock can deviate significantly.

Impact of Inflation and Rising Interest Rates

Inflation and rising interest rates pose significant challenges for Uber.

The Inflationary Squeeze on Uber and its Users:

- Increased Operational Costs: Inflation directly impacts Uber's operational costs, including fuel prices, driver wages, and maintenance expenses. These increases can squeeze profit margins.

- Consumer Spending: Rising prices can lead to reduced consumer spending on non-essential services like ride-sharing and food delivery. This could negatively affect demand for Uber's services.

- Pricing Strategies: Uber may attempt to mitigate the impact of inflation by raising prices, but this could further reduce demand, creating a delicate balancing act.

Effective cost management and strategic pricing will be critical for Uber to navigate the inflationary environment.

Uber's Competitive Landscape and Market Share

Uber's competitive landscape is a crucial factor to consider.

Competition and Market Dominance During a Downturn:

- Intense Competition: Companies like Lyft and DoorDash pose stiff competition. During a recession, competitive pressures could intensify as companies fight for market share.

- Consolidation: The possibility of mergers or acquisitions within the ride-sharing and food delivery industries can't be ruled out. This could dramatically reshape the competitive landscape.

- Market Share: Uber's ability to maintain or gain market share during a downturn will heavily influence its financial performance.

Maintaining a strong competitive edge will be critical for Uber's success, even during periods of economic stability, let alone a recession.

Long-Term Growth Prospects and Technological Advancements

Uber's investments in innovation could be a significant factor influencing its long-term resilience.

Future-Proofing Uber Through Innovation:

- Autonomous Vehicles: Investments in autonomous vehicle technology could significantly reduce operational costs and increase efficiency in the long run, potentially improving profitability and resilience.

- Technological Advancements: Continued investments in technology and software will be essential for optimizing operations, enhancing the customer experience, and improving efficiency.

- Market Expansion: Expanding into new markets and service offerings can diversify revenue streams and reduce reliance on any single market.

The success of these long-term initiatives will largely determine Uber's ability to thrive in the long term, regardless of the economic climate.

Conclusion: Is Investing in Uber Stock During a Recession a Smart Move?

The question of whether Uber stock is recession-proof is complex. While Uber's diversified business model offers some degree of resilience, the impact of inflation, rising interest rates, and intense competition cannot be ignored. Analyst predictions are mixed, reflecting the inherent uncertainties associated with economic downturns and the intricacies of Uber's business.

Based on our analysis, Uber's resilience depends heavily on its ability to manage costs, maintain market share, and leverage its technological advancements. While some segments might benefit from increased demand during a recession, others might experience a decline.

Therefore, investing in Uber stock during a recession requires careful consideration. It's crucial to conduct thorough research and assess your risk tolerance. While Uber's potential for growth remains compelling, the potential risks associated with economic downturns should not be underestimated. Consider consulting with a financial advisor before making any investment decisions. Further research into recession-proof investment strategies could provide additional insights to help you make an informed decision regarding Uber stock and other potential investments.

Featured Posts

-

Mlb Dfs Picks May 8th 2 Sleeper Picks And 1 Hitter To Avoid

May 18, 2025

Mlb Dfs Picks May 8th 2 Sleeper Picks And 1 Hitter To Avoid

May 18, 2025 -

Finding The Top No Id Verification Gambling Sites In 2025

May 18, 2025

Finding The Top No Id Verification Gambling Sites In 2025

May 18, 2025 -

Amanda Bynes Classmate Reveals Troubling Past Behavior

May 18, 2025

Amanda Bynes Classmate Reveals Troubling Past Behavior

May 18, 2025 -

I Naytilia Os Kommati Tis Ethnikis Mas Taytotitas Kasselakis

May 18, 2025

I Naytilia Os Kommati Tis Ethnikis Mas Taytotitas Kasselakis

May 18, 2025 -

Is Betting On The Los Angeles Wildfires Ethical Exploring The Moral Implications Of Disaster Gambling

May 18, 2025

Is Betting On The Los Angeles Wildfires Ethical Exploring The Moral Implications Of Disaster Gambling

May 18, 2025

Latest Posts

-

Addressing The Speculation Pedro Pascal On His Relationship With Jennifer Aniston

May 18, 2025

Addressing The Speculation Pedro Pascal On His Relationship With Jennifer Aniston

May 18, 2025 -

Pedro Pascal The Last Decades Rise To Hollywood Leading Man

May 18, 2025

Pedro Pascal The Last Decades Rise To Hollywood Leading Man

May 18, 2025 -

The Pedro Pascal And Jennifer Aniston Dating Rumors Fact Or Fiction

May 18, 2025

The Pedro Pascal And Jennifer Aniston Dating Rumors Fact Or Fiction

May 18, 2025 -

Jennifer Aniston And Pedro Pascal A Relationship Timeline And Rumor Analysis

May 18, 2025

Jennifer Aniston And Pedro Pascal A Relationship Timeline And Rumor Analysis

May 18, 2025 -

Is There Truth To The Pedro Pascal Jennifer Aniston Romance Rumors A Look At The Evidence

May 18, 2025

Is There Truth To The Pedro Pascal Jennifer Aniston Romance Rumors A Look At The Evidence

May 18, 2025