Is Uber's Autonomous Driving Technology A Good ETF Investment?

Table of Contents

Understanding the Autonomous Vehicle Market and its Investment Potential

The autonomous vehicle (AV) industry is poised for explosive growth. Investing in this sector offers the potential for significant returns, but understanding the market's dynamics is crucial.

The Growth of the Autonomous Vehicle Industry

The autonomous vehicle market is predicted to experience phenomenal growth. Reports suggest a market size exceeding $X trillion by 2030 (Source: [Insert reputable source here]), driven by several key factors:

- Market size projections for the next 5-10 years: Conservative estimates project a multi-billion dollar market within the next decade, with exponential growth thereafter.

- Key growth drivers: Improved safety through reduced human error, increased efficiency in logistics and transportation, and a significant reduction in traffic congestion are all major drivers.

- Government regulations and their impact: Government support and investment in infrastructure, along with the development of clear regulatory frameworks, are essential for the successful deployment of AVs. However, regulatory uncertainty can also pose a significant risk.

ETFs and their role in accessing this market

Exchange Traded Funds (ETFs) offer a diversified way to gain exposure to the autonomous vehicle sector without the risk associated with investing in individual companies. An ETF pools investments from multiple investors, enabling diversified holdings across various companies involved in the development and deployment of AV technology.

- Advantages of ETFs: Diversification reduces risk, they offer high liquidity, making them easy to buy and sell, and generally have low management fees.

- Disadvantages of ETFs: ETFs might provide lower returns than individual stocks if one company significantly outperforms the others in the ETF, and you lack direct control over your individual investments.

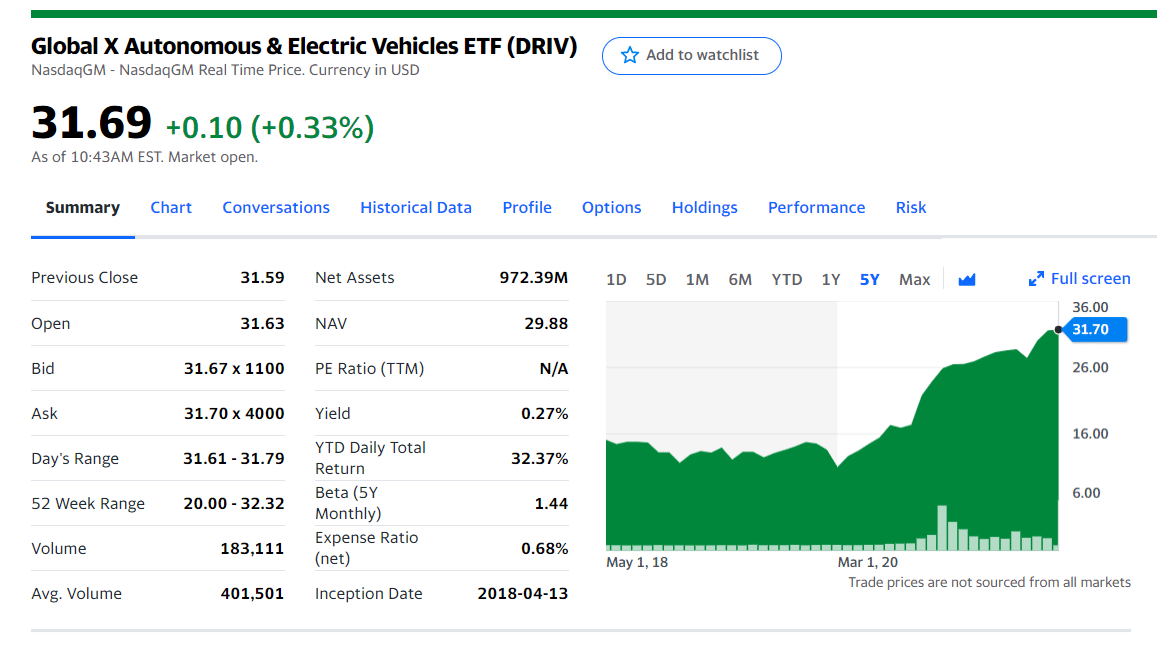

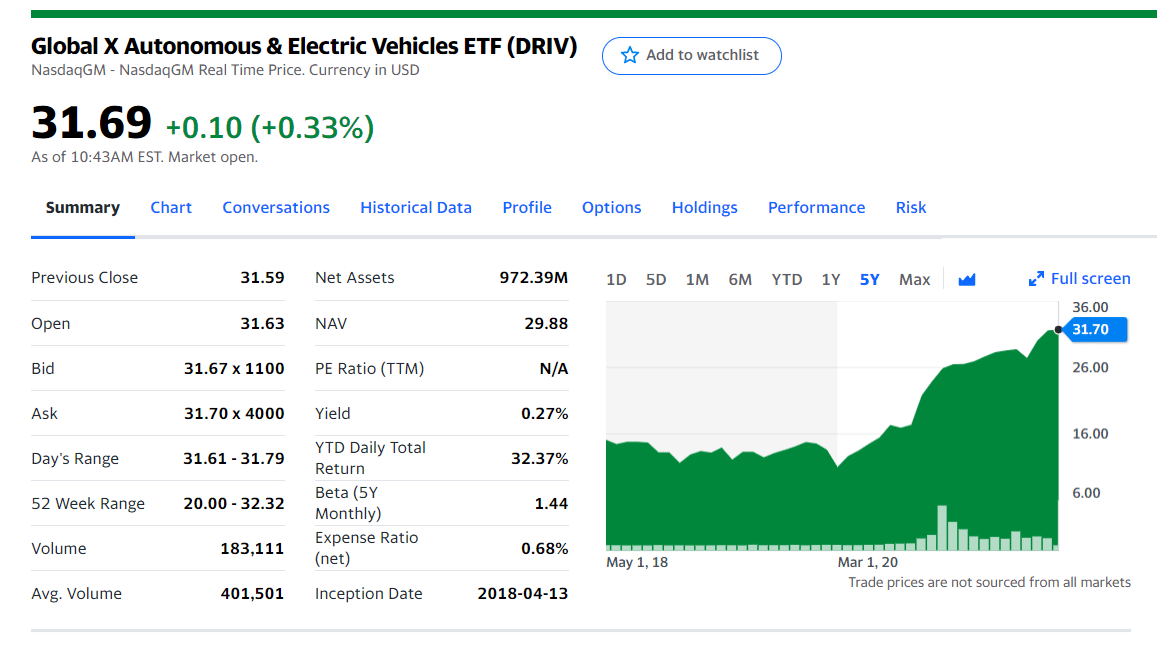

- Examples of relevant ETFs: While there isn't currently an ETF solely focused on Uber's autonomous driving technology, broader technology ETFs and those focused on the transportation sector may offer some indirect exposure. (Examples: [Insert examples of relevant ETFs here, including tickers]).

Analyzing Uber's Position in the Autonomous Vehicle Race

Uber is a major player in the autonomous vehicle space, having invested heavily in research and development. However, its journey has been marked by both successes and setbacks.

- Key technologies Uber is developing: Uber ATG (Advanced Technologies Group) is working on various aspects of self-driving technology, including sensor fusion, mapping, and AI-powered decision-making systems.

- Partnerships with other companies in the autonomous driving sector: Uber has collaborated with various technology companies and automotive manufacturers to accelerate its AV development.

- Challenges faced by Uber: Safety concerns, regulatory hurdles in different jurisdictions, and fierce competition from established players like Waymo and Tesla, pose significant obstacles.

Assessing the Risks Associated with Investing in Uber's Autonomous Driving Technology

Investing in the autonomous vehicle market, particularly through ETFs with indirect exposure to Uber, carries substantial risks.

Technological Risks

The development of fully autonomous driving technology (Level 5 autonomy) is incredibly complex and faces significant technological challenges.

- Challenges in achieving Level 5 autonomy: Unpredictable real-world scenarios, robust software capable of handling various conditions, and sensor reliability are critical issues.

- Software glitches and safety concerns: Software bugs, sensor malfunctions, and cybersecurity vulnerabilities pose serious safety risks, impacting public perception and potentially leading to regulatory setbacks.

- Unforeseen technical obstacles and their financial implications: The development process is prone to unforeseen challenges, potentially leading to significant delays and increased costs.

Regulatory and Legal Risks

The regulatory landscape for autonomous vehicles is constantly evolving and differs significantly across various countries and regions.

- Changing regulatory landscapes: New regulations, licensing requirements, and safety standards could hinder the deployment of autonomous vehicles, impacting the profitability of related companies.

- Liability issues in case of accidents involving autonomous vehicles: Determining liability in accidents involving AVs is a complex legal issue, which presents significant financial risk for companies involved.

- Potential delays or bans on autonomous vehicle deployment: Negative public perception or serious accidents could lead to regulatory delays or even bans, affecting investment returns.

Competitive Risks

Uber faces intense competition from other well-funded and established players in the autonomous vehicle industry.

- Major competitors: Waymo, Tesla, Cruise, and other automotive manufacturers are major competitors, each with significant resources and expertise.

- Competitive advantages and disadvantages of Uber's technology: Uber’s technology needs to stand out to succeed in this fiercely competitive market.

- Potential for disruptive technologies to emerge: Rapid technological advancements could render existing technologies obsolete, impacting the investment value of related companies.

Diversification and Risk Management Strategies for ETF Investments in Autonomous Driving

Mitigating the inherent risks in the autonomous driving sector requires a carefully planned investment strategy.

Diversifying your portfolio

Diversification is essential to minimize investment risk. Don't put all your eggs in one basket.

- Why diversification is crucial: Spreading investments across different sectors and asset classes reduces the impact of losses in any single sector.

- Examples of other tech sectors to consider for diversification: Consider investing in other technology sectors like cloud computing, cybersecurity, or artificial intelligence to diversify.

- How to construct a diversified portfolio: Consult with a financial advisor to create a portfolio that aligns with your risk tolerance and investment goals.

Understanding ETF risk profiles

Carefully evaluate the risk profile of any ETF before investing.

- Key factors to consider when evaluating ETF risk: Consider the ETF's holdings, expense ratio, historical volatility, and the overall market conditions.

- How to choose ETFs aligned with individual risk tolerance levels: Choose ETFs that align with your comfort level for risk and potential returns. Conservative investors should focus on lower-risk options.

- The importance of reviewing investment goals regularly: Regularly review your investment goals and risk tolerance to adjust your portfolio accordingly.

Conclusion: Making Informed Decisions about Autonomous Vehicle ETF Investments

Investing in ETFs related to Uber's autonomous driving technology offers the potential for high rewards, but it comes with significant risks. Technological hurdles, regulatory uncertainty, and intense competition make it a high-risk investment. Before considering investing in autonomous driving ETFs, carefully assess your risk tolerance and ensure your portfolio is diversified. Thoroughly research Uber's autonomous vehicle initiatives and the broader autonomous vehicle market before making any decisions. Remember to consult with a qualified financial advisor to make informed decisions about your autonomous vehicle ETF investments. Carefully consider investing in autonomous driving ETFs, and research Uber's autonomous vehicle initiatives thoroughly before investing. Make informed decisions about your autonomous vehicle ETF investments.

Featured Posts

-

Cannes Film Festival 2025 Will Exes Pattinson And Stewart Attend

May 19, 2025

Cannes Film Festival 2025 Will Exes Pattinson And Stewart Attend

May 19, 2025 -

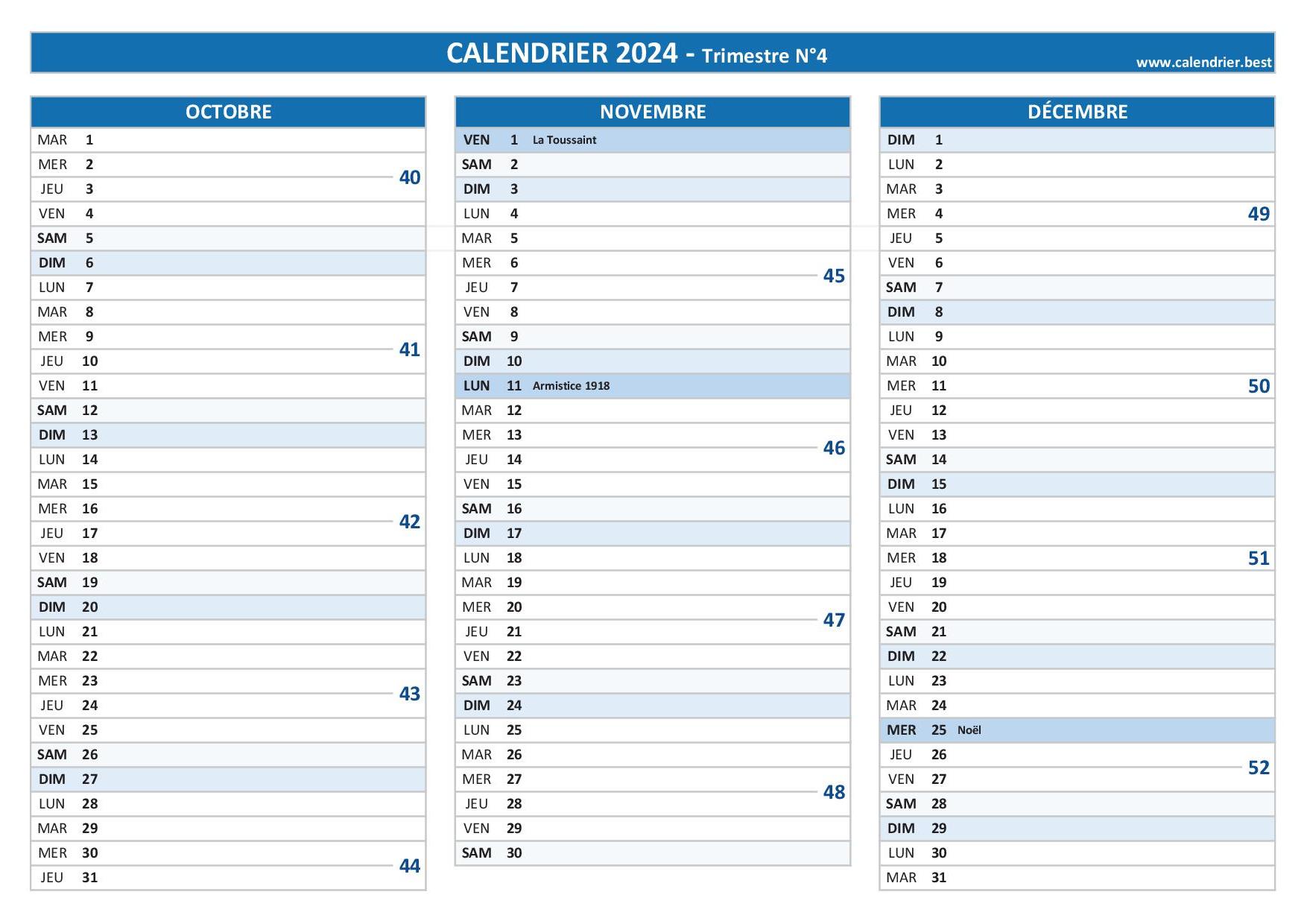

Credit Mutuel Am Decryptage Des Resultats Du 4eme Trimestre 2024

May 19, 2025

Credit Mutuel Am Decryptage Des Resultats Du 4eme Trimestre 2024

May 19, 2025 -

Investissement Responsable Credit Mutuel Am Le Defi De L Environnement Maritime

May 19, 2025

Investissement Responsable Credit Mutuel Am Le Defi De L Environnement Maritime

May 19, 2025 -

Endynamosi Ton Sxeseon Ierosolymon Kai Antioxeias Mia Nea Epoxi Synergasias

May 19, 2025

Endynamosi Ton Sxeseon Ierosolymon Kai Antioxeias Mia Nea Epoxi Synergasias

May 19, 2025 -

Times Kaysimon Kypros Sygkritiki Anazitisi And Fthinotera Pratiria

May 19, 2025

Times Kaysimon Kypros Sygkritiki Anazitisi And Fthinotera Pratiria

May 19, 2025