Japan's Q1 Economic Slowdown: Examining The Pre-Tariff Situation

Table of Contents

Domestic Consumption: A Weakening Engine of Growth

Domestic consumption is typically a significant engine of Japan's economic growth. However, Q1 witnessed a noticeable weakening in this crucial sector. Several factors contributed to this decline:

-

Wage Stagnation: Despite a low unemployment rate, wage growth in Japan has remained stubbornly low, leaving many consumers with limited disposable income. This constrained spending power directly impacted consumer confidence and overall retail sales.

-

Rising Prices: Inflation, while relatively low compared to some other countries, has begun to erode consumer purchasing power. Rising prices for essential goods, particularly energy and food, have forced households to cut back on discretionary spending.

-

Sectoral Analysis: The impact of decreased consumer spending varied across sectors. While some segments, such as online retail, showed relative resilience, others, including the automobile industry, faced significant headwinds. Sales of durable goods were particularly affected by the combination of wage stagnation and price increases.

-

Historical Comparison: Comparing Q1's performance with previous quarters reveals a clear slowdown in the growth rate of domestic consumption. This decline represents a significant departure from the relatively stronger performance observed in recent years.

-

Economic Indicators: Data from various sources, including the consumer confidence index and retail sales figures, paint a consistent picture of weakening domestic demand. These indicators underscore the severity of the slowdown and the urgent need for policy intervention. Analyzing these indicators in the context of historical trends reveals a concerning downward trajectory.

Investment Trends and Business Sentiment

The state of business investment provides another critical lens through which to examine Japan's Q1 economic slowdown. Several interconnected factors contributed to a subdued investment climate:

-

Global Uncertainty: Global economic uncertainty, stemming from geopolitical tensions and slowing growth in key trading partners, has made businesses hesitant to commit to significant new investments. This risk aversion is reflected in delayed capital expenditure plans across various sectors.

-

Corporate Profits: While some large corporations reported healthy profits, many smaller businesses faced challenges, limiting their capacity and willingness to invest. A squeeze on profit margins due to increased input costs further dampened investment enthusiasm.

-

Capital Expenditure: Analysis across various sectors reveals a general decrease in capital expenditure in Q1. Industries particularly vulnerable to global economic fluctuations showed a more pronounced reduction in investment.

-

Business Confidence: Surveys of business sentiment reveal a decline in confidence during Q1, reflecting concerns about the future economic outlook. This pessimism further reinforced the reluctance of businesses to expand their operations or undertake new investment projects.

-

Historical Perspective: Comparing Q1 investment trends with previous periods highlights a significant deceleration in the growth rate of business investment, signaling a potential prolonged period of subdued activity.

External Factors and Global Trade

External factors, even before considering the full impact of potential tariffs, played a significant role in Japan's Q1 economic slowdown. This section explores these pre-tariff external pressures:

-

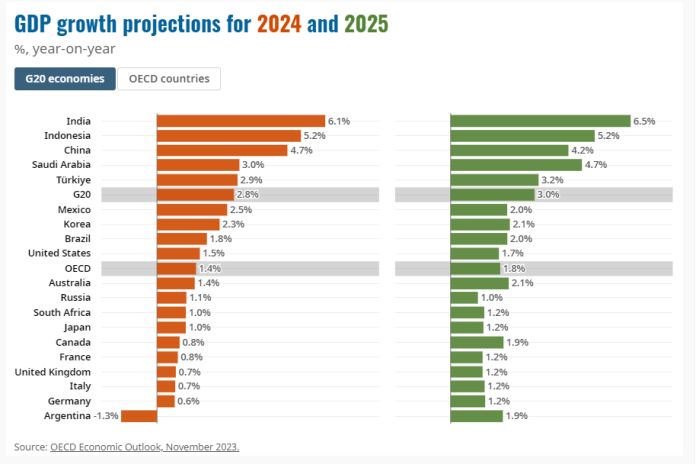

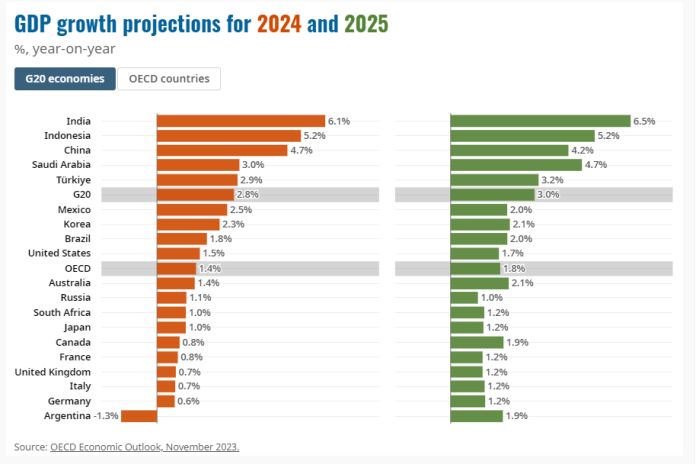

Slowing Global Demand: Slower economic growth in many of Japan's key trading partners led to a decrease in demand for Japanese exports, significantly impacting export-oriented industries. This reduction in external demand amplified the domestic slowdown.

-

Trading Partner Performance: Analysis of the economic performance of Japan's key trading partners reveals a widespread slowdown, creating a less favorable external environment for Japanese businesses. This interconnectedness highlights the vulnerability of the Japanese economy to global economic fluctuations.

-

Preemptive Trade Friction: Concerns about potential trade friction, even before the implementation of any new tariffs, created uncertainty and negatively impacted business investment and export expectations. This anticipatory effect highlights the sensitivity of the Japanese economy to even the potential threat of trade wars.

-

Supply Chain Disruptions: While not a major factor in Q1, the potential for future supply chain disruptions, given global geopolitical uncertainty, represents a significant ongoing risk for Japan's export-oriented economy.

-

Export/Import Data: Visualizing export and import data reveals a clear decline in the growth rate of exports during Q1, confirming the significant negative impact of slowing global demand and trade uncertainty.

Government Policy Response and its Effectiveness

The Japanese government responded to the economic slowdown with a combination of fiscal and monetary policy measures. The effectiveness of these measures remains a subject of ongoing debate:

-

Policy Measures: The government implemented fiscal stimulus measures, including increased government spending on infrastructure projects. Monetary policy measures included maintaining low interest rates.

-

Policy Effectiveness: The effectiveness of these policies in counteracting the slowdown is debatable. While some argue that they mitigated the severity of the downturn, others point to their limited impact on addressing underlying structural issues.

-

Limitations and Unintended Consequences: Critics argue that the fiscal stimulus was insufficient to counteract the weakening domestic demand, while others raise concerns about potential unintended consequences, such as increased government debt.

-

Future Policy Options: Looking ahead, the government may need to consider additional policy options to address the underlying structural issues contributing to the slowdown. This might involve measures to stimulate wage growth and boost consumer confidence.

-

Comparison with Past Responses: A comparison with past government responses to economic downturns reveals a somewhat cautious approach in Q1, possibly reflecting concerns about fiscal sustainability and the need to balance short-term stimulus with long-term structural reforms.

Conclusion

Japan's Q1 economic slowdown resulted from a complex interplay of factors. Weakening domestic consumption, subdued business investment, and slowing global demand all contributed to the sluggish growth, even before considering potential tariffs. Understanding these pre-existing economic challenges is crucial for accurately predicting the future impact of potential external shocks and formulating effective policy responses. Staying informed about Japan's economic performance is vital; monitor key economic indicators like consumer confidence, business investment, and export figures to gain a better understanding of the evolving situation. Continue your research on Japan's Q1 economic slowdown and its implications for future growth by subscribing to reputable economic news sources and following relevant data releases. A thorough understanding of Japan's Q1 economic slowdown is crucial for navigating the complexities of the global economic landscape.

Featured Posts

-

Understanding The Trump Family Relationships And Key Figures

May 17, 2025

Understanding The Trump Family Relationships And Key Figures

May 17, 2025 -

E Scooter On Auckland Southern Motorway Dashcam Footage Shows Risky Ride

May 17, 2025

E Scooter On Auckland Southern Motorway Dashcam Footage Shows Risky Ride

May 17, 2025 -

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025 -

Nba Ta Zeygaria Ton Playoffs Kai Oi Imerominies Ton Agonon 2024

May 17, 2025

Nba Ta Zeygaria Ton Playoffs Kai Oi Imerominies Ton Agonon 2024

May 17, 2025 -

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025