Jeanine Pirro's Stock Market Warning: Ignore For Weeks?

Table of Contents

Understanding Jeanine Pirro's Warning

Jeanine Pirro's stock market prediction, while not explicitly detailed in a single, formal statement, is generally understood to convey concerns about significant market volatility and the potential for a downturn. Pinpointing precise sources for her statements can be challenging, as they’re often interwoven into her broader commentary on current events. However, her commentary consistently reflects a pessimistic outlook regarding the economic climate.

-

Key Points of Pirro's Warning: Pirro's concerns generally revolve around high inflation, rising interest rates, and geopolitical instability. She hasn't specified particular market indicators, but her warnings often imply a broad concern about the overall economic health and its impact on investment values.

-

Implied Timeframe: The timeframe for Pirro's prediction remains unclear. While she hasn't explicitly stated a specific timeframe (short-term or long-term), the urgency in her messaging suggests at least a medium-term concern, perhaps spanning several months to a year.

-

Potential Consequences: The potential consequences highlighted by Pirro align with a general market downturn, potentially involving a stock market correction or even a more severe market crash and ensuing economic recession.

-

Pirro's Credibility: It's crucial to acknowledge that Jeanine Pirro's background is primarily in law enforcement and media, not finance or economics. While her insights into political and social dynamics might offer valuable context, her pronouncements on complex economic issues should be viewed with caution and not considered authoritative financial advice.

Analyzing the Economic Landscape

To assess the validity of Pirro's warning, we must analyze the current economic climate. Several key economic indicators deserve consideration:

-

Inflation and Interest Rates: Currently, inflation remains a significant concern in many global economies. Central banks are responding by raising interest rates, a move intended to curb inflation but which can also slow economic growth and impact market valuations. High interest rates increase borrowing costs for businesses and consumers, potentially dampening economic activity.

-

Recession Risk: Concerns about a potential recession are prevalent among economists, fueled by persistent inflation and aggressive interest rate hikes. The probability of a recession is a significant factor impacting stock market performance and investor sentiment.

-

Geopolitical Events and Supply Chain Issues: Global geopolitical instability, such as the ongoing conflict in Ukraine, continues to contribute to market volatility. Supply chain disruptions, though easing in some sectors, still pose challenges to global economic stability.

-

Expert Opinions: While some economists share Pirro's concerns about the potential for a market downturn, others maintain a more optimistic outlook, highlighting the resilience of certain sectors and the potential for a soft landing. It's essential to consult multiple viewpoints before making any investment decisions. (Note: Include relevant charts and graphs here illustrating inflation rates, interest rates, GDP growth, etc. Source the data from reputable financial institutions).

The Role of Political Uncertainty

Political uncertainty significantly influences market sentiment. Upcoming elections, changes in government policies, and regulatory shifts can all cause market fluctuations.

-

Election Impact: Political rhetoric surrounding elections often impacts investor confidence. Uncertainties about future policies can lead to market volatility as investors anticipate potential changes.

-

Government Policies: Fiscal and monetary policies implemented by governments have a profound impact on the economy and the stock market. Changes in tax rates, spending levels, or interest rate targets can significantly influence investor decisions.

-

Regulatory Changes: New regulations or changes to existing ones can affect specific industries and companies, leading to market adjustments. Uncertainty surrounding regulatory developments can also contribute to volatility.

Should You Ignore Pirro's Warning? A Cautious Approach

While Jeanine Pirro's stock market warning shouldn't be ignored entirely, it's vital to approach it with a balanced and cautious perspective. Blindly following or completely disregarding any single prediction is unwise.

-

Diversified Investment Portfolio: The cornerstone of successful long-term investing is a well-diversified portfolio. Spreading investments across various asset classes (stocks, bonds, real estate, etc.) mitigates the risk associated with any single investment performing poorly.

-

Consult a Financial Advisor: Before making significant investment changes, always consult with a qualified financial advisor. They can help you assess your risk tolerance, evaluate your investment goals, and develop a personalized strategy.

-

Risk Management Strategies: Implement risk management techniques such as dollar-cost averaging (investing a fixed amount regularly regardless of market fluctuations) and maintaining a suitable level of cash reserves.

-

Long-Term Investing: Focus on long-term investment strategies rather than attempting short-term market timing. Short-term market predictions are notoriously unreliable.

Conclusion

Jeanine Pirro's stock market warning, while deserving attention, should be analyzed alongside broader economic and political factors. While her concerns regarding market volatility are understandable, reacting impulsively to a single prediction is rarely a prudent investment strategy. A comprehensive analysis of various economic indicators and a robust risk management approach are crucial for responsible investing. Don't ignore the potential implications of Jeanine Pirro's stock market warning, but instead, approach it with a measured response and a well-defined investment strategy. Consult a financial advisor, diversify your portfolio, and develop a plan that incorporates strategies to navigate potential market downturns. Remember, proactive and responsible financial planning is your best defense against any stock market storm.

Featured Posts

-

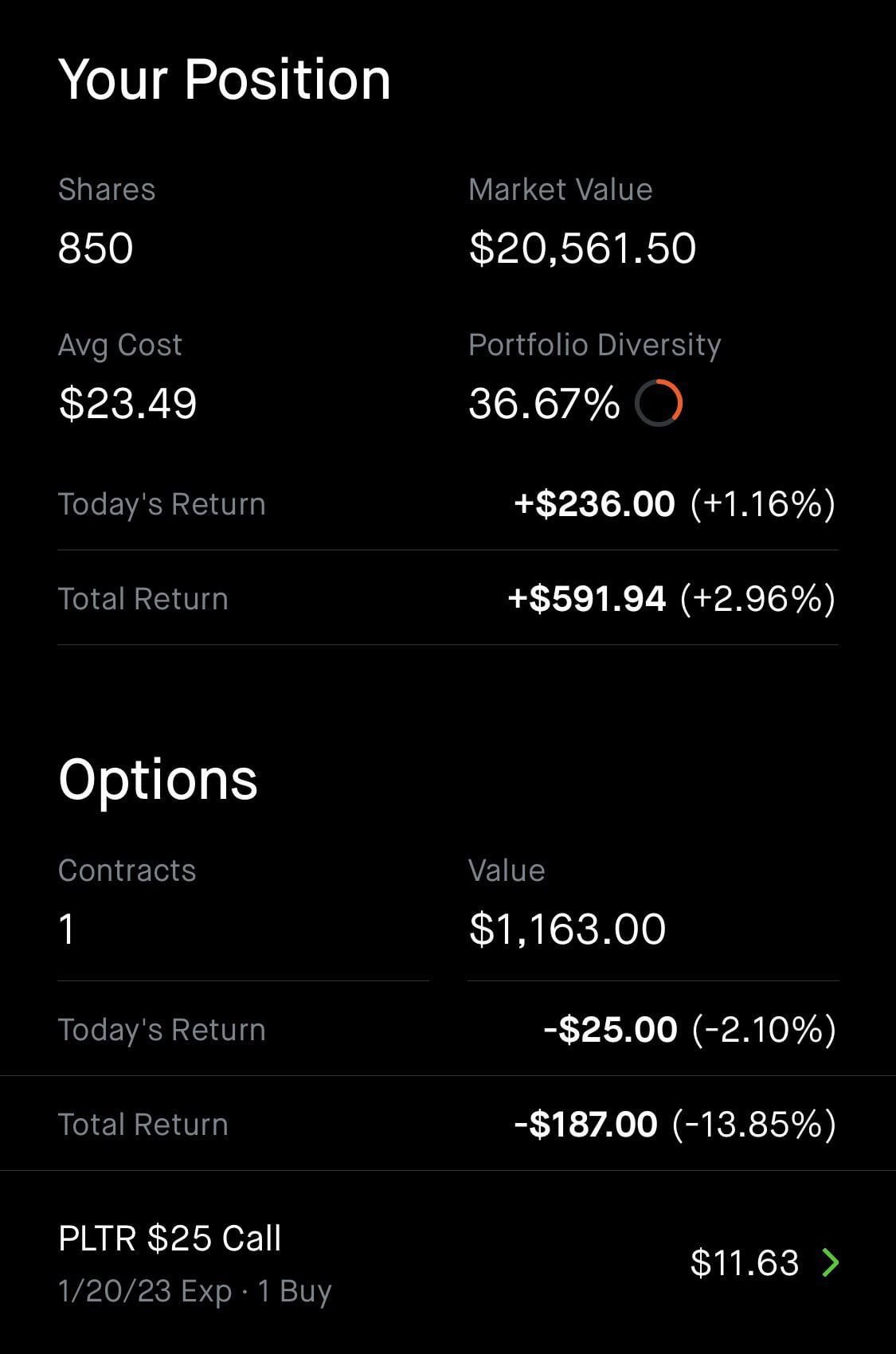

Should You Buy Pltr Stock Before May 5th A Data Driven Approach

May 09, 2025

Should You Buy Pltr Stock Before May 5th A Data Driven Approach

May 09, 2025 -

Indias Rise New Global Power Ranking After Uk France And Russia

May 09, 2025

Indias Rise New Global Power Ranking After Uk France And Russia

May 09, 2025 -

Call For Regulatory Changes Indian Insurers And Bond Forwards

May 09, 2025

Call For Regulatory Changes Indian Insurers And Bond Forwards

May 09, 2025 -

Rytsarskoe Zvanie Dlya Stivena Fraya Reaktsiya I Podrobnosti

May 09, 2025

Rytsarskoe Zvanie Dlya Stivena Fraya Reaktsiya I Podrobnosti

May 09, 2025 -

Daycare Debate Psychologist Sparks Outrage With Viral Podcast Claims

May 09, 2025

Daycare Debate Psychologist Sparks Outrage With Viral Podcast Claims

May 09, 2025