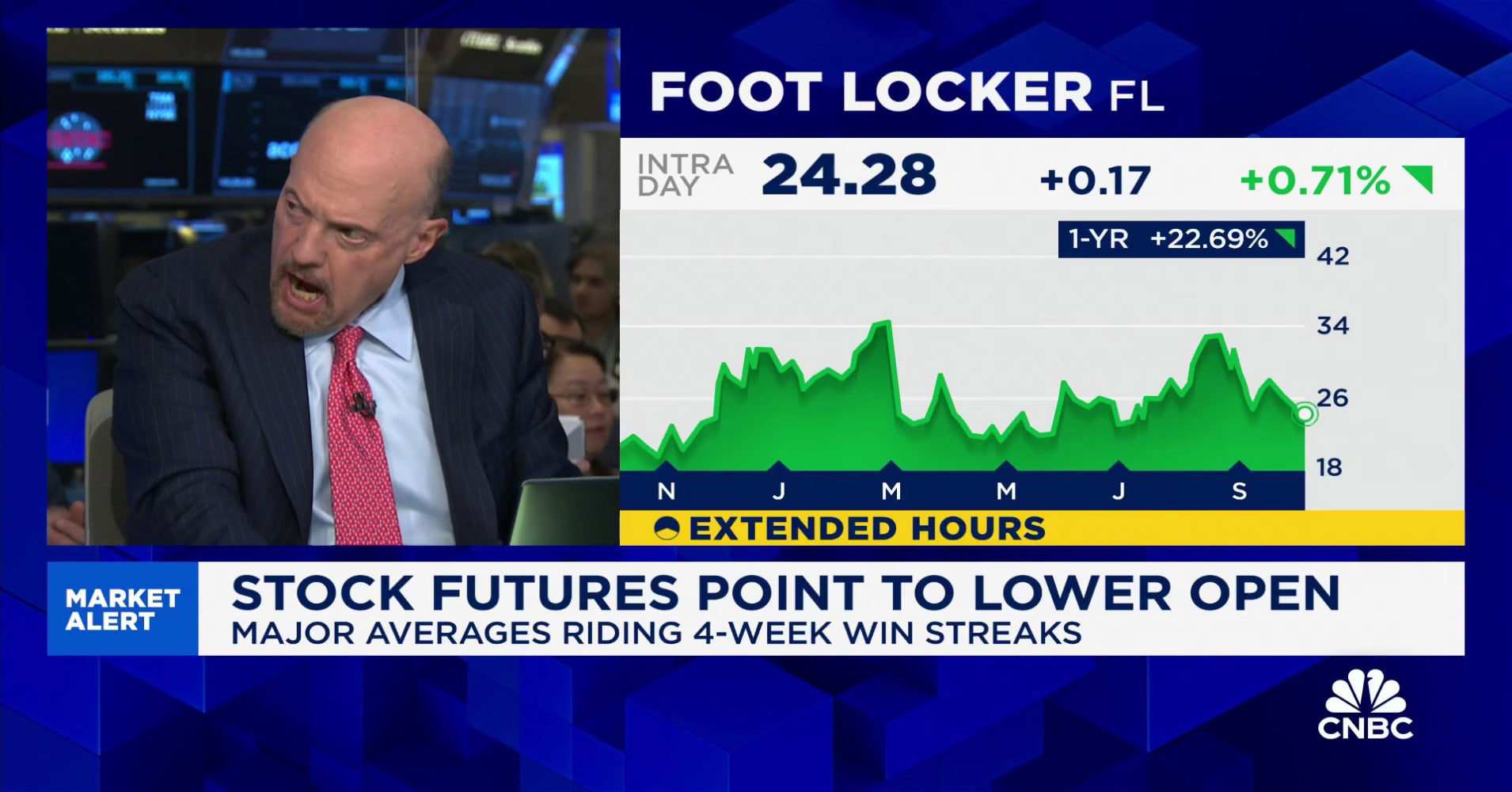

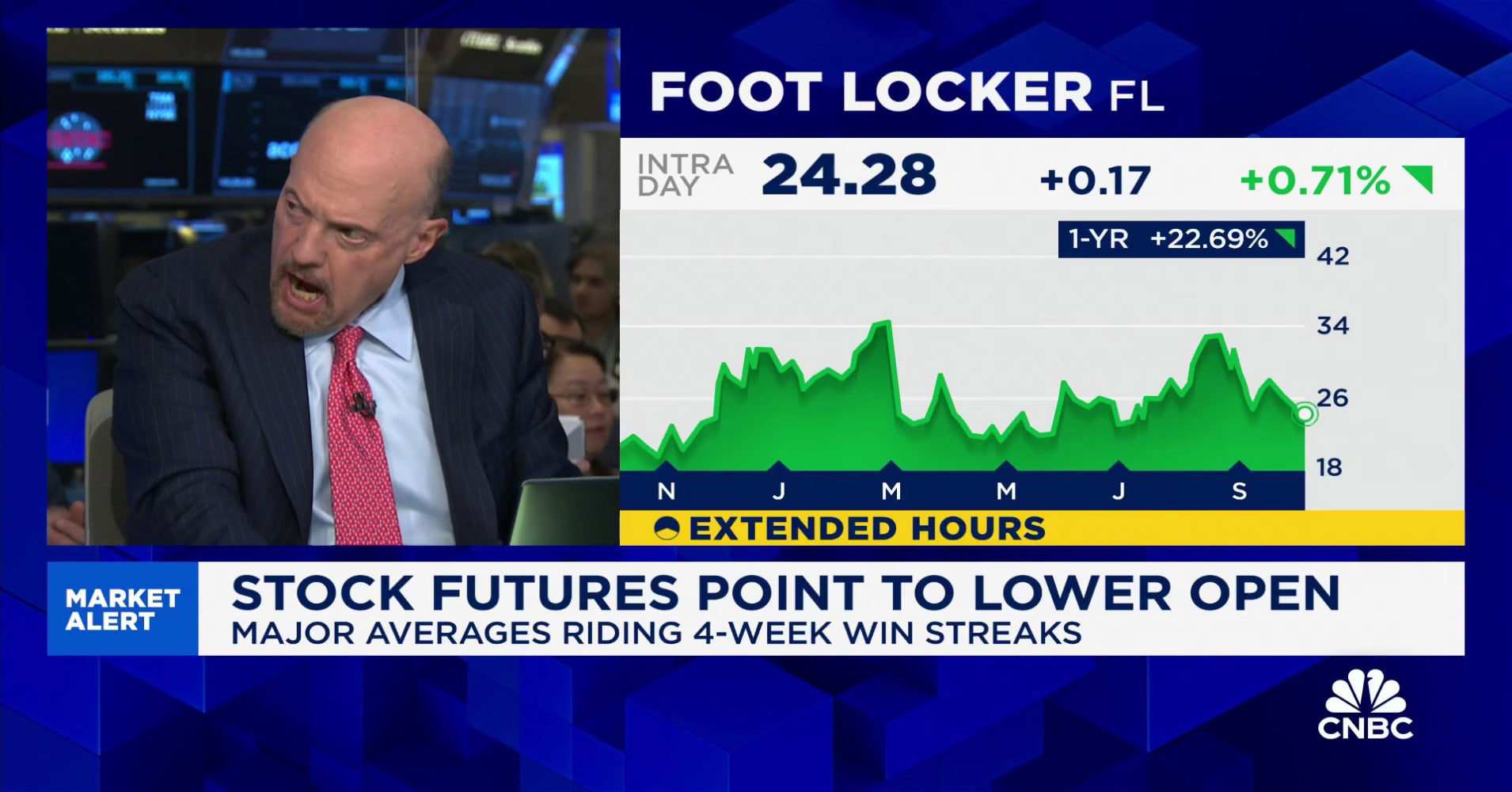

Jim Cramer On Foot Locker (FL): Is It A Solid Investment?

Table of Contents

Jim Cramer's Stance on Foot Locker (FL): A Historical Overview

Jim Cramer, the renowned host of CNBC's "Mad Money," has offered various opinions on Foot Locker over the years. His pronouncements haven't always been consistent, reflecting the dynamic nature of the retail and footwear market. Understanding the context of his past recommendations is crucial.

-

Example: In Q2 2022, Cramer expressed a bullish sentiment towards FL, citing strong earnings reports and a positive outlook for the athleisure sector. He stated (paraphrased), "Foot Locker is showing resilience; their focus on key brands is paying off."

-

Example: Conversely, his outlook shifted more bearish in Q4 2023, driven by concerns over elevated inventory levels and softening consumer demand. He warned (paraphrased), "The inventory situation at Foot Locker is a red flag; they need to manage it carefully."

Analyzing Cramer's past comments reveals a pattern influenced by Foot Locker's performance and broader economic conditions. His opinions are a valuable data point, but not the sole determinant of an investment decision.

Foot Locker's (FL) Current Financial Performance and Market Position

To assess the investment potential of Foot Locker (FL), a thorough examination of its current financial health and market standing is essential. Recent quarterly earnings reports reveal (replace with actual data): [Insert recent financial data, e.g., revenue growth, net income, earnings per share]. These figures need to be analyzed within the context of the broader athletic footwear and apparel industry.

-

Recent Quarterly Earnings Reports and Implications: [Analyze the latest earnings reports, discussing key performance indicators and their implications for future growth.]

-

Comparison with Major Competitors: Foot Locker competes with giants like Nike and Adidas. A comparative analysis of market share and growth strategies is necessary to understand FL's competitive edge. [Insert comparative data and analysis].

-

Foot Locker's Digital Transformation Strategy: The company's success hinges on its ability to adapt to the changing retail landscape. Its digital transformation strategy—including its online presence, mobile app, and omnichannel approach—is crucial for future growth. [Discuss the effectiveness of their digital strategy].

Key Factors Influencing Investment Decisions in Foot Locker (FL)

Several factors beyond Foot Locker's direct control significantly impact its performance and investment attractiveness.

-

Macroeconomic Factors: Inflation, interest rates, and overall consumer spending directly affect discretionary spending on footwear and apparel. High inflation, for example, can reduce consumer purchasing power, impacting Foot Locker's sales. [Analyze the impact of macroeconomic trends on FL].

-

Industry Trends: The athleisure market is constantly evolving. Shifts in consumer preferences, the rise of direct-to-consumer brands, and the impact of sustainability concerns all influence Foot Locker's trajectory. [Discuss current trends and their potential impact on FL].

-

Brand Strength and Customer Loyalty: Foot Locker's brand recognition and customer loyalty are significant assets. However, maintaining these requires ongoing efforts to adapt to evolving consumer needs and preferences. [Analyze Foot Locker's brand strength and customer loyalty].

-

Risks and Challenges: Supply chain disruptions, competition, and changing consumer behavior present significant challenges to Foot Locker. A comprehensive risk assessment is crucial for any investment decision. [Discuss key risks and challenges facing FL].

Alternative Investment Perspectives on Foot Locker (FL)

While Jim Cramer's opinion is valuable, it's essential to consider a broader range of perspectives. Other financial analysts and experts may have different opinions based on their investment strategies and analyses.

-

Analyst Ratings and Price Targets: Review the consensus view of financial analysts regarding Foot Locker's stock. Consider the range of price targets and the rationale behind their ratings. [Insert data on analyst ratings and price targets].

-

Investment Strategies: Value investing might favor Foot Locker if its stock price is considered undervalued relative to its intrinsic value. Growth investors, on the other hand, may focus on the potential for future growth. [Discuss different investment strategies and their applicability to FL].

Conclusion: Is Foot Locker (FL) Right for You?

So, is Foot Locker (FL) a solid investment? Jim Cramer's insights offer a valuable perspective, but they are just one piece of the puzzle. A holistic investment decision requires considering its financial performance, market position, industry trends, and the wider economic climate. This analysis provides a framework for your own due diligence. Ultimately, the decision rests with you. Conduct thorough research, assess your risk tolerance, and perhaps consult a financial advisor before investing in Foot Locker (FL) or any stock. Is Foot Locker (FL) the right fit for your investment portfolio? Only you can decide.

Featured Posts

-

Devenir Gardien Reussir Sur Un Marche Difficile A Penetrer

May 15, 2025

Devenir Gardien Reussir Sur Un Marche Difficile A Penetrer

May 15, 2025 -

Man Shot At Ohio City Apartment Complex Police Investigate

May 15, 2025

Man Shot At Ohio City Apartment Complex Police Investigate

May 15, 2025 -

Access To Birth Control Examining The Post Roe Otc Landscape

May 15, 2025

Access To Birth Control Examining The Post Roe Otc Landscape

May 15, 2025 -

The Anthony Edwards Baby Mama Saga Unfolding Online

May 15, 2025

The Anthony Edwards Baby Mama Saga Unfolding Online

May 15, 2025 -

Giant Sea Wall Persetujuan Dpr Untuk Proyek Presiden Prabowo

May 15, 2025

Giant Sea Wall Persetujuan Dpr Untuk Proyek Presiden Prabowo

May 15, 2025

Latest Posts

-

Paysandu Vs Bahia Cronica Del Encuentro 0 1

May 15, 2025

Paysandu Vs Bahia Cronica Del Encuentro 0 1

May 15, 2025 -

Victoria De Olimpia Sobre Penarol 2 0 Resumen Y Goles Destacados

May 15, 2025

Victoria De Olimpia Sobre Penarol 2 0 Resumen Y Goles Destacados

May 15, 2025 -

Penarol Vs Olimpia Resultado Final 0 2 Goles Y Analisis Del Juego

May 15, 2025

Penarol Vs Olimpia Resultado Final 0 2 Goles Y Analisis Del Juego

May 15, 2025 -

Olimpia Golea A Penarol 2 0 Resumen Goles Y Cronica Del Encuentro

May 15, 2025

Olimpia Golea A Penarol 2 0 Resumen Goles Y Cronica Del Encuentro

May 15, 2025 -

Partido En Directo Roma Monza Informacion Y Analisis

May 15, 2025

Partido En Directo Roma Monza Informacion Y Analisis

May 15, 2025