Jim Cramer's Take On CoreWeave (CRWV): The OpenAI Connection

Table of Contents

CoreWeave's Business Model and its Reliance on AI

Specialized Infrastructure for AI Workloads

CoreWeave focuses on providing high-performance computing (HPC) resources specifically designed for the demands of artificial intelligence applications. Unlike general-purpose cloud providers, CoreWeave's data center infrastructure is meticulously optimized for GPU-intensive workloads. This specialization is a key differentiator, allowing them to offer superior performance and efficiency for AI tasks. They leverage cutting-edge NVIDIA GPUs, along with other specialized hardware, to ensure optimal processing power.

- Scalability: CoreWeave's infrastructure is designed to scale rapidly, allowing clients to easily adjust their computing resources as needed.

- Efficiency: Their optimized infrastructure minimizes energy consumption and maximizes performance, leading to cost savings for clients.

- Cost-effectiveness: While high-performance computing can be expensive, CoreWeave strives for cost-effectiveness through efficient resource allocation and optimized pricing models.

- Specialized support: CoreWeave provides expert support tailored to the unique challenges of AI development and deployment.

The Growing Demand for AI Computing Power

The AI market is experiencing explosive growth, fueled by advancements in machine learning, deep learning, and the rise of large language models (LLMs). This surge in AI adoption is creating an unprecedented demand for advanced computing resources far exceeding the capabilities of traditional cloud providers. Many established cloud platforms struggle to keep pace with the specialized needs of AI development, creating a significant opportunity for companies like CoreWeave.

- Increased adoption of AI: Businesses across various sectors are increasingly integrating AI into their operations, driving demand for robust computing power.

- Growth of large language models (LLMs): The development and deployment of LLMs like GPT-3 and others require immense computational resources, further intensifying the demand.

- Need for specialized infrastructure: The unique demands of AI workloads necessitate specialized infrastructure optimized for GPU processing and high-bandwidth communication, highlighting CoreWeave's competitive advantage.

The CoreWeave-OpenAI Partnership: A Strategic Advantage

OpenAI as a Key Customer and Technology Partner

CoreWeave enjoys a significant strategic partnership with OpenAI, a leading AI research company renowned for its groundbreaking models like GPT. This relationship positions CoreWeave as a crucial provider of infrastructure for OpenAI's operations. The partnership provides mutual benefits: OpenAI gains access to high-performance computing resources, while CoreWeave receives validation of its infrastructure's capabilities and gains a high-profile client.

- Access to cutting-edge AI technology: The collaboration provides CoreWeave with insights into the latest AI advancements and technologies.

- Validation of CoreWeave's infrastructure: OpenAI's reliance on CoreWeave's services serves as a strong testament to its quality and reliability.

- Potential for future collaborations: This partnership lays the groundwork for potential future collaborations and expansion of services between the two companies.

Implications for CoreWeave's Future Growth

The CoreWeave-OpenAI partnership significantly strengthens CoreWeave's market position within the rapidly expanding AI infrastructure sector. This strategic alliance is likely to translate into increased revenue, expansion of market share, and enhanced investor confidence.

- Increased investor confidence: The association with a prominent player like OpenAI boosts CoreWeave's credibility and attracts further investment.

- Strengthened brand reputation: The partnership elevates CoreWeave's brand visibility and strengthens its reputation within the AI community.

- Potential for strategic acquisitions: The success of this partnership could pave the way for future acquisitions and expansion into related fields.

Jim Cramer's Analysis and Investment Recommendation

Decoding Cramer's Statements on CRWV

While specific quotes require referencing Cramer's actual broadcasts and articles, his general sentiment towards CoreWeave often reflects the company's strong potential within the burgeoning AI market. His analysis likely highlights the strategic importance of the OpenAI partnership and the growing demand for the services CoreWeave provides. He may also discuss the risks inherent in investing in a relatively new company within a rapidly evolving sector.

- Key quotes: (Insert relevant quotes from Jim Cramer's analysis of CRWV here, citing sources)

- Overall sentiment: (Summarize Cramer's overall positive or negative assessment of CRWV)

- Specific recommendations: (Detail any buy, sell, or hold recommendations made by Cramer)

Considering the Investment Landscape for CRWV

Investing in CoreWeave, like any stock, carries both risks and rewards. The company operates in a high-growth market, but faces competition from established cloud providers and other emerging players in the AI infrastructure space. Technological advancements and regulatory changes could also influence the company's future performance.

- Market competition: The competitive landscape includes established cloud providers like AWS, Google Cloud, and Microsoft Azure, each vying for a share of the AI market.

- Technological advancements: Rapid technological advancements could render current infrastructure obsolete, necessitating continuous investment in upgrades.

- Regulatory considerations: Data privacy regulations and other government policies could impact CoreWeave's operations and profitability.

Conclusion

Jim Cramer's perspective on CoreWeave (CRWV) highlights the company's strategic position within the AI infrastructure landscape, largely due to its significant partnership with OpenAI. CoreWeave's specialized business model, focused on providing high-performance computing resources tailored to AI workloads, positions it to capitalize on the explosive growth of the AI market. The partnership with OpenAI further strengthens its position and provides a significant advantage. However, potential investors must carefully weigh the risks and rewards before making any investment decisions related to CRWV.

Call to Action: Jim Cramer's insights offer valuable perspectives on CoreWeave (CRWV) and its potential within the rapidly expanding AI sector. However, remember to conduct thorough due diligence and consider the potential risks before investing in CoreWeave or any stock. Consult with a qualified financial advisor before making any investment decisions concerning CoreWeave, CRWV, and its relationship to OpenAI.

Featured Posts

-

Switzerland Condemns Chinas Military Drills Near Taiwan

May 22, 2025

Switzerland Condemns Chinas Military Drills Near Taiwan

May 22, 2025 -

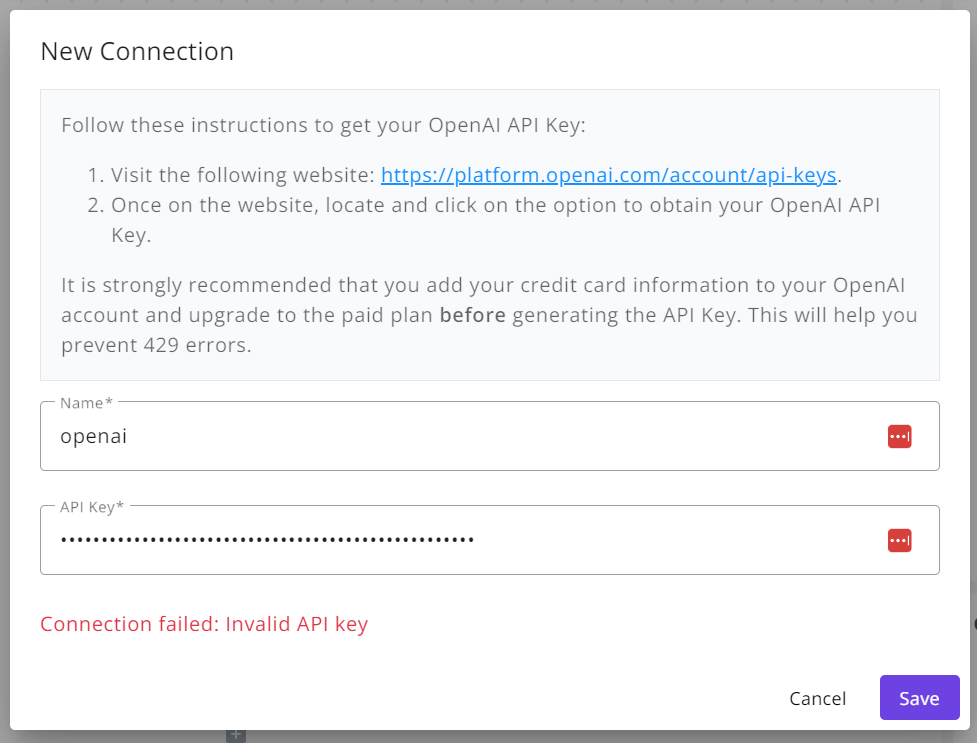

Cac Tuyen Duong Ket Noi Tp Hcm Den Ba Ria Vung Tau

May 22, 2025

Cac Tuyen Duong Ket Noi Tp Hcm Den Ba Ria Vung Tau

May 22, 2025 -

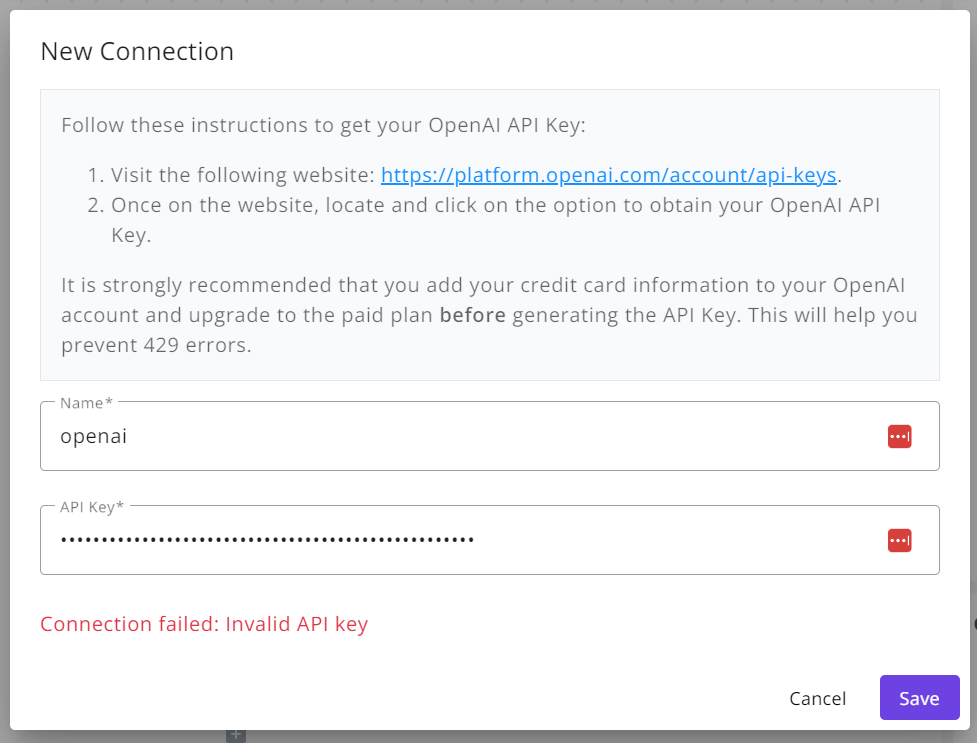

Build Voice Assistants With Ease Open Ais 2024 Developer Conference Highlights

May 22, 2025

Build Voice Assistants With Ease Open Ais 2024 Developer Conference Highlights

May 22, 2025 -

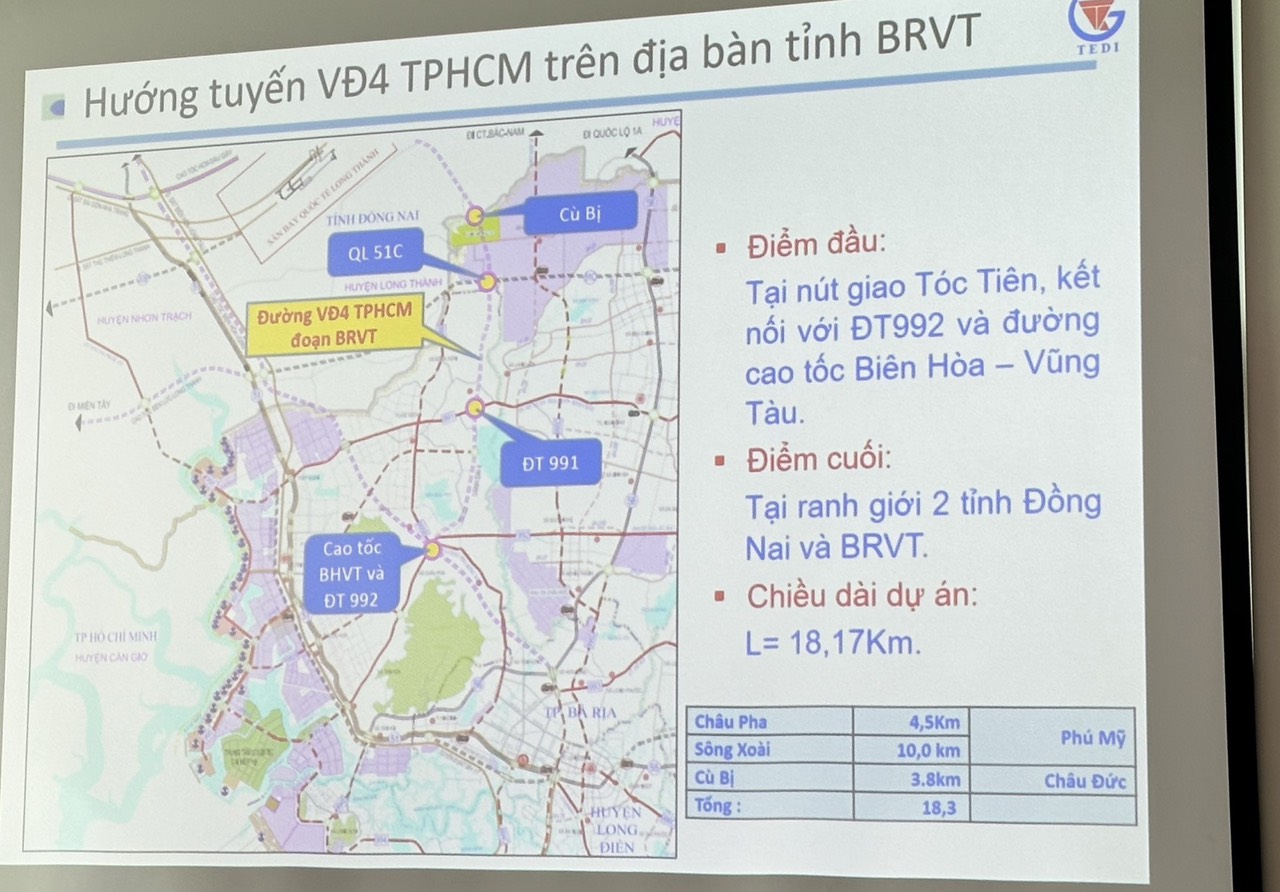

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 22, 2025

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 22, 2025 -

Blake Lively Faces Lawsuit All The Details On The Justin Baldoni Case And Celebrity Involvement

May 22, 2025

Blake Lively Faces Lawsuit All The Details On The Justin Baldoni Case And Celebrity Involvement

May 22, 2025

Latest Posts

-

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025 -

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025 -

Todays Wordle Answer March 16th Solving Wordle 1366

May 22, 2025

Todays Wordle Answer March 16th Solving Wordle 1366

May 22, 2025 -

Challenging Wordle Puzzle Nyt Answer For March 26

May 22, 2025

Challenging Wordle Puzzle Nyt Answer For March 26

May 22, 2025