Job Market Crisis: TD Bank Forecasts Significant Losses Amidst Recession Concerns

Table of Contents

TD Bank's Recessionary Forecast and its Impact on Employment

TD Bank's recent forecast paints a concerning picture for the Canadian job market. While the bank hasn't released a precise number, their projections suggest a notable increase in unemployment, fueled by a looming recession. Their analysis relies on a range of economic indicators, including consumer spending, inflation rates, and business investment. The methodology employed incorporates various econometric models and historical data to predict the severity and duration of the potential economic downturn.

- Specific percentage of job losses predicted by TD Bank: While not explicitly stated as a single percentage, TD Bank's warnings imply a substantial increase in unemployment, potentially impacting hundreds of thousands of Canadians. The exact figure remains dependent on the severity and length of the recession.

- Industries expected to be most severely impacted: Sectors like technology, real estate, and potentially construction are expected to experience significant job losses due to their sensitivity to interest rate hikes and decreased consumer spending.

- Geographical areas predicted to experience the highest unemployment rates: Areas heavily reliant on specific at-risk industries, or with already higher unemployment rates, are likely to be disproportionately affected.

- Comparison to previous recessionary periods and job loss figures: While the current situation presents unique challenges (e.g., lingering supply chain issues), comparing the predicted impact to previous recessions, such as the 2008-2009 financial crisis, can offer valuable context. However, it's crucial to remember that each economic downturn has its own distinct characteristics.

Underlying Factors Contributing to the Potential Job Market Crisis

Several interconnected factors are contributing to TD Bank's pessimistic outlook. The current economic climate is a complex interplay of various challenges.

- High inflation rates and their effect on business profitability and hiring: Persistent inflation erodes business profits, making companies less likely to expand and hire new employees. Increased costs also force businesses to potentially reduce staff to maintain profitability.

- The impact of rising interest rates on investment and borrowing: Higher interest rates increase borrowing costs for businesses, hindering investment and expansion plans, leading to reduced hiring and potential layoffs.

- The role of global economic uncertainty and geopolitical factors: Global events, such as the ongoing war in Ukraine and energy price volatility, add further uncertainty to the economic outlook, impacting investor confidence and business decisions.

- Persistent supply chain disruptions and their influence on production and employment: Ongoing supply chain bottlenecks continue to constrain production and increase costs, impacting business viability and employment.

- Decreasing consumer spending and its implications for business growth: As inflation erodes purchasing power and consumer confidence declines, decreased spending directly impacts businesses' revenue and their ability to maintain employment levels.

Strategies for Navigating the Potential Job Market Crisis

Proactive measures are crucial for individuals and businesses to mitigate the potential impact of a job market crisis.

- Importance of continuous skills development and upskilling/reskilling to remain competitive: Investing in new skills and adapting to evolving industry demands is essential to enhance job security.

- Strategies for improving job security, such as networking and diversifying skills: Building a strong professional network and developing diverse skills can improve resilience in a challenging job market.

- Advice on financial planning and budgeting in anticipation of potential job loss: Creating a robust financial plan, including an emergency fund, can provide a safety net in the event of unemployment.

- Suggestions for businesses to retain employees and mitigate layoffs: Implementing strategies like flexible work arrangements, improved employee benefits, and open communication can help businesses retain valuable staff.

- Resources available to support job seekers during an economic downturn: Government programs, retraining initiatives, and job search assistance services can provide vital support to individuals facing unemployment.

Government Intervention and Policy Responses

The Canadian government will likely play a significant role in addressing the potential job market crisis. This may involve implementing economic stimulus packages to boost growth, expanding unemployment benefits to support job seekers, and strengthening the social safety net. Specific policy responses will depend on the severity of the economic downturn and the government's overall economic strategy.

Conclusion

TD Bank's forecast highlights a significant risk of a job market crisis in Canada, driven by high inflation, rising interest rates, and global economic uncertainty. The potential for substantial job losses underscores the urgency of preparing for such an event. Understanding the implications of this job market crisis, as highlighted by TD Bank's forecast, allows for strategic preparation. Staying informed about the evolving economic situation and proactively planning for potential job market challenges is crucial. Take action today to mitigate the potential impact on your career and finances. Learn more about TD Bank's economic forecast and prepare for potential job market challenges.

Featured Posts

-

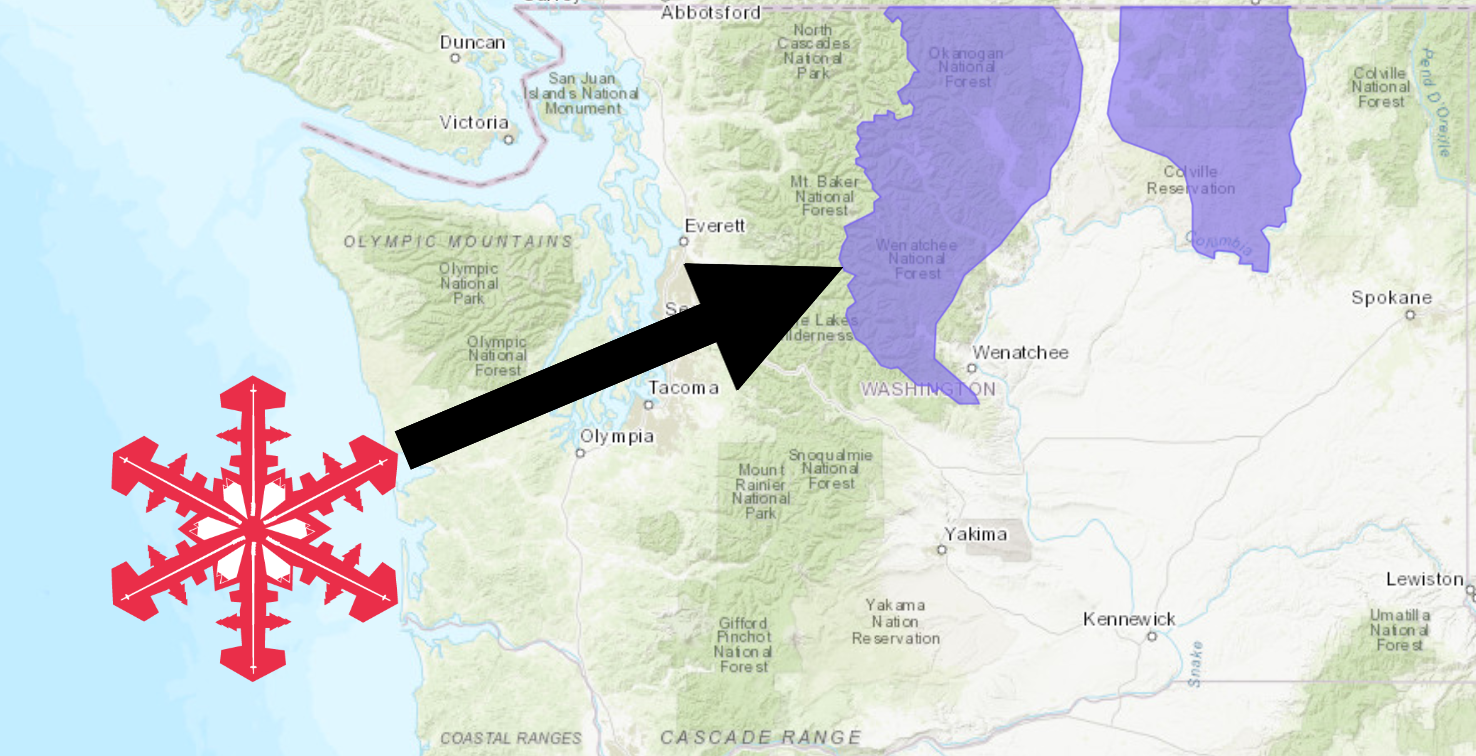

Wind Advisory And Snow Tuesday What To Expect

May 28, 2025

Wind Advisory And Snow Tuesday What To Expect

May 28, 2025 -

Jennifer Lopez Set To Host 2025 American Music Awards

May 28, 2025

Jennifer Lopez Set To Host 2025 American Music Awards

May 28, 2025 -

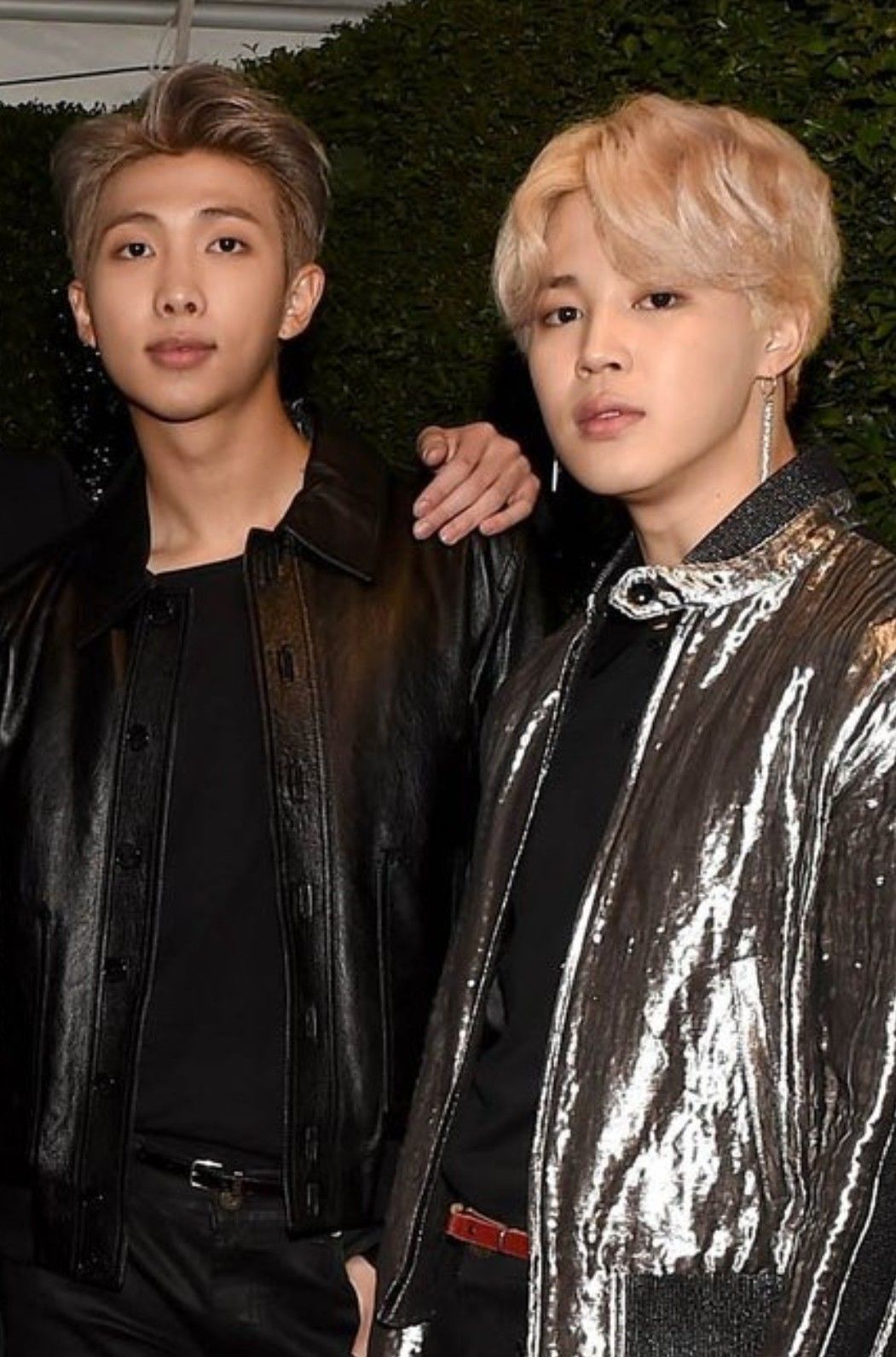

K Pops Biggest Night Amas Nominations For Rose Rm Jimin Ateez And Stray Kids

May 28, 2025

K Pops Biggest Night Amas Nominations For Rose Rm Jimin Ateez And Stray Kids

May 28, 2025 -

Temukan Tiket Penerbangan Murah Saudia Bali Jeddah

May 28, 2025

Temukan Tiket Penerbangan Murah Saudia Bali Jeddah

May 28, 2025 -

Sinners Strong Start Top Half Draw At The French Open

May 28, 2025

Sinners Strong Start Top Half Draw At The French Open

May 28, 2025

Latest Posts

-

Enhanced Partnership Starboard And Tui Cruises Announce Expanded Collaboration

May 29, 2025

Enhanced Partnership Starboard And Tui Cruises Announce Expanded Collaboration

May 29, 2025 -

Robbie Williams Christens Cruise Ship In Malaga With Concert

May 29, 2025

Robbie Williams Christens Cruise Ship In Malaga With Concert

May 29, 2025 -

Mein Schiff Relax A Look At The Inaugural Season

May 29, 2025

Mein Schiff Relax A Look At The Inaugural Season

May 29, 2025 -

Mein Schiff Relax Begins Maiden Voyage Cruise News

May 29, 2025

Mein Schiff Relax Begins Maiden Voyage Cruise News

May 29, 2025 -

Mein Schiff Relax Maiden Season Kicks Off

May 29, 2025

Mein Schiff Relax Maiden Season Kicks Off

May 29, 2025