Kering Stock Takes A Hit: 6% Drop After Weak First Quarter Results

Table of Contents

Weak Sales Growth Across Key Brands

Kering's Q1 results revealed disappointing sales growth across its key brands, significantly underperforming market expectations. This underperformance was particularly noticeable in Gucci and Yves Saint Laurent, two brands that typically drive a significant portion of Kering's revenue. The luxury brand sales figures paint a concerning picture.

- Gucci sales experienced a concerning 14% decline compared to the same period last year. This represents a substantial drop and suggests a significant shift in consumer behavior towards the brand.

- Yves Saint Laurent performance, while still showing growth, fell far short of predictions, indicating a potential saturation or slowing demand in certain product categories. Growth was only around 4%, significantly lower than anticipated.

- Bottega Veneta sales remained relatively stagnant, showing minimal growth compared to Q1 2022, highlighting the challenges faced by this brand in maintaining momentum within the competitive luxury market.

Several factors contribute to this sales slowdown. Decreased consumer spending, particularly in the high-end luxury segment, due to rising inflation and economic uncertainty played a significant role. Supply chain disruptions and challenges in adapting to rapidly changing market trends also contributed to the overall underperformance. The slowing luxury brand sales growth is a worrying indicator for the luxury goods sector as a whole.

Impact of Geopolitical Factors and Economic Uncertainty

The current global economic climate has undeniably impacted Kering's performance. Geopolitical risks and economic uncertainty significantly influence consumer confidence and spending habits, particularly in the luxury goods sector where purchases are often discretionary.

- The war in Ukraine significantly affected supply chains, particularly for materials sourced from or transported through the region, disrupting production and delivery schedules. Furthermore, the war dampened tourism in Europe, a key source of revenue for many luxury brands.

- Inflationary pressures have considerably reduced consumer discretionary spending. With rising costs of living, consumers are re-evaluating their spending habits, often prioritizing essential purchases over luxury goods.

- The looming threat of a global recession further exacerbates the situation, prompting caution and reduced spending among high-net-worth individuals who are a key demographic for luxury brands. This economic uncertainty creates market volatility and significantly impacts luxury market spending.

These geopolitical risks and economic headwinds created significant challenges for Kering, adding to the pressure already faced from weakening sales growth.

Changing Consumer Preferences and Market Trends

The luxury market is not static; consumer preferences and market trends are constantly evolving. Kering's Q1 results highlight the importance of adapting to these shifts.

- Competition within the luxury goods market is intensifying, with new players entering the field and existing brands constantly innovating. Kering must adapt and innovate to stay ahead.

- Changing consumer preferences require brands to constantly analyze and understand what resonates with their target audience. This entails adapting product lines, marketing strategies, and brand messaging to meet evolving demands. New consumer trends require careful analysis and timely responses.

- Product innovation is crucial for staying relevant and attracting new customers. Kering needs to invest in research and development to create innovative products that capture the attention of a discerning and ever-changing clientele. This is key to maintaining market share and staying competitive.

Kering's Response and Future Outlook

In response to the disappointing Q1 results, Kering is undertaking several strategic initiatives to address the challenges and improve its future performance. This includes focusing on cost-cutting measures, bolstering marketing efforts, and introducing new product lines to appeal to evolving consumer preferences.

- Kering is investing heavily in digital marketing and e-commerce to reach a wider customer base and enhance brand engagement.

- Analysts predict a gradual recovery in sales, forecasting a potential 8% rebound by Q3 2024. However, this projection remains dependent on various market factors.

- The company is focusing on strengthening its brand positioning and product differentiation to maintain its competitive advantage within the luxury goods sector.

Analyzing the Kering Stock Drop and its Implications

The 6% drop in Kering stock price reflects a confluence of factors: weak sales across key brands, the impact of economic uncertainty and geopolitical risks, and the challenge of adapting to ever-shifting consumer preferences. This downturn underscores the volatility of the luxury goods market and its sensitivity to macroeconomic factors. The impact on investors is significant, highlighting the importance of closely monitoring Kering's performance in the coming quarters. While the outlook remains uncertain, Kering's response strategies suggest a commitment to navigating the challenges and regaining market momentum. To stay informed about Kering’s progress and the fluctuating Kering stock price, follow reputable financial news sources such as the Financial Times, Bloomberg, and Reuters. Continue to monitor the performance of Kering stock and the broader luxury market for further insights.

Featured Posts

-

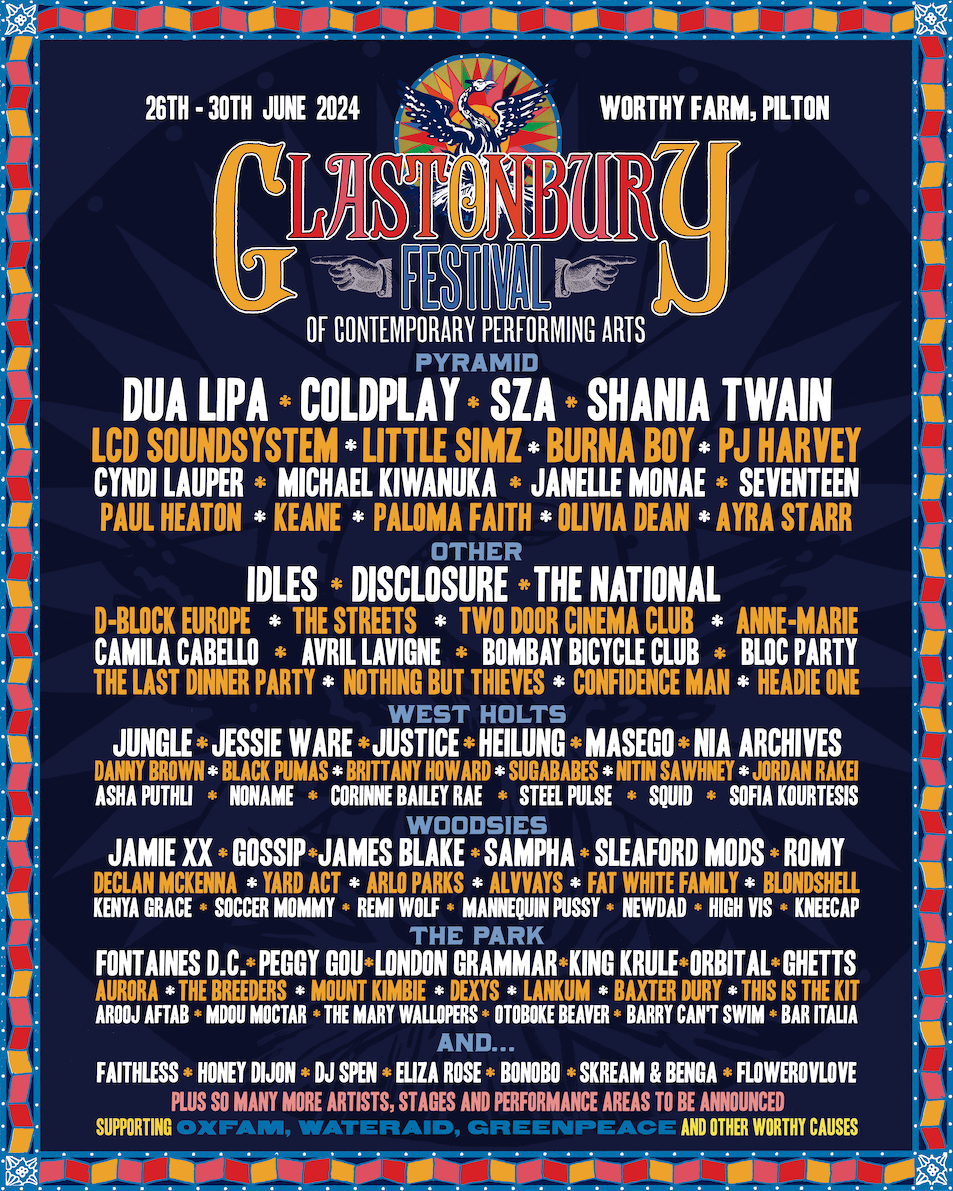

Unofficial Glastonbury Lineup Leak Us Bands Potential Appearance Creates Frenzy

May 25, 2025

Unofficial Glastonbury Lineup Leak Us Bands Potential Appearance Creates Frenzy

May 25, 2025 -

Elon Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 25, 2025

Elon Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 25, 2025 -

Kharkovschina Svadebniy Rekord Bolee 600 Brakov Za Mesyats

May 25, 2025

Kharkovschina Svadebniy Rekord Bolee 600 Brakov Za Mesyats

May 25, 2025 -

Walker Peters To West Ham Examining The Transfer Offer And Its Implications

May 25, 2025

Walker Peters To West Ham Examining The Transfer Offer And Its Implications

May 25, 2025 -

Full Soundtrack List Picture This Prime Videos Latest Rom Com

May 25, 2025

Full Soundtrack List Picture This Prime Videos Latest Rom Com

May 25, 2025

Latest Posts

-

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025 -

From Poop Papers To Podcast Gold Ai Driven Content Transformation

May 25, 2025

From Poop Papers To Podcast Gold Ai Driven Content Transformation

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Influence

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Influence

May 25, 2025 -

The Impact Of Elon Musks Actions On Dogecoins Price

May 25, 2025

The Impact Of Elon Musks Actions On Dogecoins Price

May 25, 2025 -

Will Elon Musk Continue To Support Dogecoin

May 25, 2025

Will Elon Musk Continue To Support Dogecoin

May 25, 2025