Klarna IPO Filing Shows 24% Revenue Increase In US Market

Table of Contents

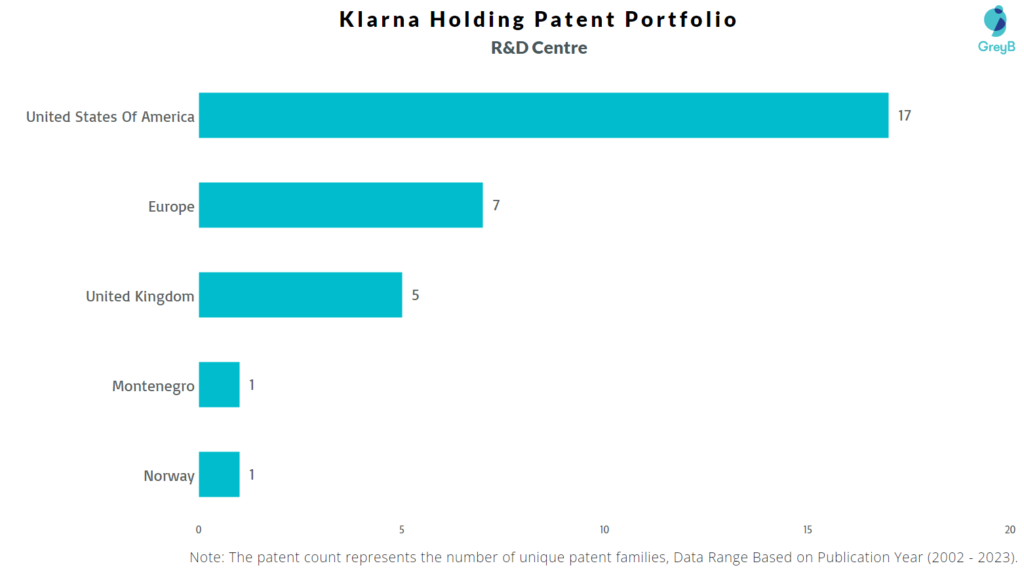

Klarna's US Market Dominance

Klarna's impressive 24% revenue increase isn't just a number; it reflects a strategic dominance in the fiercely competitive US BNPL market.

Market Share Growth

Klarna's market share in the US has seen phenomenal growth. While precise figures are often proprietary, analysts suggest a significant year-over-year increase, outpacing many of its key competitors.

- Estimated Market Share Growth: While exact figures remain confidential, industry reports suggest a double-digit percentage point increase in Klarna's US market share over the past year.

- Growth Rate Comparison: Klarna's growth significantly outpaces the overall BNPL market expansion rate in the US, indicating a strong competitive advantage.

- Key Competitors: Competitors like Affirm, PayPal's BNPL services, and Afterpay (now owned by Square) are facing increasing pressure from Klarna's aggressive growth strategy.

Strategic Partnerships and Acquisitions

Klarna's success isn't solely organic; it's fueled by strategic partnerships and smart acquisitions.

- Retailer Partnerships: Klarna has forged crucial alliances with major US retailers, integrating its BNPL service seamlessly into their checkout processes. This broad reach significantly expands its customer base.

- Strategic Acquisitions: While specific acquisitions may not be publicly detailed in the filing to the same extent as the revenue figures, any acquisitions made in the US would have likely contributed positively to the revenue increase. Further investigation into Klarna’s M&A activity during the period is recommended.

Consumer Adoption of Klarna's Services

The surge in Klarna US revenue is a testament to the growing popularity of its services among US consumers.

- Ease of Use: Klarna's user-friendly interface and straightforward application process have made it incredibly accessible to a broad consumer base.

- Promotional Offers: Targeted promotions and attractive incentives have driven significant consumer adoption.

- Retailer Partnerships (Reiteration): The widespread availability of Klarna at numerous popular retail outlets significantly enhances its convenience and accessibility for shoppers.

- Changing Consumer Spending Habits: The shift towards flexible payment options aligns perfectly with Klarna's offering, contributing to its growing popularity.

Financial Performance Details from the IPO Filing

Klarna's IPO filing provides a glimpse into the financial underpinnings of its US success.

Revenue Breakdown

The 24% revenue increase is likely attributed to a combination of factors. The IPO filing, however, likely offers a more specific breakdown of revenue sources.

- Transaction Fees: A major portion of Klarna's revenue is derived from transaction fees charged to merchants for processing BNPL payments.

- Merchant Services: Klarna's merchant services, such as marketing and analytics tools, contribute additional revenue streams.

- Other Revenue Sources: Other potential sources include potential interest income or other fees related to the BNPL operation. The IPO filing will likely contain more detail on the proportion each contributes to overall revenue.

Profitability and Future Projections

While Klarna's impressive revenue growth is noteworthy, the IPO filing will also address its profitability and future projections for its US operations.

- Net Income: The filing will shed light on Klarna's net income in the US market.

- Operating Margins: Operating margins will provide insights into the efficiency of its US operations.

- Future Growth Projections: Klarna's IPO filing will undoubtedly include projections for continued growth in the US market, outlining expectations for the coming years and the factors that contribute to the optimistic forecast.

- Challenges and Risks: The filing will likely also address potential challenges and risks, such as increasing competition, regulatory hurdles, and potential economic downturns.

Implications for the BNPL Industry and Investors

Klarna's success has significant implications for the broader BNPL landscape and investor sentiment.

Industry Growth and Competition

Klarna's performance underscores the phenomenal growth potential of the US BNPL market.

- Market Size Estimations: Market research firms project continued rapid expansion of the US BNPL market in the coming years.

- Future Growth Projections: The overall BNPL market is expected to grow substantially, driven by increased consumer adoption and technological advancements.

- Competitive Landscape: Klarna's success will intensify competition within the BNPL sector, prompting other players to innovate and adapt their strategies.

Investor Sentiment and Stock Performance

The market reaction to Klarna's IPO filing, particularly regarding its US revenue performance, is likely to be positive.

- Stock Price Changes: The stock price is expected to respond favorably to the news of such substantial revenue growth.

- Analyst Ratings: Financial analysts will likely revise their ratings and forecasts for Klarna based on the revealed financial performance.

- Investor Sentiment: Overall investor sentiment towards Klarna is expected to be significantly positive, given the strong financial performance and growth potential of the US market.

Conclusion

Klarna's 24% US revenue surge, as unveiled in its IPO filing, is a compelling testament to its strategic prowess and the booming BNPL market. Strong market share gains, strategic partnerships, and rising consumer adoption are key drivers of this remarkable growth. This success has far-reaching implications for the BNPL industry and investors alike. To stay informed on Klarna's continued progress and the dynamic evolution of the BNPL landscape, follow Klarna's investor relations page and reputable financial news sources for updates on Klarna's US market performance and Klarna's growth in the US.

Featured Posts

-

Building The Gen 3 Starters A Pokemon Fans Lego Creation

May 14, 2025

Building The Gen 3 Starters A Pokemon Fans Lego Creation

May 14, 2025 -

Tommy Fury Wants Jake Paul Rematch A Betrayal Of His Own Words

May 14, 2025

Tommy Fury Wants Jake Paul Rematch A Betrayal Of His Own Words

May 14, 2025 -

Maya Jamas Casual Chic White Shorts And Vest At The Ksi Baller League

May 14, 2025

Maya Jamas Casual Chic White Shorts And Vest At The Ksi Baller League

May 14, 2025 -

Inlichtingen Bayern Over Nederlander Een Dure Aangelegenheid

May 14, 2025

Inlichtingen Bayern Over Nederlander Een Dure Aangelegenheid

May 14, 2025 -

Absurd Estonian Eurovision Entry An Italian Parody Takes Center Stage

May 14, 2025

Absurd Estonian Eurovision Entry An Italian Parody Takes Center Stage

May 14, 2025