Klarna's US IPO: A 24% Revenue Surge And What It Means

Table of Contents

Klarna's Impressive Revenue Growth and its Drivers

The 24% Revenue Surge: A Closer Look

Klarna's 24% revenue increase represents a substantial leap forward, solidifying its position as a market leader. This growth wasn't uniform across the board; a deeper dive reveals key contributing factors:

- Geographic Diversification: While precise regional breakdowns aren't publicly available, it's likely the US market contributed significantly, given its massive size and increasing adoption of BNPL services. European markets also undoubtedly played a key role in this overall growth.

- Product Portfolio Success: Klarna's revenue stream isn't solely reliant on its core BNPL offering. The Klarna shopping app, offering curated deals and a seamless user experience, likely contributed significantly to overall revenue growth. Other services, such as its virtual card and loyalty programs, also add to the diversified income stream.

- Driving Forces: Several key factors propelled this impressive growth. The increasing consumer adoption of BNPL solutions for its convenience and flexibility is a significant driver. Strategic partnerships with major retailers and e-commerce platforms expanded Klarna's reach to a wider audience. Finally, expansion into new markets – both geographically and in terms of service offerings – further fueled the revenue increase.

Analysis of Klarna's Market Position within the BNPL Sector

Klarna's position within the intensely competitive BNPL sector is undeniably strong. However, a nuanced analysis requires considering its rivals:

- Competitive Landscape: Major players like Affirm, PayPal (with its own BNPL offerings), and Afterpay (now part of Square) pose significant competition. Each has its strengths and weaknesses, with some focusing on specific market segments or offering unique features.

- Market Share and Growth Potential in the US: While exact market share figures fluctuate, Klarna holds a significant portion, especially considering its brand recognition and global reach. The vast untapped potential within the US market offers significant growth opportunities.

- Competitive Advantages: Klarna's success stems from several key advantages. Its strong brand recognition and global presence provide a significant competitive edge. Its diverse product portfolio offers more than just BNPL; it provides a comprehensive financial ecosystem for consumers. A smooth user experience and a vast network of merchant partners solidify its position.

Implications of Klarna's Revenue Growth for a Potential US IPO

Attractiveness to Investors: High Revenue Growth and Market Potential

Klarna's substantial revenue growth makes it highly attractive to potential investors. The Klarna IPO is anticipated to garner considerable interest:

- Expected Valuation: While the precise valuation remains speculative, analysts project a substantial figure based on its revenue growth, market leadership, and future potential within the BNPL market.

- Investor Appeal: Investors are drawn to Klarna's impressive financial performance, indicating stability and profitability. Its market leadership and the projected continued expansion of the BNPL sector add to its allure.

- Potential Risks: However, potential investors need to consider inherent risks. Market volatility, intense competition from established players and new entrants, and evolving regulatory landscapes all pose potential challenges.

Impact on the Buy Now Pay Later Market

Klarna's IPO is expected to significantly impact the overall BNPL landscape:

- Ripple Effect on Other BNPL Companies: A successful IPO could trigger increased investment and valuation across the BNPL sector, boosting other companies' stock prices. It could also prompt increased competition and innovation within the market.

- Increased Investment and Competition: The success of Klarna's IPO will likely attract more venture capital and private equity investment into the BNPL space, leading to heightened competition. This could result in benefits for consumers, such as improved services and lower fees.

- Long-Term Implications for Consumers and Merchants: The increased competition and investment resulting from Klarna's IPO might lead to more flexible payment options for consumers and potentially more favorable terms for merchants.

Challenges and Future Outlook for Klarna

Regulatory Scrutiny and Financial Risks

Klarna faces several challenges, including increasing regulatory scrutiny:

- Regulatory Scrutiny: The BNPL industry faces increasing regulatory oversight globally concerning consumer protection, debt management, and potential risks associated with high-interest rates and potential for consumer overspending.

- Financial Risks: The inherent risks associated with loan defaults and increasing consumer debt levels are significant concerns. Klarna must develop robust risk management strategies to mitigate potential losses.

- Mitigation Strategies: To counter these risks, Klarna will likely focus on responsible lending practices, improved credit assessment techniques, and transparent communication with consumers.

Maintaining Growth and Innovation in a Competitive Market

Sustaining growth in a highly competitive market requires strategic foresight:

- Maintaining Competitive Edge: Klarna must continuously innovate, expand its product offerings, and strengthen its partnerships to stay ahead of the competition.

- Expansion into New Financial Services: Diversification into other financial services, such as personal finance management tools or investment products, could further enhance Klarna's offerings and revenue streams.

- Long-Term Vision: Klarna's long-term success depends on its ability to adapt to evolving consumer preferences, technological advancements, and regulatory changes. A clear, well-defined long-term vision is crucial for sustained growth.

Conclusion

This article analyzed Klarna's impressive 24% revenue surge and its implications for a potential US IPO. The strong revenue growth positions Klarna favorably in the competitive BNPL market, attracting significant investor interest. However, challenges such as regulatory scrutiny and managing financial risks must be carefully addressed. The Klarna IPO, and its success, will undoubtedly shape the future of the Buy Now Pay Later industry.

Call to Action: Stay informed about the latest developments regarding Klarna's US IPO and the evolving BNPL landscape. Keep up-to-date on the latest news and analysis related to the Klarna IPO and the future of Buy Now Pay Later services. Learn more about the implications of the Klarna revenue surge and its impact on the financial markets by subscribing to our newsletter for in-depth analysis and expert commentary on the Klarna IPO and the broader BNPL industry.

Featured Posts

-

Agenda Sevilla Que Hacer El Miercoles 7 De Mayo De 2025

May 14, 2025

Agenda Sevilla Que Hacer El Miercoles 7 De Mayo De 2025

May 14, 2025 -

Is Dean Huijsen The Next Premier League Star Transfer Rumours Heat Up

May 14, 2025

Is Dean Huijsen The Next Premier League Star Transfer Rumours Heat Up

May 14, 2025 -

Calvin Klein Euphoria Deep Discount At Nordstrom Rack This Week

May 14, 2025

Calvin Klein Euphoria Deep Discount At Nordstrom Rack This Week

May 14, 2025 -

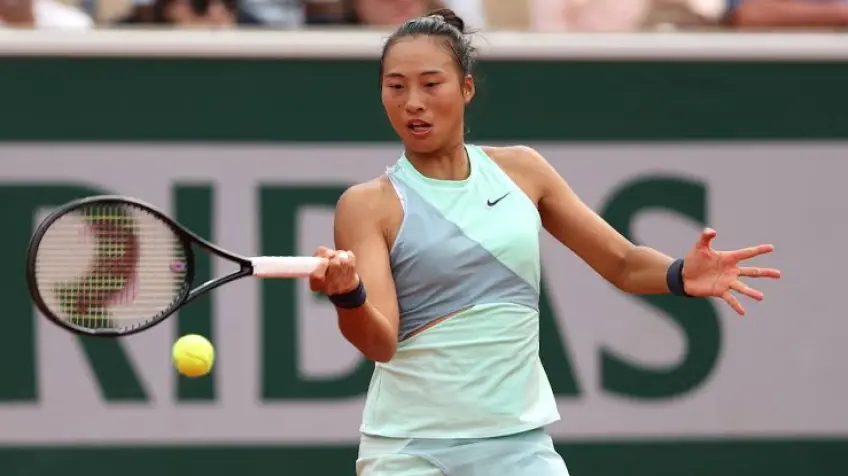

Potapova Upsets Zheng Qinwen At Madrid Open

May 14, 2025

Potapova Upsets Zheng Qinwen At Madrid Open

May 14, 2025 -

Informe Medico Sobre El Expresidente Uruguayo Jose Mujica

May 14, 2025

Informe Medico Sobre El Expresidente Uruguayo Jose Mujica

May 14, 2025