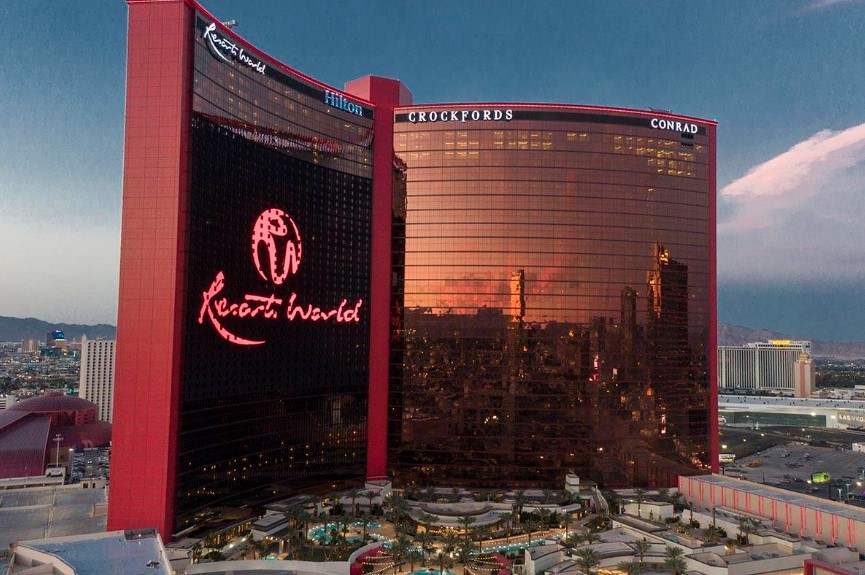

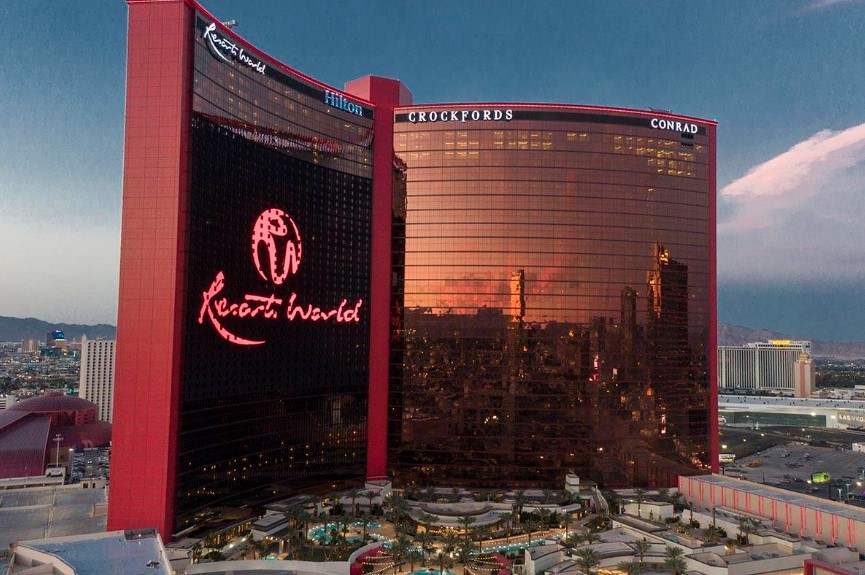

Las Vegas Resorts World Faces $10.5 Million Penalty In Money Laundering Case

Table of Contents

The Allegations: How Resorts World Allegedly Facilitated Money Laundering

The Nevada Gaming Control Board (NGCB) alleges that Las Vegas Resorts World facilitated a significant money laundering scheme. The investigation centered on suspicious financial transactions, violations of anti-money laundering (AML) regulations, and a failure to file adequate suspicious activity reports (SARs). The specific allegations remain somewhat opaque due to the ongoing nature of some aspects of the investigation, but reports suggest the scheme involved:

- High-volume transactions: The alleged scheme involved a large number of financial transactions, exceeding typical levels for legitimate casino activity, raising red flags for regulators. These transactions were meticulously structured to avoid detection, indicative of a sophisticated money laundering operation.

- Structured deposits: Smaller deposits, deliberately kept below reporting thresholds, were allegedly aggregated to conceal the true source and nature of the funds. This classic money laundering tactic highlights a potential weakness in Resorts World's AML compliance program.

- Lack of due diligence: The NGCB's investigation reportedly found instances where Resorts World failed to adequately verify the identities of customers involved in suspicious transactions, a critical failure in adhering to Know Your Customer (KYC) protocols.

- Internal employee involvement (alleged): While details are limited to protect the ongoing investigation, reports suggest that some employees may have been involved in facilitating these transactions, either through negligence or active participation. This underscores the need for comprehensive employee training and internal controls.

The Nevada Gaming Control Board's Investigation and Findings

The Nevada Gaming Control Board's investigation into Resorts World spanned several months. The NGCB's rigorous process included:

- Review of financial records: The NGCB meticulously examined Resorts World's financial records, looking for patterns of suspicious activity.

- Interviews with employees and customers: Interviews were conducted to gather information about the alleged money laundering scheme and to determine the extent of any employee involvement.

- Analysis of transaction data: Sophisticated data analysis techniques were used to identify suspicious patterns and connections within the vast volume of transactions processed by the casino.

The NGCB's findings substantiated the allegations, leading to the $10.5 million penalty. This penalty was levied based on Nevada gaming regulations concerning AML compliance failures, the severity of the alleged scheme, and the potential harm to the integrity of Nevada’s gaming industry. The legal basis for the penalty is rooted in the NGCB's authority to enforce regulations and protect the public interest.

Resorts World's Response and Future Implications

Resorts World has issued a statement acknowledging the penalty and expressing its commitment to improving its AML compliance procedures. The statement emphasized their cooperation with the NGCB investigation and their dedication to upholding the highest ethical standards. However, the statement stopped short of admitting guilt.

- Potential legal challenges: While Resorts World hasn’t yet announced any legal action, the size of the penalty suggests a potential appeal is being considered. The legal battle could be protracted and costly, further impacting the resort's reputation and financial stability.

- Reputational damage: The money laundering allegations have undoubtedly damaged Resorts World's reputation. The negative publicity could lead to reduced customer confidence and affect future business prospects.

- Impact on the industry: This case will likely lead to increased scrutiny of other Las Vegas casinos and a renewed focus on AML compliance throughout the gaming industry. Expect tighter regulations and stricter enforcement of existing rules.

- Regulatory changes: The NGCB's actions may prompt a review and potential revision of existing regulations, possibly leading to stricter penalties for future AML violations.

Increased Scrutiny on Casino Compliance and AML Procedures

This case underscores the critical need for robust anti-money laundering (AML) compliance measures within the casino industry. The increased scrutiny will undoubtedly force casinos to:

- Strengthen KYC procedures: Casinos must enhance their Know Your Customer (KYC) procedures to ensure thorough identification and verification of all customers.

- Implement advanced technology: Utilizing advanced technology, such as transaction monitoring systems, is crucial for identifying suspicious activity in real-time.

- Enhance employee training: Comprehensive AML training programs for all employees are vital to preventing and detecting money laundering attempts.

- Improve internal controls: Strong internal controls and regular audits are necessary to ensure the effectiveness of AML compliance programs.

Conclusion

The $10.5 million penalty imposed on Las Vegas Resorts World serves as a stark reminder of the crucial importance of stringent anti-money laundering measures within the casino industry. This case highlights the serious consequences of non-compliance and underscores the ongoing need for robust regulatory oversight to maintain the integrity of Las Vegas's gaming sector. The increased scrutiny and potential for stricter regulations will likely reshape the landscape of casino operations, emphasizing proactive compliance as a critical element for success.

Call to Action: Stay informed on the evolving landscape of casino regulations and the ongoing fight against financial crime in Las Vegas. Learn more about the Las Vegas Resorts World case and the implications for the future of casino compliance. Follow us for updates on this important story and other developments in the Las Vegas Resorts World money laundering case and related issues.

Featured Posts

-

Spring Breakout Rosters 2025 A Detailed Breakdown By Team

May 18, 2025

Spring Breakout Rosters 2025 A Detailed Breakdown By Team

May 18, 2025 -

Mlb Dfs May 8th Sleeper Picks And Hitter To Target

May 18, 2025

Mlb Dfs May 8th Sleeper Picks And Hitter To Target

May 18, 2025 -

Reliable Australian Crypto Casino Sites Your 2025 Guide

May 18, 2025

Reliable Australian Crypto Casino Sites Your 2025 Guide

May 18, 2025 -

Suicide Suspected In Fatal Dam Square Car Explosion

May 18, 2025

Suicide Suspected In Fatal Dam Square Car Explosion

May 18, 2025 -

Hollywoods Impact On Casino Design And Aesthetics

May 18, 2025

Hollywoods Impact On Casino Design And Aesthetics

May 18, 2025

Latest Posts

-

Proposed Migrant Deportation To Remote Island Fuels French Controversy

May 19, 2025

Proposed Migrant Deportation To Remote Island Fuels French Controversy

May 19, 2025 -

Ile De Sein Migrant Plan Fueling Debate In French Politics

May 19, 2025

Ile De Sein Migrant Plan Fueling Debate In French Politics

May 19, 2025 -

Frances Plan To Deport Migrants To Remote Island Sparks Outrage

May 19, 2025

Frances Plan To Deport Migrants To Remote Island Sparks Outrage

May 19, 2025 -

Universite Islamique Financement Reduit De 19 Millions D Euros Par Une Region

May 19, 2025

Universite Islamique Financement Reduit De 19 Millions D Euros Par Une Region

May 19, 2025 -

Coupes Budgetaires Une Region Retire 19 Millions D Euros A Une Universite Islamique

May 19, 2025

Coupes Budgetaires Une Region Retire 19 Millions D Euros A Une Universite Islamique

May 19, 2025