Late To The Palantir Party? Evaluating The Stock Before Its Predicted 2025 Growth

Table of Contents

Palantir's Current Market Position and Business Model

Understanding Palantir's current standing is crucial for any potential investor. Palantir operates using a dual-platform strategy: Gotham, focused on government contracts, and Foundry, catering to commercial clients. This diversification is a key element of their business model.

-

Revenue Streams and Financial Performance: Palantir generates revenue through software licenses, maintenance, and services. Recent financial reports should be reviewed for the latest performance data. Analyzing year-over-year revenue growth, profitability margins, and cash flow is crucial for assessing the company's financial health and stability as a data analytics stock.

-

Competitive Advantages and Disadvantages: Palantir's sophisticated data analytics platforms offer a competitive edge. Its ability to handle massive datasets and provide actionable insights is a significant strength. However, the company faces competition from established players in the data analytics market, such as Microsoft, AWS, and Google. This competition presents a challenge to Palantir's long-term market share in the software stock sector.

-

Key Clients and Partnerships: Palantir boasts a diverse client base.

- Significant government contracts: Palantir holds substantial contracts with various US government agencies and international governments, contributing significantly to its revenue.

- Growing commercial client base: Palantir is expanding its reach in the commercial sector, securing clients across diverse industries including finance, healthcare, and manufacturing. This diversification mitigates risk associated with over-reliance on government contracts.

- Strategic partnerships: Collaborations with other technology companies enhance Palantir's capabilities and expand its market reach.

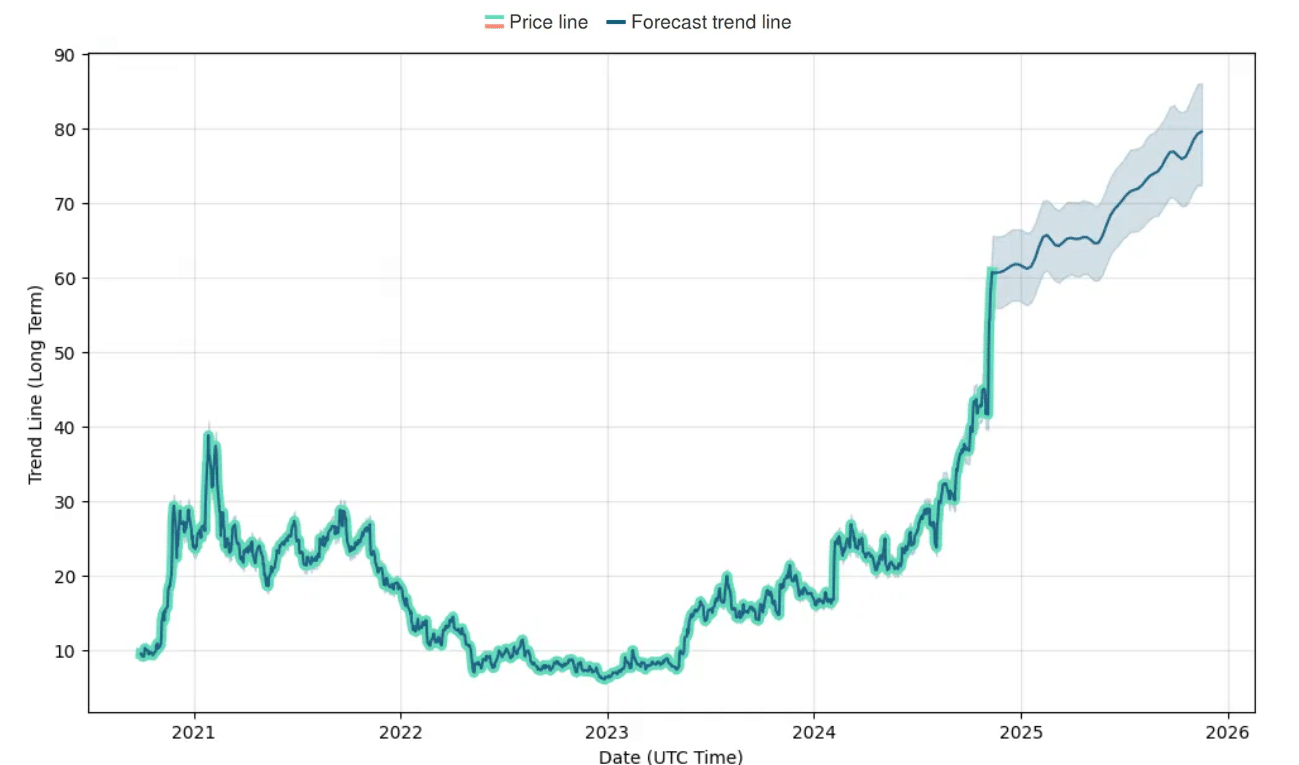

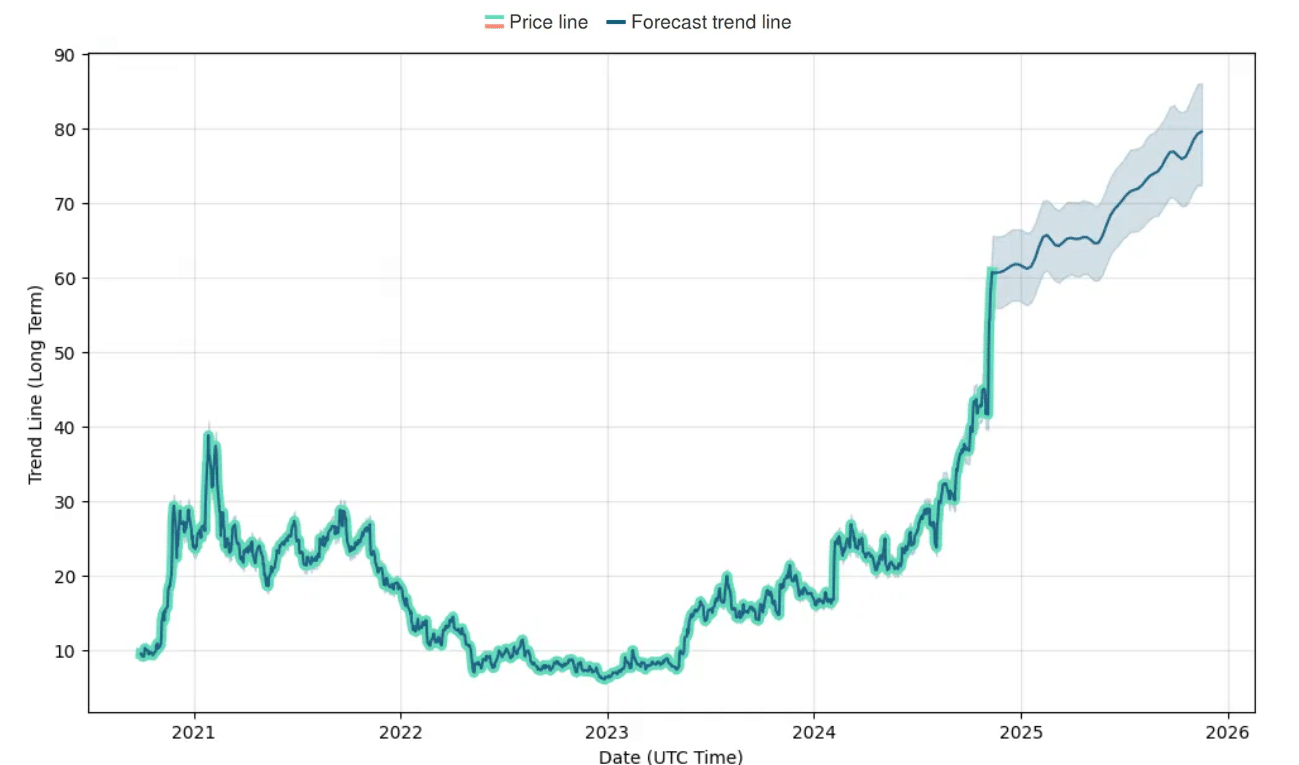

Assessing Palantir's Growth Potential Until 2025

Predicting the future is inherently uncertain, but analyzing trends provides valuable insight. Palantir's future growth hinges on several factors.

-

Market Forecasts and Projected Market Share: The data analytics market is experiencing significant expansion, fueled by the increasing reliance on data-driven decision-making. Analyzing market forecasts and Palantir's projected market share within this expanding sector is crucial to evaluating its Palantir stock prediction.

-

The Role of AI and ML: Palantir is heavily investing in artificial intelligence (AI) and machine learning (ML) to enhance its platforms. The integration of AI and ML is expected to be a major growth driver, providing more sophisticated analytics and improved efficiency. This AI integration positions Palantir favorably within the rapidly evolving data analytics landscape.

-

Impact of New Products and Advancements: New product launches and technological advancements can significantly impact Palantir's growth trajectory. Monitoring Palantir's innovation pipeline and its ability to adapt to evolving market demands is crucial for assessing its long-term potential.

-

Key Growth Drivers:

- Increasing demand: The ongoing, ever-increasing demand for data analytics solutions across various sectors is a substantial tailwind.

- Market expansion: Expansion into new markets and geographic regions presents significant growth opportunities.

- Successful AI/ML integration: Successful implementation of AI and ML into its platforms will likely enhance the value proposition and attract new clients.

Evaluating the Risks Associated with Investing in Palantir

While Palantir offers significant upside potential, investing involves risks.

-

Volatility of Tech Stocks: Palantir, as a technology stock, is subject to market volatility. Share prices can fluctuate significantly based on market sentiment, economic conditions, and company-specific news. Understanding this inherent volatility is critical for managing investment risk.

-

Competitive Landscape: The data analytics market is competitive. Established players pose a threat, and emerging competitors could disrupt Palantir's market share. Analyzing the competitive landscape and identifying potential threats is essential for responsible investment in a Palantir stock.

-

Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could negatively impact the company's financial performance. This dependence represents a considerable risk for Palantir investment.

-

Key Risks:

- Government contract reliance: High dependence on government contracts creates vulnerability to policy changes and budget fluctuations.

- Intense competition: The competitive landscape in data analytics requires constant innovation and adaptation to maintain a strong market position.

- Regulatory changes: Regulatory changes impacting data privacy and security could impact Palantir's operations and profitability.

How to Approach Investing in Palantir Stock

Investing in Palantir requires a strategic approach.

-

Investment Strategies: Consider both long-term and short-term investment strategies, aligning your choice with your risk tolerance and financial goals. A long-term perspective often allows for weathering short-term market fluctuations.

-

Due Diligence: Before investing, conduct thorough due diligence. Analyze financial statements, review industry reports, and understand the company's business model and competitive landscape.

-

Portfolio Diversification: Diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket. Spread your investments across different asset classes and sectors. A diversified approach reduces your overall risk exposure.

-

Risk Management: Develop a risk management strategy that aligns with your investment goals and risk tolerance. Understand potential downsides and have a plan to manage potential losses.

-

Investment Advice:

- Thorough research: Invest time in researching Palantir and the data analytics market before investing.

- Risk tolerance: Assess your risk tolerance and choose an investment strategy that aligns with your comfort level.

- Portfolio diversification: Diversify your portfolio to minimize potential losses.

- Financial advisor: Consult with a financial advisor before making any significant investment decisions.

Conclusion

This article has analyzed Palantir's current position, its growth potential until 2025, and associated risks. While Palantir presents exciting growth opportunities in the data analytics market, investing in Palantir stock involves inherent risks. Thorough due diligence and a well-defined investment strategy are crucial. Before making any investment decisions regarding Palantir stock, carefully review the information presented here and conduct your own thorough research. Remember to consult a financial advisor before investing in Palantir or any other stock. Is Palantir right for your investment portfolio? Only you can decide.

Featured Posts

-

Androids Fresh Look Insufficient To Sway Gen Z From Apple

May 09, 2025

Androids Fresh Look Insufficient To Sway Gen Z From Apple

May 09, 2025 -

Major Nhl Storylines Dominating The 2024 25 Seasons Second Half

May 09, 2025

Major Nhl Storylines Dominating The 2024 25 Seasons Second Half

May 09, 2025 -

Snls Bad Harry Styles Impression Leaves Him Devastated

May 09, 2025

Snls Bad Harry Styles Impression Leaves Him Devastated

May 09, 2025 -

Daycares Impact On Young Children Expert Insights On Developmental Risks

May 09, 2025

Daycares Impact On Young Children Expert Insights On Developmental Risks

May 09, 2025 -

Leon Draisaitls Exceptional Season Hart Trophy Nomination And Oilers Success

May 09, 2025

Leon Draisaitls Exceptional Season Hart Trophy Nomination And Oilers Success

May 09, 2025