Latest Oil Market News And Analysis: May 16, 2024

Table of Contents

Global Crude Oil Price Movements

Brent Crude and WTI Crude Price Analysis

On May 16th, 2024, Brent crude oil saw a significant increase, closing at $85 per barrel, a 3% rise compared to the previous day's closing price. West Texas Intermediate (WTI) crude also experienced a surge, ending the day at $82 per barrel, representing a 2.5% increase. This upward trend reflects a complex interplay of factors.

- Price fluctuations throughout the day: Both Brent and WTI experienced considerable intraday fluctuations, reflecting the market's reaction to the unfolding news and changing market sentiment. Early morning trading saw a dip, followed by a steady climb throughout the day.

- Comparison to previous day's closing prices: The closing prices represent a marked increase from the previous day, signaling a shift in market sentiment towards a tighter supply outlook.

- Factors influencing price changes: The unexpected OPEC+ production cut announcement was the primary driver of the price increase. However, ongoing geopolitical instability in several key oil-producing regions also contributed to the upward pressure on prices. Supply chain disruptions and robust demand forecasts further fueled the price surge.

[Insert chart or graph showcasing price movements of Brent and WTI Crude on May 16th, 2024]

OPEC+ Influence and Production Decisions

Recent OPEC+ Meeting Summary and Impact

The recent OPEC+ meeting held on May 15th, 2024, resulted in a surprise announcement of deeper-than-expected production cuts, exceeding market expectations. This decision aimed to support oil prices by tightening the global supply of crude oil.

- Summary of production adjustments: OPEC+ agreed to reduce daily production by an additional 1.16 million barrels, impacting global oil supply significantly.

- Analysis of the rationale behind the decisions: The stated rationale behind the cuts cited concerns about weakening global demand and the need to stabilize the market after recent price volatility. However, some analysts believe geopolitical factors also played a significant role.

- Impact on global oil supply and prices: The production cuts are expected to lead to a tighter global oil supply, pushing prices upwards in the short to medium term. This decision triggered the immediate price increases seen on May 16th.

[Include links to reputable news sources reporting on OPEC+ decisions, e.g., Reuters, Bloomberg]

Geopolitical Factors Affecting Oil Prices

Geopolitical Risks and Their Influence

Geopolitical risks continue to be a significant factor influencing oil prices. Ongoing tensions in several regions directly impact oil supply chains and overall market sentiment.

- Specific geopolitical events and their impact: The ongoing conflict in [mention specific region] and continued sanctions on [mention specific country] are creating uncertainty in the market, contributing to price volatility.

- Potential future implications: Escalation of geopolitical tensions in these areas could further tighten oil supplies and drive prices even higher.

- Analysis of market response to geopolitical uncertainty: The market typically reacts negatively to geopolitical instability, often leading to price spikes as investors seek safe haven assets.

[Include a map showing regions of geopolitical instability impacting oil production or trade]

Economic Indicators and Demand Outlook

Economic Growth Projections and Oil Demand

Economic indicators point towards a mixed outlook for global economic growth. This has a direct impact on oil demand, influencing prices.

- Global economic outlook and its impact on oil consumption: While some regions show strong growth, others face economic slowdown, creating uncertainty in the overall demand forecast.

- Analysis of current and projected oil demand: Current oil demand remains strong, but concerns persist about a potential slowdown in the second half of the year.

- Relationship between economic indicators and oil prices: Positive economic indicators typically translate to increased oil demand, pushing prices higher. Conversely, negative indicators can cause a dip in demand and oil prices.

[Include a table summarizing key economic indicators like GDP growth, manufacturing PMI for major economies]

Alternative Energy Sources and Their Influence

The Growing Role of Renewables

The increasing adoption of renewable energy sources is gradually impacting the oil market.

- Growth trends in renewable energy: The global investment in solar and wind energy continues to grow, gradually reducing reliance on fossil fuels.

- Impact on fossil fuel demand: The rise of renewables is putting downward pressure on long-term oil demand.

- Long-term implications for the oil market: In the long run, the continued growth of renewable energy is likely to lead to a decline in oil demand, transforming the oil market landscape.

Conclusion: Staying Informed on the Oil Market

The oil market analysis for May 16th, 2024, highlights significant price increases driven primarily by the unexpected OPEC+ production cuts and persistent geopolitical uncertainty. Understanding these factors and their interplay is crucial for navigating the complex energy market. Regularly monitoring oil market news and analysis is vital for informed decision-making, whether you're an investor, business owner, or simply a consumer. Stay updated on the ever-changing oil market with our daily reports. Check back tomorrow for the latest oil price analysis!

Featured Posts

-

Favelas Als Investitionsziel Die Strategie Der Vereinigten Arabischen Emirate In Brasilien

May 17, 2025

Favelas Als Investitionsziel Die Strategie Der Vereinigten Arabischen Emirate In Brasilien

May 17, 2025 -

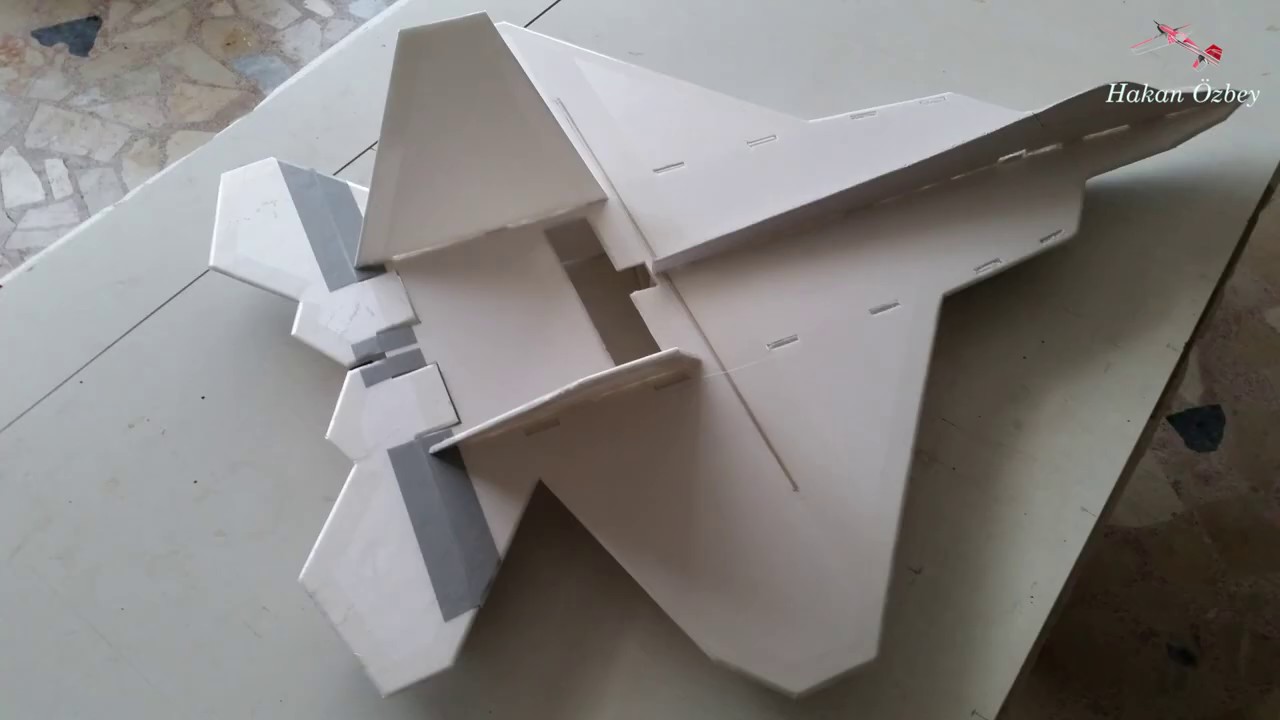

Proposed Military Upgrades Trumps F 55 And F 22 Plans

May 17, 2025

Proposed Military Upgrades Trumps F 55 And F 22 Plans

May 17, 2025 -

Network18 Media And Investments Stock Price Technical Analysis And Forecasts 21 Apr 2025

May 17, 2025

Network18 Media And Investments Stock Price Technical Analysis And Forecasts 21 Apr 2025

May 17, 2025 -

Elaekeyhtioeiden Osakesijoitusten Tappiot Alkuvuonna 2024

May 17, 2025

Elaekeyhtioeiden Osakesijoitusten Tappiot Alkuvuonna 2024

May 17, 2025 -

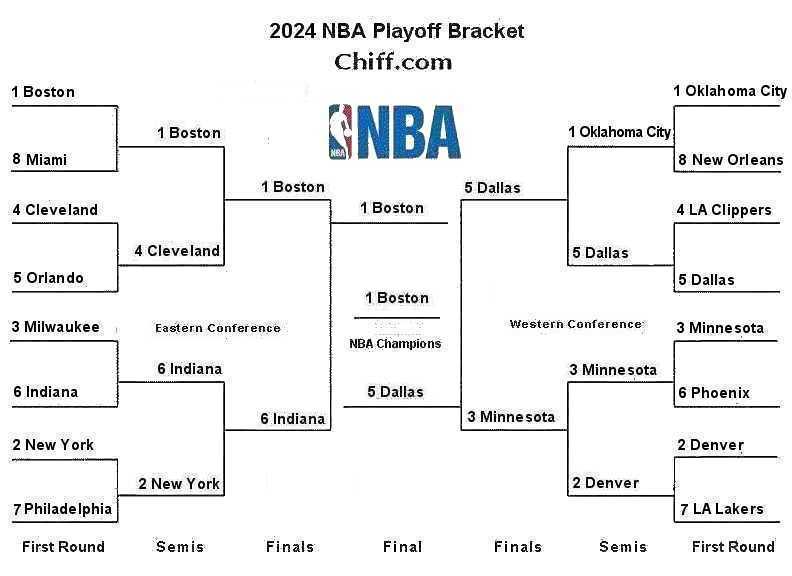

How To Watch Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Free Live Stream

May 17, 2025

How To Watch Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Free Live Stream

May 17, 2025