Legal Battle Looms: Barrick Challenges Mali's Gold Mine Takeover Bid

Table of Contents

Mali's Justification for the Takeover

Mali's government has presented its case for the takeover based on two primary arguments: alleged contract violations by Barrick and the assertion of national resource sovereignty.

Allegations of Contract Violations

The Malian government claims that Barrick has breached its mining contracts in several key areas. These allegations form the bedrock of their justification for the takeover.

- Inadequate Investment in Local Communities: Mali alleges insufficient investment in local infrastructure, community development projects, and social programs, falling short of the agreed-upon commitments within the mining contracts. Specific examples include unmet targets for job creation among local populations and a lack of investment in education and healthcare initiatives within affected communities.

- Non-Compliance with Environmental Regulations: The Malian government points to instances of environmental damage caused by Barrick's mining operations, including alleged failures to adhere to environmental impact assessments and remediation plans. Details on specific environmental violations, such as water contamination or deforestation, are expected to be presented during the legal proceedings.

- Outstanding Payments and Royalty Disputes: Disputes over outstanding payments and royalty calculations are also part of Mali's case against Barrick. These alleged financial discrepancies are a significant element of the contract violation claims.

National Resource Sovereignty

The Malian government frames its actions within a broader narrative of reclaiming control over its natural resources and maximizing benefits for its citizens. This is a key aspect of the broader political and economic landscape within Mali.

- Public Statements by Malian Officials: Malian officials have issued public statements emphasizing their right to control their national resources and their determination to renegotiate terms that they deem unfavorable. These statements highlight the government's commitment to national sovereignty over its mineral wealth.

- Political Context within Mali: The takeover bid occurs within a specific political context in Mali, with the government potentially seeking to consolidate power and bolster its legitimacy by demonstrating control over key economic assets.

- Relevant Legislation and Policy Documents: The Malian government is likely to reference specific legislation and policy documents that support its claim to national resource sovereignty. These documents will be central to their legal arguments.

Barrick's Response and Legal Strategy

Barrick Gold has strongly refuted Mali's claims and is pursuing a robust legal strategy to challenge the takeover.

Dispute Resolution Mechanisms

Barrick is utilizing international dispute resolution mechanisms to challenge the government's actions. The company asserts that the takeover is a breach of international investment agreements and existing contracts, potentially jeopardizing the legal framework for foreign investment in the region.

- International Agreements and Treaties: Barrick is likely to invoke specific international investment agreements (IIAs) and bilateral investment treaties (BITs) that protect foreign investments from arbitrary actions by host governments.

- Planned Legal Strategy and Arbitration Venues: Barrick is expected to pursue international arbitration, a process outlined within the IIAs and BITs, to resolve this dispute. Specific venues for arbitration will depend on the applicable treaties. This is a critical element of Barrick's defense.

- Timeline of Legal Proceedings: The legal proceedings are anticipated to be lengthy, potentially spanning several years, involving complex legal arguments and expert testimony.

Economic Ramifications

Barrick will underscore the severe economic ramifications of the takeover for both Mali and itself. This economic argument is a significant component of Barrick's counter-case.

- Estimated Economic Impact on Mali's GDP: The loss of Barrick's mining operations would significantly impact Mali's GDP, potentially leading to substantial economic hardship.

- Projected Job Losses in the Mining Sector: Thousands of jobs in the mining sector are at risk due to the potential shutdown of Barrick's operations.

- Implications for Investor Confidence: The takeover could severely damage investor confidence in Mali, discouraging future foreign direct investment in the country's mining sector.

International Implications and the Future of Mining in Mali

The Barrick Gold Mali case holds significant international implications, particularly for the future of mining in Mali and the broader African continent.

Investor Confidence

The outcome of this legal battle will significantly influence the perception of risk for foreign investors considering projects in Mali and other resource-rich nations in Africa.

- Impact on Foreign Direct Investment (FDI): A ruling in favor of Mali could deter future FDI in the mining sector, while a victory for Barrick could bolster investor confidence.

- Effect on Other Mining Projects in the Region: The case will serve as a precedent, influencing how other mining companies operate and negotiate with governments in the region.

- Similar Disputes in Other Countries: This dispute mirrors similar resource nationalism disputes in other countries, underscoring the complexities of balancing national interests with the needs of foreign investors.

Resource Nationalism and Development

The case underscores the inherent tensions between national resource sovereignty and attracting foreign investment for economic development. This is a critical issue for resource-rich nations striving for sustainable growth.

- Models for Resource Management and Benefit Sharing: The dispute highlights the need for transparent and mutually beneficial models for resource management and the equitable sharing of profits between host countries and foreign investors.

- Role of International Organizations: International organizations play a crucial role in mediating such disputes, promoting fair practices, and fostering a conducive environment for foreign investment.

- Future Outlook on the Mining Sector in Mali: The resolution of this dispute will shape the future landscape of the Malian mining sector and its capacity to attract and retain foreign investment.

Conclusion

The legal battle between Barrick Gold and the Malian government over the gold mine takeover is a complex and multifaceted issue with far-reaching implications. This high-stakes conflict significantly impacts foreign investment in Mali, the future of the mining sector, and the global debate surrounding resource nationalism. The outcome will influence how international mining companies engage with resource-rich nations and set a precedent for future disputes. Stay informed on the developments in the Barrick Gold Mali case to understand its impact on the mining industry and global investment climates. Keep an eye out for updates on this developing Barrick Gold Mali legal battle.

Featured Posts

-

Unclaimed Lotto Jackpot Winning Ticket Sold At This Shop

May 28, 2025

Unclaimed Lotto Jackpot Winning Ticket Sold At This Shop

May 28, 2025 -

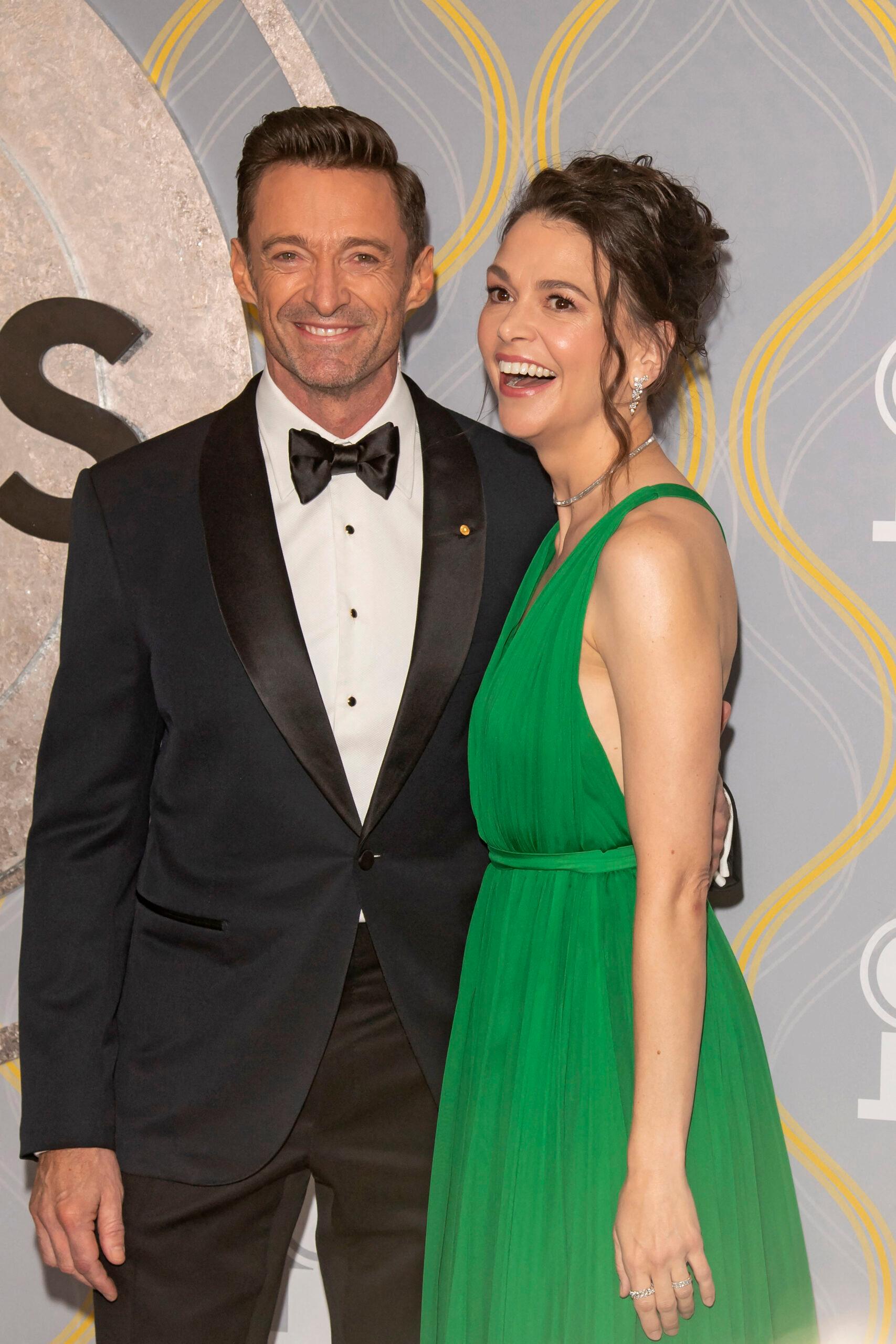

Hugh Jackman And Sutton Foster Is Their Romance Cooling

May 28, 2025

Hugh Jackman And Sutton Foster Is Their Romance Cooling

May 28, 2025 -

Securing A Loan No Credit Check Guaranteed Approval From A Direct Lender

May 28, 2025

Securing A Loan No Credit Check Guaranteed Approval From A Direct Lender

May 28, 2025 -

American Music Awards K Pop Dominance With Rose Rm Jimin Ateez And Stray Kids

May 28, 2025

American Music Awards K Pop Dominance With Rose Rm Jimin Ateez And Stray Kids

May 28, 2025 -

Alcaraz Ends Sinners Winning Streak At Italian Open

May 28, 2025

Alcaraz Ends Sinners Winning Streak At Italian Open

May 28, 2025

Latest Posts

-

Pop Icon Robbie Williams Performs At Cruise Ship Christening In Malaga

May 29, 2025

Pop Icon Robbie Williams Performs At Cruise Ship Christening In Malaga

May 29, 2025 -

Robbie Williams Malaga Concert Cruise Ship Christening Spectacle

May 29, 2025

Robbie Williams Malaga Concert Cruise Ship Christening Spectacle

May 29, 2025 -

Enhanced Partnership Starboard And Tui Cruises Announce Expanded Collaboration

May 29, 2025

Enhanced Partnership Starboard And Tui Cruises Announce Expanded Collaboration

May 29, 2025 -

Robbie Williams Christens Cruise Ship In Malaga With Concert

May 29, 2025

Robbie Williams Christens Cruise Ship In Malaga With Concert

May 29, 2025 -

Mein Schiff Relax A Look At The Inaugural Season

May 29, 2025

Mein Schiff Relax A Look At The Inaugural Season

May 29, 2025