Leveraged Semiconductor ETF: A Case Study Of Timing And Market Volatility

Table of Contents

Understanding Leveraged Semiconductor ETFs

Mechanics of Leveraged ETFs

Leveraged ETFs aim to deliver a multiple (e.g., 2x, 3x) of the daily performance of an underlying index. However, it's crucial to understand how they work.

- Leverage Ratio: This indicates the multiple of the daily index return the ETF seeks to achieve. A 2x ETF aims for double the daily return, while a 3x ETF aims for triple.

- Daily Rebalancing: Leveraged ETFs are rebalanced daily to maintain their leverage. This daily resetting can lead to significant deviations from the underlying index's performance over longer periods.

- Compounding Effects: The daily rebalancing can lead to significant discrepancies over time. A prolonged downward trend can result in substantial losses due to the compounding effect of daily negative returns.

For example, let's imagine a semiconductor index drops 10% on day one, then rises 10% on day two. A non-leveraged ETF would return to its original value. However, a 2x leveraged ETF would likely experience a larger drop on day one and a smaller rise on day two, resulting in a net loss. This is due to the compounding effect of daily rebalancing. Specific ETFs like SOXL (which tracks the semiconductor sector) can be utilized to illustrate this point (though always check for the most recent relevant ETF information).

Semiconductor Industry Volatility

The semiconductor sector is inherently volatile due to several factors:

- Global Demand Fluctuations: Economic downturns significantly impact demand, leading to price swings.

- Supply Chain Disruptions: Geopolitical events or natural disasters can disrupt the supply chain, causing shortages and price increases.

- Technological Innovation Cycles: Rapid technological advancements can render existing technologies obsolete, impacting the valuations of companies.

- Government Regulations and Trade Wars: Changes in regulations or trade disputes can have a significant impact on the industry.

Historically, the semiconductor industry has seen significant price swings. For instance, the chip shortage of 2020-2021 caused dramatic price increases, while subsequent easing of demand led to price corrections, impacting leveraged semiconductor ETF returns accordingly. (Include a relevant chart/graph here if possible illustrating historical volatility).

Timing the Market: A Critical Factor

Identifying Market Trends

Accurately timing the market is challenging but crucial for success with leveraged semiconductor ETFs. Several methods can aid in trend identification:

- Fundamental Analysis: Examine company earnings, revenue growth, and industry trends to assess the overall health of the semiconductor sector.

- Technical Analysis: Use charts and technical indicators (moving averages, RSI) to identify potential support and resistance levels, and predict price movements.

- Macroeconomic Factors: Consider broader economic indicators (interest rates, inflation) that can significantly impact the semiconductor industry.

However, even with careful analysis, predicting market bottoms and tops with certainty is extremely difficult. Successful timing often involves a combination of these methods and a degree of intuition.

Risk Management Strategies

Leveraged ETFs magnify both gains and losses. Robust risk management is paramount:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio with other asset classes to reduce overall risk.

- Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market price, to reduce the impact of volatility.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your ETF holdings if the price drops below a predetermined level, limiting potential losses.

- Position Sizing: Carefully determine the appropriate amount to invest in the leveraged ETF, aligning with your risk tolerance.

Understanding your risk tolerance is paramount before investing in leveraged ETFs. These instruments are not suitable for all investors.

Case Study Examples

Specific Market Events

Let's examine a few instances illustrating how market events affect leveraged semiconductor ETFs:

- Event 1: The 2020-2021 chip shortage: This event significantly boosted semiconductor prices, resulting in substantial gains for leveraged ETFs. (Include specific data showing ETF performance during this period).

- Event 2: A major technological breakthrough (e.g., the launch of a new generation of smartphones): This could create a surge in demand for specific semiconductor components, impacting ETF performance positively. (Illustrate with data).

- Event 3: A significant geopolitical event impacting the supply chain: This could negatively affect production and prices, resulting in substantial losses for leveraged ETFs. (Show data and analysis).

Lessons Learned

The case studies above highlight several key lessons:

- Timing is Crucial: Successfully timing market movements is essential for maximizing profits with leveraged semiconductor ETFs. However, accurately predicting market direction is challenging.

- Risk Management is Paramount: Employing robust risk management strategies is vital to mitigate potential losses.

- Leveraged ETFs Amplify Returns: Both gains and losses are amplified. This should be fully understood before investing.

Careful research, thorough understanding of market dynamics, and a well-defined investment strategy are crucial when utilizing leveraged semiconductor ETFs.

Conclusion

Investing in leveraged semiconductor ETFs offers the potential for high returns but comes with equally high risk due to the amplified market volatility of the semiconductor industry itself. Careful timing of the market and effective risk management are absolutely crucial for success. This case study highlights the need for thorough research, a clear understanding of the mechanics of leveraged ETFs, and a well-defined investment strategy aligned with your risk tolerance. Before investing in a leveraged semiconductor ETF, conduct your own in-depth due diligence and consider consulting a financial advisor. Learn more about how to effectively utilize a leveraged semiconductor ETF strategy today!

Featured Posts

-

Gazifikatsiya Eao Novye Vozmozhnosti Blagodarya Gazpromu

May 13, 2025

Gazifikatsiya Eao Novye Vozmozhnosti Blagodarya Gazpromu

May 13, 2025 -

The High Stakes Of Tariff Turbulence Abi Research On The Tech Industrys Trade War Experience

May 13, 2025

The High Stakes Of Tariff Turbulence Abi Research On The Tech Industrys Trade War Experience

May 13, 2025 -

Philippine Elections 2022 Dutertes Impact On The Results

May 13, 2025

Philippine Elections 2022 Dutertes Impact On The Results

May 13, 2025 -

Winterwatch 2024 Dates Locations And What To Expect

May 13, 2025

Winterwatch 2024 Dates Locations And What To Expect

May 13, 2025 -

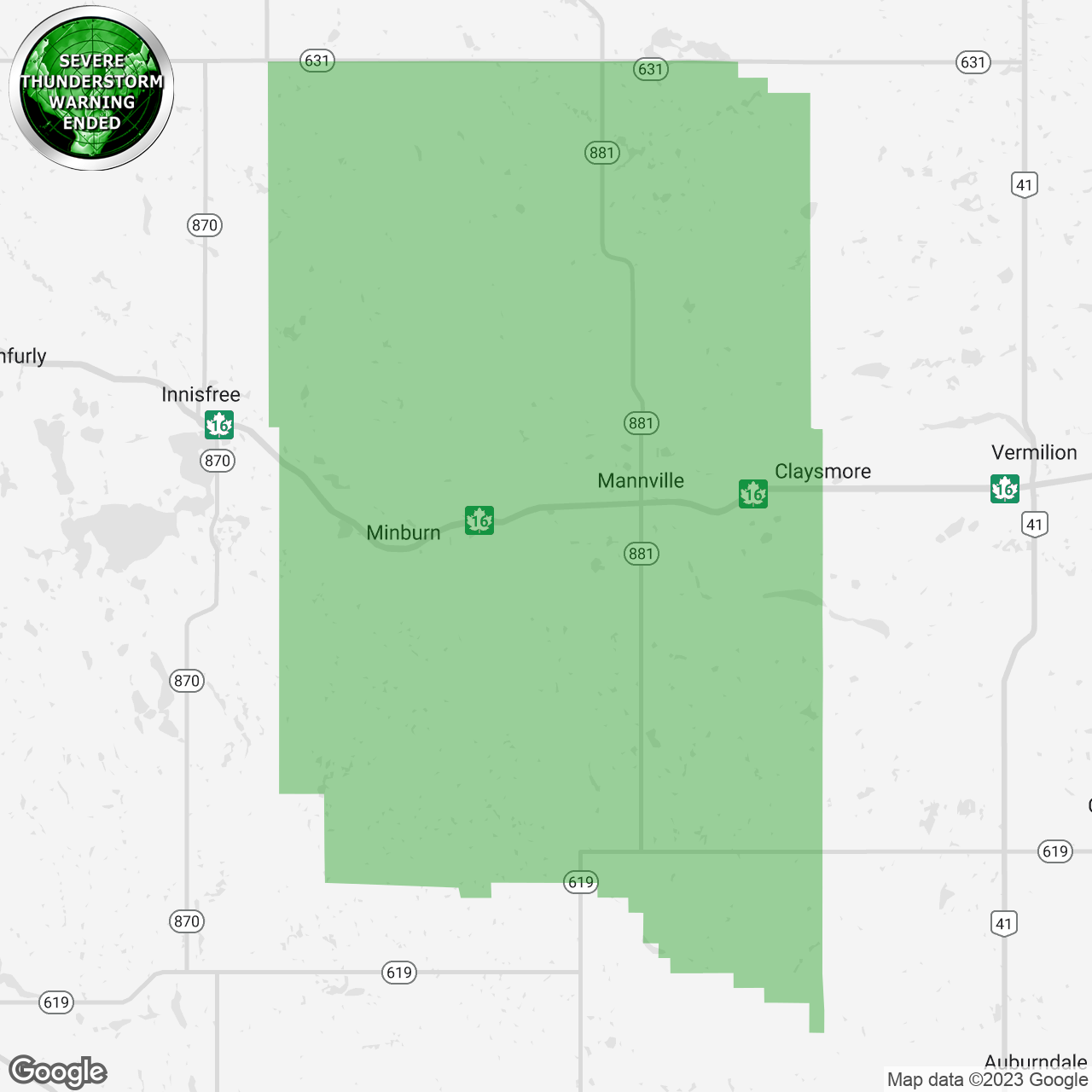

Stay Safe Bay Area Under Severe Thunderstorm Warning

May 13, 2025

Stay Safe Bay Area Under Severe Thunderstorm Warning

May 13, 2025

Latest Posts

-

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025 -

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch Now

May 14, 2025

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch Now

May 14, 2025 -

Scotty Mc Creerys Son Honors George Strait In Sweet Video Watch Now

May 14, 2025

Scotty Mc Creerys Son Honors George Strait In Sweet Video Watch Now

May 14, 2025 -

Scotty Mc Creerys Sons Adorable George Strait Tribute A Must Watch Video

May 14, 2025

Scotty Mc Creerys Sons Adorable George Strait Tribute A Must Watch Video

May 14, 2025 -

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025