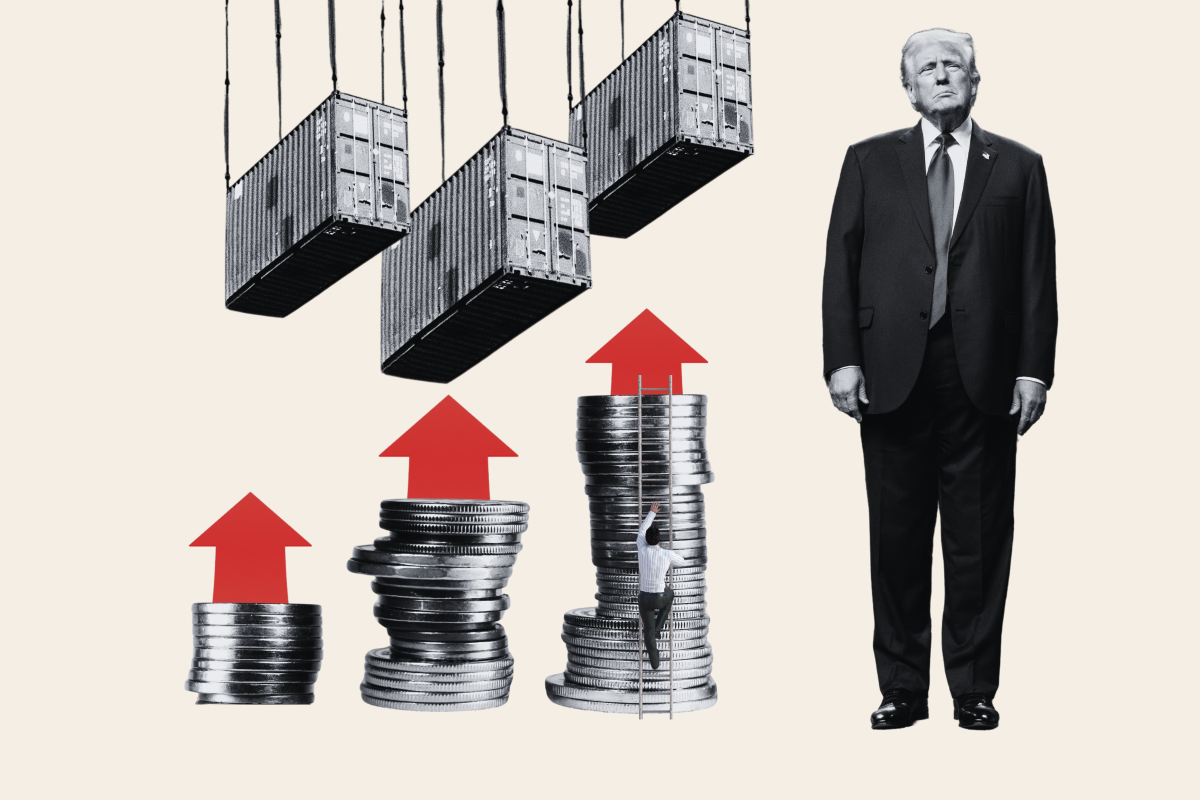

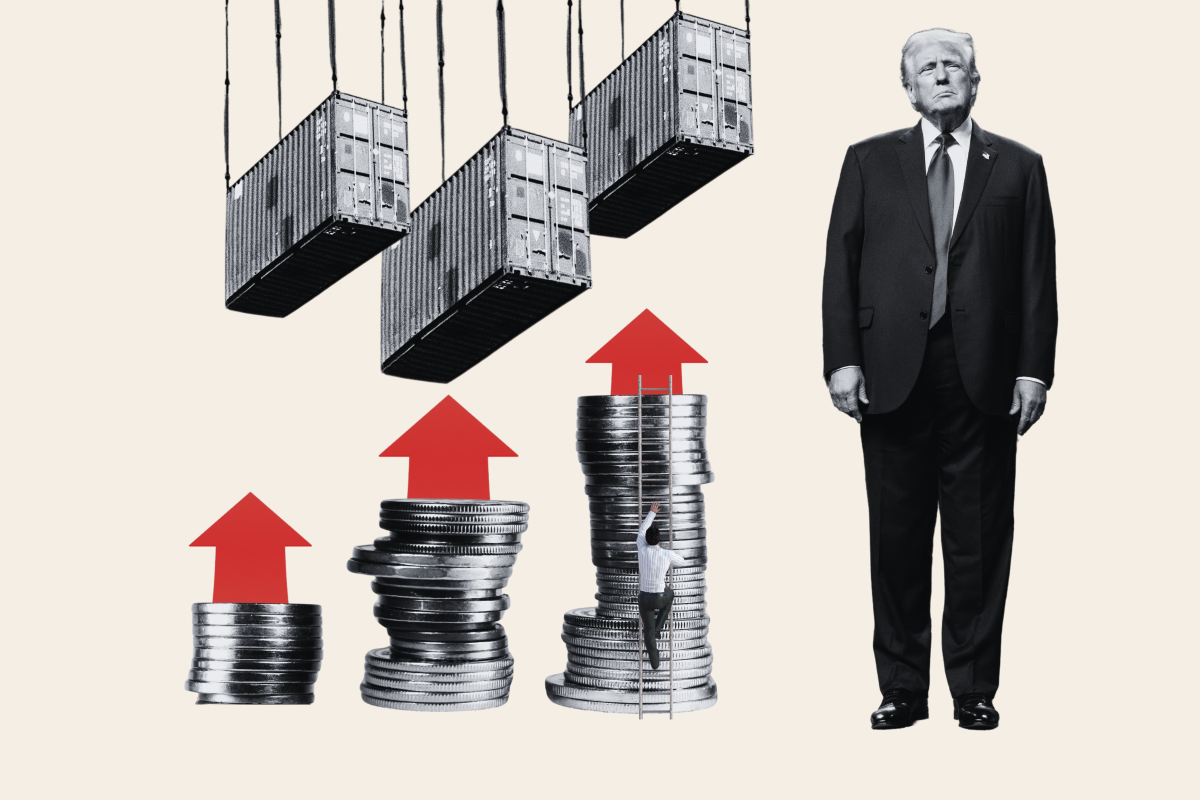

‘Liberation Day’ Tariffs: A Stock Market Perspective And Forecast

Table of Contents

Understanding the ‘Liberation Day’ Tariffs

Scope and Impact

The ‘Liberation Day’ tariffs encompass a broad range of goods, primarily targeting imports from [Specify countries]. These tariffs are expected to significantly impact several key sectors:

- Technology: Increased costs on imported components could affect the profitability of tech companies reliant on global supply chains. This could lead to higher prices for consumers and potentially slower growth in the sector.

- Agriculture: Farmers exporting goods to [Specify countries] may face reduced demand due to increased prices. This could lead to lower profits and potential job losses within the agricultural sector.

- Manufacturing: Companies heavily reliant on imported materials will experience increased production costs, potentially impacting their competitiveness and profitability.

The projected tariff rates range from [Specify percentage range], resulting in potentially significant price increases for consumers and disruptions to established trade patterns. The possibility of retaliatory tariffs from affected countries further complicates the situation, creating a potentially volatile international trade environment.

Historical Context

Historically, the implementation of significant tariffs has often led to increased market volatility. For example, [cite a relevant historical example, e.g., the Smoot-Hawley Tariff Act of 1930 and its contribution to the Great Depression]. While each situation is unique, these historical precedents highlight the potential for negative economic consequences and market uncertainty when significant tariff changes are implemented. Analyzing the impact of past tariffs on specific sectors can provide valuable insights into potential outcomes in the present context. Studies show that [cite relevant statistical data or studies regarding the impact of previous tariffs on stock markets].

Political and Geopolitical Implications

The ‘Liberation Day’ tariffs have profound political and geopolitical implications. The imposition of these tariffs will inevitably strain trade relations between the involved countries, potentially leading to diplomatic tensions and trade disputes. The potential for retaliatory actions creates a cycle of escalating trade barriers, threatening global economic stability. The resulting political instability could further impact investor confidence and lead to increased market volatility. The international implications extend beyond immediate economic effects, potentially affecting alliances and geopolitical power dynamics.

Stock Market Forecast and Sectoral Analysis

Potential Winners and Losers

Based on our analysis, certain sectors are expected to be more significantly affected than others.

Potential Losers:

- Companies heavily reliant on imports from targeted countries (e.g., certain manufacturing firms, retailers).

- Companies with significant exposure to the affected sectors (e.g., logistics companies transporting imported goods).

Potential Winners:

- Domestic producers of goods now competing with less-competitive imports.

- Companies offering substitute goods or services unaffected by the tariffs.

For example, [Name a specific company] in the [Industry] sector may experience significant challenges due to increased import costs, while [Name another company] in the [Industry] sector might benefit from increased demand for domestically produced alternatives.

Investment Strategies

Given the anticipated market volatility, a diversified investment strategy is crucial. Investors should carefully consider their risk tolerance and investment time horizon. Diversification across different asset classes (stocks, bonds, real estate) and sectors can help mitigate potential losses.

- Consider investing in ETFs or mutual funds that offer broad market exposure.

- Focus on companies with strong fundamentals and resilient business models.

- Conduct thorough due diligence before making any investment decisions.

Remember that past performance is not indicative of future results. Thorough research and a well-defined investment plan are essential during periods of market uncertainty.

Market Volatility and Risk Assessment

The ‘Liberation Day’ tariffs are likely to increase market volatility in the short term. Investors should be prepared for periods of significant price swings and potential market corrections. Short-term investors might experience greater losses, while long-term investors with a robust strategy might be able to weather the storm. Understanding your own risk tolerance is paramount. Avoid making impulsive decisions based on short-term market fluctuations and stick to your long-term investment plan.

Long-Term Implications and Economic Outlook

Impact on Inflation and Consumer Prices

The tariffs are likely to contribute to inflationary pressures. Increased import costs will translate to higher prices for consumers, potentially dampening consumer spending and slowing economic growth. This inflationary effect will be felt across various sectors, impacting the overall cost of living. The extent of inflationary impact will depend on several factors, including the elasticity of demand for affected goods and the responsiveness of businesses to price changes.

Global Economic Growth Projections

The ‘Liberation Day’ tariffs threaten to disrupt global supply chains and international trade, negatively affecting global economic growth forecasts. Reduced trade flows and increased uncertainty will likely discourage investment and hinder economic expansion. International organizations are already revising their growth projections downwards, reflecting this uncertainty.

Potential for Policy Adjustments

The future of these tariffs remains uncertain. Negotiations between the involved countries could lead to adjustments or even a complete reversal of the tariffs. The political landscape and economic conditions will play significant roles in determining any future policy changes. Staying informed about ongoing developments and potential policy shifts is essential for investors navigating this complex situation.

Conclusion

The ‘Liberation Day’ tariffs pose significant challenges to the global economy and stock markets. Understanding the potential impact on various sectors, including technology, agriculture, and manufacturing, is vital for making informed investment decisions. The potential for increased market volatility, inflation, and disruptions to global trade necessitates a cautious and well-diversified investment approach. Investors should conduct thorough due diligence, consider their risk tolerance, and remain informed about ongoing developments concerning these tariffs and related market fluctuations. Consider subscribing to market updates or consulting with a financial advisor to navigate the complexities of ‘Liberation Day’ tariffs and their effects on your portfolio. Careful planning and adaptation are key to mitigating the potential risks associated with ‘Liberation Day’ tariffs and their ripple effects on the global economy.

Featured Posts

-

Ethereum Price Prediction Will Eth Hit 2 700

May 08, 2025

Ethereum Price Prediction Will Eth Hit 2 700

May 08, 2025 -

Thunder Game 1 Alex Caruso Enters Nba Playoff History Books

May 08, 2025

Thunder Game 1 Alex Caruso Enters Nba Playoff History Books

May 08, 2025 -

Sifrenizi Unuttunuz Mu Kripto Varlik Mirasiniz Tehlikede

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Varlik Mirasiniz Tehlikede

May 08, 2025 -

Tfasyl Sadmt Barbwza W Khsart Alasnan Fy Marakana

May 08, 2025

Tfasyl Sadmt Barbwza W Khsart Alasnan Fy Marakana

May 08, 2025 -

Exploring The Price Increase Of Dogecoin Shiba Inu And Sui

May 08, 2025

Exploring The Price Increase Of Dogecoin Shiba Inu And Sui

May 08, 2025