Live Music Stock Slide: Friday Forecast And Potential Impacts

Table of Contents

Factors Contributing to the Live Music Stock Slide

Several interconnected factors are driving the current decline in live music stock values. Understanding these underlying issues is crucial for investors seeking to make informed decisions.

Inflation and Reduced Consumer Spending

Rising inflation and the global cost-of-living crisis are significantly impacting disposable income. This directly translates to decreased concert attendance, a cornerstone of the live music industry's revenue streams.

- Higher Ticket Prices: Increased inflation affects not only the consumer's purchasing power but also the costs associated with attending live events. Ticket prices, already a significant expense for many, are rising, further reducing attendance.

- Added Expenses: The total cost of attending a concert extends beyond the ticket price. Travel, accommodation, merchandise, and food & beverage all contribute to the overall expense, putting pressure on consumers' budgets.

- Impact Across the Board: This impact is felt across the entire spectrum of the live music industry, from large stadium tours to smaller, independent venues. Recent data showing declining ticket sales and lower venue occupancy rates across various market segments supports this trend.

Increased Competition and Market Saturation

The live music market is experiencing a surge in new entrants, leading to increased competition and market saturation. This influx of new venues, festivals, and artists makes it increasingly difficult for established players to maintain market share and profitability.

- New Festival Emergence: The rise of numerous new music festivals adds to the already crowded landscape. This increased competition forces existing players to fight for a share of the available audience.

- Venue Proliferation: The construction of new venues, both large and small, intensifies competition for touring artists and concertgoers alike. This oversaturation can lead to lower ticket sales and decreased revenue for all involved.

- Impact on Profitability: The increased competition directly impacts the profitability of established live music companies. Maintaining market share requires aggressive marketing and potentially lower ticket prices, squeezing profit margins. Examples like the recent surge of smaller regional festivals directly competing with established players illustrate this issue.

Rising Operational Costs

Live music events are becoming increasingly expensive to produce. Rising operational costs are significantly impacting profit margins and adding pressure to the industry.

- Venue Rental Costs: Rental fees for concert venues are increasing, adding a significant expense to event budgets.

- Artist Fees: Demand for popular artists remains high, driving up their performance fees and further increasing operational costs.

- Labor and Fuel Costs: Increased labor costs and soaring fuel prices, impacting transportation and logistics, exacerbate the financial pressures faced by live music companies. Data highlighting the year-on-year increase in these costs clearly shows the impact on profitability.

Geopolitical Uncertainty and Economic Slowdown

Global economic instability and geopolitical uncertainty are creating a climate of fear and impacting investor confidence. This impacts investment decisions across various sectors, including the live music industry.

- Investor Sentiment: Concerns about recession and economic downturns make investors hesitant to invest in industries perceived as less stable, such as entertainment.

- Market Volatility: The overall market climate significantly impacts investor sentiment towards specific sectors. Periods of economic uncertainty often lead to a sell-off in less-essential sectors, like entertainment.

- Economic Indicators: Key economic indicators, such as inflation rates, GDP growth, and unemployment figures, play a significant role in shaping investor confidence and influencing investment decisions in the live music sector.

Potential Impacts of the Live Music Stock Slide

The current downturn in live music stocks has far-reaching consequences, impacting investors, the industry itself, and concertgoers.

Impact on Investors

The decline in live music stock prices directly translates to potential portfolio losses for investors holding these assets.

- Portfolio Losses: Investors holding significant positions in live music stocks are facing potential losses as stock prices continue to decline.

- Further Declines: The possibility of further price drops remains significant, depending on market trends and the overall economic climate.

- Portfolio Diversification: Diversifying investment portfolios to mitigate risks associated with the live music sector is crucial.

- Market Monitoring: Continuous monitoring of market trends and financial news is essential for making informed investment decisions.

Impact on the Live Music Industry

The stock slide could lead to significant changes within the live music industry itself.

- Mergers and Acquisitions: Weaker companies might be forced into mergers or acquisitions to survive the downturn.

- Market Consolidation: The industry could see a consolidation of power, leading to fewer independent players and potentially less diversity in the types of events offered.

- Artist Fee Pressure: Artists might face pressure to lower their fees to maintain profitability for event organizers.

- Industry Adaptation: Companies will need to innovate and adapt to remain competitive in this challenging market.

Impact on Concertgoers

The consequences of the stock slide may eventually affect concertgoers in several ways.

- Higher Ticket Prices: To offset increased operational costs, event organizers might increase ticket prices, impacting affordability for consumers.

- Reduced Event Numbers: The economic downturn could lead to fewer live music events or a reduction in the scale of events.

- Limited Ticket Availability: This could lead to decreased ticket availability and less choice for concertgoers.

- Coping Mechanisms: Concertgoers may need to adjust their concert-going habits, perhaps prioritizing specific shows over others based on affordability.

Conclusion

The live music stock slide presents a significant challenge, impacting investors and the live music industry alike. Understanding the contributing factors – inflation, competition, operational costs, and geopolitical uncertainty – is key to navigating this turbulent period. Investors should carefully assess their risk tolerance and diversify their portfolios. Closely monitoring Friday’s market forecast and ongoing live music stock market analysis is crucial to making informed investment decisions and mitigating potential losses associated with live music stocks. Stay informed, adapt your strategies, and remain vigilant in this dynamic market environment.

Featured Posts

-

Dara O Briain A Voice Of Reason In Modern Comedy

May 30, 2025

Dara O Briain A Voice Of Reason In Modern Comedy

May 30, 2025 -

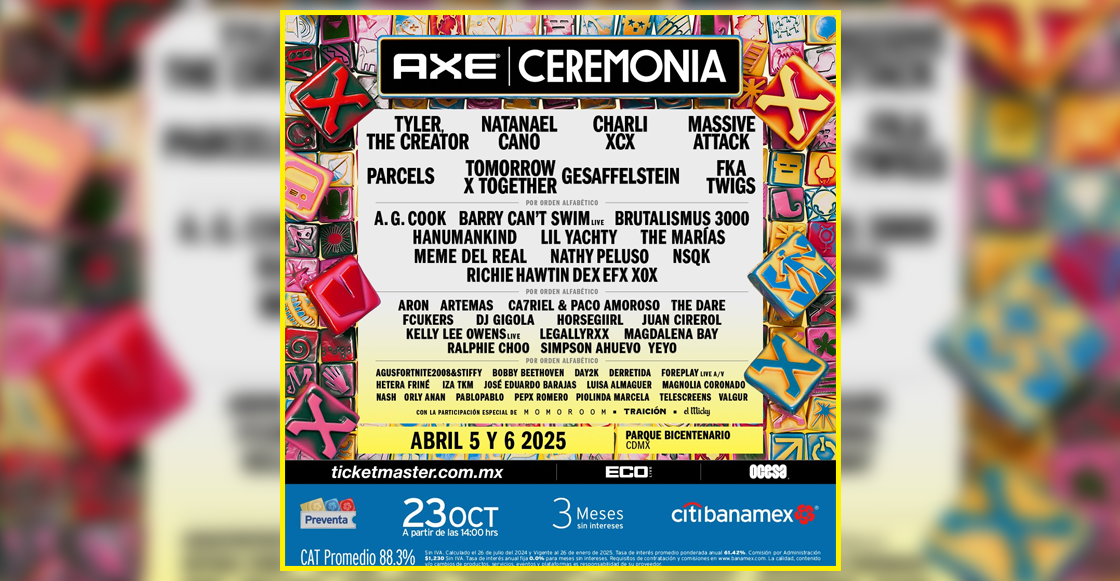

Ticketmaster Reembolso Por Cancelacion Del Festival Axe Ceremonia 2025

May 30, 2025

Ticketmaster Reembolso Por Cancelacion Del Festival Axe Ceremonia 2025

May 30, 2025 -

Expect Cool Wet And Windy Weather In San Diego County

May 30, 2025

Expect Cool Wet And Windy Weather In San Diego County

May 30, 2025 -

Ticketmaster Como Virtual Venue Esta Cambiando La Compra De Entradas

May 30, 2025

Ticketmaster Como Virtual Venue Esta Cambiando La Compra De Entradas

May 30, 2025 -

Canadas Measles Elimination Status At Risk Could Fall 2024 See A Resurgence

May 30, 2025

Canadas Measles Elimination Status At Risk Could Fall 2024 See A Resurgence

May 30, 2025