Live Music Stocks Surge Pre-Market Monday

Table of Contents

Factors Contributing to the Live Music Stock Surge

Several key factors contributed to the impressive pre-market rise in live music stocks. The industry is showing clear signs of recovery and growth, fueled by a combination of increased concert attendance, strong financial performances from major players, and positive investor sentiment.

Reopening of Venues and Increased Concert Attendance

The lifting of pandemic restrictions has been instrumental in the resurgence of live music. Large-scale concerts and festivals are back, filling venues and boosting ticket sales. We're seeing a clear return to pre-pandemic levels and beyond in many markets.

- Significant increase in ticket sales compared to previous years: Data shows a substantial upswing in ticket sales, indicating strong consumer demand for live music experiences.

- Sold-out shows across various genres and venues: From stadium rock shows to intimate jazz performances, venues are reporting consistently sold-out events, demonstrating broad appeal.

- Positive media coverage of successful live events: The success of these events has generated significant positive media attention, further fueling public interest and investor confidence. For example, the recent Coachella festival saw record attendance and widespread positive press coverage.

Strong Financial Performance of Major Players

Major players in the live music industry, such as Live Nation and AEG Presents, have reported impressive financial results, contributing significantly to the positive sentiment surrounding live music stocks.

- Improved booking numbers and higher ticket prices: Increased demand has allowed promoters to secure more bookings and command higher ticket prices.

- Increased sponsorship and merchandise sales: Sponsorships and merchandise sales have also seen a significant boost, adding to overall revenue streams.

- Successful diversification into new revenue streams: Many companies are diversifying into areas like streaming and virtual concerts, creating additional revenue streams and mitigating risk. This diversification strategy is a key factor driving investor confidence in live music stocks.

Investor Confidence and Market Sentiment

Positive investor sentiment is a crucial driver of stock prices. Analysts' upgraded ratings and increased buy recommendations reflect growing confidence in the live music sector's recovery.

- Upgraded ratings from investment firms: Several prominent investment firms have upgraded their ratings for live music stocks, signaling a positive outlook.

- Increased buy recommendations from analysts: Analysts' recommendations are a strong indicator of market sentiment, and the increase in "buy" recommendations reflects their belief in the industry's future.

- Positive market outlook for the entertainment sector: The broader entertainment sector is also experiencing a period of growth, further bolstering the positive sentiment surrounding live music stocks.

Potential Risks and Considerations for Investors

While the outlook for live music stocks is positive, investors should be aware of potential risks and challenges.

Inflation and Rising Costs

Inflation is a significant factor impacting the live music industry. Rising costs for venue rentals, staffing, security, and other operational expenses could affect profitability.

- Increased costs of venue rentals, staffing, and security: These costs are rising rapidly, potentially squeezing profit margins.

- Potential impact on ticket sales due to higher prices: Increased ticket prices to offset rising costs could reduce demand, especially in a sensitive economic climate.

- Strategies for mitigating the effects of inflation: Companies are implementing various strategies, such as negotiating better deals with vendors and optimizing operational efficiency, to manage inflation's impact.

Geopolitical Uncertainty and Supply Chain Issues

Geopolitical instability and supply chain disruptions pose significant risks to the live music industry. Events could be cancelled or delayed due to unforeseen circumstances.

- Potential travel restrictions affecting artists and audiences: International travel restrictions could impact the ability of artists to perform and audiences to attend concerts.

- Challenges in securing essential supplies and equipment: Disruptions in global supply chains can make it difficult to secure essential equipment and supplies for events.

- Risk mitigation strategies for unpredictable events: Companies are developing contingency plans to mitigate risks associated with geopolitical uncertainty and supply chain issues.

Competition and Market Saturation

The live music industry is becoming increasingly competitive. Market saturation could lead to price wars and reduced profitability for some players.

- Increased competition among venues and promoters: The industry is attracting more players, leading to increased competition for artists and audiences.

- Strategies for differentiating and attracting audiences: Companies are focusing on unique experiences and innovative marketing strategies to differentiate themselves from competitors.

- Importance of innovative business models and technologies: Adoption of new technologies and innovative business models is crucial for staying competitive in this dynamic market.

Conclusion

The pre-market surge in live music stocks on Monday reflects a positive outlook for the industry's recovery and growth. While factors like inflation and geopolitical uncertainty present challenges, the resurgence of live events and strong financial performance from major players point towards a promising future. This significant jump in live music stocks provides a compelling investment opportunity, but investors should carefully consider the potential risks before making any decisions. Stay informed about the latest developments in the live music industry and monitor the performance of live music stocks closely to capitalize on emerging opportunities. Further research into individual companies and market trends is crucial for informed investment strategies in the dynamic live music stock market.

Featured Posts

-

Warum Sie Zurueckkehrten Juedische Sportgeschichte Augsburgs

May 30, 2025

Warum Sie Zurueckkehrten Juedische Sportgeschichte Augsburgs

May 30, 2025 -

Assemblee Nationale Frontieres Et Chaos Le Bras De Fer Rn Lfi

May 30, 2025

Assemblee Nationale Frontieres Et Chaos Le Bras De Fer Rn Lfi

May 30, 2025 -

Optakt Til Danmark Portugal Kampanalyse Og Forventninger

May 30, 2025

Optakt Til Danmark Portugal Kampanalyse Og Forventninger

May 30, 2025 -

Elon Musks Daughters Modeling Debut A Look At Vivian Jenna Wilson

May 30, 2025

Elon Musks Daughters Modeling Debut A Look At Vivian Jenna Wilson

May 30, 2025 -

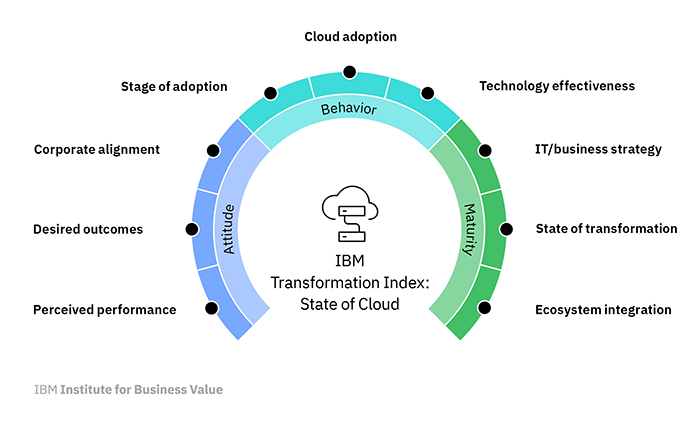

Deutsche Banks Digital Transformation Accelerated By Ibm Software

May 30, 2025

Deutsche Banks Digital Transformation Accelerated By Ibm Software

May 30, 2025