Live Nation Entertainment (LYV): Understanding The Financial Landscape And Future Prospects

Table of Contents

Live Nation's Revenue Streams and Financial Performance

Live Nation's financial success hinges on a diversified revenue model, encompassing several key areas.

Ticket Sales and Ticketing Fees

Live Nation's dominance in the ticketing market through Ticketmaster is a cornerstone of its revenue generation. This segment accounts for a significant portion of LYV's overall income. Recent years have seen consistent growth, fueled by the ever-increasing demand for live music experiences.

- Breakdown of revenue percentages from ticket sales: While the exact figures fluctuate year to year, ticket sales and associated fees consistently represent a substantial percentage of Live Nation's total revenue. Analyzing their SEC filings reveals the precise breakdown.

- Impact of digital ticketing: The shift to digital ticketing has streamlined operations and reduced costs while improving the fan experience. This transition has positively impacted revenue growth.

- Analysis of pricing strategies: Live Nation employs dynamic pricing strategies, adjusting ticket prices based on demand and other market factors. This approach maximizes revenue while managing risk.

- Discussion of competition: While Live Nation holds a dominant market share, competition exists from smaller ticketing platforms and emerging technologies. This competitive landscape necessitates continuous innovation and adaptation.

Venue Operations and Promoters

Live Nation owns and operates a vast network of venues globally, ranging from sprawling stadiums to intimate clubs. Revenue from venue operations and concert promotions forms another significant pillar of their financial performance.

- Geographic diversification of venues: Live Nation's venues are spread across various geographical regions, mitigating risks associated with regional economic downturns or localized events.

- Impact of inflation on operational costs: Inflationary pressures significantly impact operational costs, including artist fees, staffing, and maintenance. Effective cost management is vital for maintaining profitability.

- Success of different venue types (stadiums vs. amphitheaters): Each venue type offers unique revenue opportunities and cost structures. Analyzing the performance of different venue sizes helps understand the overall profitability.

- Artist relationships and their impact on revenue: Strong relationships with major artists are crucial for securing high-demand shows, directly impacting revenue.

Sponsorship and Advertising

Beyond ticket sales and venue operations, sponsorship deals and advertising revenue contribute significantly to Live Nation's financial health. This segment presents considerable growth potential.

- Examples of major sponsors: Live Nation secures partnerships with major brands across various sectors, generating substantial revenue. Identifying these sponsors helps understand the effectiveness of their marketing strategies.

- Effectiveness of advertising strategies: Live Nation employs diverse advertising strategies, leveraging both traditional and digital channels to reach target audiences. Evaluating the return on investment (ROI) of these strategies is essential.

- Opportunities for growth in digital advertising: The digital landscape offers new opportunities for targeted advertising, which can enhance revenue streams and improve marketing ROI.

- Impact of brand partnerships: Strategic brand partnerships extend beyond mere advertising, creating mutually beneficial relationships that enhance brand visibility and increase revenue potential.

Analyzing Live Nation's Financial Statements

A thorough assessment of Live Nation's financial health requires a deep dive into its financial statements. Analyzing key financial ratios and metrics provides valuable insights.

Key Financial Ratios and Metrics

Understanding key financial ratios is crucial for evaluating LYV's financial performance.

- Analysis of key financial ratios: Ratios like debt-to-equity ratio, profit margins, and return on equity reveal Live Nation's financial strength and efficiency. Comparing these ratios with industry competitors provides valuable context.

- Comparison with industry competitors: Benchmarking Live Nation's financial performance against competitors like AEG helps understand its relative position within the industry.

- Evaluation of long-term debt: Assessing Live Nation's long-term debt levels and the associated interest expense is crucial for understanding its financial risk profile.

- Assessment of profitability and growth: Analyzing profitability trends, revenue growth, and earnings per share (EPS) reveals the overall financial health and future growth prospects of the company.

Debt and Leverage

Live Nation's debt levels play a significant role in its financial stability.

- Details of current debt levels: Understanding the extent of Live Nation's debt obligations provides context for assessing its financial risk.

- Analysis of interest expense: A significant interest expense can impact profitability, and analysis is essential to understanding its long-term implications.

- Credit rating assessment: Credit rating agencies provide assessments of Live Nation's creditworthiness, influencing investor confidence and borrowing costs.

- Future debt repayment plans: Understanding Live Nation's plans for debt repayment helps assess its long-term financial sustainability.

Future Prospects and Challenges for Live Nation

While Live Nation enjoys a dominant position, several factors influence its future prospects.

Growth Opportunities

Live Nation has several avenues for future growth.

- Expansion into international markets: Further expansion into underpenetrated international markets presents significant growth opportunities.

- Development of new revenue streams: Exploring new revenue streams, such as merchandise sales, VIP experiences, and digital content, can diversify revenue and enhance profitability.

- Investment in technology (e.g., virtual concerts, AI): Investing in technology, such as virtual concerts and AI-powered tools for personalized fan experiences, can enhance revenue and operational efficiency.

- Strategic acquisitions: Strategic acquisitions of smaller promoters or ticketing platforms can strengthen market position and enhance revenue streams.

Potential Risks and Challenges

Several challenges could impact Live Nation's future performance.

- Impact of recessions on concert attendance: Economic downturns typically reduce discretionary spending, impacting concert attendance and revenue.

- Competition from smaller promoters and streaming services: Increasing competition from smaller promoters and streaming services necessitates continuous innovation and adaptation.

- Changing consumer behavior and preferences: Evolving consumer preferences and entertainment consumption patterns require flexibility and adaptability.

- Potential regulatory hurdles: Navigating regulatory challenges related to antitrust issues and ticketing practices is crucial for maintaining a sustainable business model.

Conclusion

Live Nation Entertainment (LYV) holds a commanding position in the global entertainment industry, but its financial health is subject to various factors. Analyzing its revenue streams, financial statements, and considering potential challenges reveals a complex picture. While its diversified revenue model and market dominance are significant strengths, economic downturns, competition, and evolving consumer preferences pose potential risks. However, Live Nation's adaptability and strategic investments in technology suggest a promising future.

Call to Action: Learn more about the financial future of Live Nation Entertainment (LYV) today! Conduct thorough due diligence and consider its potential as an investment opportunity. Further research into LYV stock and the concert industry can provide a more comprehensive understanding of its future prospects. Don't miss the opportunity to invest wisely in Live Nation Entertainment (LYV).

Featured Posts

-

Get To Know The Eurovision 2025 Artists

May 29, 2025

Get To Know The Eurovision 2025 Artists

May 29, 2025 -

Joshlin Sale Smiths Denial Lombaard And Letoni Implicated

May 29, 2025

Joshlin Sale Smiths Denial Lombaard And Letoni Implicated

May 29, 2025 -

Examining Eric Damaseaus You Tube Channel For Anti Lgbt Propaganda

May 29, 2025

Examining Eric Damaseaus You Tube Channel For Anti Lgbt Propaganda

May 29, 2025 -

Analysis Tuis Entry Into The Adults Only Cruise Market

May 29, 2025

Analysis Tuis Entry Into The Adults Only Cruise Market

May 29, 2025 -

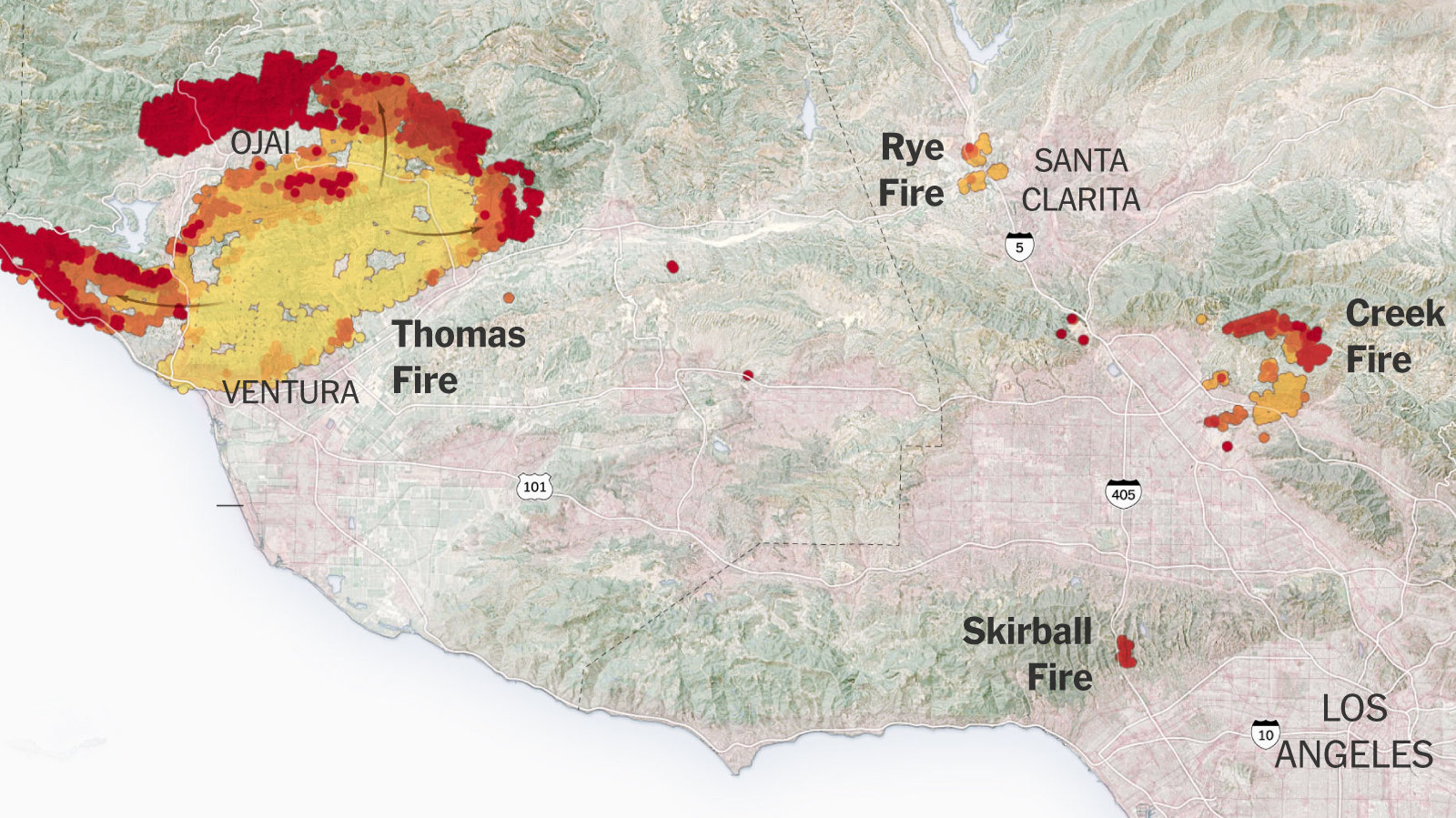

Los Angeles Wildfires And The Gambling Industry A Concerning Development

May 29, 2025

Los Angeles Wildfires And The Gambling Industry A Concerning Development

May 29, 2025

Latest Posts

-

Bayern Verdacht Auf Drogenhandel Frau Verkaufte Marihuana An Automatenkiosk

May 30, 2025

Bayern Verdacht Auf Drogenhandel Frau Verkaufte Marihuana An Automatenkiosk

May 30, 2025 -

Marihuana Handel In Bayern Automatenkiosk Im Visier Der Ermittler

May 30, 2025

Marihuana Handel In Bayern Automatenkiosk Im Visier Der Ermittler

May 30, 2025 -

Frau In Bayern Soll Marihuana In Automatenkiosk Verkauft Haben Ermittlungen Laufen

May 30, 2025

Frau In Bayern Soll Marihuana In Automatenkiosk Verkauft Haben Ermittlungen Laufen

May 30, 2025 -

Juedische Sportler In Augsburg Ihre Geschichte Und Rueckkehr

May 30, 2025

Juedische Sportler In Augsburg Ihre Geschichte Und Rueckkehr

May 30, 2025 -

Augsburger Sportgeschichte Die Rueckkehr Der Juedischen Athleten

May 30, 2025

Augsburger Sportgeschichte Die Rueckkehr Der Juedischen Athleten

May 30, 2025