Live Now, Pay Later: Benefits, Risks, And How To Use It Wisely

Table of Contents

Benefits of Live Now, Pay Later Services

Live now, pay later options offer several compelling advantages for savvy consumers. Understanding these benefits is crucial before deciding if this type of short-term financing aligns with your financial goals.

Increased Purchasing Power

BNPL significantly boosts your purchasing power. Instead of delaying a desired purchase until you've saved enough, you can acquire it immediately.

- Electronics: That new laptop or gaming console can be yours today.

- Furniture: Upgrade your living room without waiting months for savings to accumulate.

- Clothing: Treat yourself to that stylish outfit without feeling the immediate financial pinch.

This immediate gratification offers significant budgeting flexibility, allowing you to spread the cost of larger items rather than making a single, potentially budget-busting, payment. Keywords: affordability, budgeting, impulse purchases.

Improved Cash Flow Management

Effective cash flow management is key to financial health, and BNPL can play a role in this. By breaking down large expenses into smaller, manageable installments, you can better control your monthly outflows.

- Avoiding credit card debt: Instead of relying on high-interest credit cards, BNPL can provide a lower-cost alternative for smaller purchases.

- Managing unexpected expenses: Need to fix your car but short on cash? BNPL can bridge the gap.

- Better cash flow for other priorities: By spreading payments, you free up more cash for other essential expenses or savings goals.

Keywords: cash flow, expense management, debt avoidance.

Building Credit (Potentially)

While not guaranteed, responsible use of BNPL can contribute to building a positive credit history. Some providers report payment activity to credit bureaus.

- On-time payments improve credit: Consistently making your payments on time demonstrates financial responsibility.

- Late payments negatively impact credit: Conversely, missed payments can severely damage your credit score. Be diligent!

- Some popular BNPL services that report to credit bureaus include [Insert examples here – Check for accuracy and update regularly].

Keywords: credit score, credit building, credit reporting.

Risks of Live Now, Pay Later Services

While the convenience of live now, pay later is attractive, it's crucial to acknowledge the potential risks. Understanding these risks is key to responsible use.

High Interest Rates and Fees

The seemingly low cost of BNPL can quickly escalate if payments are missed. Interest rates and late payment fees can be surprisingly high, sometimes exceeding those on credit cards.

- Examples of interest rates and fees: Research specific providers to understand the exact costs involved before committing.

- Potential for accumulating debt quickly: Missed payments, coupled with accumulating interest, can lead to a rapid increase in your debt burden.

Keywords: interest rates, late payment fees, debt accumulation, hidden fees.

Debt Trap Potential

The ease of accessing credit through multiple BNPL accounts increases the risk of overspending and falling into a debt cycle.

- Importance of responsible budgeting: Create a realistic budget and only use BNPL for purchases you can comfortably afford to repay.

- Managing multiple repayments: Keeping track of multiple repayment schedules across different providers can be challenging.

Keywords: debt cycle, overspending, financial responsibility.

Impact on Credit Score (Potentially)

Late or missed payments on BNPL accounts are reported to credit bureaus, negatively impacting your credit score.

- Negative impact on credit reports: This can make it harder to obtain loans, mortgages, or even credit cards in the future.

- Difficulty accessing credit later: A damaged credit score can significantly limit your future financial options.

Keywords: credit damage, credit report, loan applications.

How to Use Live Now, Pay Later Wisely

Using BNPL responsibly requires careful planning and disciplined spending habits.

Budgeting and Planning

Before using any BNPL service, create a detailed budget. Only use it for purchases you can comfortably afford within your existing financial plan.

- Tracking expenses: Monitor your spending habits to identify areas where you can cut back.

- Planning repayments: Factor BNPL repayments into your monthly budget to avoid unexpected shortfalls.

- Avoiding impulse buys: Resist the temptation to use BNPL for unnecessary or impulsive purchases.

Keywords: financial planning, responsible spending, budget management.

Choosing the Right Provider

Not all BNPL providers are created equal. Compare different providers based on fees, interest rates, and customer reviews.

- Research different options: Explore various BNPL services available in your region.

- Compare terms and conditions: Carefully review the terms and conditions of each provider before signing up.

Keywords: BNPL providers, comparison shopping, customer reviews.

Sticking to Your Repayment Plan

The key to avoiding the pitfalls of BNPL is making on-time payments. Set up automatic payments or use reminders to ensure you never miss a deadline.

- Setting up automatic payments: Automate payments to eliminate the risk of forgetting.

- Using reminders: Set up calendar reminders to ensure you're aware of upcoming payment deadlines.

Keywords: on-time payments, debt management, financial discipline.

Conclusion

Live now, pay later services offer increased purchasing power and improved cash flow management when used responsibly. However, high interest rates, potential debt traps, and the risk of credit damage necessitate careful consideration. Responsible use hinges on detailed budgeting, selecting the right provider, and adhering strictly to your repayment plan. Financial literacy is key; understanding your spending habits and managing your debt are crucial for maximizing the potential benefits of live now, pay later options while avoiding the pitfalls. Research different buy now pay later options, compare providers, and prioritize smart spending to ensure you're making informed decisions about your finances. Further reading on personal finance management will enhance your financial literacy and empower you to make responsible choices with buy now, pay later services. Remember, informed decision-making is vital when using any form of short-term financing.

Featured Posts

-

Hybe Ceo On Bts 2025 Comeback Confirmed Members Need Time

May 30, 2025

Hybe Ceo On Bts 2025 Comeback Confirmed Members Need Time

May 30, 2025 -

The Baim Collection Artifacts And Histories From A Lifetime Ago

May 30, 2025

The Baim Collection Artifacts And Histories From A Lifetime Ago

May 30, 2025 -

Ryujinx Emulator Development Halted Nintendos Involvement

May 30, 2025

Ryujinx Emulator Development Halted Nintendos Involvement

May 30, 2025 -

Harvards Response To Trumps America First Nationalism

May 30, 2025

Harvards Response To Trumps America First Nationalism

May 30, 2025 -

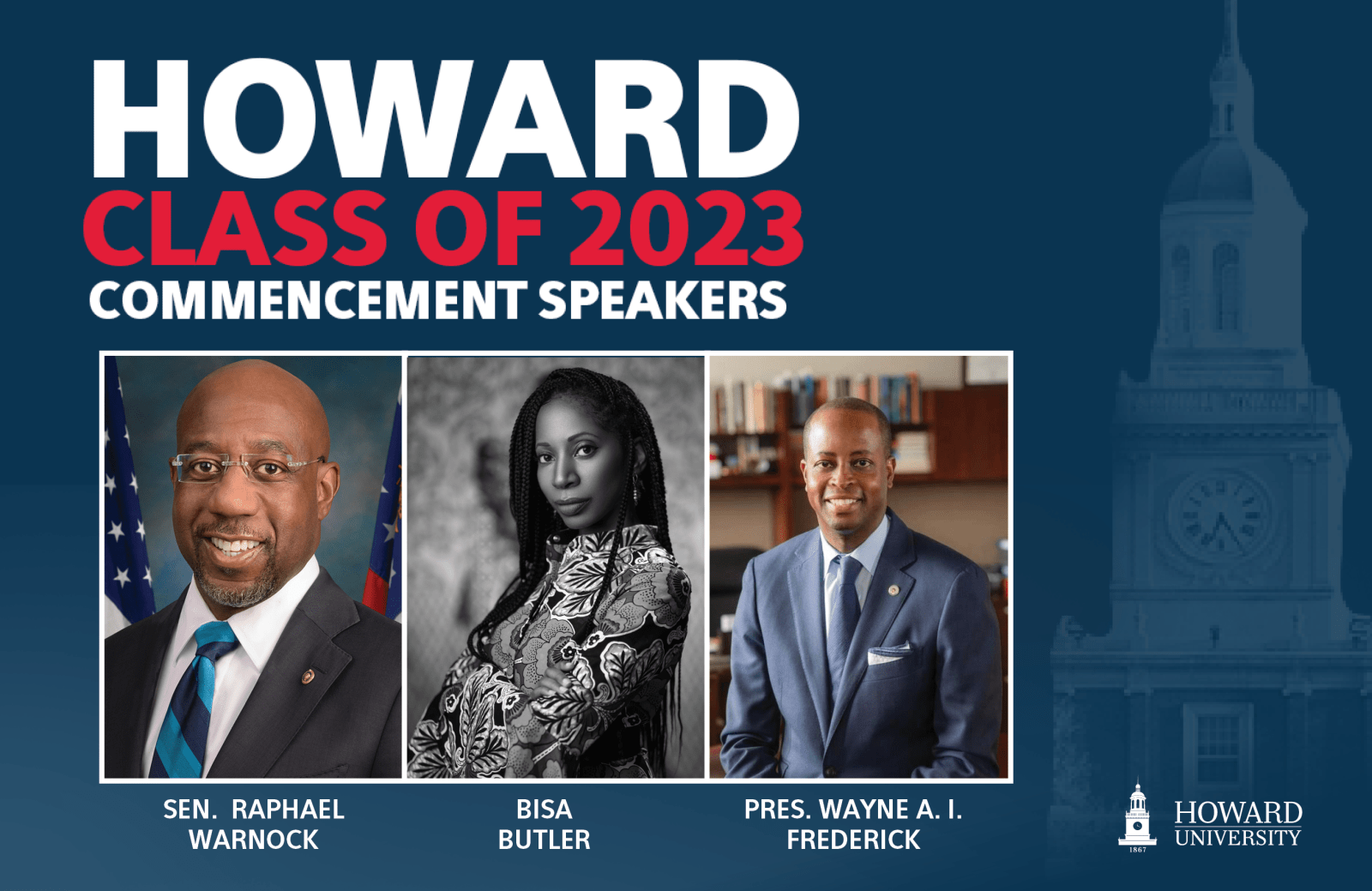

Grand View Universitys 2024 Commencement Speaker Boesen

May 30, 2025

Grand View Universitys 2024 Commencement Speaker Boesen

May 30, 2025