Live Stock Market Updates: Dow Futures, Bonds, And Bitcoin Price Action

Table of Contents

Dow Futures: Gauging the Day's Potential

Dow futures contracts are derivative instruments that track the anticipated performance of the Dow Jones Industrial Average (DJIA). They offer valuable insight into the potential direction of the stock market before the official opening bell. Pre-market trading using Dow futures allows investors to gauge market sentiment and adjust their strategies accordingly.

Factors significantly influencing Dow futures include:

- Economic Data Releases: Key economic indicators like GDP growth, inflation reports (CPI and PPI), and employment figures (Non-Farm Payrolls) directly impact investor confidence and, subsequently, Dow futures. Strong economic data generally supports higher futures prices, while weak data can lead to declines.

- Corporate Earnings Reports: Strong earnings reports from major companies listed in the DJIA can boost investor optimism and drive up Dow futures, while disappointing results can trigger sell-offs.

- Geopolitical Events: International conflicts, political instability, and significant geopolitical shifts can create uncertainty in the market, influencing Dow futures prices.

- Federal Reserve Policy Decisions: Decisions by the Federal Reserve regarding interest rates and monetary policy profoundly affect investor sentiment and market direction. Interest rate hikes, for example, typically put downward pressure on Dow futures.

(Note: This section requires frequent updates with current Dow futures data and interpretation. A chart showing recent Dow futures price action would be included here.)

Bond Market Analysis: Interest Rate Sensitivity

The bond market exhibits an inverse relationship with interest rates. When interest rates rise, bond prices generally fall, and vice versa. This relationship is crucial for understanding the overall market sentiment and risk assessment. Analyzing bond yields, especially the 10-year Treasury yield, provides insights into investor expectations for future inflation and economic growth.

- Impact of Interest Rate Changes: Rising interest rates increase the attractiveness of new bonds offering higher yields, leading to lower prices for existing bonds. Conversely, falling interest rates make existing bonds more attractive, driving up their prices.

- Current Bond Yields and Implications: (This section requires frequent updates with the current 10-year Treasury yield and analysis of its implications for the market.)

- Different Types of Bonds: The bond market encompasses various instruments, each with a different risk profile. Treasury bonds are considered relatively low-risk, while corporate bonds carry higher risk depending on the issuer's creditworthiness.

(Note: A chart illustrating recent bond yield movements would be included here.)

Bitcoin Price Action: Crypto Market Volatility

Bitcoin, the largest cryptocurrency by market capitalization, is known for its high volatility. Its price is driven by a complex interplay of factors:

- Regulatory Developments: Government regulations and policy decisions regarding cryptocurrencies significantly impact Bitcoin's price. Positive regulatory developments often lead to price increases, while negative news can trigger sell-offs.

- Institutional Investor Adoption: Increased adoption of Bitcoin by institutional investors, such as hedge funds and investment firms, can drive up demand and price.

- Market Sentiment and News Cycles: Positive news and overall market sentiment can fuel Bitcoin's price, while negative news or fear, uncertainty, and doubt (FUD) can lead to sharp declines.

- Technological Advancements: Developments within the cryptocurrency space, such as upgrades to the Bitcoin blockchain, can influence investor confidence and price.

(Note: This section requires frequent updates with the current Bitcoin price, trading volume data, and analysis. A chart showing Bitcoin's price action would be included here.)

Conclusion: Staying Informed on Live Stock Market Updates

Understanding the interplay between Dow futures, bond yields, and Bitcoin price action provides a comprehensive view of the current market conditions. Monitoring these key indicators is essential for making informed investment decisions. Remember that the markets are dynamic and constantly evolving, requiring continuous monitoring of live stock market updates.

To stay ahead of the curve, regularly check back for the latest live stock market updates on this site. You can also subscribe to our email alerts to receive timely notifications on significant market movements. Further research into specific financial instruments and investment strategies will enhance your understanding of market trends and improve your investment outcomes. Stay informed and invest wisely!

Featured Posts

-

Accessibility In Games Feeling The Pinch Of Industry Cutbacks

May 23, 2025

Accessibility In Games Feeling The Pinch Of Industry Cutbacks

May 23, 2025 -

Hollywood Legends Iconic Performances Debut And Oscar Winner Available On Disney

May 23, 2025

Hollywood Legends Iconic Performances Debut And Oscar Winner Available On Disney

May 23, 2025 -

Bangladesh Cruise To Victory Over Zimbabwe Mehidy Hasans Bat And Ball Do The Damage

May 23, 2025

Bangladesh Cruise To Victory Over Zimbabwe Mehidy Hasans Bat And Ball Do The Damage

May 23, 2025 -

The Karate Kid A Complete Guide To The Franchise

May 23, 2025

The Karate Kid A Complete Guide To The Franchise

May 23, 2025 -

Ralph Macchio On A My Cousin Vinny Reboot Latest News And Joe Pesci Update

May 23, 2025

Ralph Macchio On A My Cousin Vinny Reboot Latest News And Joe Pesci Update

May 23, 2025

Latest Posts

-

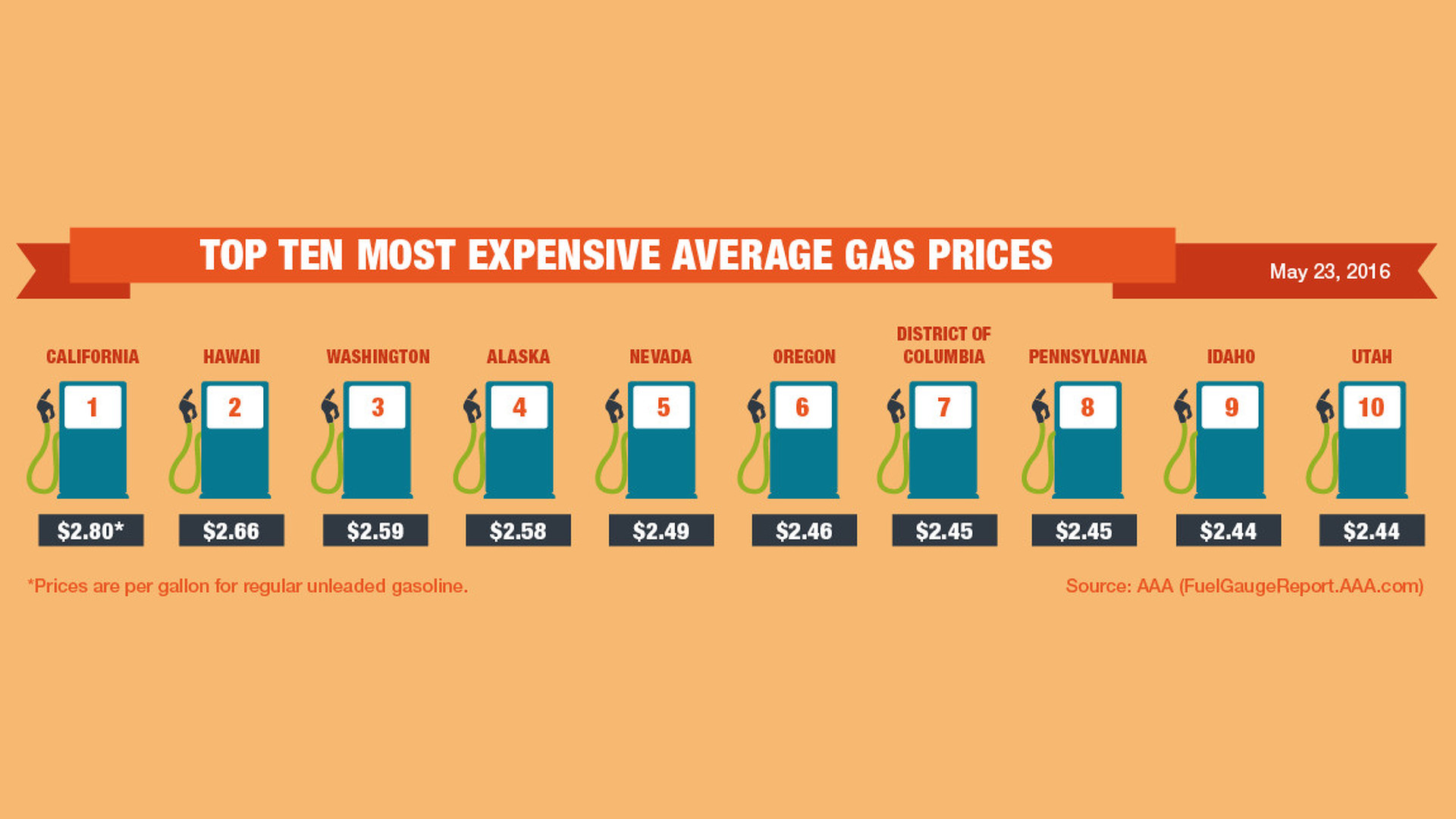

Memorial Day Gas Prices A Decade Low Outlook

May 23, 2025

Memorial Day Gas Prices A Decade Low Outlook

May 23, 2025 -

Record Low Gas Prices Predicted For Memorial Day Weekend

May 23, 2025

Record Low Gas Prices Predicted For Memorial Day Weekend

May 23, 2025 -

Expect Record Low Gas Prices This Memorial Day Weekend

May 23, 2025

Expect Record Low Gas Prices This Memorial Day Weekend

May 23, 2025 -

Expect Cheap Gas This Memorial Day Weekend

May 23, 2025

Expect Cheap Gas This Memorial Day Weekend

May 23, 2025 -

Are Memorial Day Gas Prices The Lowest In Decades

May 23, 2025

Are Memorial Day Gas Prices The Lowest In Decades

May 23, 2025