Live Stock Market Updates: Dow, S&P 500 Data For May 26th

Table of Contents

Dow Jones Industrial Average Performance on May 26th

Opening, Closing, and Intraday High/Low

On May 26th, the Dow Jones Industrial Average opened at 33,820. It experienced fluctuations throughout the day, reaching an intraday high of 33,950 and an intraday low of 33,700. The index closed at 33,850, representing a 0.2% increase from the previous day's closing value. This positive movement, though modest, signaled a degree of market resilience amidst ongoing economic uncertainty.

Key Factors Influencing Dow Movement

Several factors contributed to the Dow's movement on May 26th:

- Positive Earnings Reports: Several Dow components released strong first-quarter earnings reports, boosting investor confidence and driving upward pressure. Companies in the technology and consumer goods sectors particularly impressed.

- Easing Inflation Concerns: While inflation remains a concern, some recent economic data hinted at a potential slowdown in price increases, alleviating some investor anxieties about aggressive interest rate hikes.

- Geopolitical Developments: Ongoing geopolitical tensions continued to cast a shadow over the market, though their impact on May 26th seemed less pronounced than in previous days. This suggests a potential adaptation by investors to the existing global landscape. Sources such as the Financial Times provided ongoing coverage of these factors.

Related keywords: Dow Jones, stock market performance, market volatility, index movement.

Sector-Specific Performance within the Dow

The technology sector demonstrated strong performance within the Dow, significantly contributing to the overall positive movement. Conversely, the energy sector showed a slight downturn, reflecting fluctuations in oil prices. The financial sector displayed mixed results, with some companies exceeding expectations and others falling short.

S&P 500 Performance on May 26th

Opening, Closing, and Intraday High/Low

The S&P 500 opened at 4,150 on May 26th. It traded within a range, reaching a high of 4,175 and a low of 4,130 before closing at 4,165. This represents a 0.3% increase compared to the previous day's close, showing a similar positive trend to the Dow.

Key Factors Influencing S&P 500 Movement

The S&P 500's performance on May 26th was influenced by several factors:

- Strong Consumer Spending Data: Reports indicating robust consumer spending provided a boost to investor sentiment, suggesting continued economic resilience despite inflationary pressures.

- Federal Reserve Commentary: Statements from Federal Reserve officials regarding the potential pace of future interest rate hikes influenced market expectations and shaped investor strategies. News sources like Bloomberg provided ongoing analysis of these statements.

- Positive Corporate Guidance: Several companies provided positive guidance for the coming quarters, contributing to a positive outlook and boosting market confidence.

Related keywords: S&P 500, stock market index, market trends, investment strategy.

Sector-Specific Performance within the S&P 500

The S&P 500 mirrored some of the Dow's sector-specific performance, with technology and consumer discretionary sectors leading gains. However, the healthcare sector showed stronger-than-expected growth within the S&P 500, suggesting a degree of diversification in positive market trends.

Correlation Between Dow and S&P 500 Performance

On May 26th, the Dow and S&P 500 exhibited a strong positive correlation. Both indices showed modest gains, indicating a broadly positive market sentiment and a synchronized response to the prevailing economic and geopolitical factors. (A chart comparing the two indices' movements throughout the day would be inserted here).

Investor Sentiment and Market Outlook

Investor sentiment on May 26th leaned towards cautious optimism. While concerns about inflation and geopolitical instability persisted, positive earnings reports and robust consumer spending data offered a counterbalance. Many analysts predicted continued market volatility in the short term but expressed a relatively positive long-term outlook. One financial analyst stated, “While uncertainty remains, the underlying strength of the economy suggests potential for further growth.”

Conclusion

The Dow and S&P 500 both experienced modest gains on May 26th, driven by a combination of positive earnings reports, easing inflation concerns (to some degree), and robust consumer spending. A strong correlation between the two indices’ movements highlighted a generally positive, albeit cautious, market sentiment. To stay abreast of the dynamic shifts in the market, don't miss out on crucial stock market updates!

Call to Action: Stay ahead of the curve! Get daily live stock market updates delivered to your inbox. Subscribe to our newsletter today for continuous market insights and analysis! [Link to Newsletter Signup]

Featured Posts

-

Trending Golden Glamour Suhana Khan And Deepika Padukones Stunning Looks

May 27, 2025

Trending Golden Glamour Suhana Khan And Deepika Padukones Stunning Looks

May 27, 2025 -

Alpine Skiing Accident Five Fatalities Near Swiss Mountain

May 27, 2025

Alpine Skiing Accident Five Fatalities Near Swiss Mountain

May 27, 2025 -

See Taylor Swifts Eras Tour Wardrobe High Quality Images And Details

May 27, 2025

See Taylor Swifts Eras Tour Wardrobe High Quality Images And Details

May 27, 2025 -

Orange Crush 2025 The Tybee Island Revival Of The Hbcu Spring Break Tradition

May 27, 2025

Orange Crush 2025 The Tybee Island Revival Of The Hbcu Spring Break Tradition

May 27, 2025 -

Emboscada Policial Bandidos Abatem Dois Agentes

May 27, 2025

Emboscada Policial Bandidos Abatem Dois Agentes

May 27, 2025

Latest Posts

-

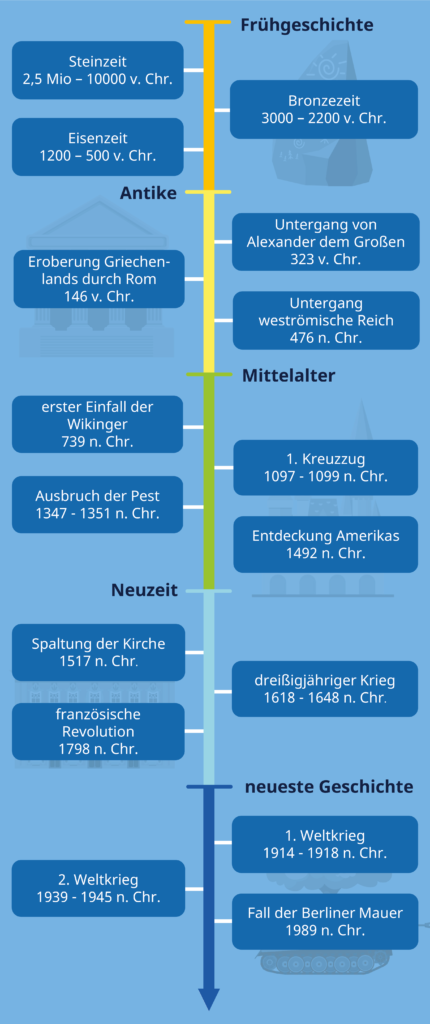

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025 -

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025 -

Andre Agassi Revine In Competitie Debutul In Pickleball

May 30, 2025

Andre Agassi Revine In Competitie Debutul In Pickleball

May 30, 2025 -

Was Geschah Am 10 April Historische Ereignisse Und Mehr

May 30, 2025

Was Geschah Am 10 April Historische Ereignisse Und Mehr

May 30, 2025 -

Agassis Pickleball Debut What We Learned

May 30, 2025

Agassis Pickleball Debut What We Learned

May 30, 2025