Long-Term Investing: Understanding The Gut-Wrenching Challenges Of Buy-and-Hold

Table of Contents

The Psychological Toll of Market Volatility

The emotional rollercoaster of long-term investing is often underestimated. Market volatility, characterized by periods of significant price swings, can severely test even the most seasoned investor's resolve.

Fear and Uncertainty

Market downturns trigger powerful emotions, fueling fear and uncertainty. The fear of missing out (FOMO) can lead investors to make rash decisions, while the anxiety of watching your portfolio decline can trigger panic selling – often at the worst possible time.

- Examples of market events that trigger fear: The 2008 financial crisis, the COVID-19 market crash, and significant geopolitical events all serve as stark reminders of market volatility and its potential impact on investment portfolios.

- Strategies for managing fear and uncertainty:

- Develop a well-defined long-term investment plan that aligns with your risk tolerance and financial goals.

- Focus on diversification across different asset classes to mitigate risk.

- Regularly review your investment strategy but avoid making frequent, impulsive changes based on short-term market fluctuations.

- Seek professional advice from a financial advisor to gain a more objective perspective and help manage your emotional response to market events.

The Temptation to Time the Market

Many investors are tempted to try and "time the market," attempting to buy low and sell high. However, this strategy is notoriously difficult, if not impossible, to execute successfully. Predicting market movements with accuracy is exceptionally challenging.

- The inherent difficulty in predicting market movements: Market fluctuations are influenced by a myriad of factors, including economic indicators, geopolitical events, and investor sentiment, making precise predictions extremely difficult.

- The opportunity cost of missing out on potential gains: Attempting to time the market often leads to missing out on significant periods of market growth, eroding potential long-term returns. Sticking to a disciplined buy-and-hold strategy often proves more profitable in the long run.

Dealing with Unexpected Life Events

Long-term investing is a marathon, not a sprint, and unexpected life events can significantly impact your investment journey.

Financial Emergencies

Unexpected expenses, such as medical bills, job loss, or home repairs, can disrupt even the most meticulously crafted long-term investment plans.

- Importance of an emergency fund: Having a readily accessible emergency fund (typically 3-6 months of living expenses) is crucial for protecting your investments during unforeseen circumstances. This allows you to cover unexpected costs without having to liquidate your long-term investments, potentially at a loss.

- Strategies for managing unexpected expenses without selling long-term investments: Consider utilizing savings, lines of credit, or borrowing from family and friends before resorting to selling your investments.

Changing Life Circumstances

Major life changes, such as marriage, having children, or approaching retirement, can significantly alter your investment goals and risk tolerance.

- The need for regular portfolio reviews and adjustments: Regularly reviewing your portfolio (at least annually) and adjusting your asset allocation to align with your evolving circumstances is critical.

- Importance of consulting with a financial advisor: A financial advisor can provide personalized guidance, helping you navigate these life changes and adjust your long-term investment strategy accordingly.

Overcoming the Challenges of Buy-and-Hold

Successfully navigating the challenges of buy-and-hold requires a strategic approach and unwavering discipline.

Developing a Robust Investment Plan

A well-defined investment plan is the cornerstone of successful long-term investing. This plan should consider your risk tolerance, investment goals (retirement, education, etc.), and time horizon.

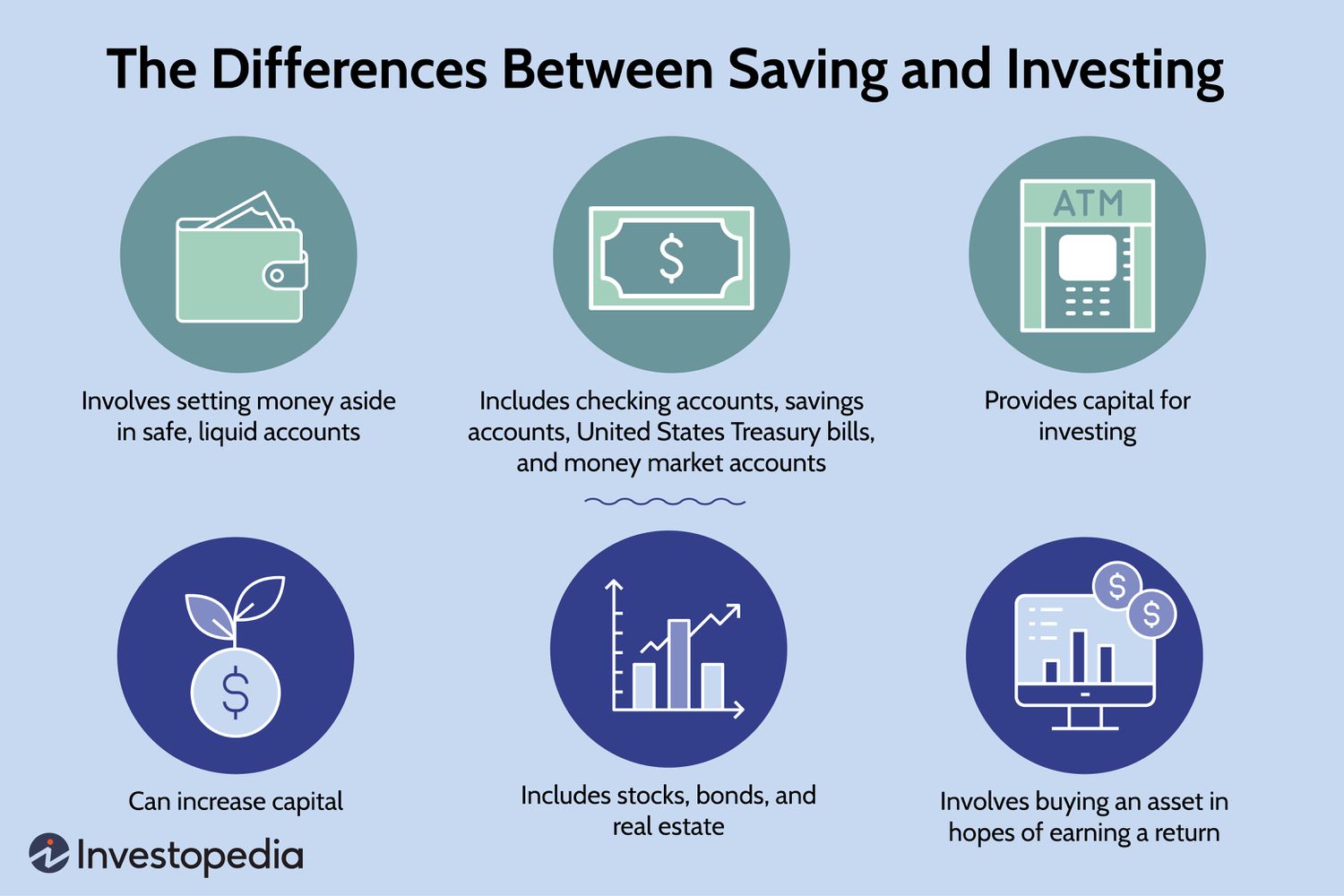

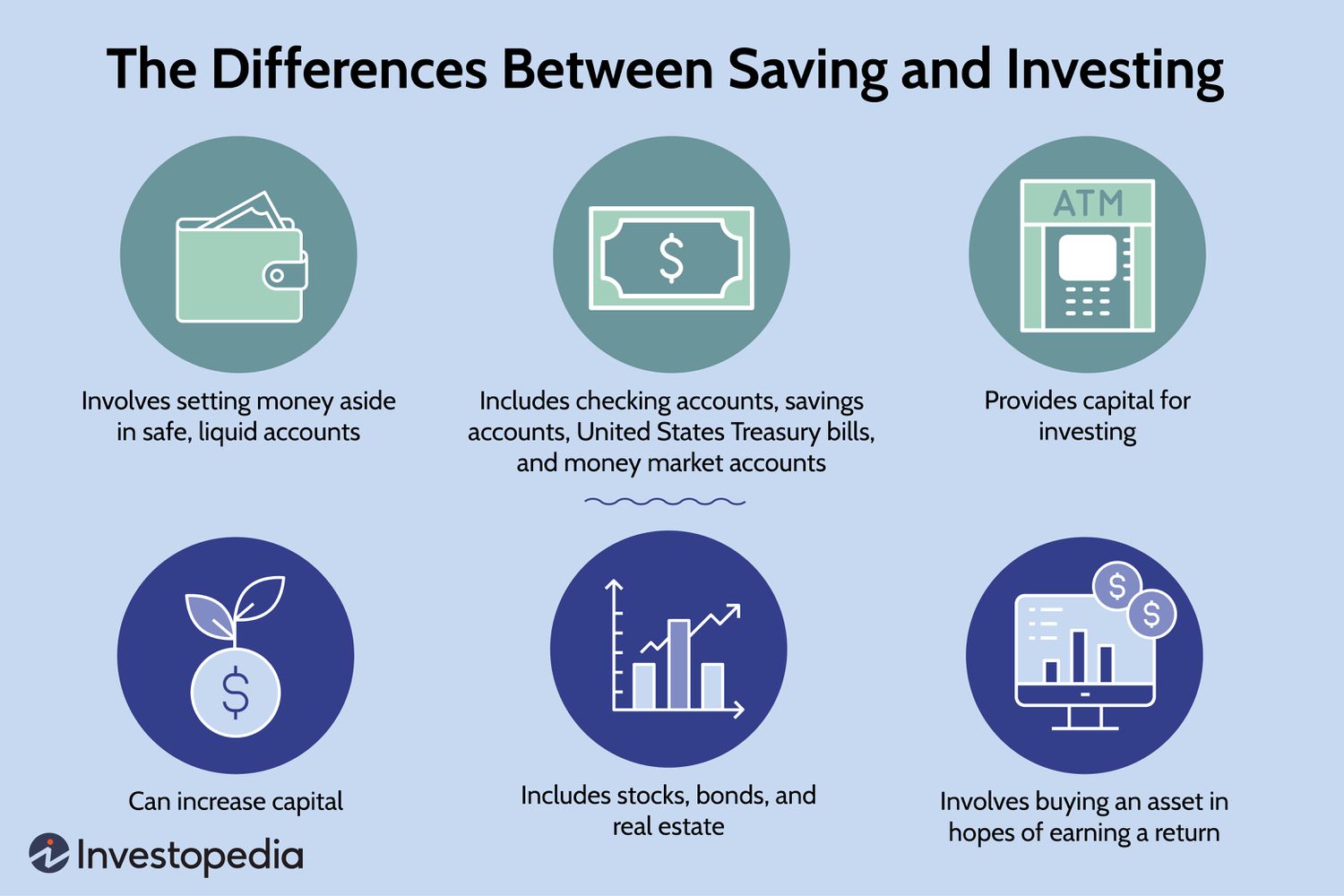

- Asset allocation strategies: Determine the appropriate allocation of your assets across different asset classes (stocks, bonds, real estate, etc.) based on your risk profile and investment goals.

- Diversification across asset classes: Diversification helps to reduce risk by spreading your investments across different asset classes, sectors, and geographies.

The Power of Patience and Discipline

Perhaps the most significant challenge of buy-and-hold investing is maintaining patience and discipline in the face of market fluctuations. Emotional decision-making can significantly hinder long-term success.

- Strategies for maintaining discipline:

- Employ dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions.

- Utilize automatic investing features offered by many brokerage accounts to automate your contributions and remove the emotional element from the process.

- The long-term benefits of consistent investing: Consistent investing, regardless of market conditions, allows you to benefit from the power of compounding returns over time.

Conclusion

Long-term investing, while offering the potential for significant financial rewards, presents several challenges. Market volatility, unexpected life events, and the emotional toll of navigating market fluctuations all demand careful planning and unwavering discipline. By developing a robust buy-and-hold strategy, diversifying your investments, building an emergency fund, and maintaining patience, you can significantly increase your chances of achieving your long-term financial goals. Embark on your journey towards financial security with a well-defined buy-and-hold strategy. Start planning your long-term investments today!

Featured Posts

-

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal Match

May 26, 2025

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal Match

May 26, 2025 -

Sinners New Horror Movie Filmed In Louisiana Release Date Announced

May 26, 2025

Sinners New Horror Movie Filmed In Louisiana Release Date Announced

May 26, 2025 -

They Met In Dc A Love Story Cut Short By Tragedy

May 26, 2025

They Met In Dc A Love Story Cut Short By Tragedy

May 26, 2025 -

L Influence D Elon Musk Sur La Diffusion De L Ideologie D Extreme Droite Via X

May 26, 2025

L Influence D Elon Musk Sur La Diffusion De L Ideologie D Extreme Droite Via X

May 26, 2025 -

Coco Gauff Through To Italian Open Third Round

May 26, 2025

Coco Gauff Through To Italian Open Third Round

May 26, 2025

Latest Posts

-

Predicting The Cubs Vs Diamondbacks Game Outright Winner Analysis

May 28, 2025

Predicting The Cubs Vs Diamondbacks Game Outright Winner Analysis

May 28, 2025 -

Dodgers Vs Diamondbacks Prediction Picks And Odds For Tonights Mlb Game

May 28, 2025

Dodgers Vs Diamondbacks Prediction Picks And Odds For Tonights Mlb Game

May 28, 2025 -

Diamondbacks Vs Cubs Game Prediction And Betting Odds

May 28, 2025

Diamondbacks Vs Cubs Game Prediction And Betting Odds

May 28, 2025 -

Diamondbacks Vs Brewers Expert Mlb Predictions And Betting Odds

May 28, 2025

Diamondbacks Vs Brewers Expert Mlb Predictions And Betting Odds

May 28, 2025 -

Jacob Wilson Breakout What The Poll Tells Us

May 28, 2025

Jacob Wilson Breakout What The Poll Tells Us

May 28, 2025