Low Personal Loan Interest Rates Available Today: 6% And Below

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several key factors determine the personal loan interest rates you'll qualify for. Understanding these factors is crucial to securing the best possible deal.

Credit Score's Crucial Role

Your credit score is arguably the most significant factor influencing your personal loan rates. Lenders use your credit score to assess your creditworthiness and risk. A higher credit score demonstrates responsible borrowing behavior, making you a less risky borrower and thus qualifying you for lower interest rates.

- 750-850 (Excellent): Expect the lowest personal loan interest rates, often below 6%.

- 700-749 (Good): You'll likely qualify for competitive rates, potentially still in the low 6% range or slightly higher.

- 650-699 (Fair): You'll probably face higher interest rates, potentially above 6%.

- Below 650 (Poor): Securing a loan may be difficult, and if approved, expect significantly higher interest rates.

Improving your credit score takes time and effort, but it's worthwhile. Here are some tips:

- Pay all bills on time.

- Keep your credit utilization low (ideally below 30%).

- Avoid applying for multiple loans simultaneously.

Loan Amount and Term

The amount you borrow and the loan term (repayment period) directly impact your interest rate and monthly payments. Larger loan amounts often come with slightly higher interest rates. Similarly, longer loan terms generally lead to lower monthly payments but result in significantly higher total interest paid over the life of the loan.

- Example: A $10,000 loan over 3 years might have a lower interest rate than the same loan spread over 5 years, but the monthly payments would be higher. However, the total interest paid would be less with the shorter term.

Choosing the right balance between manageable monthly payments and minimizing total interest is key.

Lender Type and Loan Features

Different lenders offer varying personal loan interest rates. Banks, credit unions, and online lenders all compete for your business.

- Banks: Often offer a wide range of loan amounts and terms but may have stricter lending criteria.

- Credit Unions: May offer more favorable rates to their members, particularly those with strong relationships.

- Online Lenders: Frequently provide convenient online applications and quick approvals but may charge higher fees.

Always be aware of potential additional fees:

- Origination fees: A one-time fee charged upfront to process your loan application.

- Prepayment penalties: Fees for paying off your loan early.

Secured loans (backed by collateral) typically come with lower interest rates than unsecured loans.

Finding the Best Low Personal Loan Interest Rates

Securing the best personal loan rates requires proactive steps.

Shop Around and Compare Offers

Don't settle for the first offer you receive. Compare rates from multiple lenders to find the most competitive options.

- Utilize online comparison tools to quickly see rates from various lenders.

- Visit the websites of individual banks, credit unions, and online lenders to check their current offers.

- Carefully read the fine print of each loan offer to fully understand the terms and conditions before committing.

Pre-Qualification vs. Application

Pre-qualifying for a loan is a smart first step. It allows you to check your eligibility and see potential rates without impacting your credit score. Once you've found a suitable offer, you can proceed with a formal application.

- Pre-qualification provides a soft credit inquiry, unlike a formal application, which triggers a hard inquiry that can slightly lower your credit score.

Negotiating for a Lower Rate

In some cases, you may be able to negotiate a lower interest rate. A strong financial profile, responsible borrowing history, and having competing offers can strengthen your negotiating position.

- Highlight your positive financial habits and stable income.

- If you have multiple loan offers with lower rates, don't hesitate to use them as leverage during negotiations.

Understanding APR (Annual Percentage Rate)

The APR (Annual Percentage Rate) is a crucial factor when comparing loan offers. It represents the total cost of your loan, including interest and other fees, expressed as an annual percentage.

- A seemingly small difference in APR can significantly impact the total cost over the life of the loan. Always compare the APR, not just the interest rate alone.

Conclusion

Securing low personal loan interest rates, even below 6%, is achievable with careful planning and research. By understanding the factors influencing rates, shopping around for the best offers, and potentially negotiating, you can significantly reduce the overall cost of borrowing. Remember, a lower personal loan interest rate means more money in your pocket and faster debt repayment. Start your search for low personal loan interest rates today! Don't miss out on the opportunity to secure a loan with favorable terms and achieve your financial goals. Compare rates, pre-qualify, and apply for a personal loan with confidence. Securing a low personal loan interest rate can significantly reduce the overall cost of your loan and save you money over time.

Featured Posts

-

Amorims Influence On Garnachos Manchester United Future

May 28, 2025

Amorims Influence On Garnachos Manchester United Future

May 28, 2025 -

Stock Market Today Dow S And P 500 Live Updates For May 27

May 28, 2025

Stock Market Today Dow S And P 500 Live Updates For May 27

May 28, 2025 -

Tucson Firefighters Face Perilous Roof Collapse

May 28, 2025

Tucson Firefighters Face Perilous Roof Collapse

May 28, 2025 -

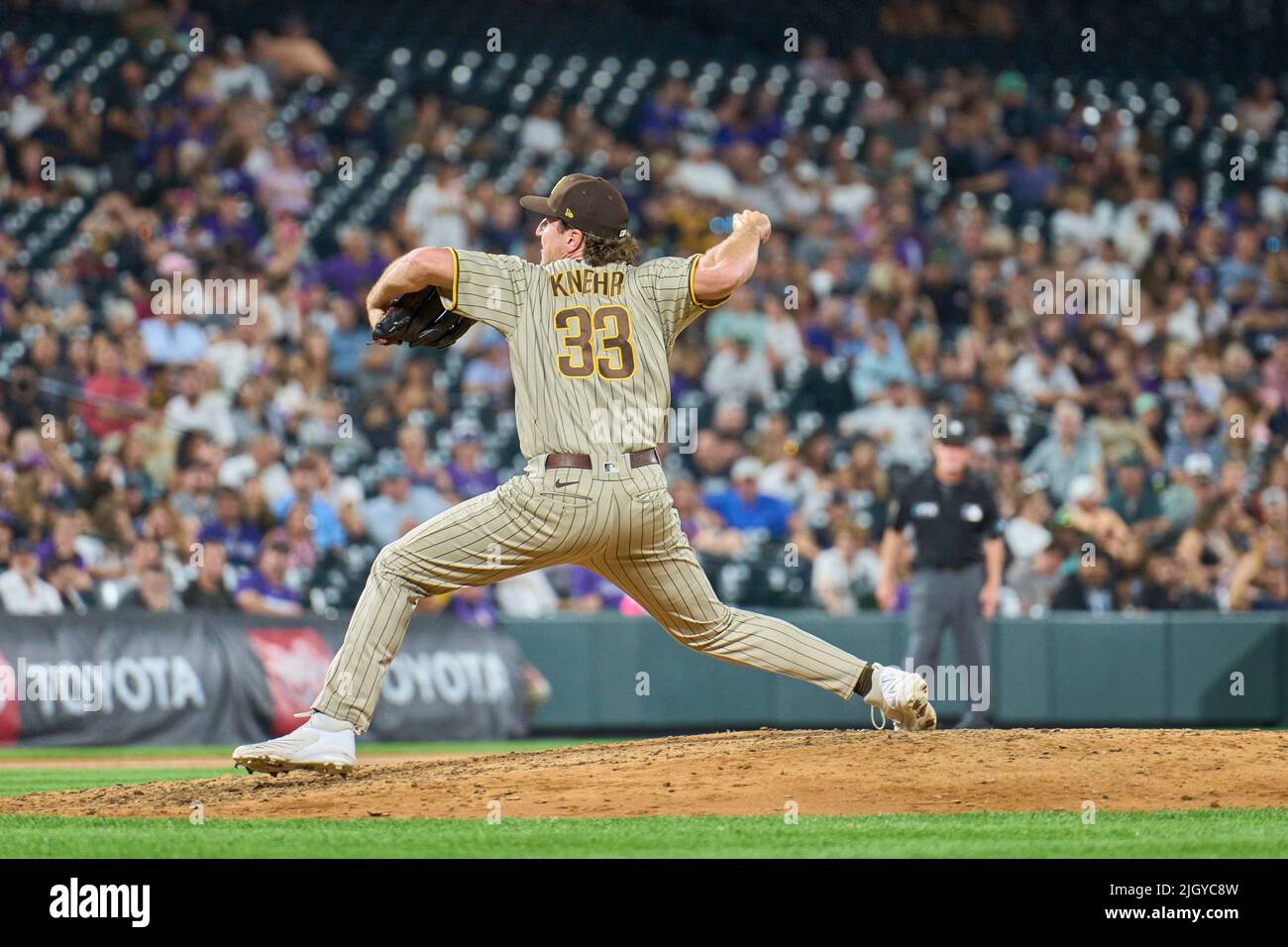

San Diego Padres At Coors Field Predicting A High Scoring Game And Potential Defeat

May 28, 2025

San Diego Padres At Coors Field Predicting A High Scoring Game And Potential Defeat

May 28, 2025 -

Kyle Stowers Two Homers Power Marlins Past Cubs

May 28, 2025

Kyle Stowers Two Homers Power Marlins Past Cubs

May 28, 2025

Latest Posts

-

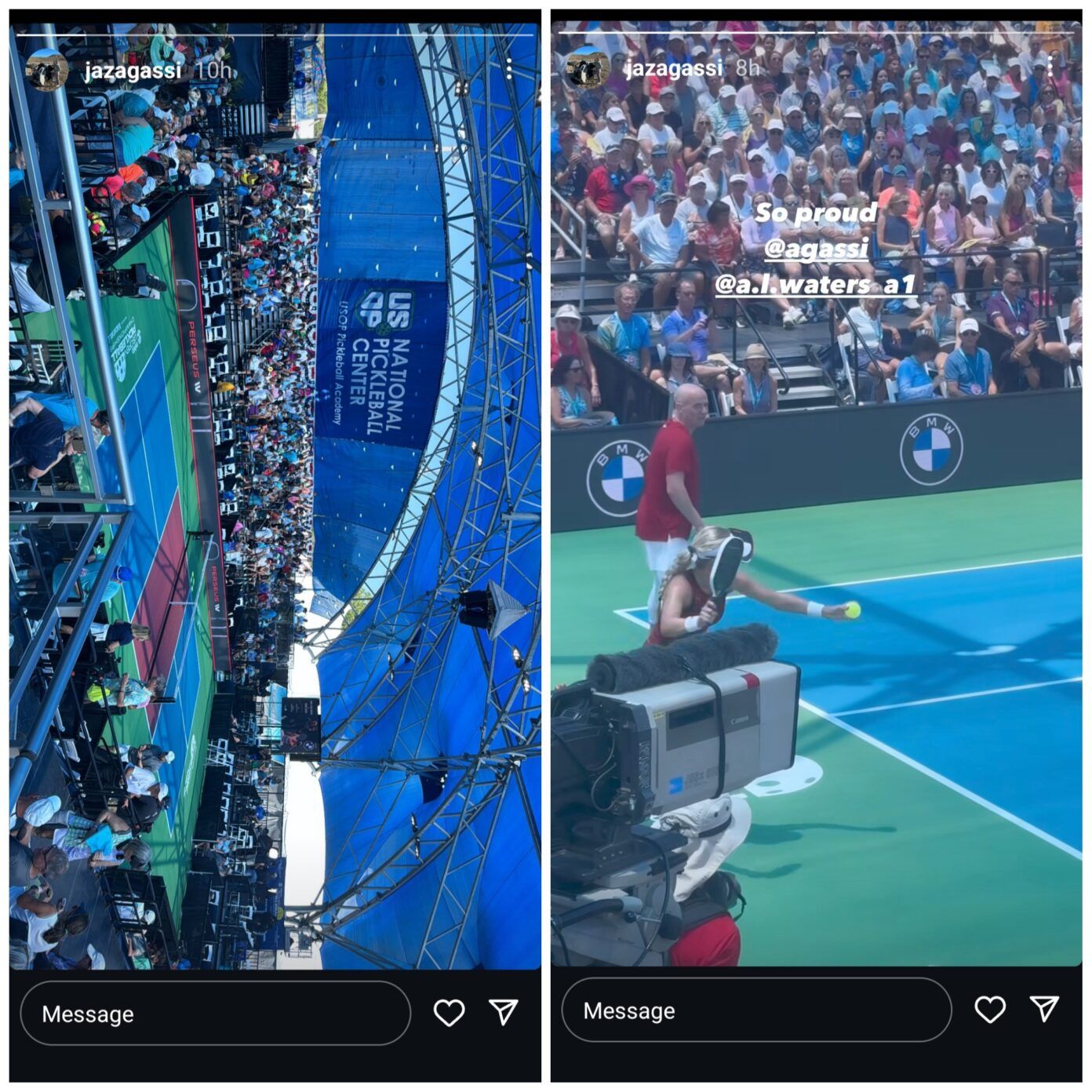

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025 -

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025 -

Andre Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Adevarul Din Spatele Succesului

May 30, 2025

Andre Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Adevarul Din Spatele Succesului

May 30, 2025 -

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025 -

Tenis Declaratia Sincera A Lui Andre Agassi Despre Anxietate

May 30, 2025

Tenis Declaratia Sincera A Lui Andre Agassi Despre Anxietate

May 30, 2025